Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I DON'T HAVE RISK PLS HELP Suppose you are going to invest equal amounts in three stocks. The annual return from each stock is normally

I DON'T HAVE RISK PLS HELP

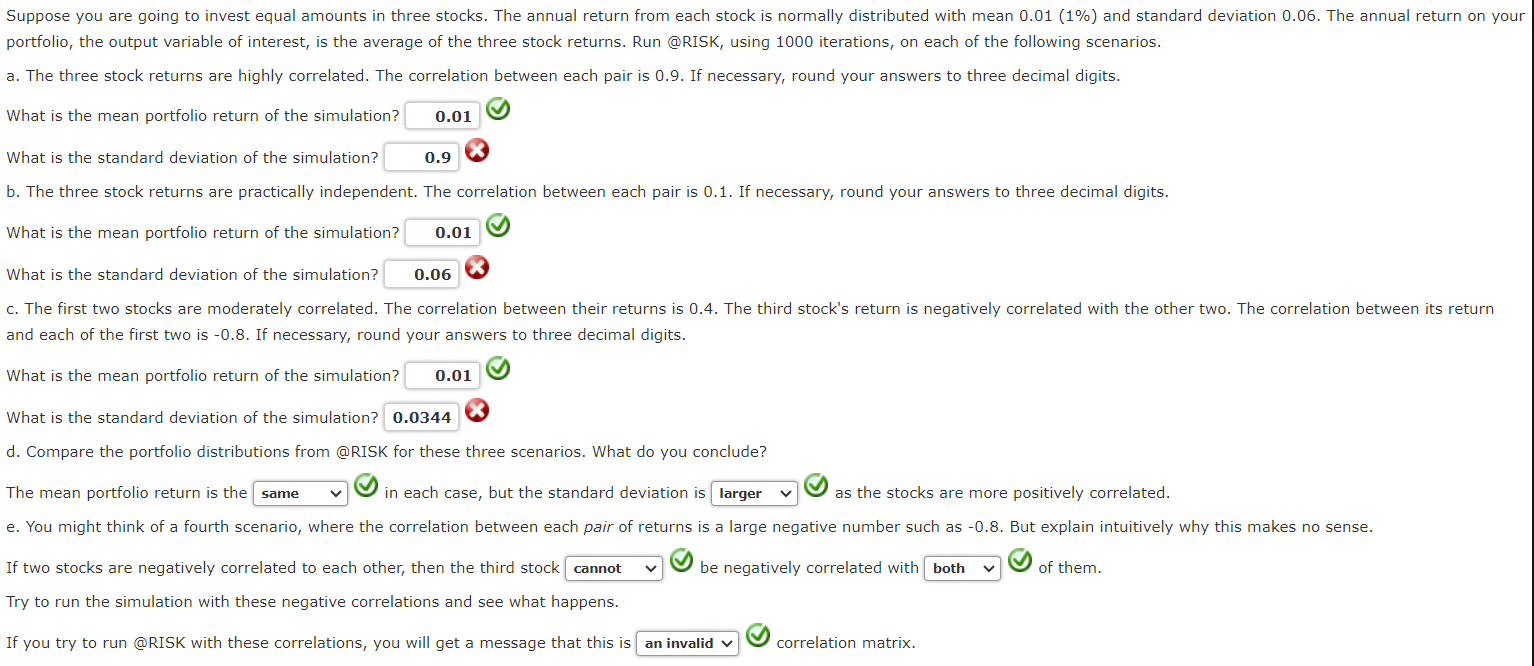

Suppose you are going to invest equal amounts in three stocks. The annual return from each stock is normally distributed with mean and standard deviation The annual return on your

portfolio, the output variable of interest, is the average of the three stock returns. Run @RISK, using iterations, on each of the following scenarios.

a The three stock returns are highly correlated. The correlation between each pair is If necessary, round your answers to three decimal digits.

What is the mean portfolio return of the simulation?

What is the standard deviation of the simulation?

b The three stock returns are practically independent. The correlation between each pair is If necessary, round your answers to three decimal digits.

What is the mean portfolio return of the simulation?

What is the standard deviation of the simulation?

c The first two stocks are moderately correlated. The correlation between their returns is The third stock's return is negatively correlated with the other two. The correlation between its return

and each of the first two is If necessary, round your answers to three decimal digits.

What is the mean portfolio return of the simulation?

What is the standard deviation of the simulation?

d Compare the portfolio distributions from @RISK for these three scenarios. What do you conclude?

The mean portfolio return is the

in each case, but the standard deviation is

as the stocks are more positively correlated.

e You might think of a fourth scenario, where the correlation between each pair of returns is a large negative number such as But explain intuitively why this makes no sense.

If two stocks are negatively correlated to each other, then the third stock

be negatively correlated with

of them.

Try to run the simulation with these negative correlations and see what happens.

If you try to run @RISK with these correlations, you will get a message that this is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started