Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I feel like I am missing some information for this but I may be wrong. As discussed, I am working with BUYER who is purchasing

I feel like I am missing some information for this but I may be wrong.

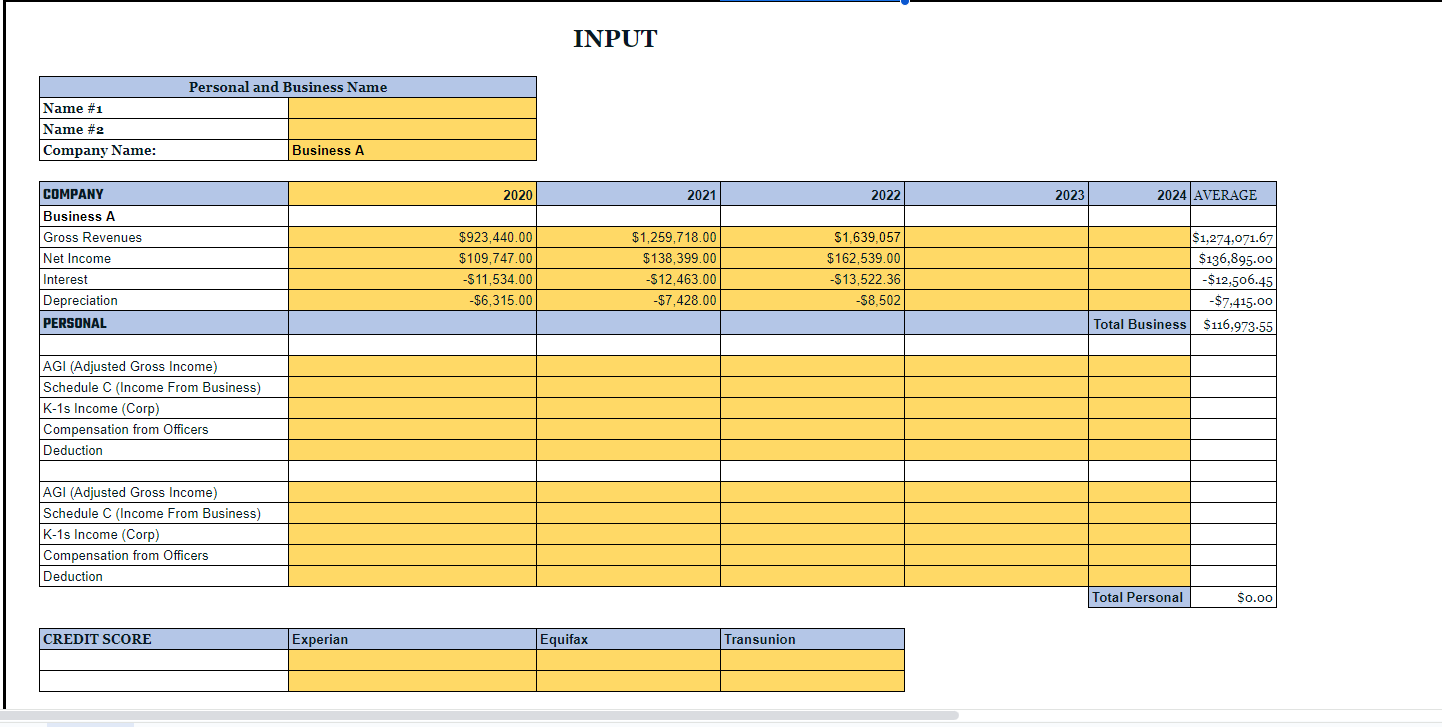

As discussed, I am working with BUYER who is purchasing the Business A in Baltimore, MD for $ million. The tax returns for the Business A show as follows. The Gross Sales were $ and net sales were $ The Compensation of officers was $ and Depreciation was $ to give additional $ to service debt. This gives a total of $ in cash to service debt. There is another $ in total deductions we can look at The Gross Sales were $ and net sales were $ The Compensation of officers was $ interest expense was $ and Depreciation was $ to give additional $ to service debt. This gives a total of $ in cash to service debt. There is another $ in total deductions we can look at The Gross Sales were $ and net sales were $ The Compensation of officers was $ interest expense was $ and Depreciation was $ to give additional $ to service debt. This gives a total of $ in cash available to service debt. There is another $ in total deductions we can look at

Assuming a loan amount of $ at interest rate prime rate with a year term, the loan payment would be $ The purchase price is $ million minus downpayment of $ is $ The year debt payment is $ The goal is also to qualify for an additional $ in working capital for inventory.

Total Cash for Debt Payments $ Year Debt Payment $

DCR

According to the BUYER business tax returns, the gross revenues in were $ and net sales were $ The business has an EIDL loan with a monthly payment of $$ Revolving Business Credit Card that has a monthly payment of $ which is high.

According to BUYER's credit report, he has a credit score. He personally has only $ in monthly debt and his yearly salary from his business is $$ He reports another $yearly income real estate rental income $ per month. He does not pay himself a lot from the business.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started