(i) Estimate the stock beta for a company. Select a publicly traded company (preferably large firms) and download the monthly closing prices for 5 years into Excel. Choose a market index (e.g. S&P 500) and download the monthly closing values for 5 years into Excel. Calculate the monthly returns for the selected company and the market index. Using the regression function in Excel, regress the stock return on the market index return. (ii) Compare and contrast the stock beta you estimated with two other sources (e.g. Yahoo! Finance, CNBC, etc.).

(i) Estimate the stock beta for a company. Select a publicly traded company (preferably large firms) and download the monthly closing prices for 5 years into Excel. Choose a market index (e.g. S&P 500) and download the monthly closing values for 5 years into Excel. Calculate the monthly returns for the selected company and the market index. Using the regression function in Excel, regress the stock return on the market index return. (ii) Compare and contrast the stock beta you estimated with two other sources (e.g. Yahoo! Finance, CNBC, etc.).

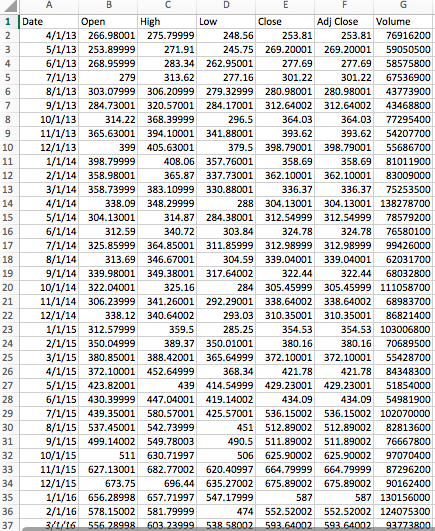

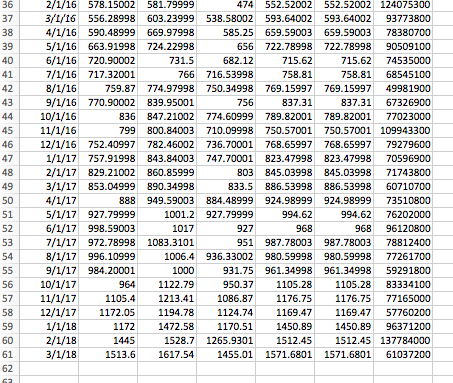

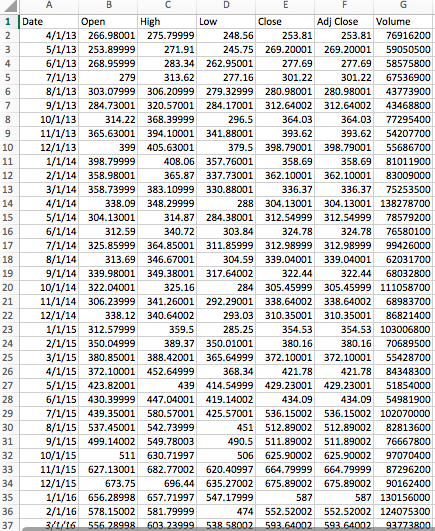

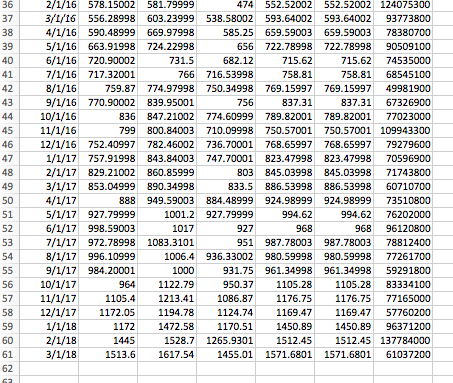

1) Amazon

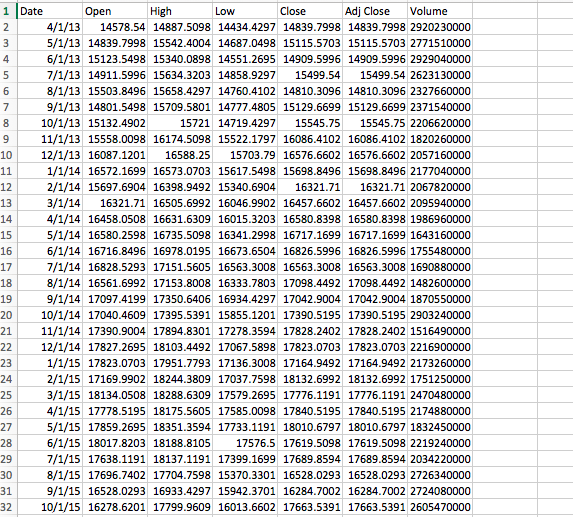

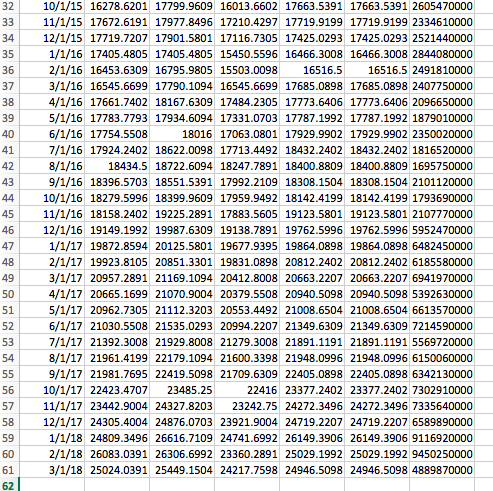

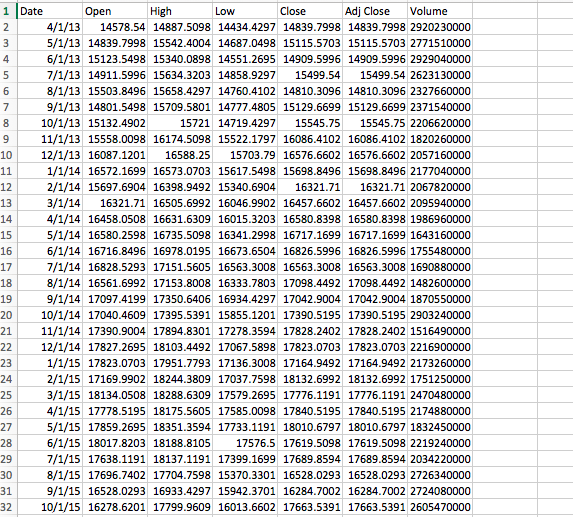

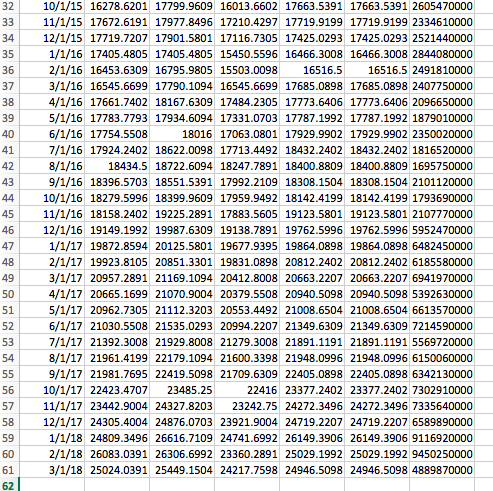

2) DOW JONES

1 Date Open Close Adj Close Volume 4/1/1314578.54 14887.5098 14434.4297 14839.7998 14839.7998 2920230000 5/1/13 14839.7998 15542.4004 14687.0498 15115.5703 15115.5703 2771510000 6/1/13 15123.5498 15340.0898 14551.2695 14909.5996 14909.5996 2929040000 7/1/13 14911.5996 15634.3203 14858.929715499.54 15499.54 2623130000 8/1/13 15503.8496 15658.4297 14760.4102 14810.3096 14810.3096 2327660000 9/1/13 14801.5498 15709.5801 14777.4805 15129.6699 15129.6699 2371540000 15721 14719.4297 15545.75 15545.75 2206620000 11/1/13 15558.0098 16174.5098 155221797 16086.4102 16086.4102 1820260000 12/1/13 16087.1201 16588.25 15703.79 16576.6602 16576.6602 2057160000 1/1/14 16572.1699 16573.0703 15617.5498 15698.8496 15698.8496 2177040000 2/1/14 15697.6904 16398.9492 15340.690416321.71 16321.71 2067820000 3/1/1416321.71 16505.6992 16046.9902 16457.6602 16457.6602 2095940000 4/1/14 16458.0508 16631.6309 16015.3203 16580.8398 16580.8398 1986960000 5/1/14 16580.2598 16735.5098 16341.2998 