I do not have the actual excel, this images come from the e-textbook.

Case Study ANSWER EXERCISE :1, 2, 4, & 6

Case Study ANSWER EXERCISE :1, 2, 4, & 6

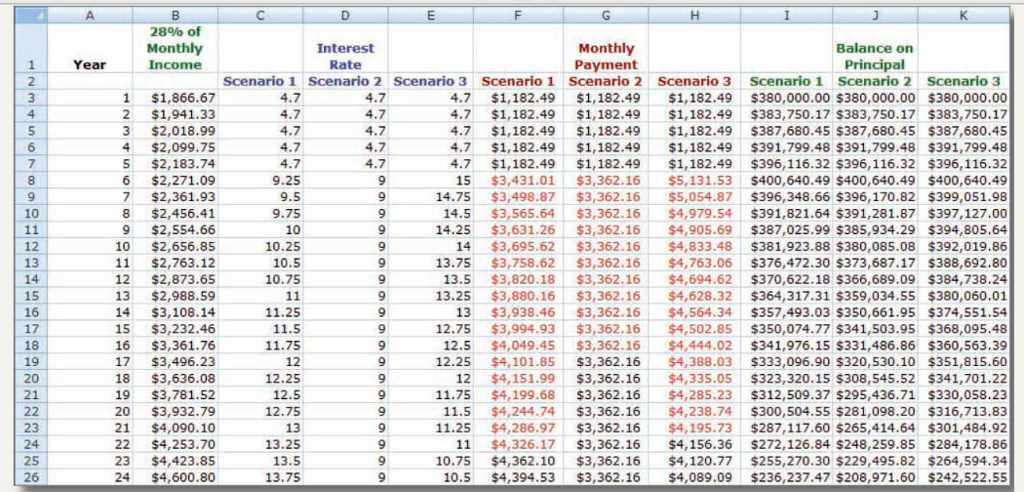

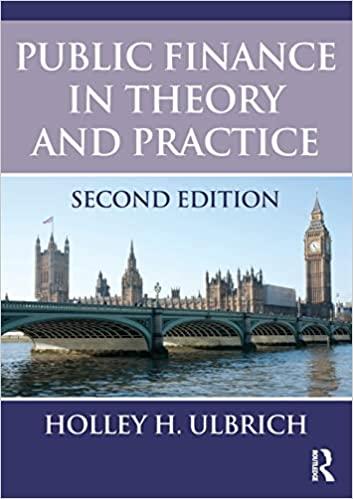

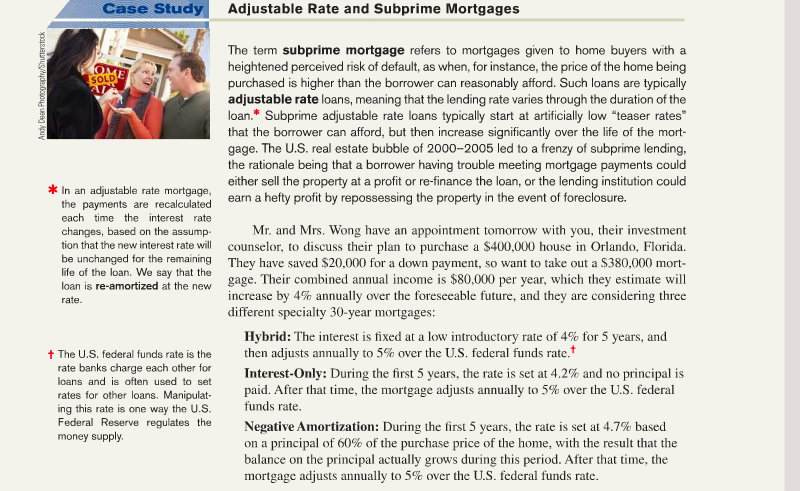

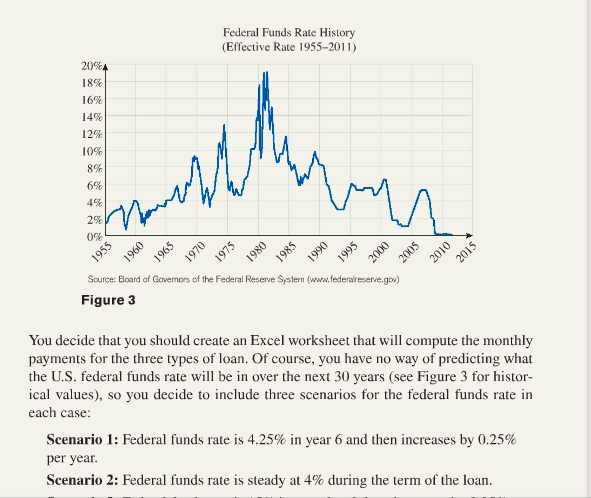

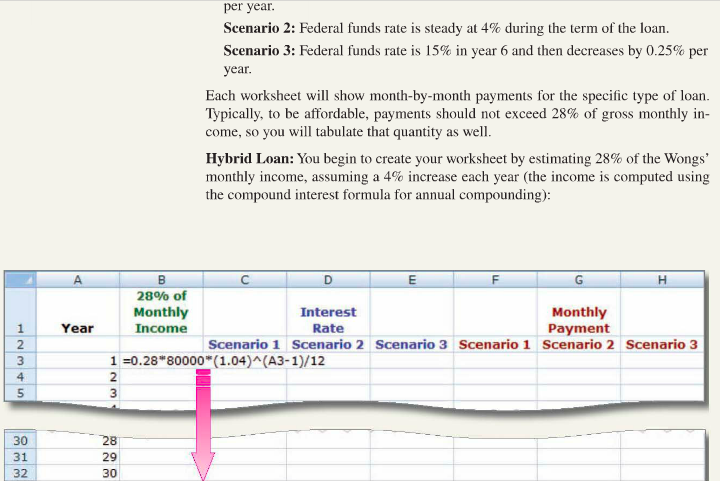

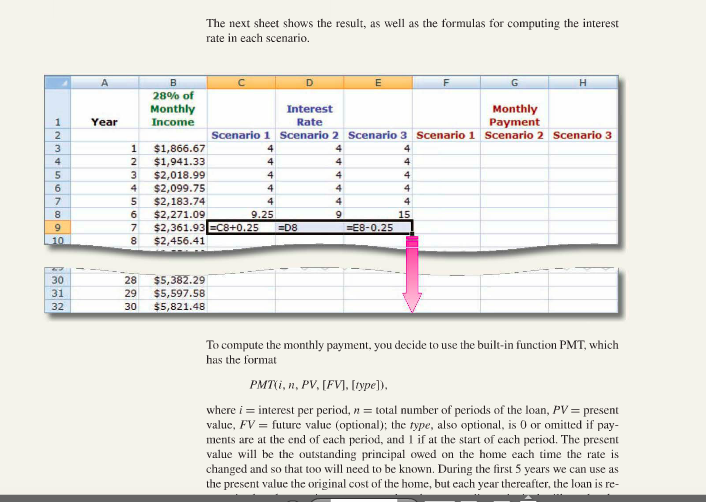

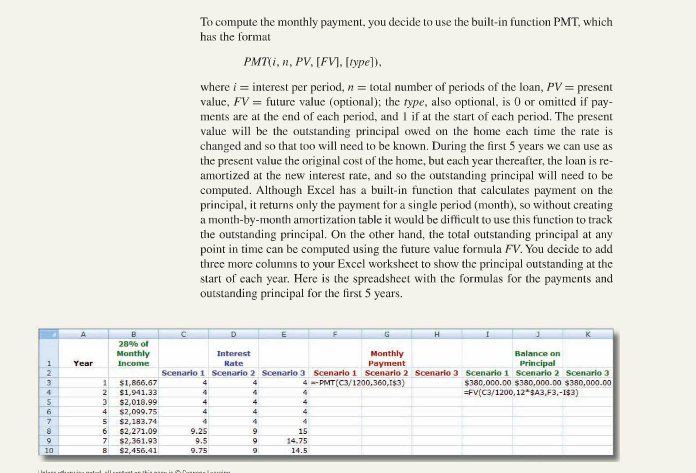

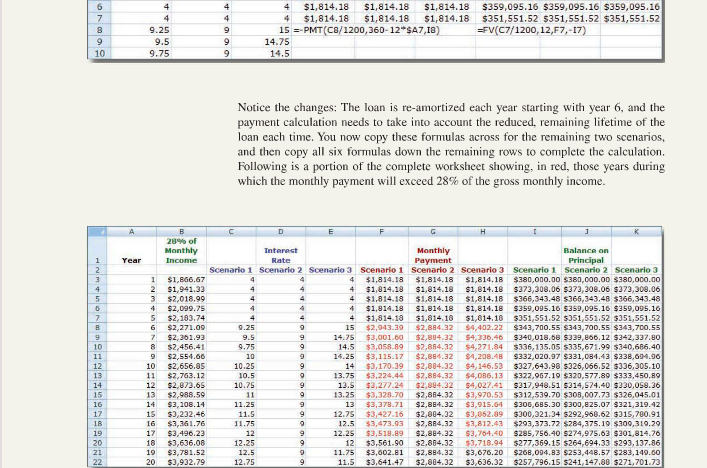

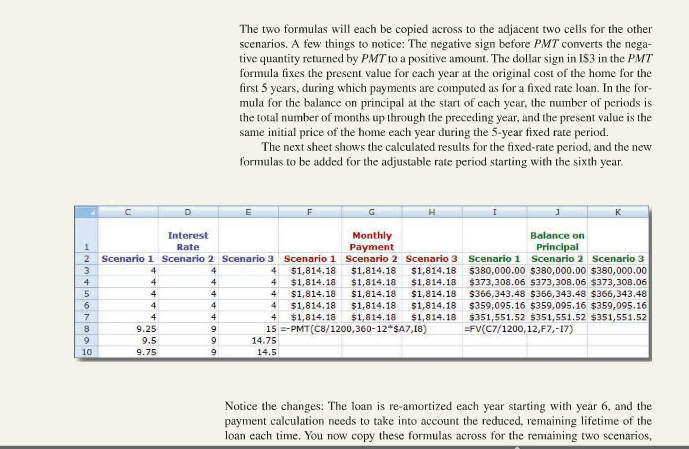

