I don't know why this balance sheet meaning. Please help me understand. thx.

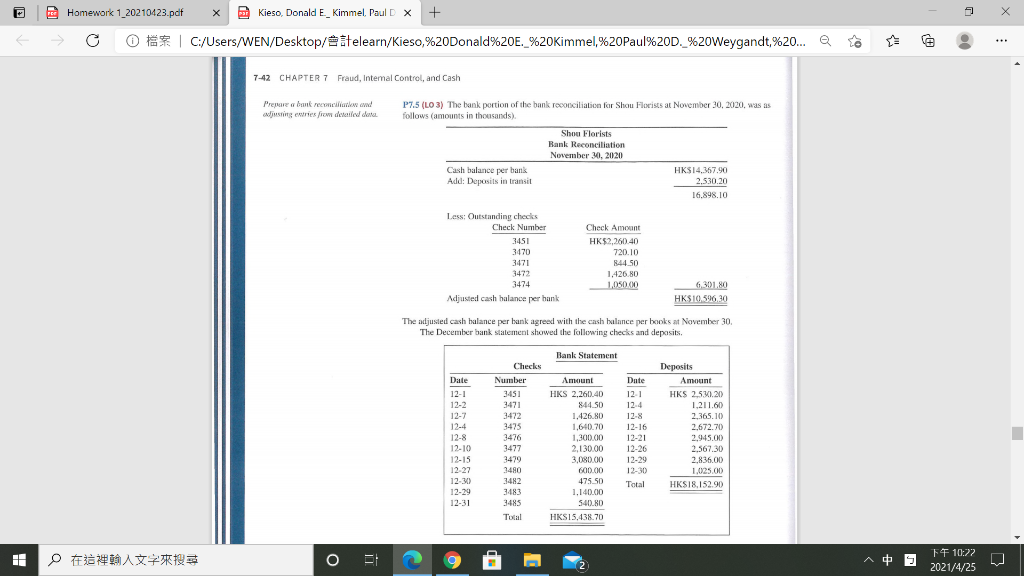

this is the original question:

this is the original question:

