Answered step by step

Verified Expert Solution

Question

1 Approved Answer

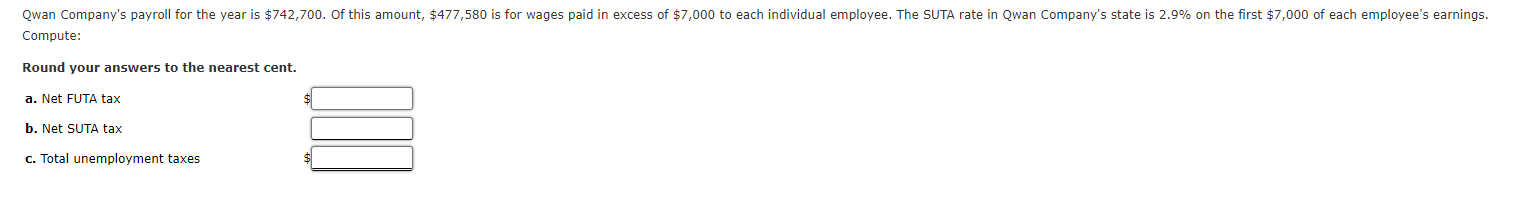

I don't understand what to do. A. Net FUTA Tax B. Net SUTA Tax C. Total unemployment taxes Compute: 1. Iqbal Company of Georgia had

I don't understand what to do.

A. Net FUTA Tax B. Net SUTA Tax C. Total unemployment taxes

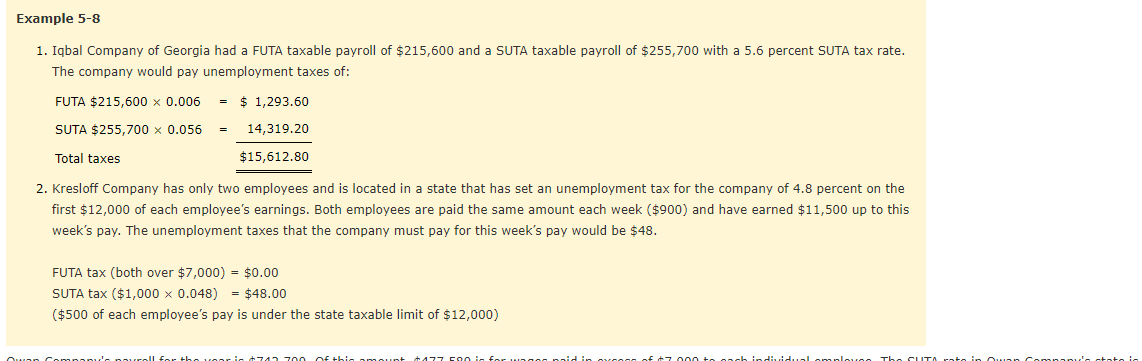

Compute: 1. Iqbal Company of Georgia had a FUTA taxable payroll of $215,600 and a SUTA taxable payroll of $255,700 with a 5.6 percent SUTA tax rate. The company would pay unemployment taxes of: FUTA$215,6000.006=$1,293.60SUTA$255,7000.056=Totaltaxes14,319.20$15,612.80 2. Kresloff Company has only two employees and is located in a state that has set an unemployment tax for the company of 4.8 percent on the first $12,000 of each employee's earnings. Both employees are paid the same amount each week ( $900 ) and have earned $11,500 up to this week's pay. The unemployment taxes that the company must pay for this week's pay would be $48. FUTA tax (both over $7,000)=$0.00 SUTA tax($1,0000.048)=$48.00 ( $500 of each employee's pay is under the state taxable limit of $12,000 )

Compute: 1. Iqbal Company of Georgia had a FUTA taxable payroll of $215,600 and a SUTA taxable payroll of $255,700 with a 5.6 percent SUTA tax rate. The company would pay unemployment taxes of: FUTA$215,6000.006=$1,293.60SUTA$255,7000.056=Totaltaxes14,319.20$15,612.80 2. Kresloff Company has only two employees and is located in a state that has set an unemployment tax for the company of 4.8 percent on the first $12,000 of each employee's earnings. Both employees are paid the same amount each week ( $900 ) and have earned $11,500 up to this week's pay. The unemployment taxes that the company must pay for this week's pay would be $48. FUTA tax (both over $7,000)=$0.00 SUTA tax($1,0000.048)=$48.00 ( $500 of each employee's pay is under the state taxable limit of $12,000 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started