i dont know how to do this, please help asap

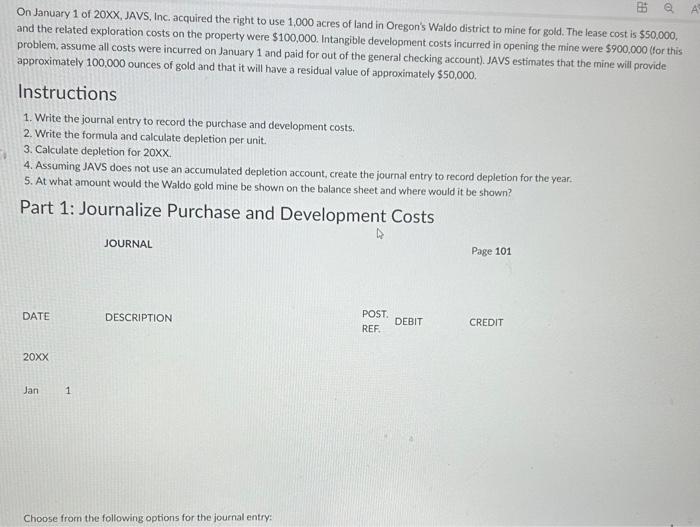

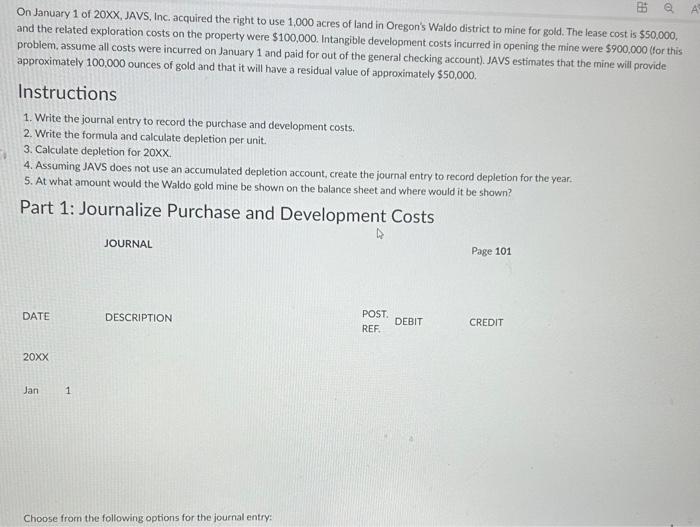

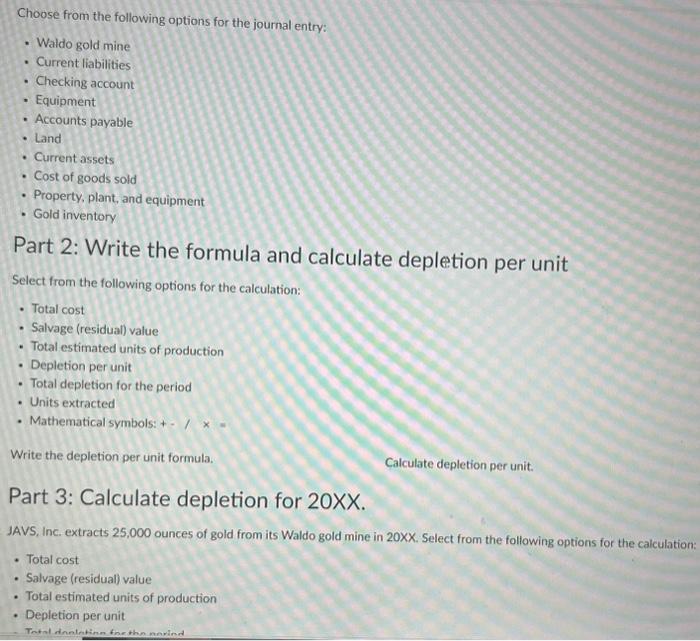

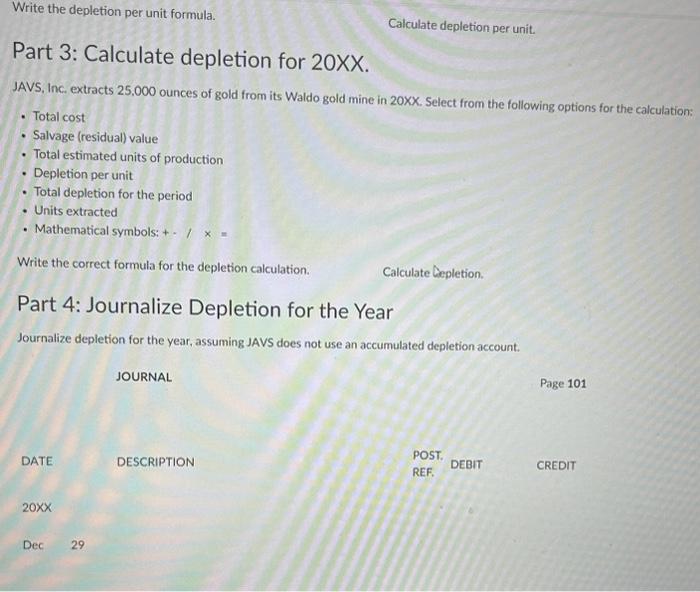

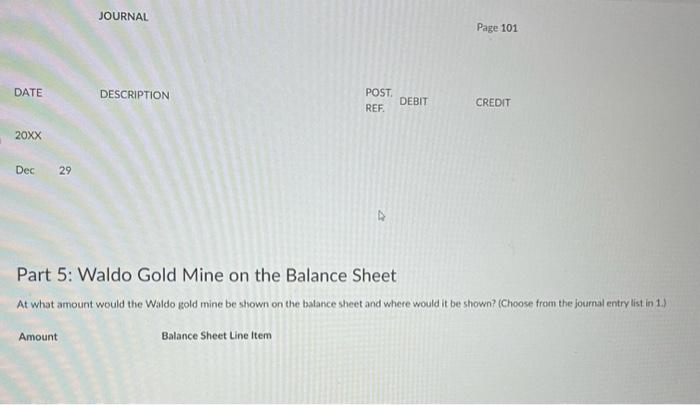

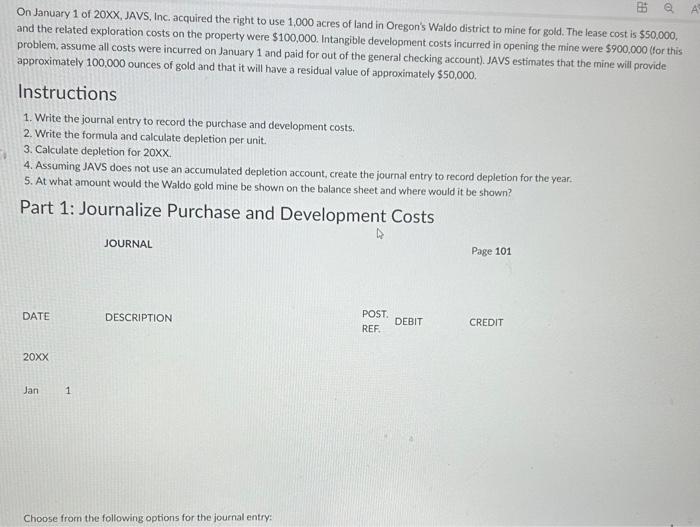

On January 1 of 20XX, JAVS, Inc. acquired the right to use 1,000 acres of land in Oregon's Waldo district to mine for gold. The lease cost is $50,000, and the related exploration costs on the property were $100,000. Intangible development costs incurred in opening the mine were $900,000 (for this problem, assume all costs were incurred on January 1 and paid for out of the general checking account). JAVS estimates that the mine will provide approximately 100,000 ounces of gold and that it will have a residual value of approximately $50,000. Instructions 1. Write the journal entry to record the purchase and development costs. 2. Write the formula and calculate depletion per unit. 3. Calculate depletion for 20XX. 4. Assuming JAVS does not use an accumulated depletion account, create the journal entry to record depletion for the year. 5. At what amount would the Waldo gold mine be shown on the balance sheet and where would it be shown? Part 1: Journalize Purchase and Development Costs JOURNAL DATE DESCRIPTION 20x Jan 1 Page 101 POST. REF. DEBIT CREDIT Choose from the following options for the journal entry: Choose from the following options for the journal entry: - Waldo gold mine - Current liabilities - Checking account - Equipment - Accounts payable - Land - Current assets - Cost of goods sold - Property, plant, and equipment - Gold inventory Part 2: Write the formula and calculate depletion per unit Select from the following options for the calculation: - Total cost - Salvage (residual) value - Total estimated units of production - Depletion per unit - Total depletion for the period - Units extracted - Mathematical symbols: +- 1 x = Write the depletion per unit formula. Calculate depletion per unit. Part 3: Calculate depletion for 20XX. JAVS, Inc. extracts 25,000 ounces of gold from its Waldo gold mine in 20XX. Select from the following options for the calculation: - Total cost - Salvage (residual) value - Total estimated units of production - Depletion per unit Part 3: Calculate depletion for 20XX. JAVS, Inc. extracts 25.000 ounces of gold from its Waldo gold mine in 20XX. Select from the following options for the calculation: - Total cost - Salvage (residual) value - Total estimated units of production - Depletion per unit - Total depletion for the period - Units extracted - Mathematical symbols: + - / x= Write the correct formula for the depletion calculation. Calculate Cepletion. Part 4: Journalize Depletion for the Year Journalize depletion for the year, assuming JAVS does not use an accumulated depletion account. Part 5: Waldo Gold Mine on the Balance Sheet At what amount would the Waldo gold mine be shown on the balance sheet and where would it be shown? (Choose from the joumal entry list in 1.) Amount Balance Sheet Line Item