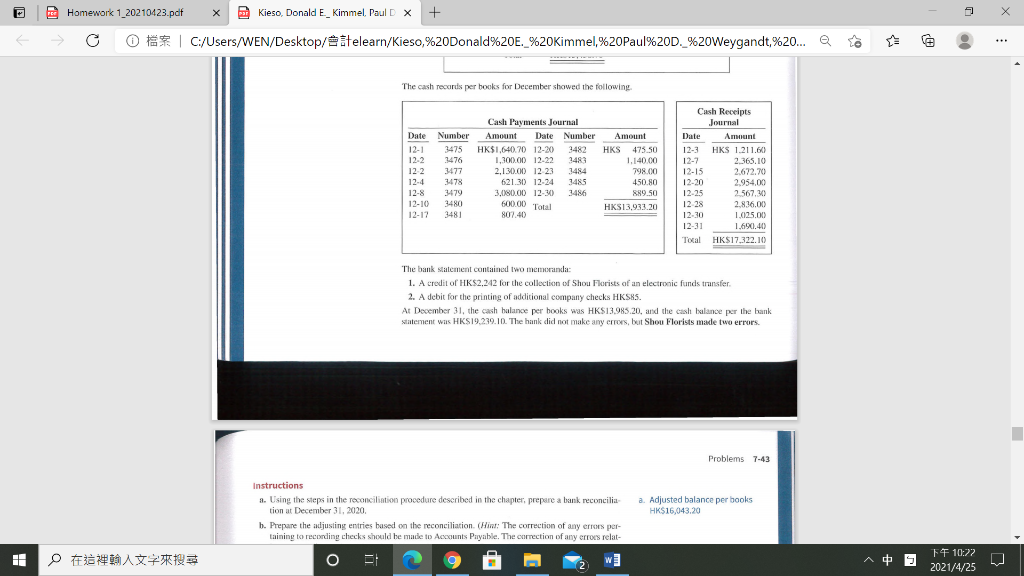

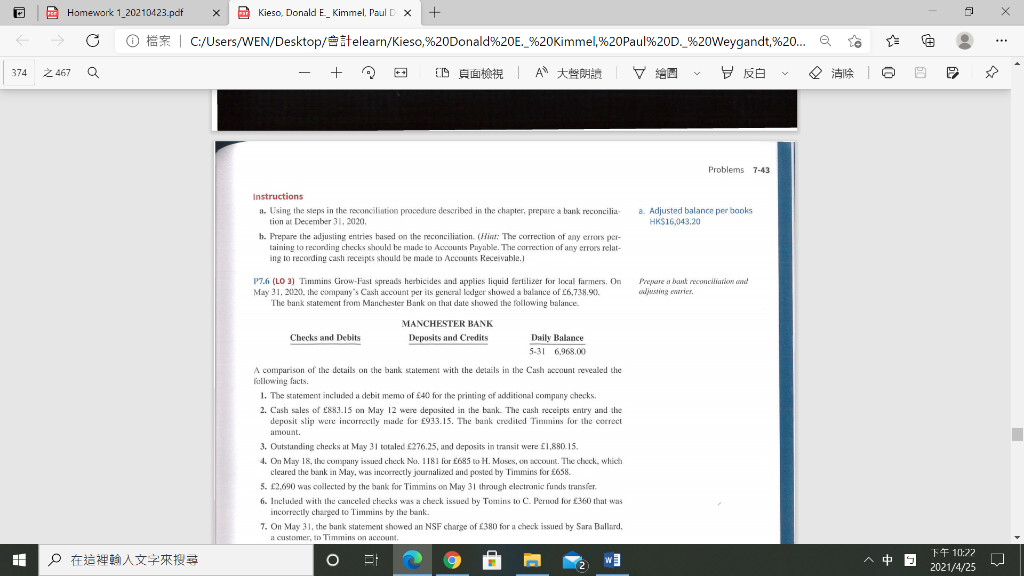

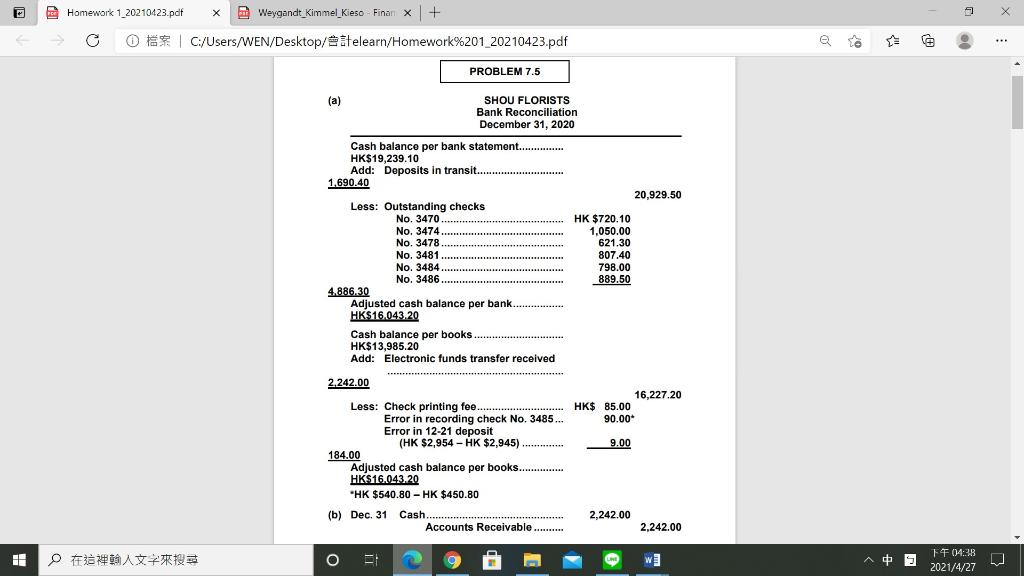

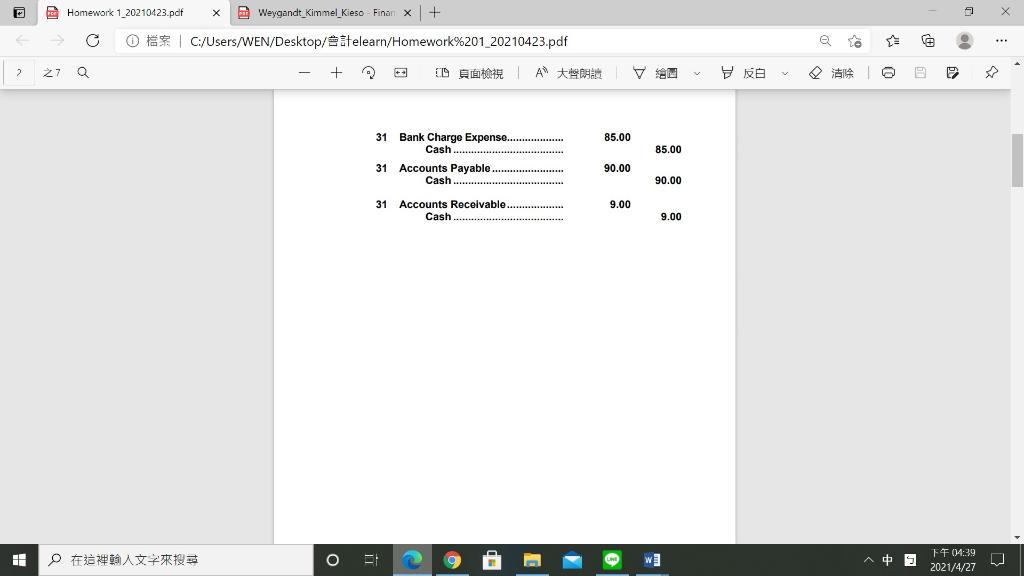

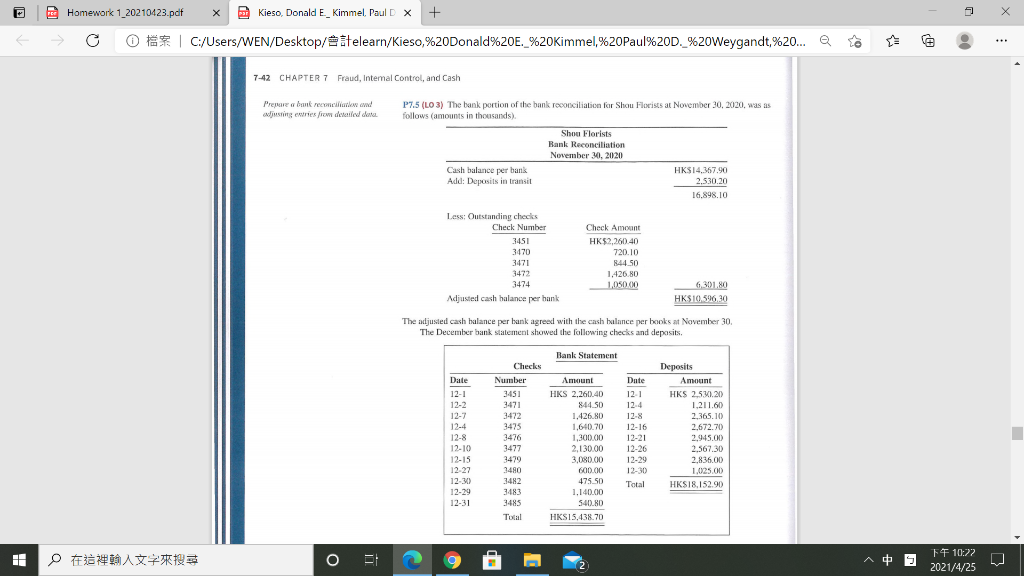

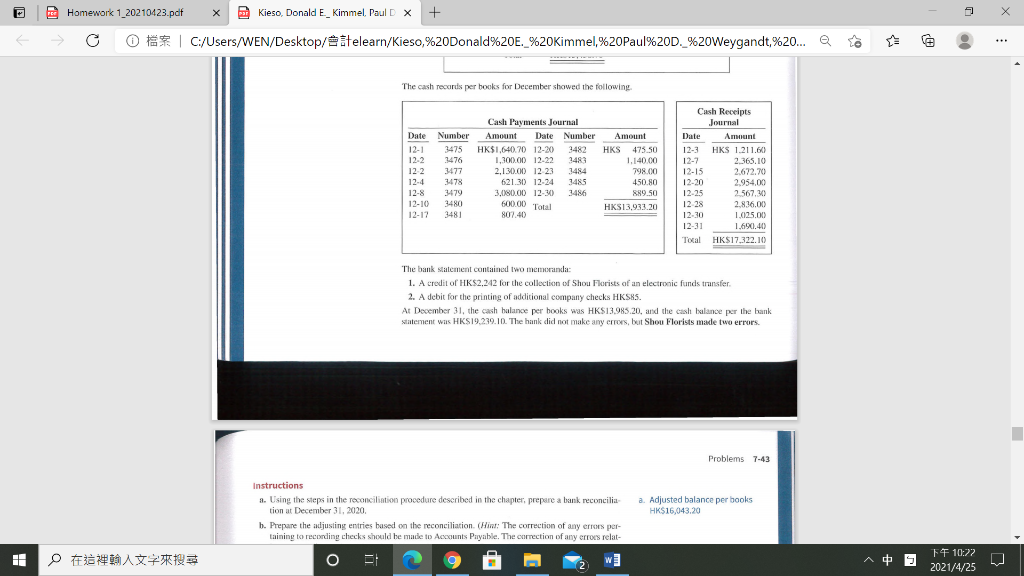

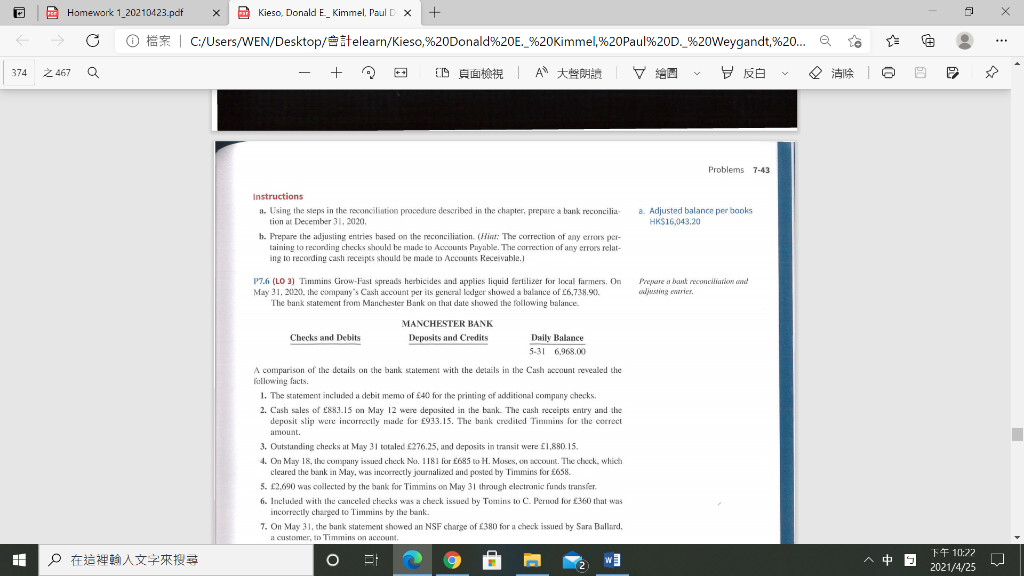

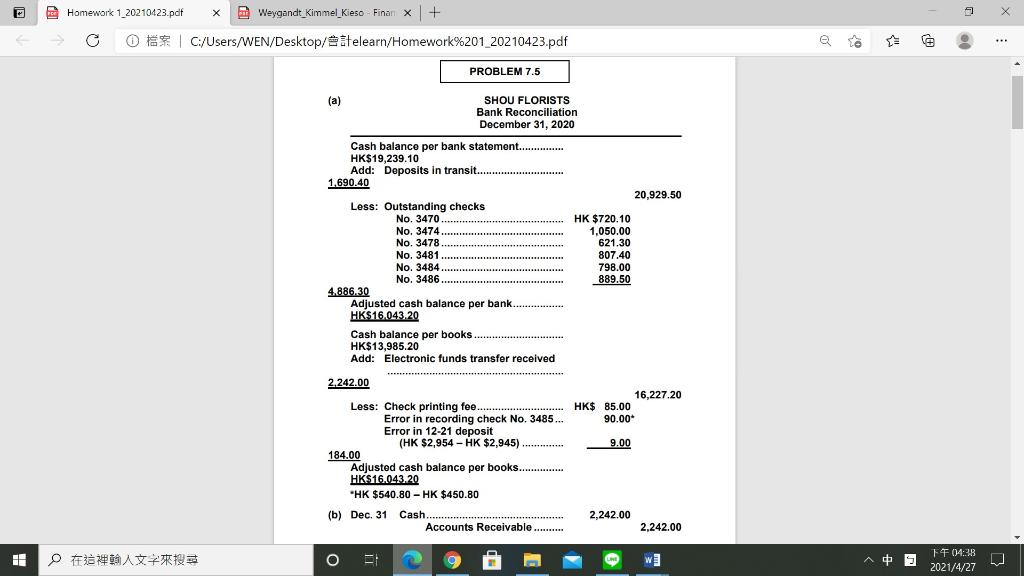

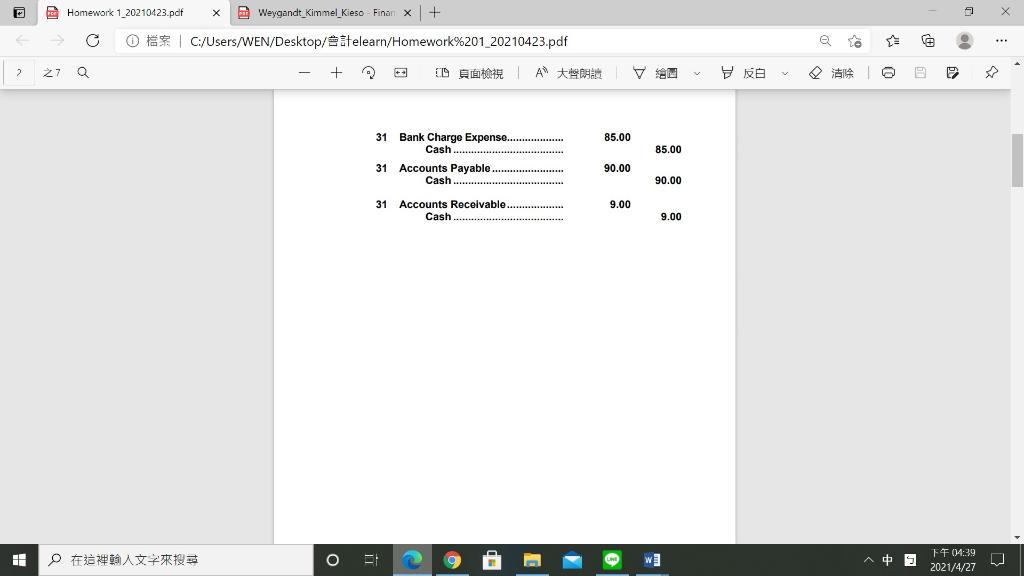

Homework 1 20210423.pdf Weygandt_Kimmel_Kieso Finar x + X OR C:/Users/WEN/Desktop/telearn/Homework%201_20210423.pdf PROBLEM 7.5 (a) SHOU FLORISTS Bank Reconciliation December 31, 2020 Cash balanco por bank statement.............. HK$19,239.10 Add: Deposits in transit.................. 1.690.40 20,929.50 HK $720.10 1,050.00 621.30 807.40 798.00 889.50 Less: Outstanding checks No. 3470 No. 3474 No. 3478 No. 3481 No. 3484 No. 3486. 4.886.30 Adjusted cash balance per bank HK$16.043.20 Cash balance per books. HK$13,985.20 Add: Electronic funds transfer received : 2.242.00 16,227.20 HK$ 85.00 90.00 9.00 Less: Check printing fee. Error in recording check No. 3485 Error in 12-21 deposit (HK $2,954 - HK $2,945)........ 184.00 Adjusted cash balanco per books................ HK$16.043.20 "HK $540.80 - HK $450.80 (b) Dec. 31 Cash... Accounts Receivable....... 