The following information relates to Wellworths Enterprises: 1. Balances on 1 October 2021 Equipment (including computers) at cost price Accumulated depreciation on equipment Bank

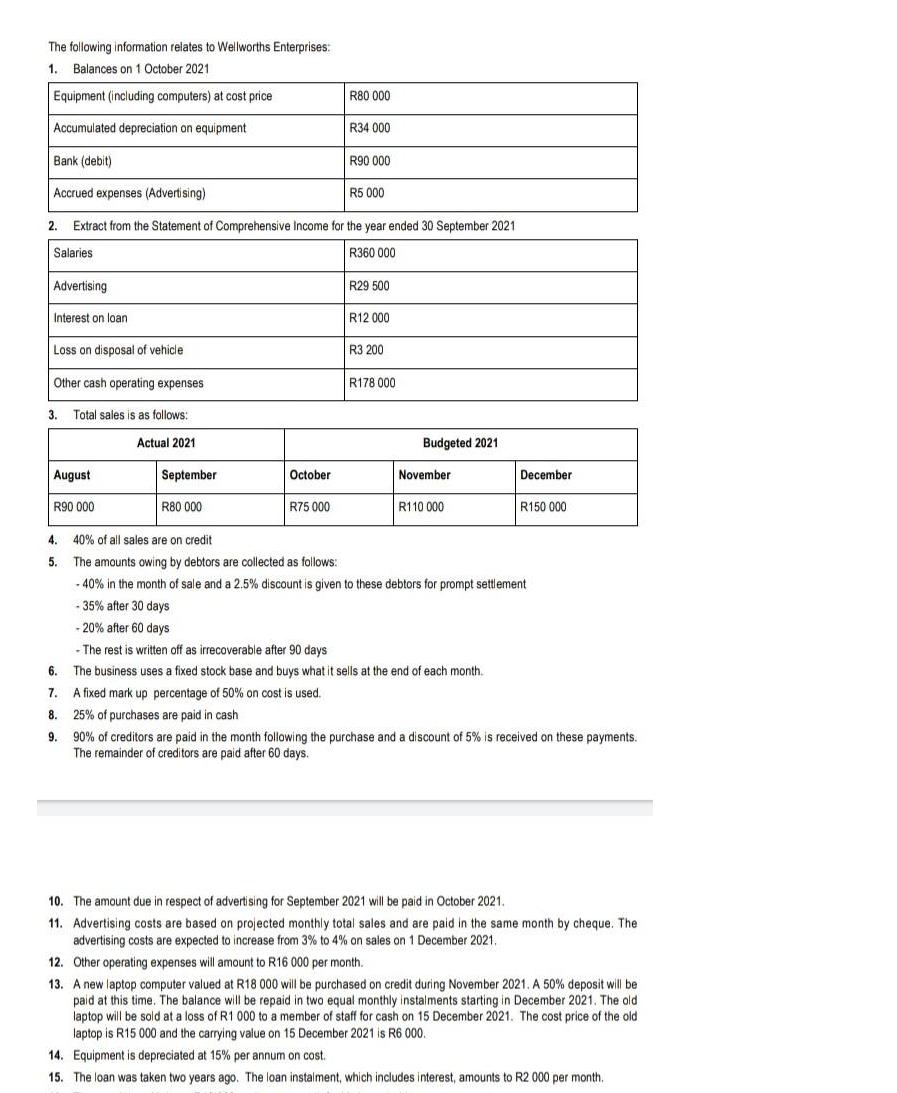

The following information relates to Wellworths Enterprises: 1. Balances on 1 October 2021 Equipment (including computers) at cost price Accumulated depreciation on equipment Bank (debit) Accrued expenses (Advertising) 2. Extract from the Statement of Comprehensive Income for the year ended 30 September 2021 Salaries R360 000 Advertising Interest on loan Loss on disposal of vehicle Other cash operating expenses 3. Total sales is as follows: Actual 2021 August R90 000 September R80 000 4. 40% of all sales are on credit 5. October R75 000 R80 000 R34 000 R90 000 R5 000 R29 500 R12 000 R3 200 R178 000 Budgeted 2021 November R110 000 December R150 000 The amounts owing by debtors are collected as follows: -40% in the month of sale and a 2.5% discount is given to these debtors for prompt settlement -35% after 30 days -20% after 60 days - The rest is written off as irrecoverable after 90 days 6. The business uses a fixed stock base and buys what it sells at the end of each month. 7. A fixed mark up percentage of 50% on cost is used. 8. 25% of purchases are paid in cash 9. 90% of creditors are paid in the month following the purchase and a discount of 5% is received on these payments. The remainder of creditors are paid after 60 days. 10. The amount due in respect of advertising for September 2021 will be paid in October 2021. 11. Advertising costs are based on projected monthly total sales and are paid in the same month by cheque. The advertising costs are expected to increase from 3% to 4% on sales on 1 December 2021. 12. Other operating expenses will amount to R16 000 per month. 13. A new laptop computer valued at R18 000 will be purchased on credit during November 2021. A 50% deposit will be paid at this time. The balance will be repaid in two equal monthly instalments starting in December 2021. The old laptop will be sold at a loss of R1 000 to a member of staff for cash on 15 December 2021. The cost price of the old laptop is R15 000 and the carrying value on 15 December 2021 is R6 000. 14. Equipment is depreciated at 15% per annum on cost. 15. The loan was taken two years ago. The loan instalment, which includes interest, amounts to R2 000 per month.

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Debtors are those customer accounts to whom business has made credit sales and amount has not been r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started