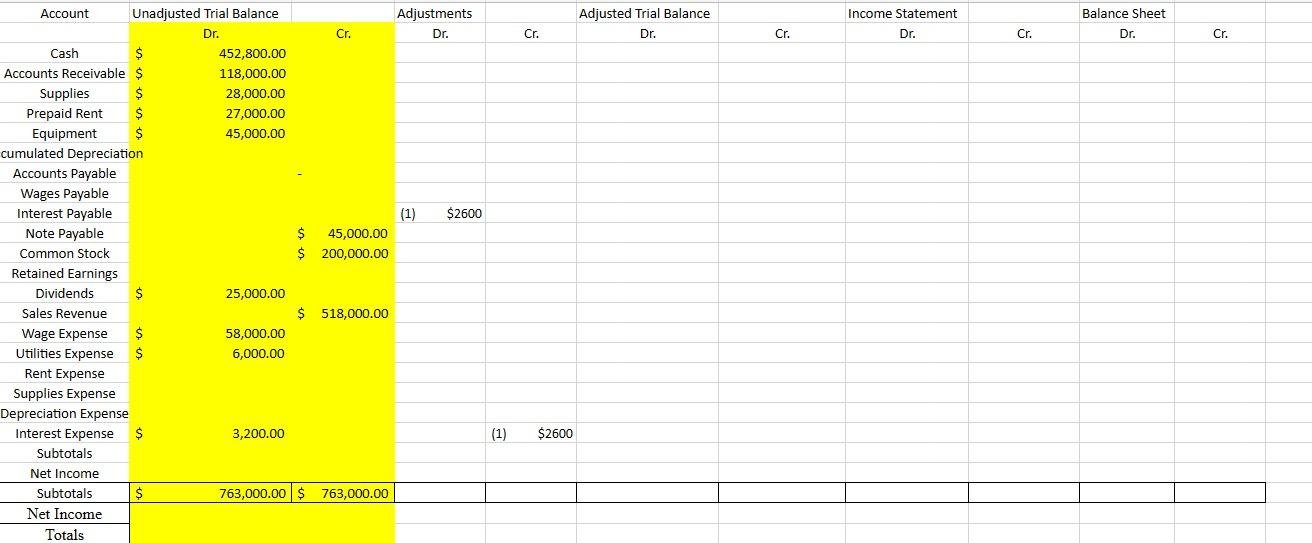

I did that now I need help with this part

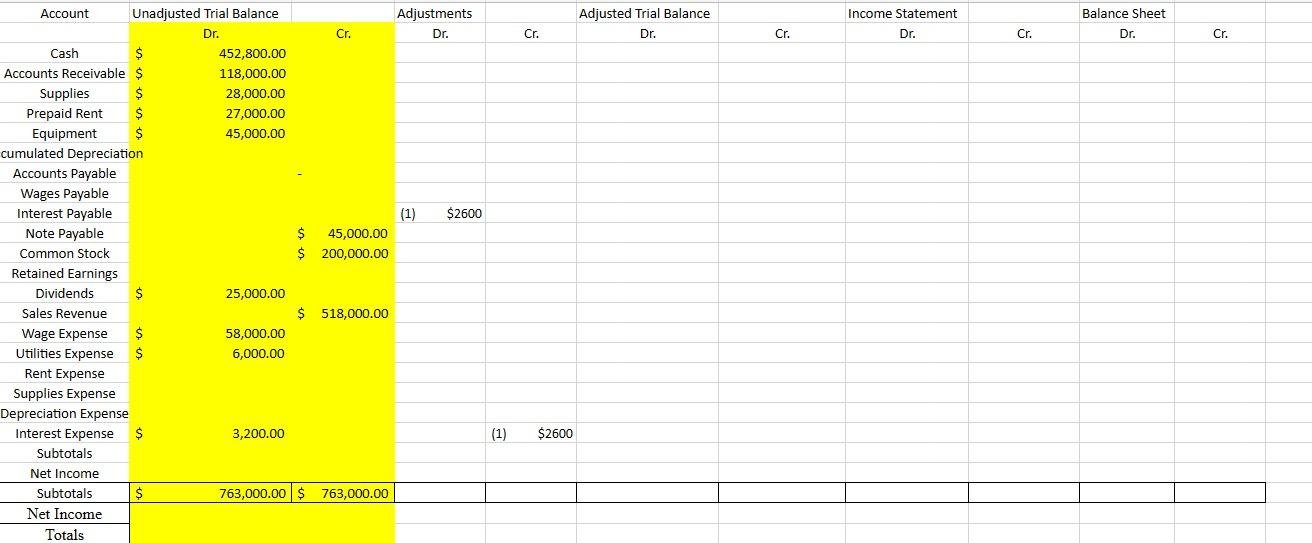

P4-7. Preparing the Trial Balance; Adjusting Journal Entries; Preparing Financial Statements. [Learning Objectives 6, 7, 8] Using the information provided in P4-6, perform the following steps for Tides Tea Company:

Journalize and post adjusting journal entries based on the following additional information (omit explanations)

At December 31, interest in the amount of $2,600 has accrued on the note payable but has not yet been recorded. This amount will be paid on January 31, 2023.

The rent payment made on February 28 was for a 12-month lease covering March 1, 2022, to February 28, 2023.

Straight-line depreciation for the full year should be recorded on the equipment purchased on February 1. The equipment has a 15-year life and no residual value.

A total of $6,000 of supplies remains on hand at the end of the year.

Wage payments in the amount of $62,000 must be accrued at year-end.

On December 14, Tides received a utilities bill in the amount of $6,200 for the month of November that has not yet been recorded. The amount will be paid in January 2023.

Prepare an adjusted trial balance as of December 31. Prepare an income statement and a balance sheet.