2,242.00 2.242.00 HE O O wi + FF04:38 2021/4/27 Homework 1_20210423.pdf Weygandt_Kimmel_Kieso - Finar x + 0 * C:/Users/WEN/Desktop/itelearn/Homework%201_20210423.pdf Q + 16 | A% ta 2 27 VM 85.00 85.00 31 Bank Charge Expense... Cash 31 Accounts Payable Cash 90.00 90.00 . 31 Accounts Receivable Cash 9.00 ... 9.00 HE O O 9 wi + 9 FF 04:39 2021/4/27 Homework 1_20210423.pdf Kieso, Donald E. Kimmel, Paul D X + 2 X ER C:/Users/WEN/Desktop/itelearn/Kieso,%20Donald%20E._%20Kimmel,%20Paul%20D_%20Weygandt, %2...@ 7-42 CHAPTER 7 Fraud, Intemal Control, and Cash Prepare a bank reconciliation singeniex fim detailed den P7.5 (LO 3) The bank portion of the bank reconciliation for Shou Florists at November 30, 2020, was as follows (amounts in thousands) Shou Florists Rank Reconciliation November 20, 2020 Cash balance per bunk Add: Deposits in transit HKS14,467.90 2.530,20 16.898,10 Less: Outstanding checks Check Number 3451 3470 3471 3472 3474 Adjusted cash balance per bank Check Amount HK$2,260.40 720.10 844.50 1,426 80 1,050.00 6,301.80 HK$10.596.30 The adjusted cash balance per bank agreed with the cash balance per books at November 30, The December bank statement showed the following checks and deposits Bank Statement Amount HKS 2.260.40 844.50 1.426.80 1,640.70 1,300.00 Date 12-1 12-2 12-7 12-4 12-8 12-10 12-15 12-27 12 12-29 12-31 