I edited the question and I downloaded a clear picture of my question

I edited the question and I downloaded a clear picture of my question

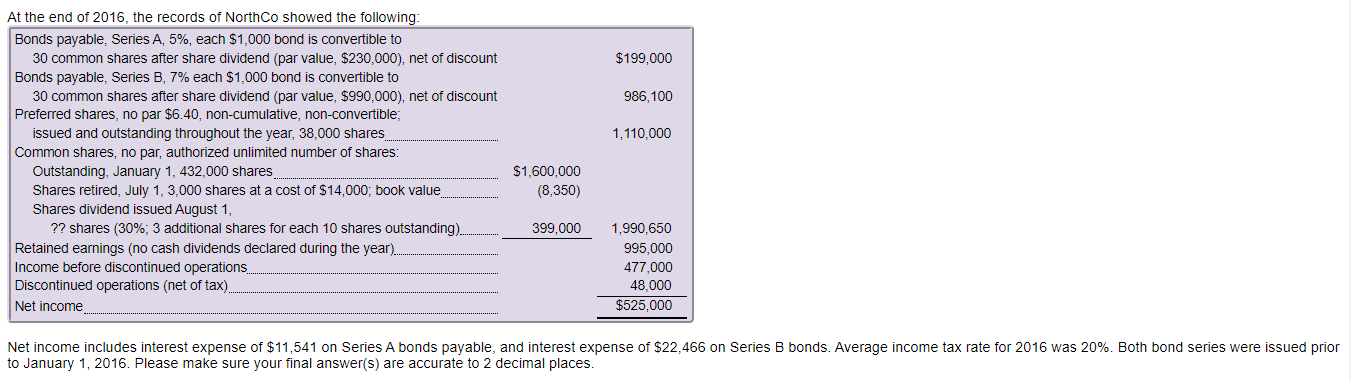

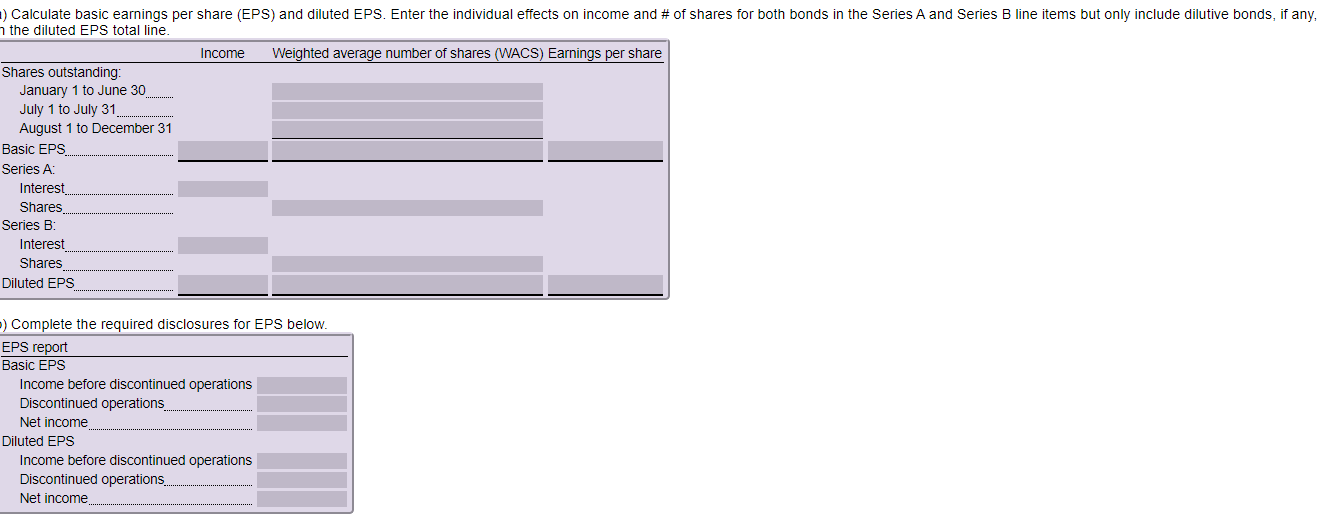

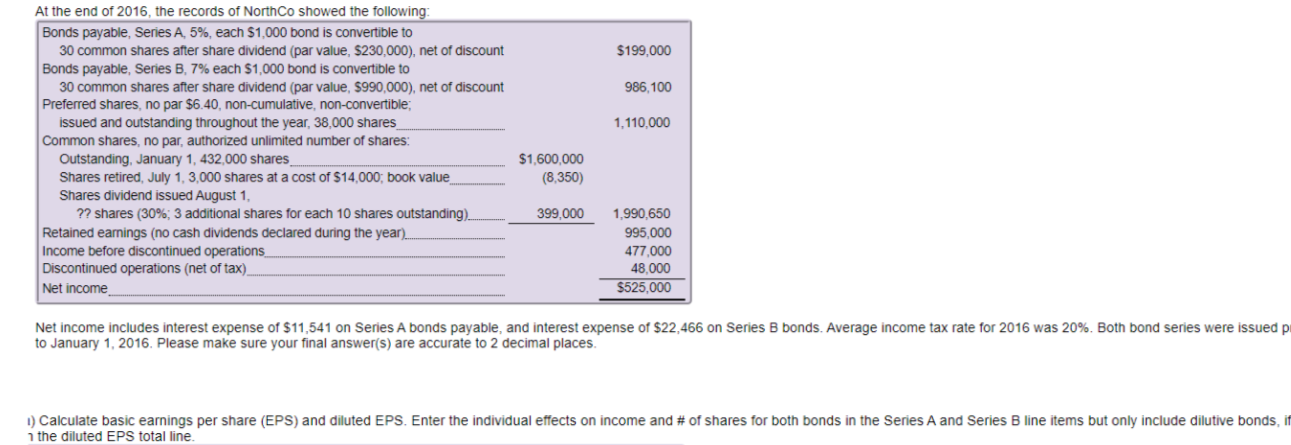

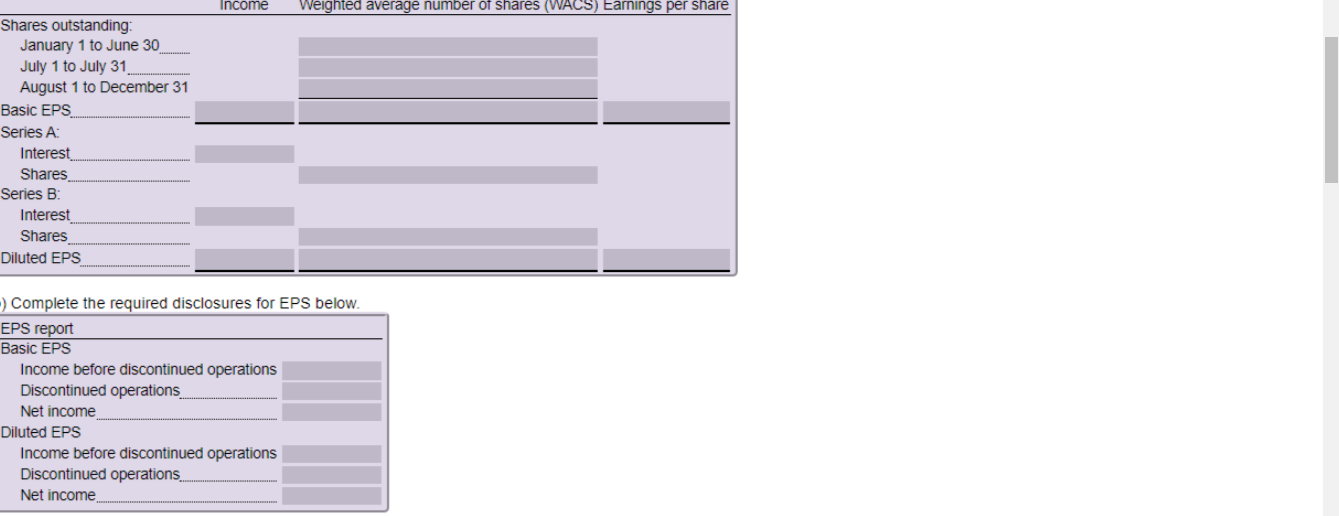

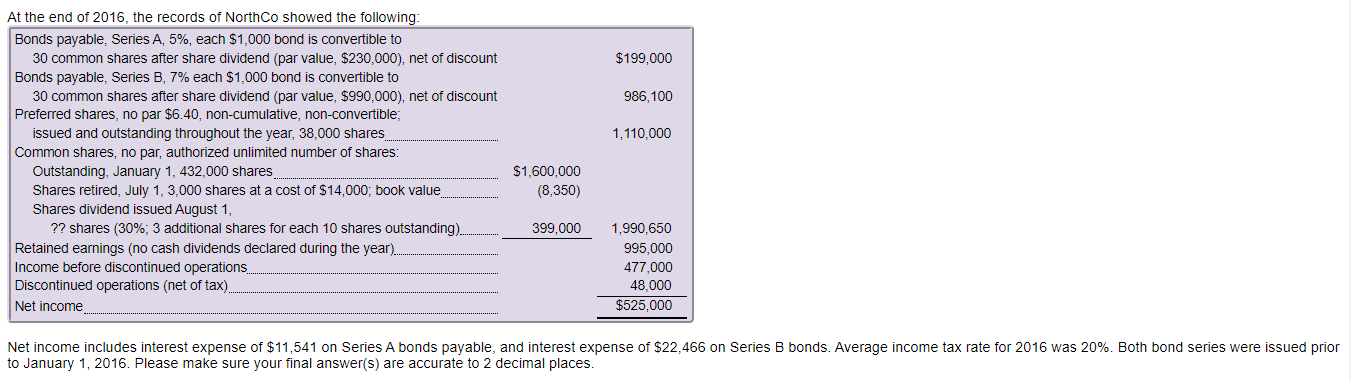

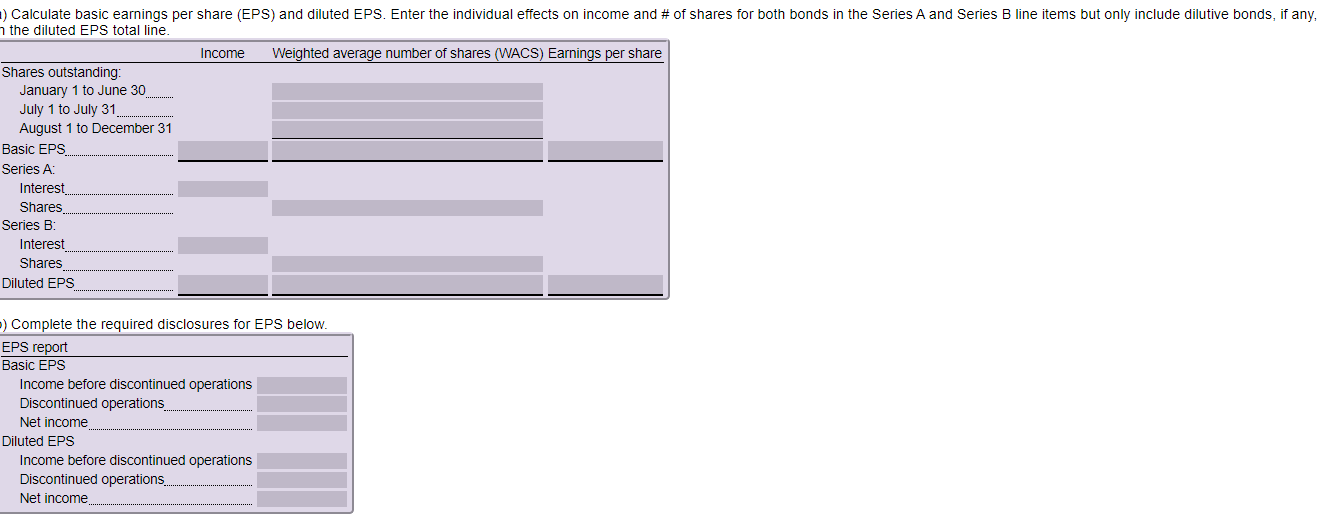

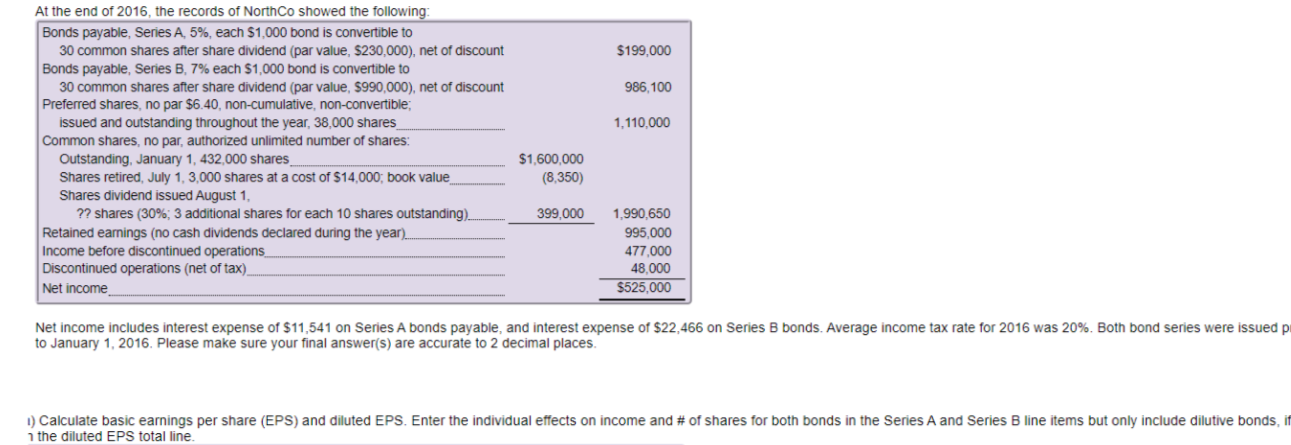

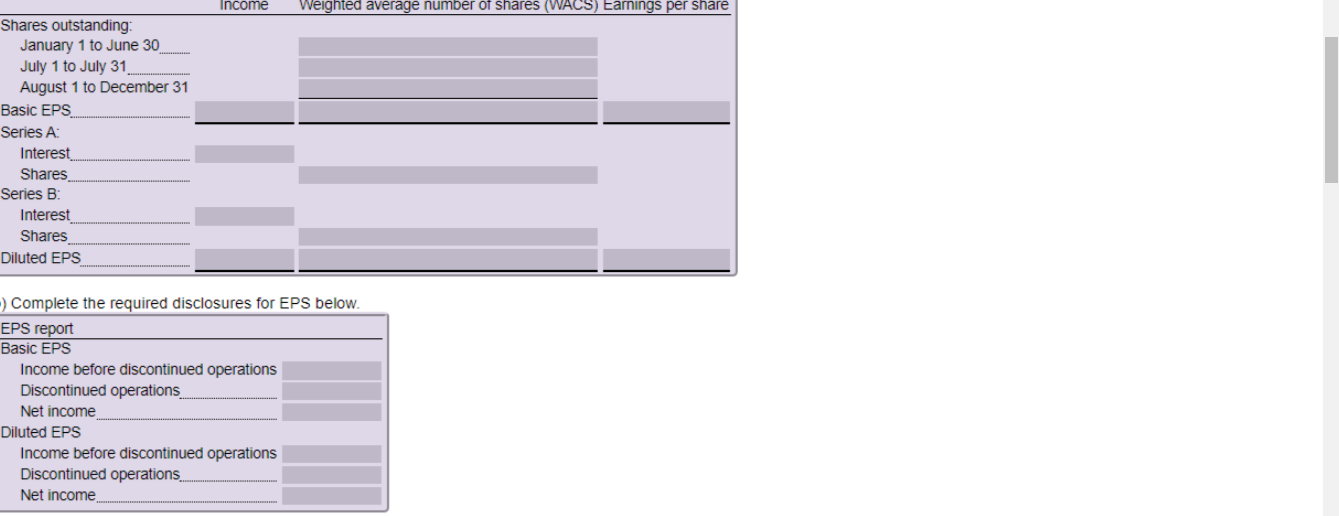

$199,000 986.100 1.110,000 At the end of 2016, the records of North Co showed the following: Bonds payable, Series A, 5%, each $1,000 bond is convertible to 30 common shares after share dividend (par value, $230,000), net of discount Bonds payable, Series B. 7% each $1,000 bond is convertible to 30 common shares after share dividend (par value, $990,000), net of discount Preferred shares, no par $6.40, non-cumulative, non-convertible; issued