Here is what I have so far

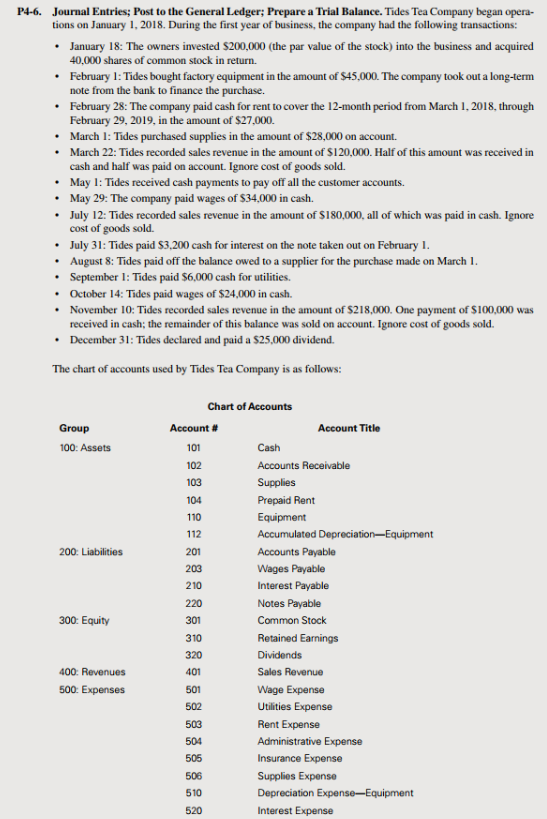

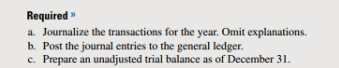

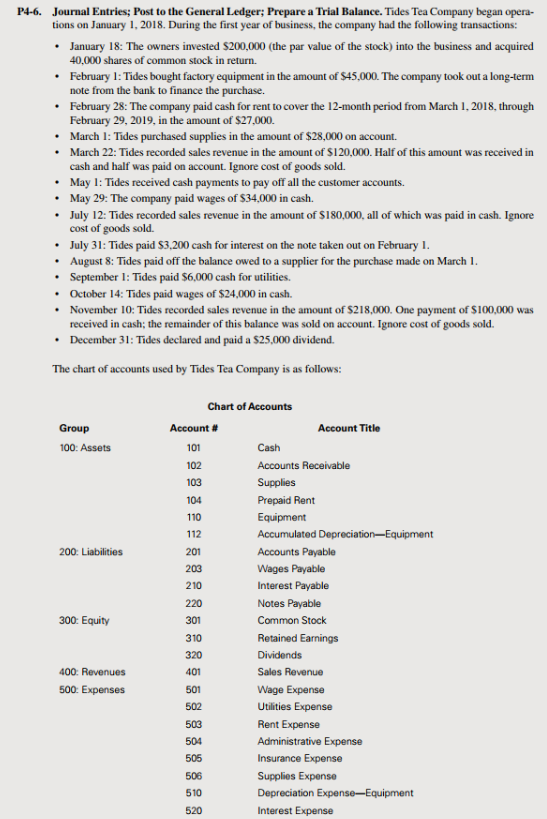

P4-6. Journal Entries; Post to the General Ledger; Prepare a Trial Balance. Tides Tea Company began operations on January 1, 2018. During the first year of business, the company had the following transactions: - January 18: The owners invested $200,000 (the par value of the stock) into the business and acquired 40,000 shares of common stock in return. - February 1: Tides bought factory equipment in the amount of $45,000. The company took out a long-term note from the bank to finance the purchase. - February 28: The company paid cash for rent to cover the 12-month period from March 1, 2018, through February 29, 2019, in the amount of $27,000. - March 1: Tides purchased supplies in the amount of $28,000 on account. - March 22: Tides recorded sales revenue in the amount of $120,000. Half of this amount was received in cash and half was paid on account. Ignore cost of goods sold. - May 1: Tides received cash payments to pay off all the customer accounts. - May 29: The company paid wages of $34,000 in cash. - July 12: Tides recorded sales revenue in the amount of $180,000, all of which was paid in cash. Ignore cost of goods sold. - July 31: Tides paid $3,200 cash for interest on the note taken out on February 1. - August 8: Tides paid off the balance owed to a supplier for the purchase made on March 1. - September 1: Tides paid $6,000 cash for utilities. - October 14: Tides paid wages of $24,000 in cash. - November 10: Tides recorded sales revenue in the amount of $218,000. One payment of $100,000 was received in cash; the remainder of this balance was sold on account. Ignore cost of goods sold. - December 31: Tides declared and paid a $25,000 dividend. The chart of accounts used by Tides Tea Company is as follows: Required " a. Journalize the transactions for the year. Omit explanations. b. Post the journal entries to