i don't know this problem so i wnat answer request

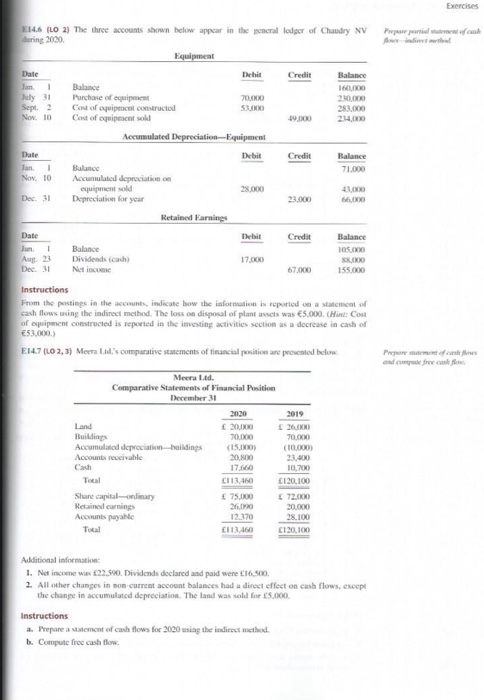

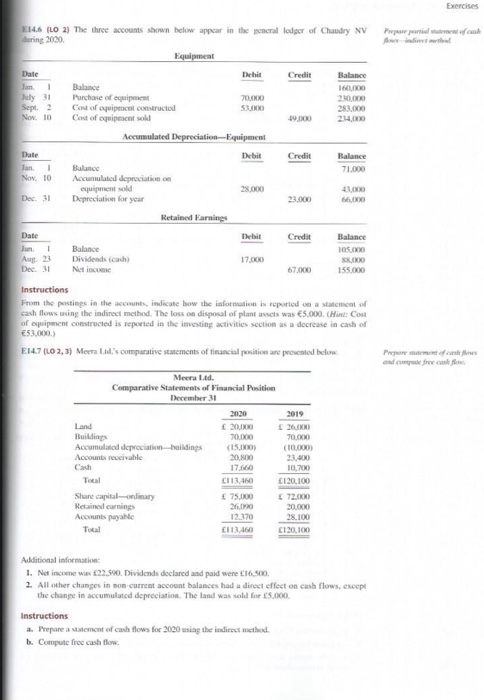

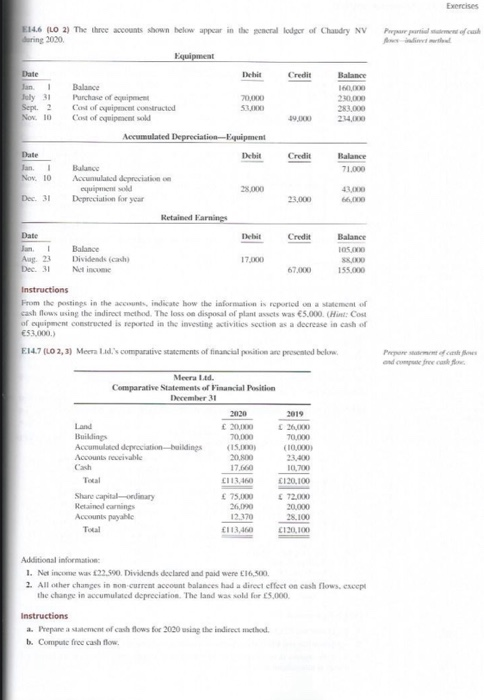

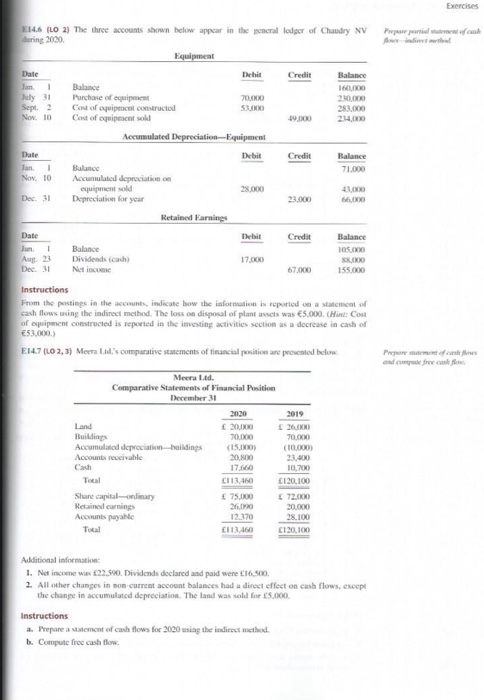

Exercises Prawo E14.6 (LO 2) The three accounts shown below appear in the per lodger of Chaudry NV during 2020 Equipment Thethit Credit Balance Date Jan July Sept. 2 Now. 10 Balance Purchase o pet Cost of quiet constructed Cost of equipment sold 7000D 53,000 230,000 283.000 214,00 39.000 Accumulated Depreciation Equipment Date Debit Credit Balance 71.000 Nov 10 Bulan Accumulated depreciation euen wold Depreciation for year 000 Dec. 31 23,000 41 66.000 Retained Earnings Date Debit Credit Balans 105.00 Balance Dividends (cach) Net income Aug2 Dec 11 17.00 67.000 155.000 Instructions From the pastips in the indicate how the information is reported on a statement of cash flow using the indirect method. The loss on disposal of plant s was 5.000. (Hint: Cost of ment constructed is reported in the investing activities section as a decrease in cash of 53.000.) E14.7 (LO 2, 3) Meera Lid's comparative statements of financial position are presented below Meeru Ltd. Comparative Statements of Financial Position December 31 2019 2020 2010 70.000 CISO 20 1776 Building Accumulated depreciation Accounts receivable Cach Total buildings 70.000 (10.000 23.00 CI 160 C120,100 Share capital ordinary Retained carings Accounts payable Total Additional information 1. Net W C .590. Dividends declared and paid were 16.500 2. All other changes in non current account balances had a direct effect on cash flows, excepe the change in accumulated depreciation. The land was sold for 5.000 