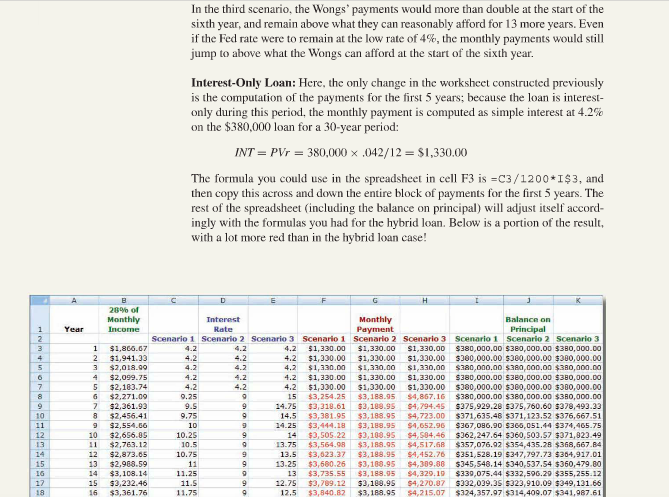

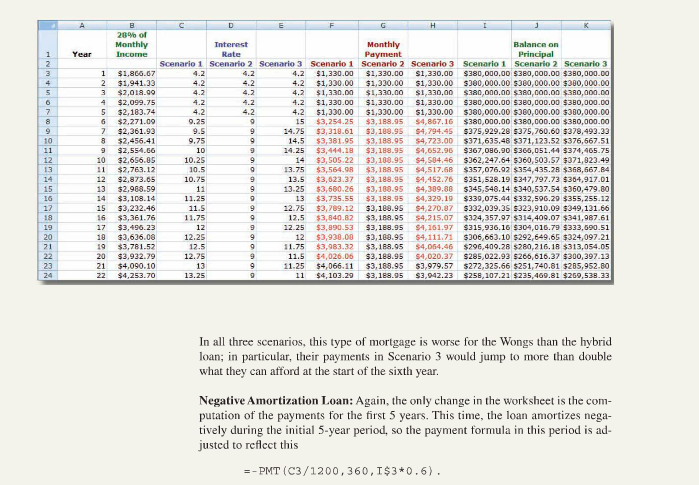

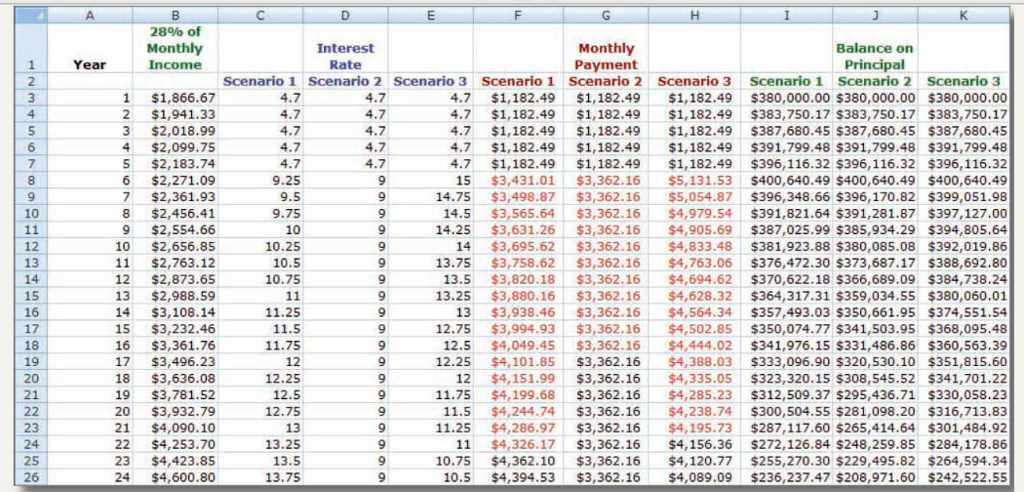

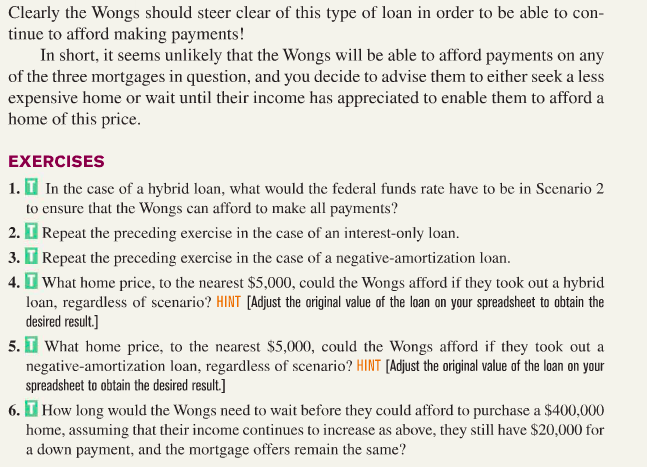

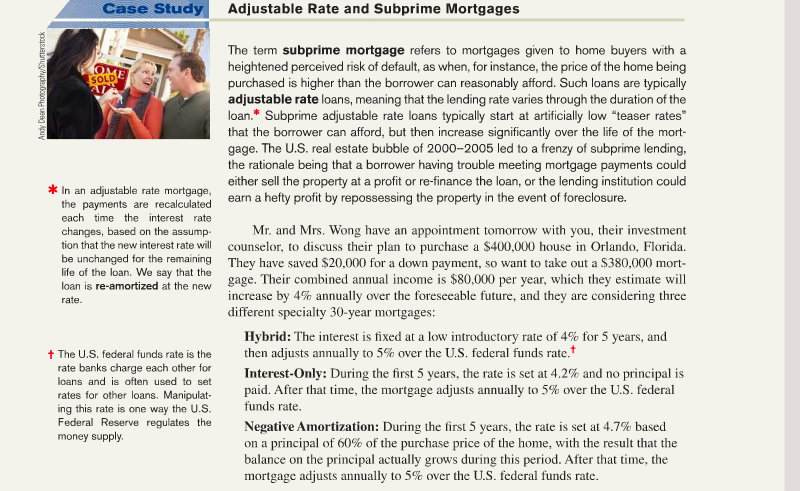

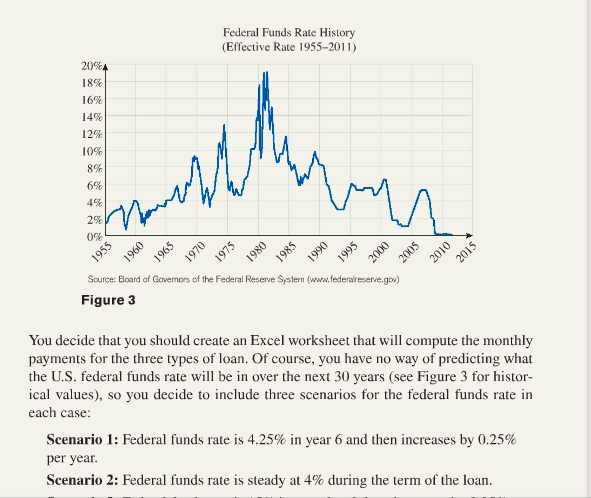

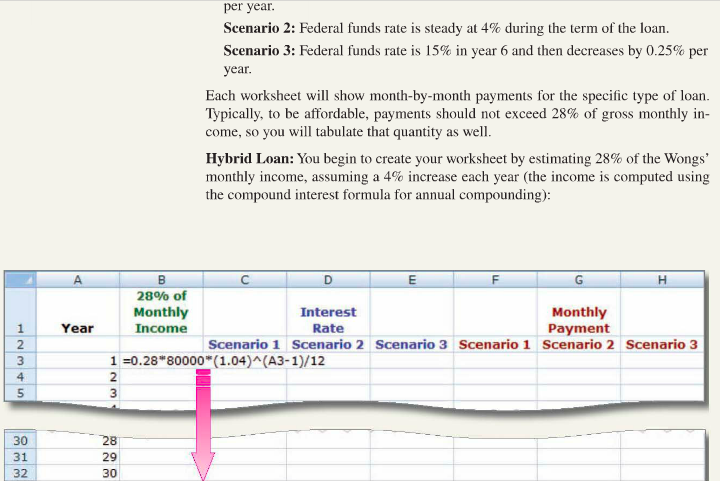

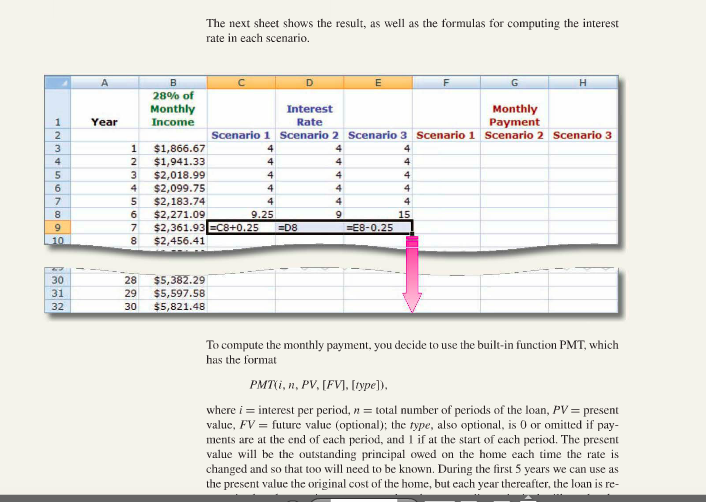

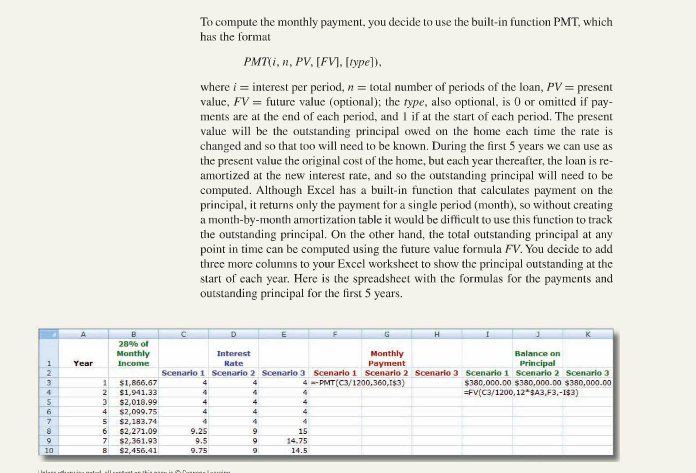

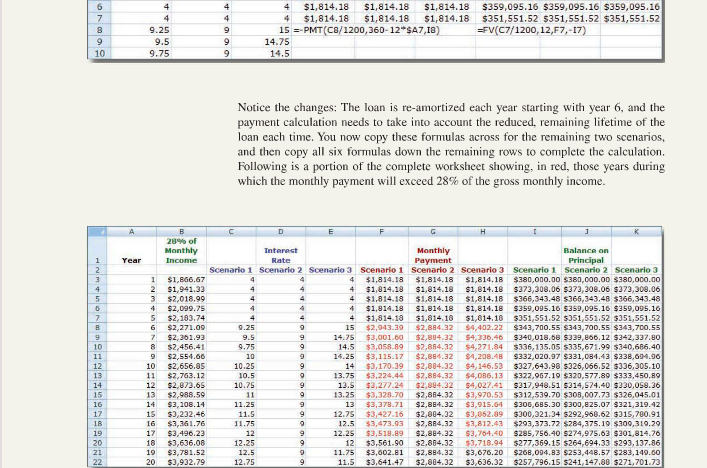

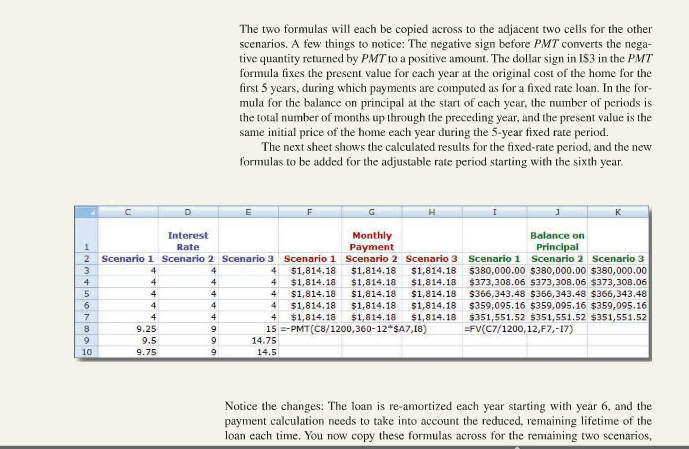

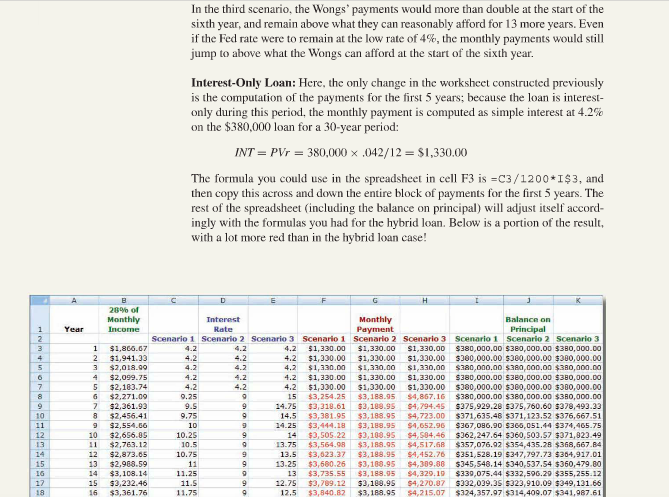

