Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i don't understand the following On November 1st, the Custom Ski Shop had an inventory of 3 competition downhill snow skis at a cost of

i don't understand the following

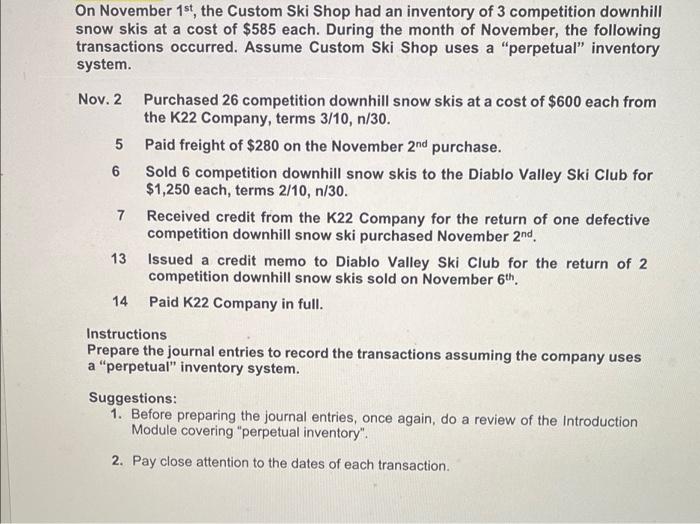

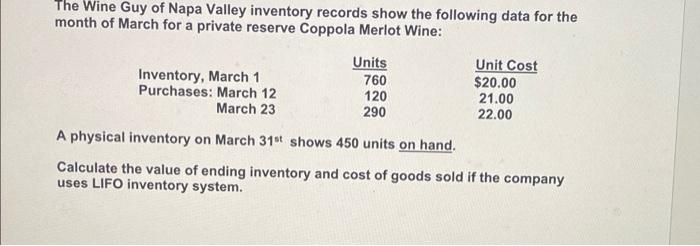

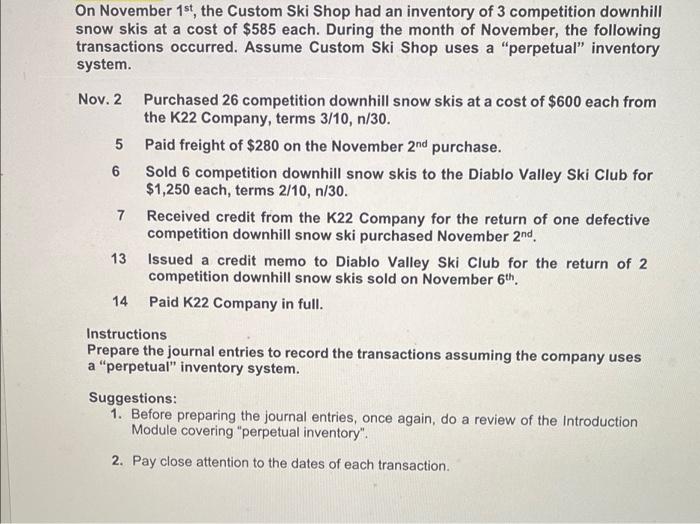

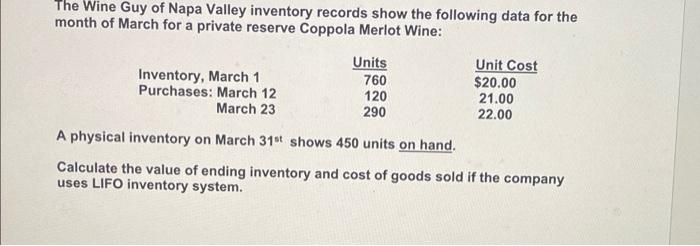

On November 1st, the Custom Ski Shop had an inventory of 3 competition downhill snow skis at a cost of $585 each. During the month of November, the following transactions occurred. Assume Custom Ski Shop uses a "perpetual" inventory system. Nov. 2 5 6 Purchased 26 competition downhill snow skis at a cost of $600 each from the K22 Company, terms 3/10, n/30. Paid freight of $280 on the November 2nd purchase. Sold 6 competition downhill snow skis to the Diablo Valley Ski Club for $1,250 each, terms 2/10, n/30. Received credit from the K22 Company for the return of one defective competition downhill snow ski purchased November 2nd, Issued a credit memo to Diablo Valley Ski Club for the return of 2 competition downhill snow skis sold on November 6th. Paid K22 Company in full. 7 13 14 Instructions Prepare the journal entries to record the transactions assuming the company uses a "perpetual" inventory system. Suggestions: 1. Before preparing the journal entries, once again, do a review of the Introduction Module covering "perpetual inventory". 2. Pay close attention to the dates of each transaction. The Wine Guy of Napa Valley inventory records show the following data for the month of March for a private reserve Coppola Merlot Wine: Units Unit Cost Inventory, March 1 760 $20.00 Purchases: March 12 120 21.00 March 23 22.00 A physical inventory on March 31" shows 450 units on hand. 290 Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory system

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started