Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do not need all of these answered! I only need the answers for the question 10-8 which is the last question. Please help me!

I do not need all of these answered! I only need the answers for the question 10-8 which is the last question. Please help me! I'm confused about how to figure it out.

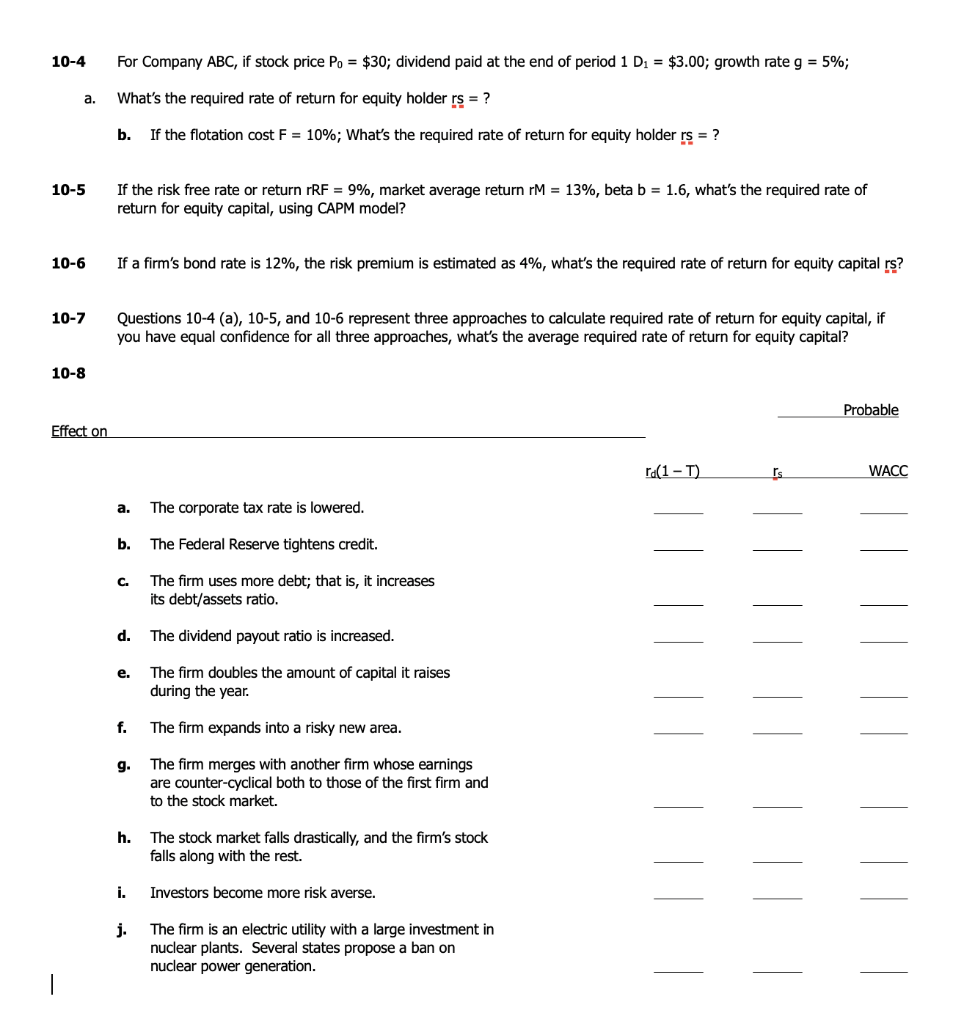

10-4 For Company ABC, if stock price Po = $30; dividend paid at the end of period 1 D1 = $3.00; growth rate g = 5%; a. What's the required rate of return for equity holder rs = ? b. If the flotation cost F = 10%; What's the required rate of return for equity holder rs = ? 10-5 If the risk free rate or return rRF = 9%, market average return rM = 13%, beta b = 1.6, what's the required rate of return for equity capital, using CAPM model? 10-6 If a firm's bond rate is 12%, the risk premium is estimated as 4%, what's the required rate of return for equity capital rs? 10-7 Questions 10-4 (a), 10-5, and 10-6 represent three approaches to calculate required rate of return for equity capital, if you have equal confidence for all three approaches, what's the average required rate of return for equity capital? 10-8 Probable Effect on rd(1-1) r's WACC a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. C. The firm uses more debt; that is, it increases its debt/assets ratio. d. The dividend payout ratio is increased. e. The firm doubles the amount of capital it raises during the year. f. The firm expands into a risky new area. g. The firm merges with another firm whose earnings are counter-cyclical both to those of the first firm and to the stock market. h. The stock market falls drastically, and the firm's stock falls along with the rest. i. Investors become more risk averse. j. The firm is an electric utility with a large investment in nuclear plants. Several states propose a ban on nuclear power generation. 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started