Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i did most of it. can you just check it and fix my mistakes please Dowell Company produces a single product. Its income statements under

i did most of it. can you just check it and fix my mistakes please

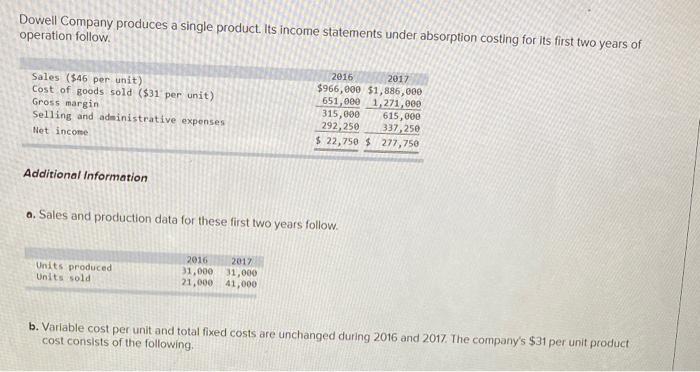

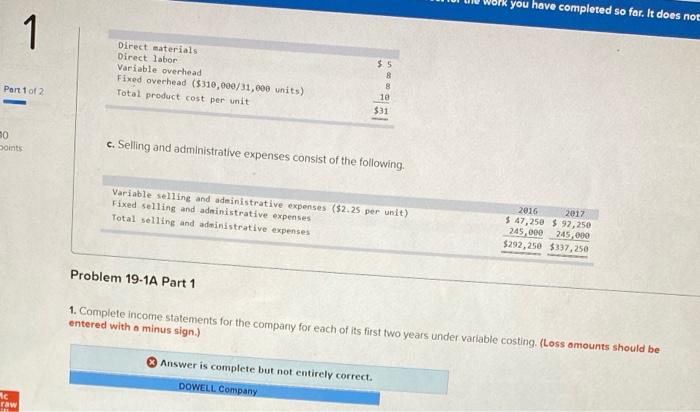

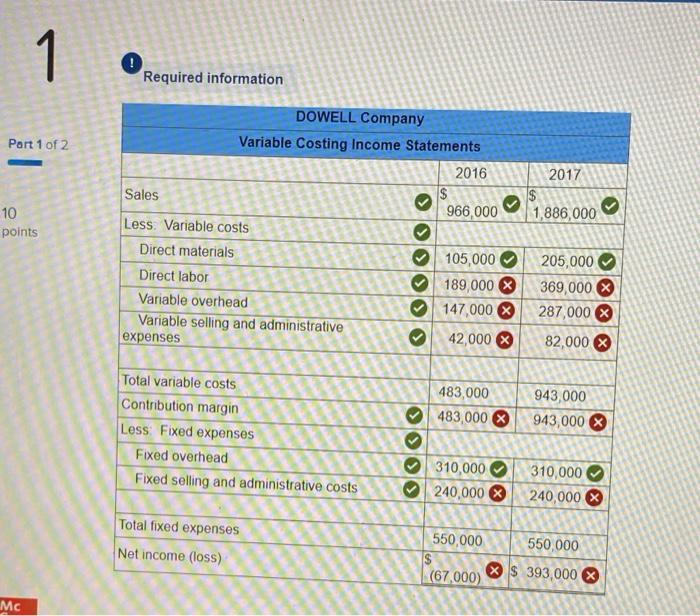

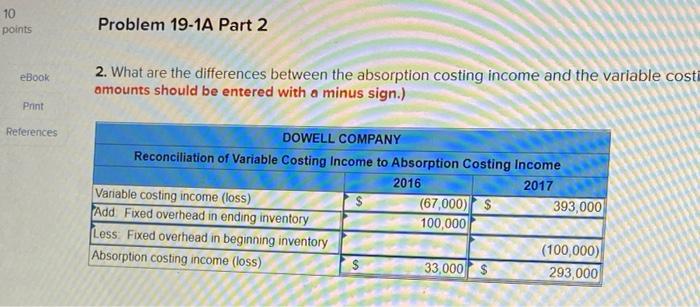

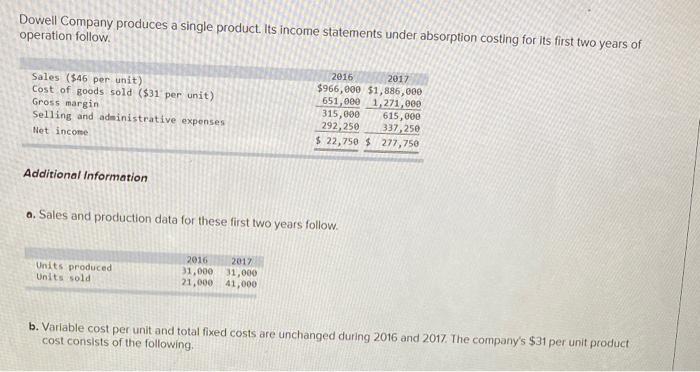

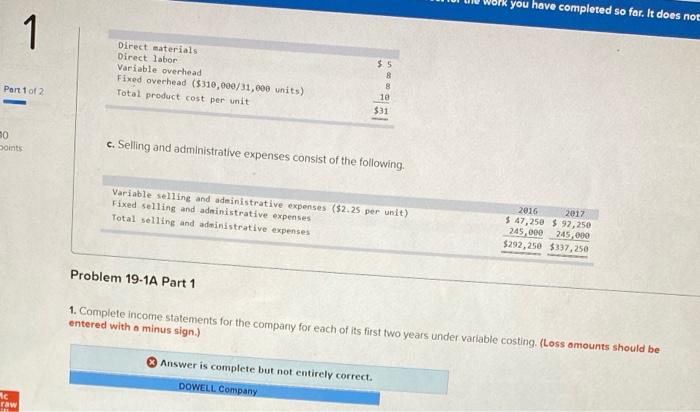

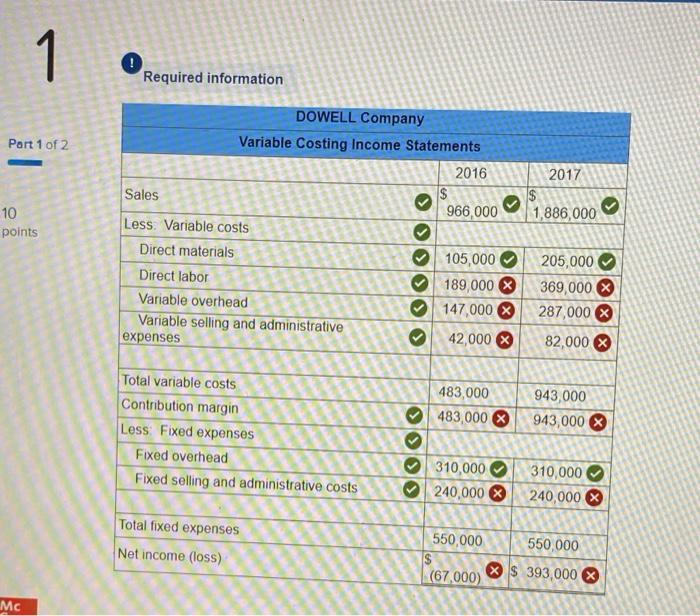

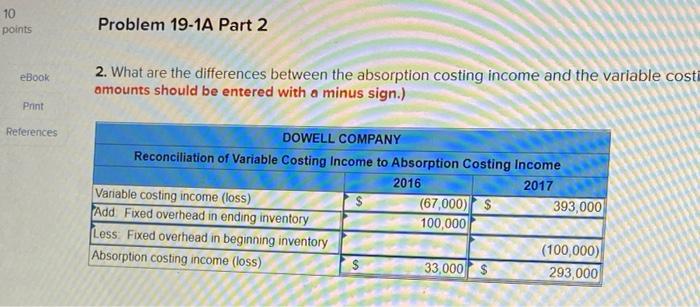

Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow Sales (546 per unit) Cost of goods sold ($31 per unit) Gross margin Selling and administrative expenses Net income 2016 2017 $966,000 $1,886,000 651,000 1,271,000 315,000 615,000 292,250 337,250 $ 22,750 $ 277,750 Additional Information a. Sales and production data for these first two years follow Units produced Units sold 2016 2012 31,000 31,000 21.000 41,000 b. Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company's $31 per unit product cost consists of the following you have completed so far. It does not 1 1 Direct materials Direct labor Variable overhead Fixed overhead (5310,000/31,000 units) Total product cost per unit Part 1 of 2 $5 8 8 10 $31 30 Doints c. Selling and administrative expenses consist of the following Variable selling and administrative expenses ($2.25 per unit) Fixed selling and administrative