Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't know the answers what is answers and explain solution 1. Bushwood Country Club incurred the following costs to acquire and prepare land for

I don't know the answers

what is answers and explain solution

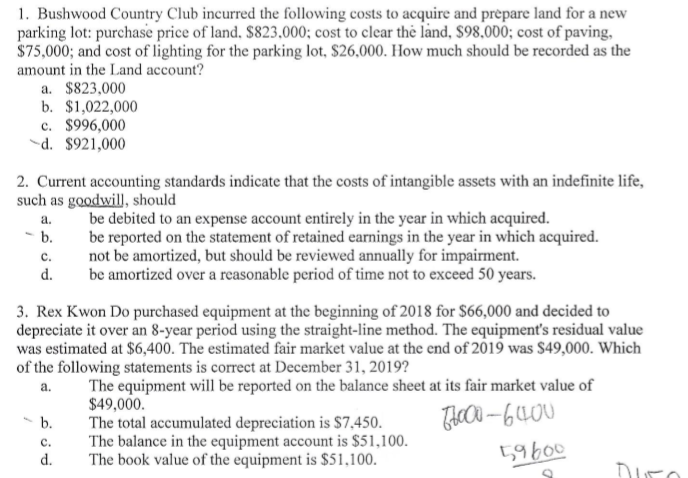

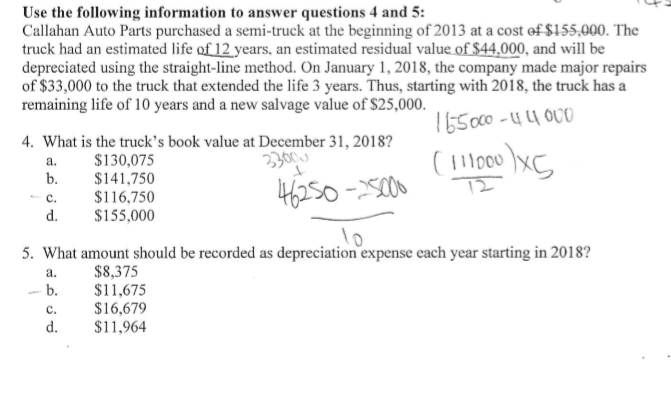

1. Bushwood Country Club incurred the following costs to acquire and prepare land for a new parking lot: purchase price of land. $823,000; cost to clear the land, $98.000; cost of paving. $75,000; and cost of lighting for the parking lot, $26,000. How much should be recorded as the amount in the Land account? a. $823.000 b. $1,022,000 c. $996,000 d. $921,000 2. Current accounting standards indicate that the costs of intangible assets with an indefinite life, such as goodwill, should a. be debited to an expense account entirely in the year in which acquired. c. d. be reported on the statement of retained earnings in the year in which acquired. not be amortized, but should be reviewed annually for impairment. be amortized over a reasonable period of time not to exceed 50 years. 3. Rex Kwon Do purchased equipment at the beginning of 2018 for $66,000 and decided to depreciate it over an 8-year period using the straight-line method. The equipment's residual value was estimated at $6,400. The estimated fair market value at the end of 2019 was $49,000. Which of the following statements is correct at December 31, 2019? a. The equipment will be reported on the balance sheet at its fair market value of b The total accumulated depreciation is $7450. cou-aou d. The book value of the equipment is $51.100. $49,000 The balance in the equipment account is $51,100 Use the following information to answer questions 4 and 5: Callahan Auto Parts purchased a semi-truck at the beginning of 2013 at a costf $155,000. The truck had an estimated life of 12 years, an estimated residual value of $44,000, and will be depreciated using the straight-line method. On January 1, 2018, the company made major repairs of $33,000 to the truck that extended the life 3 years. Thus, starting with 2018, the truck has a remaining life of 10 years and a new salvage value of $25,000 . What is the truck's book value at December 31,2018? a. $130,075 $141,750 c. $116,750 $155,000 5. What amount should be recorded as depreciation expense each year starting in 2018? a.$8,375 b. ,675 c. $16,679 d. $11,964Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started