Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't want to solve it 1.4 Exercise 1.4 For the above stock and bond prices, design a portfolio with initial wealth of $10000 split

I don't want to solve it 1.4

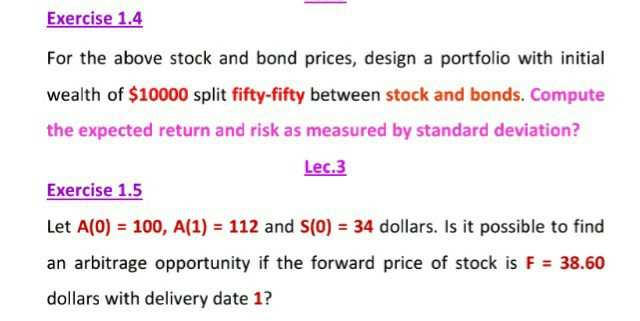

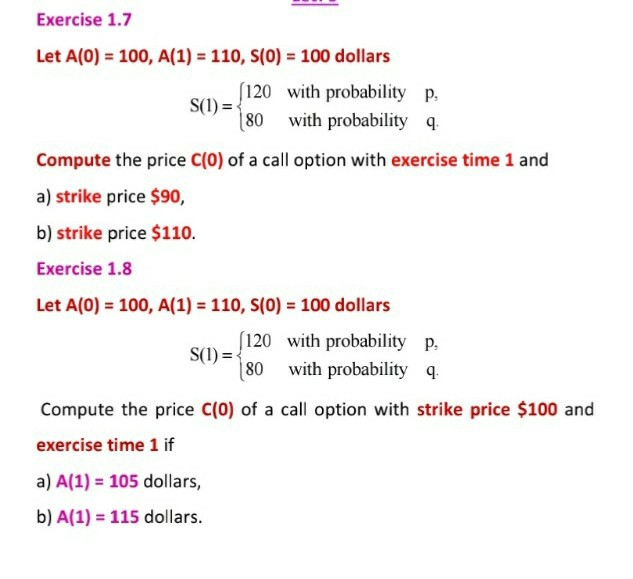

Exercise 1.4 For the above stock and bond prices, design a portfolio with initial wealth of $10000 split fifty-fifty between stock and bonds. Compute the expected return and risk as measured by standard deviation? Lec.3 Exercise 1.5 Let A(0) = 100, A(1) = 112 and S(0) = 34 dollars. Is it possible to find an arbitrage opportunity if the forward price of stock is F = 38.60 dollars with delivery date 1? Exercise 1.7 Let A(0) = 100, A(1) = 110, S(0) = 100 dollars (120 with probability P, S(1) = { 80 with probability 9. Compute the price c(o) of a call option with exercise time 1 and a) strike price $90, b) strike price $110. Exercise 1.8 Let A(0) = 100, A(1) = 110, S(0) = 100 dollars (120 with probability p. S(1) = 80 with probability 4. Compute the price c(0) of a call option with strike price $100 and exercise time 1 if a) A(1) = 105 dollars, b) A(1) = 115 dollars. Exercise 1.4 For the above stock and bond prices, design a portfolio with initial wealth of $10000 split fifty-fifty between stock and bonds. Compute the expected return and risk as measured by standard deviation? Lec.3 Exercise 1.5 Let A(0) = 100, A(1) = 112 and S(0) = 34 dollars. Is it possible to find an arbitrage opportunity if the forward price of stock is F = 38.60 dollars with delivery date 1? Exercise 1.7 Let A(0) = 100, A(1) = 110, S(0) = 100 dollars (120 with probability P, S(1) = { 80 with probability 9. Compute the price c(o) of a call option with exercise time 1 and a) strike price $90, b) strike price $110. Exercise 1.8 Let A(0) = 100, A(1) = 110, S(0) = 100 dollars (120 with probability p. S(1) = 80 with probability 4. Compute the price c(0) of a call option with strike price $100 and exercise time 1 if a) A(1) = 105 dollars, b) A(1) = 115 dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started