the general ledger. c. Prepare an unadjusted trial balance as of December 31 . P4-6. Journal Entries; Post to the General Ledger; Prepare a Trial Balance. Tides Tea Company began operations on January 1, 2018. During the first year of business, the company had the following transactions: - January 18: The owners invested $200,000 (the par value of the stock) into the business and acquired 40,000 shares of common stock in return. - February 1: Tides bought factory equipment in the amount of $45,000. The company took out a long-term note from the bank to finance the purchase. - February 28: The company paid cash for rent to cover the 12-month period from March 1, 2018, through February 29, 2019, in the amount of $27,000. - March 1: Tides purchased supplies in the amount of $28,000 on account. - March 22: Tides recorded sales revenue in the amount of $120,000. Half of this amount was received in cash and half was paid on account. Ignore cost of goods sold. - May 1: Tides received cash payments to pay off all the customer accounts. - May 29: The company paid wages of $34,000 in cash. - July 12: Tides recorded sales revenue in the amount of $180,000, all of which was paid in cash. Ignore cost of goods sold. - July 31: Tides paid $3,200 cash for interest on the note taken out on February 1. - August 8: Tides paid off the balance owed to a supplier for the purchase made on March 1. - September 1: Tides paid $6,000 cash for utilities. - October 14: Tides paid wages of $24,000 in cash. - November 10: Tides recorded sales revenue in the amount of $218,000. One payment of $100,000 was received in cash; the remainder of this balance was sold on account. Ignore cost of goods sold. - December 31: Tides declared and paid a $25,000 dividend. The chart of accounts used by Tides Tea Company is as follows: Required " a. Journalize the transactions for the year. Omit explanations. b. Post the journal entries to the general ledger. c. Prepare an unadjusted trial balance as of December 31