I DONT NEED EXPLANATION

JUST WORK PROBLEM#7-7

Follow Example Steps on PROBLEM#7

Don't use excel show all your work clear writing ( I also attached the table)

thank you

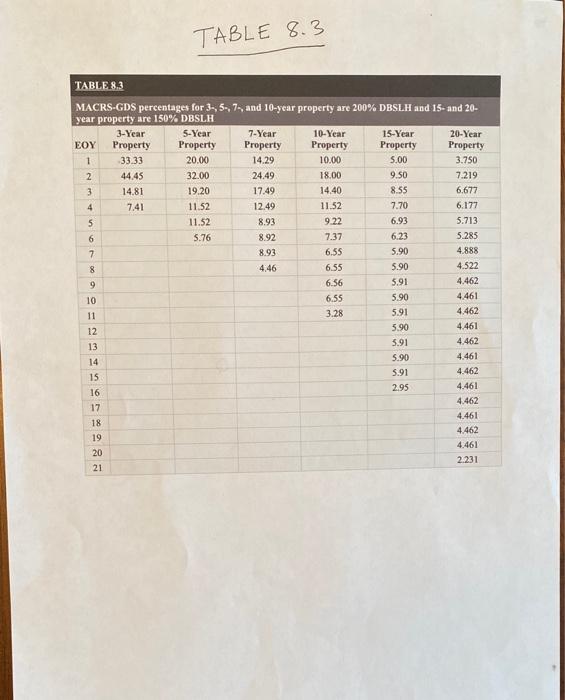

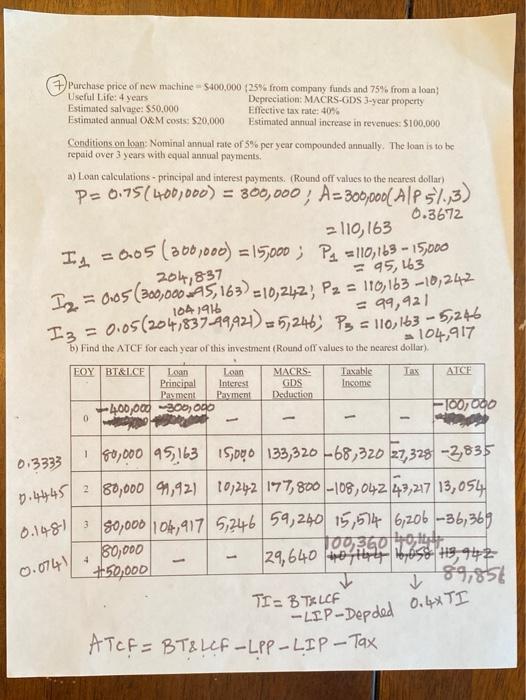

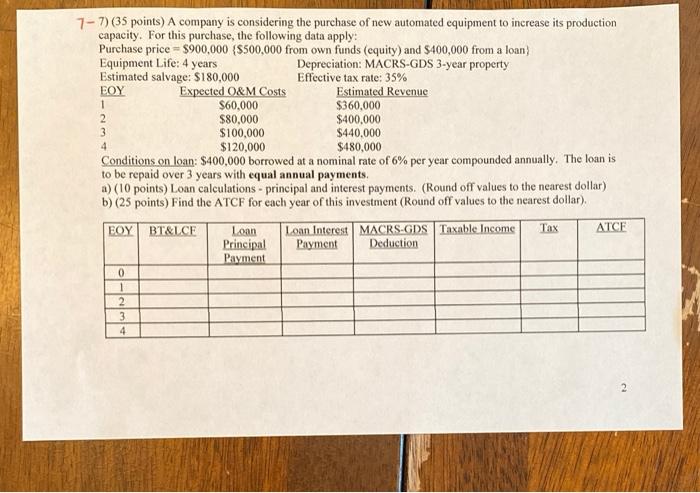

TABLE 8.3 TABLE 8.3 MACRS-GDS percentages for 3,5,7, and 10-year property are 200% DBSLH and 15-and 20- year property are 150% DBSLH 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year EOY Property Property Property Property Property Property 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 4.461 18 19 4.462 4.461 20 2.231 21 Effective tax rate: 40% Purchase price of new machine - 5400,000 (25% from company funds and 75% from a loan Useful Life: 4 years Depreciation: MACRS-GDS 3-year property Estimated salvape: $50.000 Estimated annual O&M costs: $20,000 Estimated annual increase in revenues: S100.000 Conditions on loan: Nominal annual rate of 5% per year compounded annually. The loan is to be repaid over 3 years with equal annual payments. a) Loan calculations - principal and interest payments. (Round off values to the nearest dollar) P=0.75(400,000) = 300,000, A- 300,000 AP 5/93) 0.3672 - 110, 163 Iy, 2005( 200,000) = 15000; Pa = 110,163 - 15,000 204,837 Iz = 0,05(300,000 A5,163) =10,242, P2 = 110,163 -10,242 Iz = 0,05(204,837 49,921) = 5,246) Ps = 110,163 - 53246 = 99,921 = 104,917 b) Find the ATCF for each year of this investment (Round off values to the nearest dollar) Tax Taxable Incams ATCE FOY BT&L.CF Loan Loan Principal Interest Payment Payment 400,000 300) ogo 0 MACRS: GDS Deduction 100,000 - 0.3333 80,000 95,163 15,000 133,320 -68,320 27,328 -2,835 280,000 99,921 10,242 177,800 -108,042 43,217 13,054 0.14813 80,000/106,917 5,246 59, 240 15,514 6,206 -36,369 80,000 Tooro 29, 640 40 16 oso H3,942 +50,000 TI - BTLCF 0.0749 I 89,856 -LIP-Depded 0,4% TI ATCE = BT&LCF-LPP - LIP - Tax 2 7-7) (35 points) A company is considering the purchase of new automated equipment to increase its production capacity. For this purchase, the following data apply: Purchase price = $900,000 ($500,000 from own funds (equity) and $400,000 from a loan Equipment Life: 4 years Depreciation: MACRS-GDS 3-year property Estimated salvage: $180,000 Effective tax rate: 35% EOY Expected O&M Costs Estimated Revenue 1 $60,000 $360,000 $80,000 $400,000 3 $100,000 $440,000 4 $120,000 $480,000 Conditions on loan: $400,000 borrowed at a nominal rate of 6% per year compounded annually. The loan is to be repaid over 3 years with equal annual payments. a) (10 points) Loan calculations principal and interest payments. (Round off values to the nearest dollar) b) (25 points) Find the ATCF for each year of this investment (Round off values to the nearest dollar), EOY BT&LCE Loon Loan Interest MACRS-GDS Taxable income Tax ATCE Principal Payment Deduction Payment 0 1 2 3 4