Checks Number 3451 3471 3472 3475 3476 3477 3479 3480 3482 3483 3485 Total Date 12.1 124 12.8 12-16 12-21 12-26 12-29 12-30 Total Deposits Amount HKS 2.520.20 1.211.60 2,365.10 2.672.70 2,945.00 2.567.30 2.836.00 1.025.00 HKSI8.152.90 2.130.00 3,080.00 600.00 475.50 1.140.00 540.80 HKS15,438.70 I O O . 9 s TT 10:22 2021/4/25 Homework 1_20210423.pdf Kieso, Donald E_Kimmel, Paul D X + 2 X OER C:/Users/WEN/Desktop/telearn/Kieso,%20Donald%20E._%20Kimmel,%20Paul%20D._%20Weygandt,%20... The cash records per books for December showed the following Date Number 12-1 3475 12-2 1476 12-2 3477 12-4 34474 12-8 3479 12-10 3480 12-12 3481 Cash Payments Journal Amount Date Number HK$1,640.70 12-20 1,300.00 12.22 2,130.00 12 23 3484 621.30 12-24 348 3.880.00 12-30 3486 Amount HKS 475.50 1.140.00 798.00 450.80 889.50 HKS13,933.20 Cash Receipts Journal Date Amount 12-3 HKS 1.211.60 ) 12-7 2.365.10 12-15 2.672.70 12-20 2.954,00 12.25 2.567.30 1228 2,836,00 12-30 1.025.00 12-31 1.691.40) Tocal HK$17,322.10 500.00 Total 807.40 The bank statement contained two memoranda: 1. A credit of HK$2,242 for the collection of Shou Florists of an electronic funds transfer 2. A debit for the printing of additional company checks HKSKS. At December 31, the cash balance per books was HK$13.985.20, and the