Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't know where to start... Exercise1 The unadjusted trial balance of Morrigan Trading Co. as of June 30, 2015, is reported below Account name

I don't know where to start...

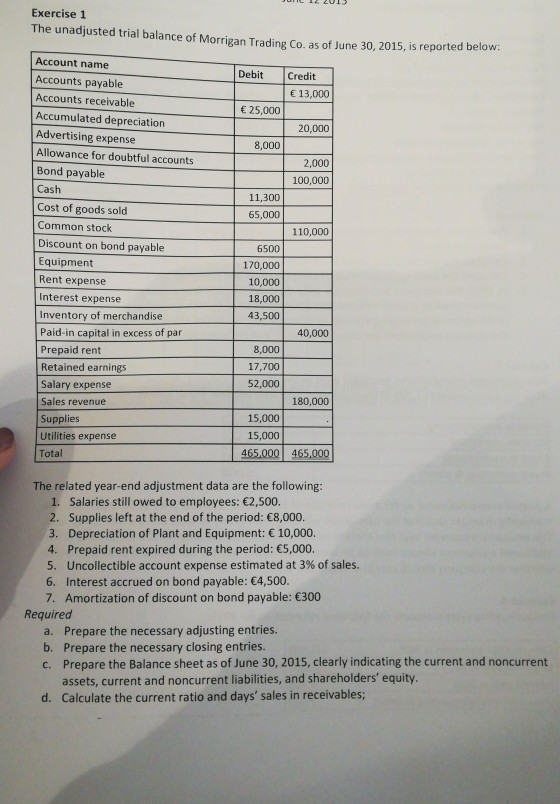

Exercise1 The unadjusted trial balance of Morrigan Trading Co. as of June 30, 2015, is reported below Account name Accounts payable Accounts receivable Accumulated depreciation Advertising expense Allowance for doubtful accounts Bond payable Cash Cost of goods sold Common stock Discount on bond payable Equipment Rent expense Interest expense Inventory of merchandise Paid-in capital in excess of par Prepaid rent Retained earnings Salary expense Sales revenue DebitCredit E 13,000 25,000 20,000 8,000 2,000 100,000 11,300 65,000 110,000 6500 170,000 10,000 18,000 43,500 40,000 8,000 17,700 52,000 180,000 15,000 15,000 Utilities expense Total 465,000 465,000 The related year-end adjustment data are the following: 1. Salaries still owed to employees: 2,500. 2. Supplies left at the end of the period: 8,000. 3. Depreciation of Plant and Equipment: 10,000. 4. Prepaid rent expired during the period: 5,000 5, Uncollectible account expense estimated at 3% of sales. 6. Interest accrued on bond payable: 4,500. 7. Amortization of discount on bond payable: 300 Required a. b. c. Prepare the necessary adjusting entries. Prepare the necessary closing entries. Prepare the Balance sheet as of June 30, 2015, clearly indicating the current and noncurrent assets, current and noncurrent liabilities, and shareholders' equity. Calculate the current ratio and days' sales in receivables; dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started