Question

I don't need number 1 answered I included it because the total cost of equipment used for the other 2 problems is answered here. Compute

I don't need number 1 answered I included it because the total cost of equipment used for the other 2 problems is answered here.

- Compute the total cost of the equipment that Ford recommends dealers buy:

Based on the costs in the article

The total cost is 1678+ 7994+ 3329+ 10125+ 7950+ 7729= 38,805

2. If a dealership is looking for payback of no more than 3 years, how much annual cash flow must the dealership generate from this investment?

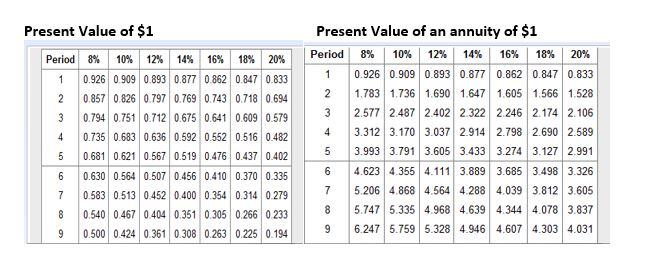

3. If a dealership requires a 10% return on its investments and is looking at a 3-year time frame, how much annual cash flow must be generated from the investment using the net present value method?

Present Value of $1 Period 8% 10% 12% 14% 16% 0.926 0909 0.893 0.877 0.862 0.847 0.857 0.826 0.797 0.769 0.743 0.7180.694 3 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.683 0.636 0.592 0.552 0.516 5 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.564 0.507 0.456 0.410 0.370 0.583 0.513 0.452 0.400 0.354 0.314 0.540 0.467 0.404 0.351 0.305 0.266 9 0.500 0.424 0.361 0.308 0.263 0.225 0.194 Present Value of an annuity of $1 Period 8% 10% 12% 14% 16% 18% 20% 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1.783 1.736 1.690 1.647 1605 1.566 1.528 2.577 2.487 2.402 2.322 2.246 2.174 2.106 3.312 3.170 3.037 2.914 2.798 2690 2.589 3.993 3.791 3.605 3.433 3.274 3.127 2.991 4.623 4.355 4.111 3.889 3.685 3.498 3.326 5.206 4.868 4.564 4.288 4.039 3.812 3.605 8 5.747 5.335 4.968 4.639 4.344 4.078 3.837 9 6 .247 5.759 5.328 4.946 4.607 4.303 4.031 OWN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started