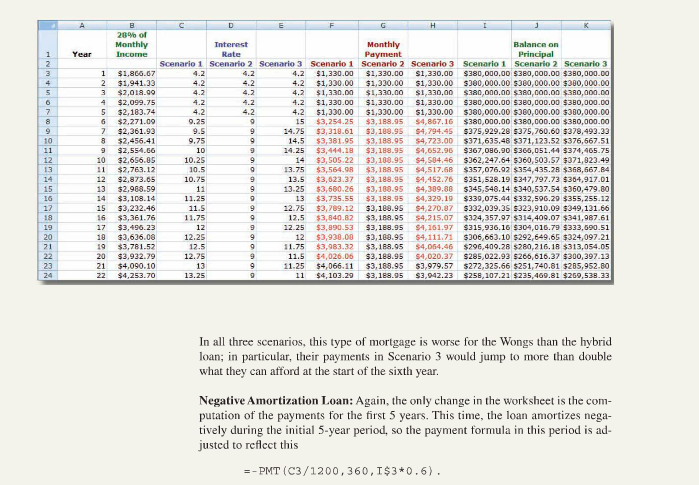

Case Study Adjustable Rate and Subprime Mortgages The term subprime mortgage refers to mortgages given to home buyers with a heightened perceived risk of default, as when, for instance, the price of the home being SOLD purchased is higher than the borrower can reasonably afford. Such loans are typically adjustable rate loans, meaning that the lending rate varies through the duration of the loan.