Answered step by step

Verified Expert Solution

Question

1 Approved Answer

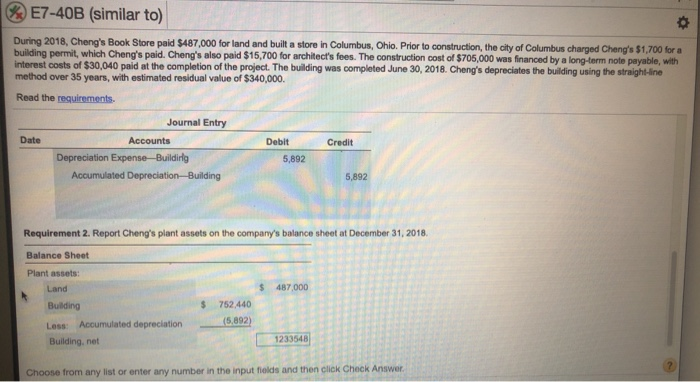

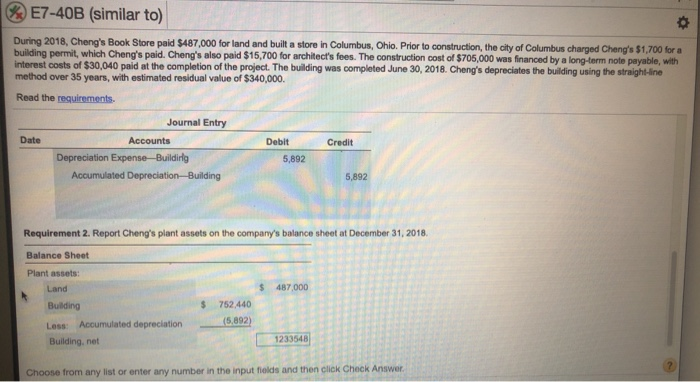

i dont understand how i got this wrong E7-40B (similar to) During 2018, Cheng's Book Store paid $487,000 for land and built a store in

i dont understand how i got this wrong

E7-40B (similar to) During 2018, Cheng's Book Store paid $487,000 for land and built a store in Columbus, Ohio. Prior to construction, the city of Columbus charged Cheng's $1,700 for a building permit, which Cheng's paid. Cheng's also paid $15,700 for architect's fees. The construction cost of $705,000 was financed by a long-term note payable, with interest costs of $30,040 paid at the completion of the project. The building was completed June 30, 2018. Cheng's depreciates the building using the straight-line method over 35 years, with estimated residual value of $340,000 Read the requirements Journal Entry Date Accounts Debit Credit Depreciation Expense-Buildirig 5,892 Accumulated Depreciation Building 5,892 Requirement 2. Report Cheng's plant assets on the company's balance sheet at December 31, 2018 $ 487,000 Balance Sheet Plant assets Land Building Less: Accumulated depreciation Building.net $ 752 440 (5.892) 1233548 Choose from any list or enter any number in the input fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started