Question

I finished my estate tax return but I am unsure about a few things and was hoping someone could punch holes in it where I

I finished my estate tax return but I am unsure about a few things and was hoping someone could punch holes in it where I may have missed the mark. One of the things is the unified tax credit. The problem says in the person died in the current year and since we are in 2024, that is what unified tax credit value I am using. But leaving a credit tax payable is where I am struggling with is my calculation correct or not. Also, the gift for the daughter. I applied it to the estate and then take it away in the deductions and I am not sure if that is correct. Again, just wanting to have this looked over by another set of eyes.

Problem:

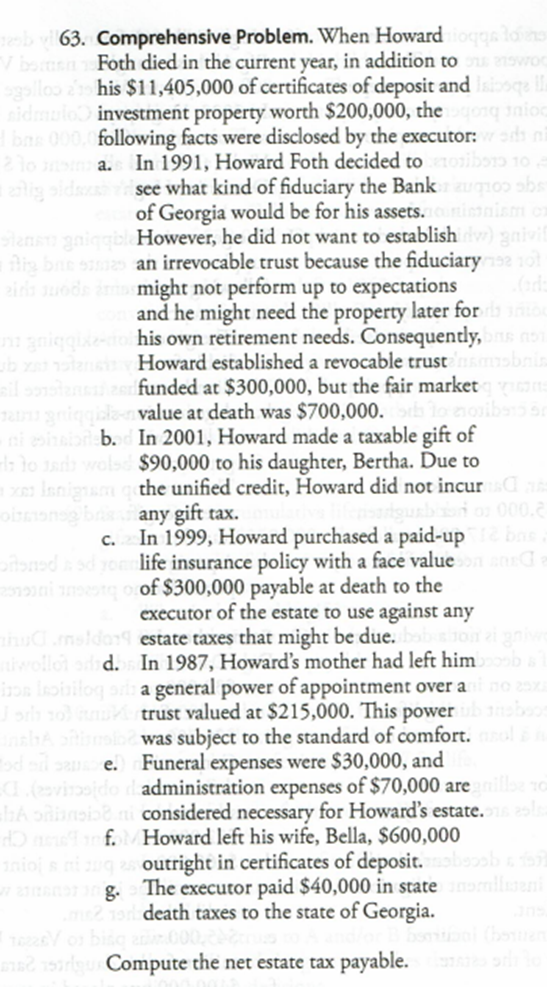

by 63. Comprehensive Problem. When Howard logga loins V bomen Foth died in the current year, in addition to wor agollos 21 his $11,405,000 of certificates of deposit and slooge aidmulo investment property worth $200,000, the qonq anion bas 000,0following facts were disclosed by the executor: wodn 210 a. In 1991, Howard Foth decided to oibor 10 anlig sids see what kind of fiduciary the Bankaugios abs of Georgia would be for his assets.ciniam c niqqble However, he did not want to establish dw) anivi flig be somes an irrevocable trust because the fiduciary 10 airs suede anos might not perform up to expectations ub xat sil and he might need the property later for s to his own retirement needs. Consequently, bus no Howard established a revocable trustensbal funded at $300,000, but the fair market value at death was $700,000. ribars ni shab. In 2001, Howard made a taxable gift of to a wolse $90,000 to his daughter, Bertha. Due to xianigram the unified credit, Howard did not incura obong bany gift tax. no 000.8 C. In 1999, Howard purchased a paid-up bas toned asd yourlife insurance policy with a face value on an 2 stoof $300,000 payable at death to the executor of the estate to use against any humaldon estate taxes that might be due. babon a give niwollot ads d. In 1987, Howard's mother had left himboob a on roblog or a general power of appointment over and no 25% Joh 10) Gertrust valued at $215,000. This powersboo anaba oftionib? was subject to the standard of comfort. ol od ad sae. Funeral expenses were $30,000, and (esviosido administration expenses of $70,000 are guillos no Asians ni considered necessary for Howard's estate.ons sle downf.MHoward left his wife, Bella, $600,000 inioj s ni ug as outright in certificates of deposit.boob g. The executor paid $40,000 in state mileseni m2 work death taxes to the state of Georgia. 16226V 03 big ann000, margue Compute the net estate tax payable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started