Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I did everything but can't figure out the part 5. Can you help me please Sales Price per unit Variable Cost per unit = -

I did everything but can't figure out the part 5. Can you help me please

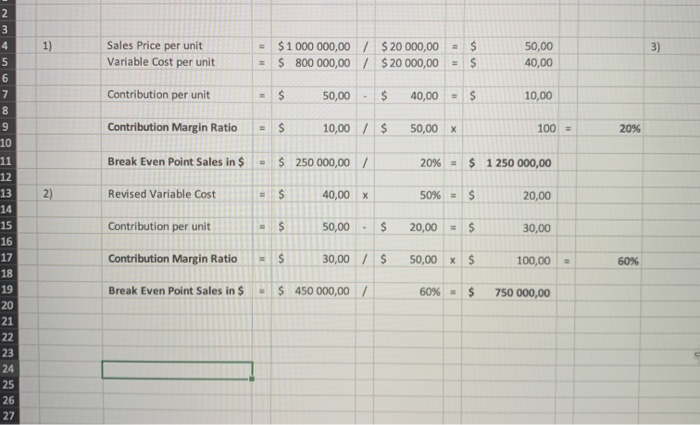

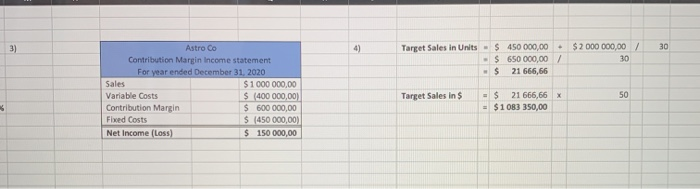

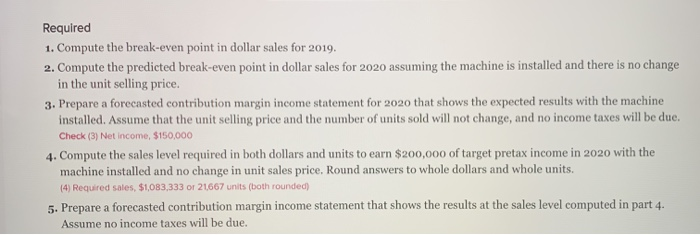

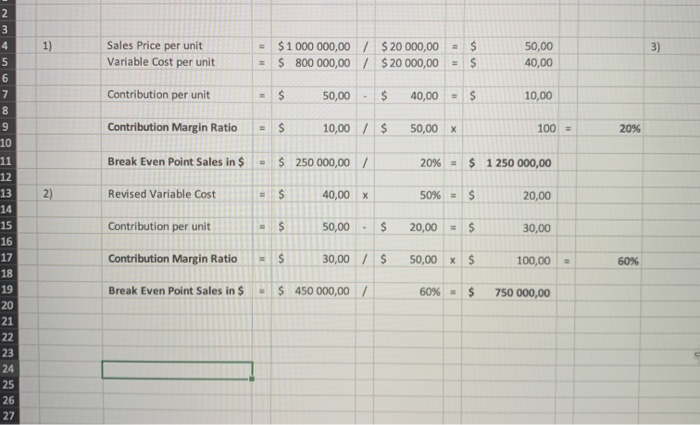

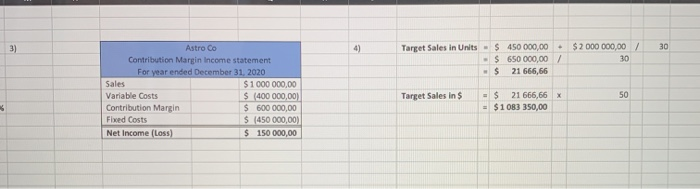

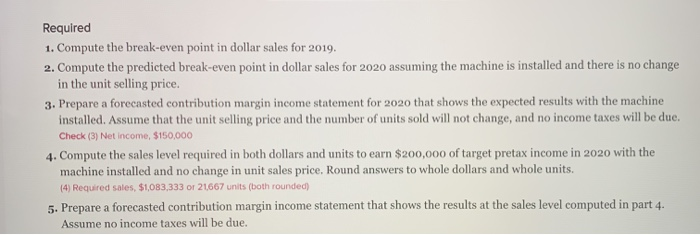

Sales Price per unit Variable Cost per unit = - $ 1 000 000,00 $ 800 000,00 / / $ 20 000,00 $ 20 000,00 = = $ $ 50,00 40,00 Contribution per unit - $ 50,00 - $ 40,00 = $ 10,00 Contribution Margin Ratio = $ 10,00 / $ 50,00 % 100 = 20% Break Even Point Sales in $ Revised Variable Cost - $ 250 000,00 / = $ 1 40,00 x 20% = $ 1 250 000,00 50% - $ 20,00 20,00 = $ALI 30,00 Contribution per unit Contribution Margin Ratio $ 1 $ 50,00 - $ 30,00 / $ 50,00 $ 100,00 = 60% Break Even Point Sales in $ - $ 450 000,00 / 60% = $ 750 000,00 $ 2 000 000,00 / 30 Target Sales in Units - $ 450 000,00 - $ 650 000,00 - $ 21 666,66 - / Astro co Contribution Margin income statement For year ended December 31, 2020 Sales $ 1 000 000,00 Variable Costs $ 400 000,00) Contribution Margin $ 600 000,00 Fixed Costs $ 1450 000,00) Net Income (Loss) $ 150 000,00 Target Sales in s x = $ 21 666,66 = $ 1083 350,00 Required 1. Compute the break-even point in dollar sales for 2019. 2. Compute the predicted break-even point in dollar sales for 2020 assuming the machine is installed and there is no change in the unit selling price. 3. Prepare a forecasted contribution margin income statement for 2020 that shows the expected results with the machine installed. Assume that the unit selling price and the number of units sold will not change, and no income taxes will be due. Check (3) Net income, $150,000 4. Compute the sales level required in both dollars and units to earn $200,000 of target pretax income in 2020 with the machine installed and no change in unit sales price. Round answers to whole dollars and whole units. (4) Required sales, $1,083,333 or 21667 units (both rounded) 5. Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume no income taxes will be due

