Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. II. III. Find the value (using Binomial Tree) of a European style call option on an underlying stock which is currently selling at

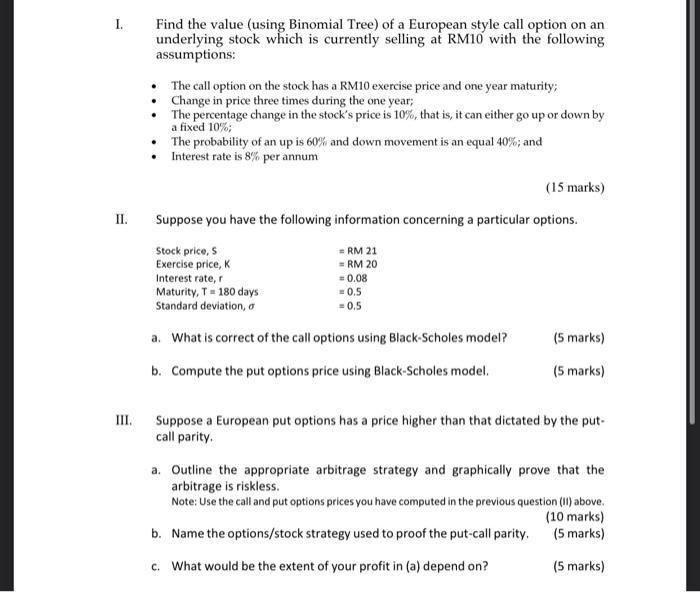

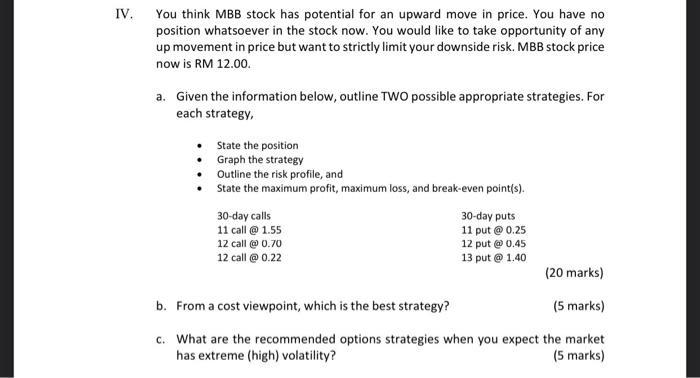

I. II. III. Find the value (using Binomial Tree) of a European style call option on an underlying stock which is currently selling at RM10 with the following assumptions: The call option on the stock has a RM10 exercise price and one year maturity; Change in price three times during the one year; The percentage change in the stock's price is 10%, that is, it can either go up or down by a fixed 10%; The probability of an up is 60% and down movement is an equal 40%; and Interest rate is 8% per annum (15 marks) Suppose you have the following information concerning a particular options. Stock price, S Exercise price, K Interest rate, r Maturity, T = 180 days Standard deviation, a = RM 21 = RM 20 = 0.08 = 0.5 = 0.5 a. What is correct of the call options using Black-Scholes model? b. Compute the put options price using Black-Scholes model. (5 marks) (5 marks) Suppose a European put options has a price higher than that dictated by the put- call parity. a. Outline the appropriate arbitrage strategy and graphically prove that the arbitrage is riskless. Note: Use the call and put options prices you have computed in the previous question (II) above. (10 marks) (5 marks) b. Name the options/stock strategy used to proof the put-call parity. c. What would be the extent of your profit in (a) depend on? (5 marks) IV. You think MBB stock has potential for an upward move in price. You have no position whatsoever in the stock now. You would like to take opportunity of any up movement in price but want to strictly limit your downside risk. MBB stock price now is RM 12.00. a. Given the information below, outline TWO possible appropriate strategies. For each strategy, State the position Graph the strategy Outline the risk profile, and State the maximum profit, maximum loss, and break-even point(s). 30-day calls 11 call @ 1.55 12 call @ 0.70 12 call @ 0.22 30-day puts 11 put @ 0.25 12 put @ 0.45 13 put @ 1.40 (20 marks) (5 marks) b. From a cost viewpoint, which is the best strategy? c. What are the recommended options strategies when you expect the market has extreme (high) volatility? (5 marks) V. Suppose you had just gone long (purchased) on lot of Syarikat XYZ stock at a price of RM 15.00 each, for a total investment of RM 15,000. You believe this stock has long term potential but wish to protect yourself from any short-term downside movement in price. Suppose 3-month, at-the-money put options on Syarikat XYZ stocks are being quoted at RM 0.15 or 15 sen each or RM 150 per lot (RM 0.15 x 1,000). a. What would be the appropriate options strategy to hedge the long stock position? (5 marks) b. Show (in a table) the payoff to the combined position for a given range of stocks prices at options maturity in 3-months. (10 marks) c. Draw the payoff profile of combined positions. (10 marks)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions I Find the value of a European call option using binomial tree method Stock price now RM10 Exercise price RM10 M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started