Answered step by step

Verified Expert Solution

Question

1 Approved Answer

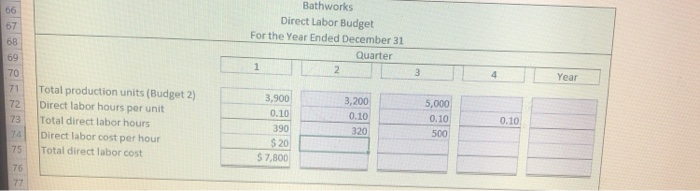

I dont have a understanding on where the numbers are suppose to come from Bathworks Direct Labor Budget For the Year Ended December 31 Quarter

I dont have a understanding on where the numbers are suppose to come from

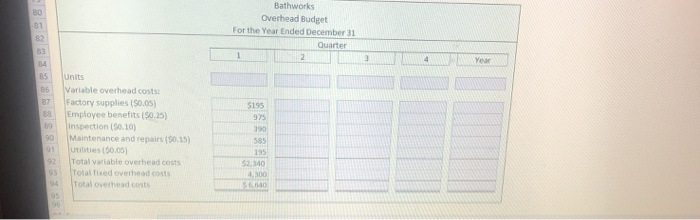

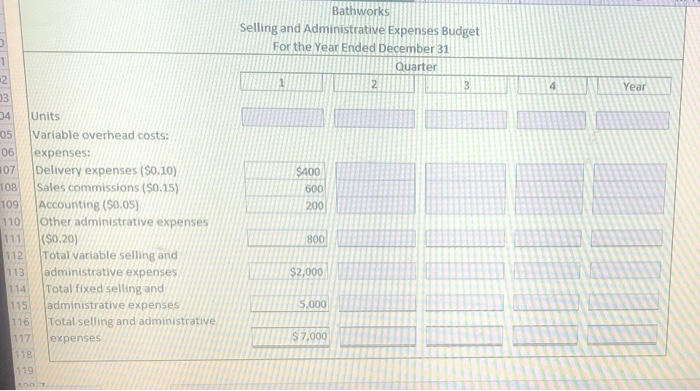

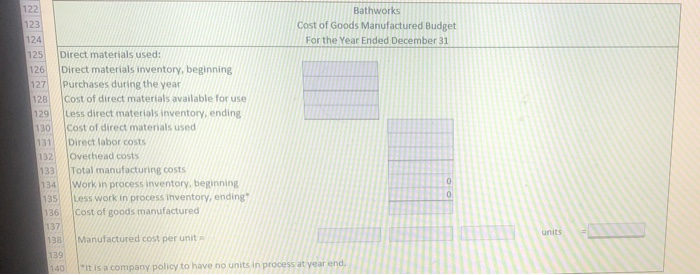

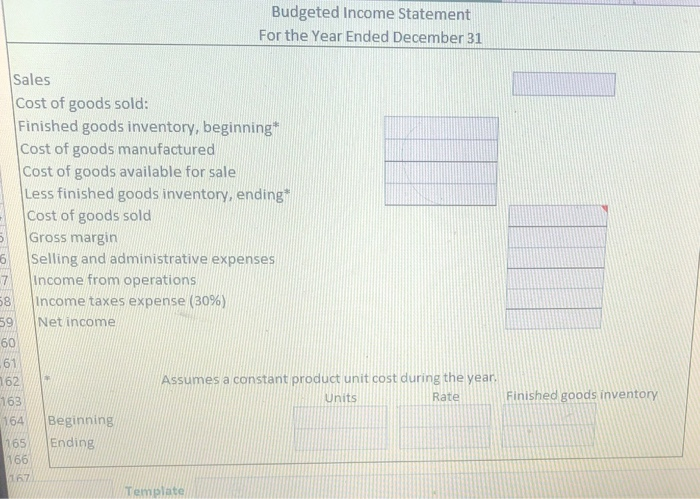

Bathworks Direct Labor Budget For the Year Ended December 31 Quarter Year 72 Total production units (Budget 2) Direct labor hours per unit Total direct labor hours Direct labor cost per hour Total direct labor cost 3,900 0.10 390 S 20 S 7,800 3,200 0.10 320 5,000 0.10 500 74 Bathworks Overhead Budget For the Year Ended December 31 Quarter Units Variable overhead costs: Factory supplies ISO.OS) Employee benefits ISO.25 inspection ( 10) Maintenance and repairs SOS) utilities $0.05 Total variable overhead costs Totalfired overhead costs. Total overhead costs. 90 01 22 Bathworks Selling and Administrative Expenses Budget For the Year Ended December 31 JA Year W 107 $400 600 200 Units Variable overhead costs: 06 expenses: Delivery expenses ($0.10) 108 Sales commissions ($0.15) 109 Accounting ($0.05) 110 Other administrative expenses 111 ($0.20) Total variable selling and 113 administrative expenses 114 Total fixed selling and 115 administrative expenses 116 Total selling and administrative 117 expenses 1181 112 5,000 $7,000 119 Bathworks Cost of Goods Manufactured Budget For the Year Ended December 31 125 126 127 128 129 130 131 132 Direct materials used: Direct materials inventory, beginning Purchases during the year Cost of direct materials available for use Less direct materials inventory, ending cost of direct materials used Direct labor costs Overhead costs Total manufacturing costs Work in process inventory, beginning Less work in process inventory, ending Cost of goods manufactured 133 138 Manufactured cost per units 140 "It is a company policy to have no units in process at year end. Budgeted Income Statement For the Year Ended December 31 Sales Cost of goods sold: Finished goods inventory, beginning Cost of goods manufactured Cost of goods available for sale Less finished goods inventory, ending Cost of goods sold Gross margin