Answered step by step

Verified Expert Solution

Question

1 Approved Answer

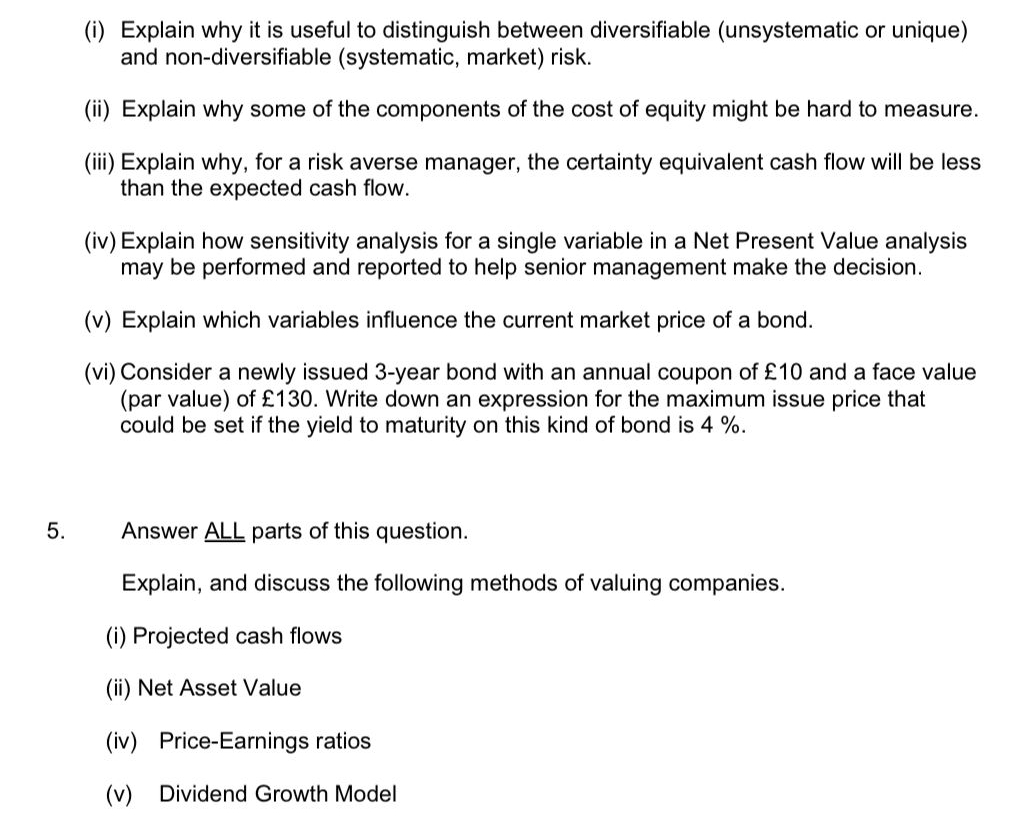

( i ) Explain why it is useful to distinguish between diversifiable ( unsystematic or unique ) and non - diversifiable ( systematic , market

i Explain why it is useful to distinguish between diversifiable unsystematic or unique and nondiversifiable systematic market risk.

ii Explain why some of the components of the cost of equity might be hard to measure.

iii Explain why, for a risk averse manager, the certainty equivalent cash flow will be less than the expected cash flow.

iv Explain how sensitivity analysis for a single variable in a Net Present Value analysis may be performed and reported to help senior management make the decision.

v Explain which variables influence the current market price of a bond.

vi Consider a newly issued year bond with an annual coupon of and a face value par value of Write down an expression for the maximum issue price that could be set if the yield to maturity on this kind of bond is

Answer ALL parts of this question.

Explain, and discuss the following methods of valuing companies.

i Projected cash flows

ii Net Asset Value

iv PriceEarnings ratios

v Dividend Growth Model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started