cash balance per the bank statement was HKS19.239.10. The bank did not make any errors, but Shou Florists made two errors. Problems 7-43 a. Adjusted balance per books HK$16,043,20 Instructions a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconcilia tion at December 31, 2020, b. Prepare the adjusting entries based on the reconciliation (Hint: The correction of any erros per- taining to recording checks should be made to Accounts Payable. The correction of any erroes relat- O . w I O s TT 10:22 2021/4/25 Homework 1_20210423.pdf Kieso, Donald E_ Kimmel, Paul D X , , + ER | C:/Users/WEN/Desktop/telearn/Kieso,%20Donald%20E._%20Kimmel,%20Paul%20D._%20Weygandt,%20... ta 374 467 Q + D | Am g Problems 7-43 Instructions a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconcilia- tion at December 31, 2020, b. Prepare the adjusting entries based on the reconciliation. (Hint: The correction of any errors per taining to recording checks should be made to Accounts Payable. The correction of any erroes relat- ing to recording cash receipts should be made to Accounts Receivable.) a. Adjusted balance per books HK$16,043.20 Prepare a bant reconciliar www P7.6 (LO 3) Timmins Grow-Fast spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2020, the company's Cash account per il general ledger showed a balance of 6,738.90). The bank statement from Manchester Bank on that date showed the following balance. MANCHESTER BANK Checks and Debits Deposits and Credits Daily Balance 5-31 6.968.00 A comparison of the details on the bank statement with the details in the Cash account revealed the following facts 1. The statement included a debit memo of 40 for the printing of additional company checks. 2. Cash sales of 883.15 on May 12 were deposited in the bank. The cash receipts entry and the deposit slip were incorrectly made for 933.15. The bank credited Timmins for the correct amount. 3. Outstanding checks at May 31 totaled 276.25, and deposits in transit were 1,850.15. 4. On May 18, the company issued check No. 1181 for E685 to H. Moses, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Timmins for 658 5. 2,690 was collected by the bank for Timmins on May 31 through electronic funds transfer 6. Included with the canceled checks was a check issued by Tomins to C. Pernod for 360 that was incorrectly charged to Timmins by the bank. 7. On May 31, the bunk statement showed an NSF charge of 380 for a check issued by Sara Ballard, a customer to Timmins on account I O O 9 w + TT 10:22 2021/4/25

this is the original question:

this is the original question: