Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't really understand how they did the math to get the percentages. I don't understand anything they are talking about actually! Please help break

I don't really understand how they did the math to get the percentages. I don't understand anything they are talking about actually! Please help break this down for me?

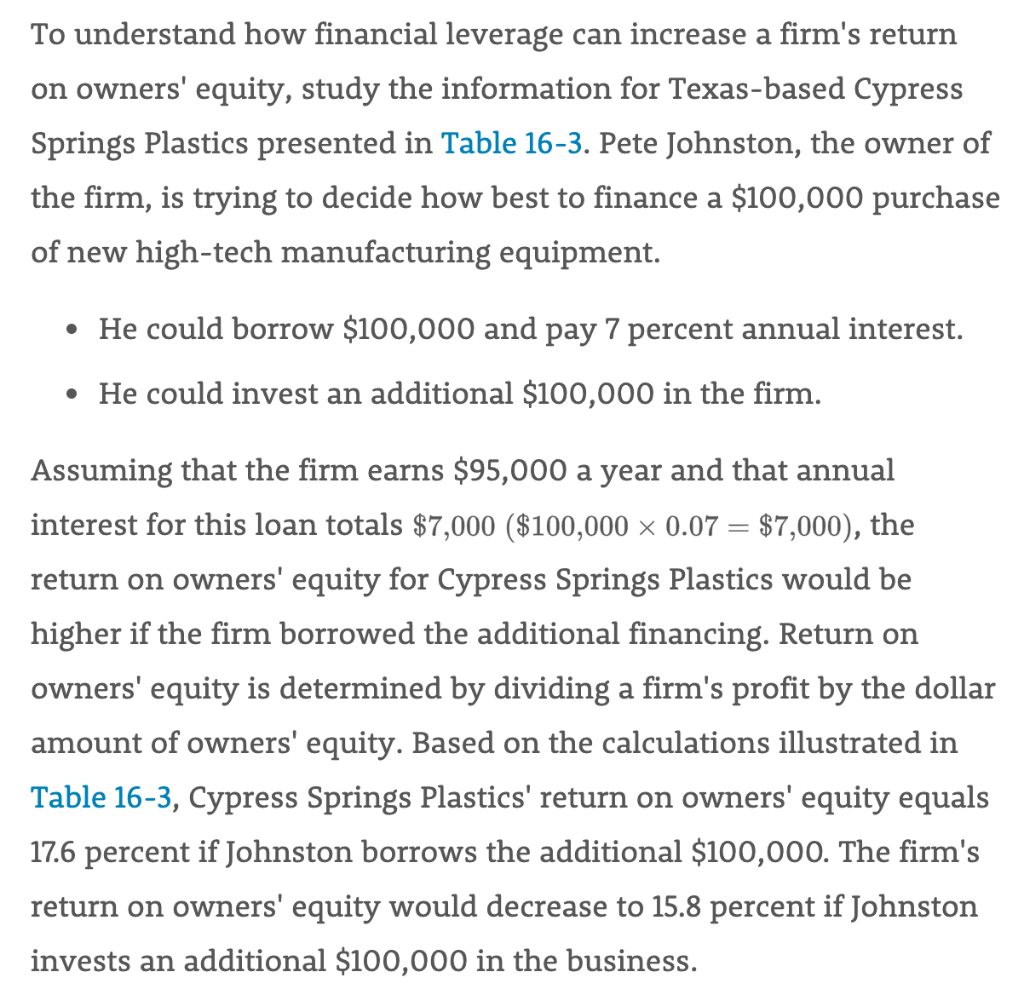

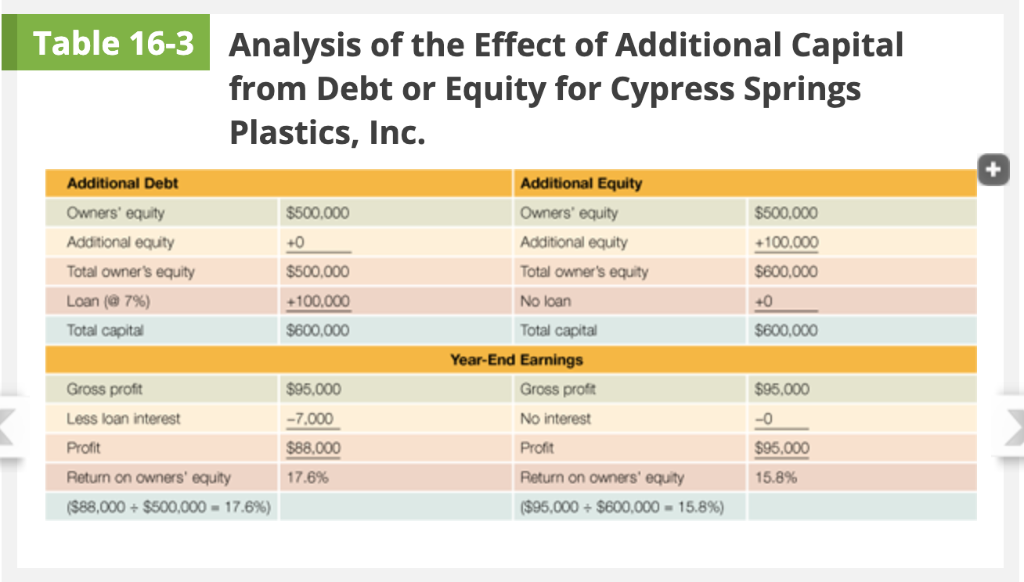

To understand how financial leverage can increase a firm's return on owners' equity, study the information for Texas-based Cypress Springs Plastics presented in Table 16-3. Pete Johnston, the owner of the firm, is trying to decide how best to finance a $100,000 purchase of new high-tech manufacturing equipment. He could borrow $100,000 and pay 7 percent annual interest. He could invest an additional $100,000 in the firm. Assuming that the firm earns $95,000 a year and that annual interest for this loan totals $7,000 ($100,000 x 0.07 $7,000), the return on owners' equity for Cypress Springs Plastics would be higher if the firm borrowed the additional financing. Return on owners' equity is determined by dividing a firm's profit by the dollar amount of owners' equity. Based on the calculations illustrated in Table 16-3, Cypress Springs Plastics' return on owners' equity equals 17.6 percent if Johnston borrows the additional $100,000. The firm's return on owners' equity would decrease to 15.8 percent if Johnston invests an additional $100,000 in the business. Table 16-3 Analysis of the Effect of Additional Capital from Debt or Equity for Cypress Springs Plastics, Inc. Additional Equity Additional Debt Owners' equity $500,000 Owners' equity $500,000 Additional equity Additional equity +0 +100,000 Total owner's equity $500,000 Total owner's equity $600,000 Loan (@7%) +100,000 +0 No loan $600,000 $600,000 Total capital Total capital Year-End Earnings $95,000 Gross profit Gross profit $95,000 Less loan interest -7,000 No interest -0 $88,000 Profit Profit $95,000 Return on owners' equity Return on owners' equity 17.6% 15.8% ($95,000+$600, 000 15.8% ) ($88,000+$500,000 = 17.6%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started