Selling and administrative expenses Income from operations Income taxes expense (30%) Net income O 58 59 Assumes a constant product unit cost during the year. Rate Finished goods inventory Units Beginning Ending Template Bathworks Direct Labor Budget For the Year Ended December 31 Quarter Year 72 Total production units (Budget 2) Direct labor hours per unit Total direct labor hours Direct labor cost per hour Total direct labor cost 3,900 0.10 390 S 20 S 7,800 3,200 0.10 320 5,000 0.10 500 74 Bathworks Overhead Budget For the Year Ended December 31 Quarter Units Variable overhead costs: Factory supplies ISO.OS) Employee benefits ISO.25 inspection ( 10) Maintenance and repairs SOS) utilities $0.05 Total variable overhead costs Totalfired overhead costs. Total overhead costs. 90 01 22 Bathworks Selling and Administrative Expenses Budget For the Year Ended December 31 JA Year W 107 $400 600 200 Units Variable overhead costs: 06 expenses: Delivery expenses ($0.10) 108 Sales commissions ($0.15) 109 Accounting ($0.05) 110 Other administrative expenses 111 ($0.20) Total variable selling and 113 administrative expenses 114 Total fixed selling and 115 administrative expenses 116 Total selling and administrative 117 expenses 1181 112 5,000 $7,000 119 Bathworks Cost of Goods Manufactured Budget For the Year Ended December 31 125 126 127 128 129 130 131 132 Direct materials used: Direct materials inventory, beginning Purchases during the year Cost of direct materials available for use Less direct materials inventory, ending cost of direct materials used Direct labor costs Overhead costs Total manufacturing costs Work in process inventory, beginning Less work in process inventory, ending Cost of goods manufactured 133 138 Manufactured cost per units 140 "It is a company policy to have no units in process at year end. Budgeted Income Statement For the Year Ended December 31 Sales Cost of goods sold: Finished goods inventory, beginning Cost of goods manufactured Cost of goods available for sale Less finished goods inventory, ending Cost of goods sold Gross margin Selling and administrative expenses Income from operations Income taxes expense (30%) Net income O 58 59 Assumes a constant product unit cost during the year. Rate Finished goods inventory Units Beginning Ending Template Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started