and outstanding throughout the year, 38,000 shares Common shares, no par, authorized unlimited number of shares: Outstanding, January 1, 432,000 shares Shares retired, July 1, 3,000 shares at a cost of $14,000; book value Shares dividend issued August 1, ?? shares (30%; 3 additional shares for each 10 shares outstanding) Retained earnings (no cash dividends declared during the year) Income before discontinued operations Discontinued operations (net of tax) Net income $1,600,000 (8,350) 399,000 1.990.650 995,000 477,000 48,000 $525,000 Net income includes interest expense of $11,541 on Series A bonds payable, and interest expense of $22,466 on Series B bonds. Average income tax rate for 2016 was 20%. Both bond series were issued p to January 1, 2016. Please make sure your final answer(s) are accurate to 2 decimal places. 1) Calculate basic earnings per share (EPS) and diluted EPS. Enter the individual effects on income and # of shares for both bonds in the Series A and Series B line items but only include dilutive bonds, it the diluted EPS total line Income Weighted average number of shares (WACS) Earnings per share Shares outstanding January 1 to June 30 July 1 to July 31 August 1 to December 31 Basic EPS Series A Interest Shares Series B Interest Shares Diluted EPS - Complete the required disclosures for EPS below. EPS report Basic EPS Income before discontinued operations Discontinued operations Net income Diluted EPS Income before discontinued operations Discontinued operations Net income $199,000 986,100 1,110,000 At the end of 2016, the records of North Co showed the following: Bonds payable, Series A, 5%, each $1,000 bond is convertible to 30 common shares after share dividend (par value, $230,000), net of discount Bonds payable, Series B, 7% each $1,000 bond is convertible to 