Sales Price per unit Variable Cost per unit = - $ 1 000 000,00 $ 800 000,00 / / $ 20 000,00 $ 20 000,00 = = $ $ 50,00 40,00 Contribution per unit - $ 50,00 - $ 40,00 = $ 10,00 Contribution Margin Ratio = $ 10,00 / $ 50,00 % 100 = 20% Break Even Point Sales in $ Revised Variable Cost - $ 250 000,00 / = $ 1 40,00 x 20% = $ 1 250 000,00 50% - $ 20,00 20,00 = $ALI 30,00 Contribution per unit Contribution Margin Ratio $ 1 $ 50,00 - $ 30,00 / $ 50,00 $ 100,00 = 60% Break Even Point Sales in $ - $ 450 000,00 / 60% = $ 750 000,00 $ 2 000 000,00 / 30 Target Sales in Units - $ 450 000,00 - $ 650 000,00 - $ 21 666,66 - / Astro co Contribution Margin income statement For year ended December 31, 2020 Sales $ 1 000 000,00 Variable Costs $ 400 000,00) Contribution Margin $ 600 000,00 Fixed Costs $ 1450 000,00) Net Income (Loss) $ 150 000,00 Target Sales in s x = $ 21 666,66 = $ 1083 350,00 Required 1. Compute the break-even point in dollar sales for 2019. 2. Compute the predicted break-even point in dollar sales for 2020 assuming the machine is installed and there is no change in the unit selling price. 3. Prepare a forecasted contribution margin income statement for 2020 that shows the expected results with the machine installed. Assume that the unit selling price and the number of units sold will not change, and no income taxes will be due. Check (3) Net income, $150,000 4. Compute the sales level required in both dollars and units to earn $200,000 of target pretax income in 2020 with the machine installed and no change in unit sales price. Round answers to whole dollars and whole units. (4) Required sales, $1,083,333 or 21667 units (both rounded) 5. Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume no income taxes will be due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started