* Subprime adjustable rate loans typically start at artificially low "teaser rates that the borrower can afford, but then increase significantly over the life of the mort- gage. The U.S. real estate bubble of 2000-2005 led to a frenzy of subprime lending, the rationale being that a borrower having trouble meeting mortgage payments could either sell the property at a profit or re-finance the loan, or the lending institution could In an adjustable rate mortgage the payments are recalculated earn a hefty profit by repossessing the property in the event of foreclosure. each time the nterest rate Mr. and Mrs. Wong have an appointment tomorrow with you, their investment changes, based on the assump tion that the new interest rate wil counselor, to discuss their plan to purchase a $400,000 house in Orlando. Florida be unchanged for the remaining They have saved S20,000 for a down payment, so want to take out a S380,000 mort. life of the loan. We say that the gage. Their combined annual income is $80,000 per year, which they estimate will loan is re-amortized at the new increase by 4% annually over the foreseeable future, and they are considering three rate different specialty 30-year mortgages Hybrid: The interest is fixed at a low introductory rate of 4% for 5 years, and then adjusts annually to 5% over the U.S. federal funds rate t The U.S. federal funds rate is the rate banks charge each other for Interest-Only: During the first 5 years, the rate is set at 4.2% and no principal is loans an s often used to set paid. After that time, the mortgage adjusts annually to 5% over the U.S. federal rates for other loans. Manipulat funds rate ing this rate is one way the U.S Federal Reserve regulates the Negative Amortization: During the first 5 years, the rate is set at 4.7% based money supply. on a principal of 60% of the purchase price of the home, with the result that the balance on the principal actually grows during this period. After that time, the mortgage adjusts annually to 5% over the U.S. federal funds rate

Case Study ANSWER EXERCISE :1, 2, 4, & 6

Case Study ANSWER EXERCISE :1, 2, 4, & 6