30 common shares after share dividend (par value, $990,000), net of discount Preferred shares, no par $6.40, non-cumulative, non-convertible; issued and outstanding throughout the year, 38,000 shares Common shares, no par, authorized unlimited number of shares: Outstanding, January 1, 432,000 shares Shares retired, July 1, 3,000 shares at a cost of $14,000; book value Shares dividend issued August 1, ?? shares (30%, 3 additional shares for each 10 shares outstanding). Retained earnings (no cash dividends declared during the year). Income before discontinued operations... Discontinued operations (net of tax). Net income $1,600,000 (8,350) 399,000 1,990,650 995,000 477,000 48,000 $525,000 Net income includes interest expense of $11,541 on Series A bonds payable, and interest expense of $22,466 on Series B bonds. Average income tax rate for 2016 was 20%. Both bond series were issued prior to January 1, 2016. Please make sure your final answer(s) are accurate to 2 decimal places. 1) Calculate basic earnings per share (EPS) and diluted EPS. Enter the individual effects on income and # of shares for both bonds in the Series A and Series B line items but only include dilutive bonds, if any, the diluted EPS total line Income Weighted average number of shares (WACS) Earnings per share Shares outstanding: January 1 to June 30 July 1 to July 31 August 1 to December 31 Basic EPS Series A Interest Shares Series B Interest Shares Diluted EPS - Complete the required disclosures for EPS below. EPS report Basic EPS Income before discontinued operations Discontinued operations Net income Diluted EPS Income before discontinued operations Discontinued operations. Net income

I edited the question and I downloaded a clear picture of my question

I edited the question and I downloaded a clear picture of my question