Instructions a. Prepare a statement of cash flows for 2020 using the indirect method. b. Compute free cash flow. Exercises moral logo of Chaudry NV E14.6 (LO 2) The three accounts shown below appear in the during 2020 Equipment Powe www Thethit Credit Balance Date Jan 1 July Sept. 2 No. 10 Balance Purchase o pet Cost of quiet constructed Cost of equipment sold 700D 53,000 230,000 283.000 244 19.000 Accumulated Depreciation Equipment Date Debit Credit Balance 71.000 Jan. Nov. 10 Bulan Accumulated depreciation yun old Depreciation for year 000 Dec. 31 23.000 41 66.000 Retained Earnings Date Debit Credit Balans 105.00 Balance Dividends (cash) Net income Au23 Dee 17.00 67.000 155.00 Instructions From the pastips in the indicate how the information is reported on a statement of cash flow using the indirect method. The loss on disposal of plant s was 5.000. (Hint: Cost of equipment constructed is reported in the investing activities section as a decrease in cash of 53.000. E14.7 (LO 2, 3) Meer Lid's comparative statements of financial position are presented below Meera Ltd. Comparative Statements of Financial Position December 31 2019 2020 2010 70.000 CISO Buildings Accumulated depreciation-buildings Accounts receivable Cach 70.000 (10.000 23.00 O 17 CI1360 120100 Share capital ordinary Retained carings Accounts payable Total Additional information 1. Net WK 2.500. Dividends declared and paid were 16.500 2. All other changes in non current account balances had a direct effect on cash flows. excepe the change in accumulated depreciation. The land was sold for 5.000 Instructions a. Prepare a statement of cash flows for 2020 using the indirect method. b. Compute free cash flow