Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I figured out how to do the first two parts but I do not know how to do the rest. Please help. Ying Import has

I figured out how to do the first two parts but I do not know how to do the rest. Please help.

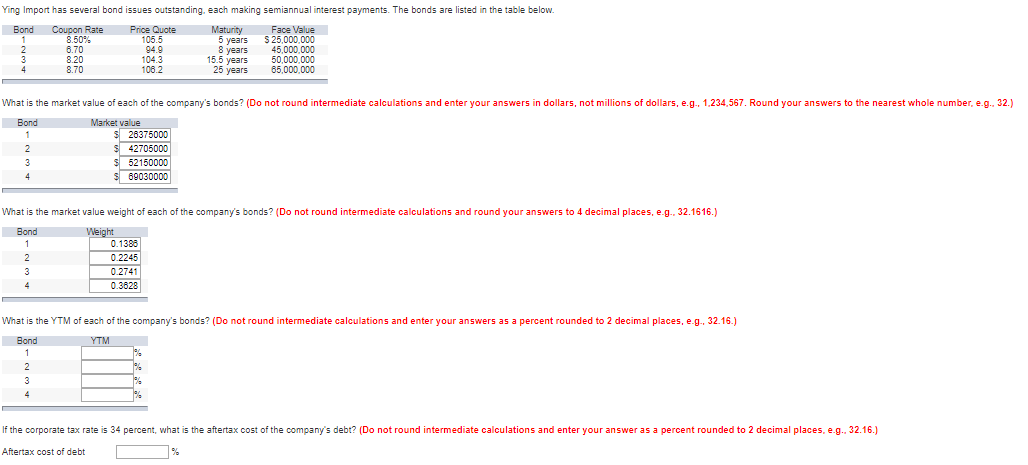

Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. Bond Coupon Rate 8.50% Price Quote 105.5 6.70 Maturity 5 years 8 years 15.5 years 25 years Face Value $25,000,000 45,000,000 50,000,000 65,000,000 8.20 1043 8.70 1002 What is the market value of each of the company's bonds? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567. Round your answers to the nearest whole number, e.g. 32.) Bond Market value $26375000 $ 42705000 $ 52150000 $89030000 What is the market value weight of each of the company's bonds? (Do not round intermediate calculations and round your answers to 4 decimal places, e... 32.1616.) Bond Weight 0.1388 0.2245 0.2741 0.3828 What is the YTM of each of the company's bonds? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e... 32. 16.) Bond YTM If the corporate tax rate is 34 percent, what is the aftertax cost of the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Aftertax cost of debt [ %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started