16717.1699 16717.1699 1643160000 6/1/14 16716.8496 16978.0195 16673.6504 16826.5996 16826.5996 1755480000 7/1/14 16828.5293 17151.5605 16563.3008 16563.3008 16563.3008 1690880000 8/1/14 16561.6992 17153.8008 16333.7803 17098.4492 17098.4492 1482600000 9/1/14 17097.4199 17350.6406 16934.4297 17042.9004 17042.9004 1870550000 10/1/14 17040.4609 17395.5391 15855.1201 17390.5195 17390.5195 2903240000 21 11/1/14 17390.9004 17894.8301 17278.3594 17828.2402 17828.2402 1516490000 22 12/1/14 17827.2695 18103.4492 17067.5898 17823.0703 17823.0703 2216900000 1/1/15 17823.0703 17951.7793 17136.3008 17164.9492 17164.9492 2173260000 2/1/15 17169.9902 18244.3809 17037.7598 18132.6992 18132.6992 1751250000 3/1/15 18134.0508 18288.6309 17579.2695 17776.1191 17776.1191 2470480000 4/1/15 17778.5195 18175.5605 17585.0098 17840.5195 17840.5195 2174880000 5/1/15 17859.2695 18351.3594 17733.1191 18010.6797 18010.6797 1832450000 28 6/1/15 18017.8203 18188.8105 17576.5 17619.5098 17619.5098 2219240000 7/1/15 17638.1191 18137.1191 17399.1699 17689.8594 17689.8594 2034220000 8/1/15 17696.7402 17704.7598 15370.3301 16528.0293 16528.0293 2726340000 9/1/15 16528.0293 16933.4297 15942.3701 16284.7002 16284.7002 2724080000 10/1/15 16278.6201 17799.9609 16013.6602 17663.5391 17663.5391 2605470000 8 10/1/13 15132.4902 12 13 14 15 16 17 19 23 24 25 26 27 29 30 31

(i) Estimate the stock beta for a company. Select a publicly traded company (preferably large firms) and download the monthly closing prices for 5 years into Excel. Choose a market index (e.g. S&P 500) and download the monthly closing values for 5 years into Excel. Calculate the monthly returns for the selected company and the market index. Using the regression function in Excel, regress the stock return on the market index return. (ii) Compare and contrast the stock beta you estimated with two other sources (e.g. Yahoo! Finance, CNBC, etc.).

(i) Estimate the stock beta for a company. Select a publicly traded company (preferably large firms) and download the monthly closing prices for 5 years into Excel. Choose a market index (e.g. S&P 500) and download the monthly closing values for 5 years into Excel. Calculate the monthly returns for the selected company and the market index. Using the regression function in Excel, regress the stock return on the market index return. (ii) Compare and contrast the stock beta you estimated with two other sources (e.g. Yahoo! Finance, CNBC, etc.).