expenses Total selling and administrative expenses 2016 2017 $ 47,250 $ 92,250 245,000 245.000 $292,250 $337,250 Problem 19.1A Part 1 1. Complete income statements for the company for each of its first two years under variable costing. (Loss amounts should be entered with a minus sign.) Answer is complete but not entirely correct DOWELL Company 1c raw 1 ! Required information Port 1 of 2 2017 1,886,000 10 points DOWELL Company Variable Costing Income Statements 2016 $ Sales 966,000 Less. Variable costs Direct materials 105,000 Direct labor 189,000 Variable overhead 147,000 $ Variable selling and administrative expenses 42,000 X 205,000 369,000 287,000 X 82,000 > 483,000 483,000 $ Total variable costs Contribution margin Less Fixed expenses Fixed overhead Fixed selling and administrative costs 943,000 943,000 X 310,000 240,000 $ 310,000 240,000 $ S Total fixed expenses Net income (loss) 550,000 550,000 $ (67.000) $ 393,000 Mc 10 points Problem 19-1A Part 2 eBook 2. What are the differences between the absorption costing income and the variable costi amounts should be entered with a minus sign.) Print References DOWELL COMPANY Reconciliation of Variable Costing Income to Absorption Costing Income 2016 2017 Variable costing income (loss) (67,000) $ 393,000 Add Fixed overhead in ending inventory 100,000 Less Fixed overhead in beginning inventory (100,000) Absorption costing income (loss) 33,000 293,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started