Answered step by step

Verified Expert Solution

Question

1 Approved Answer

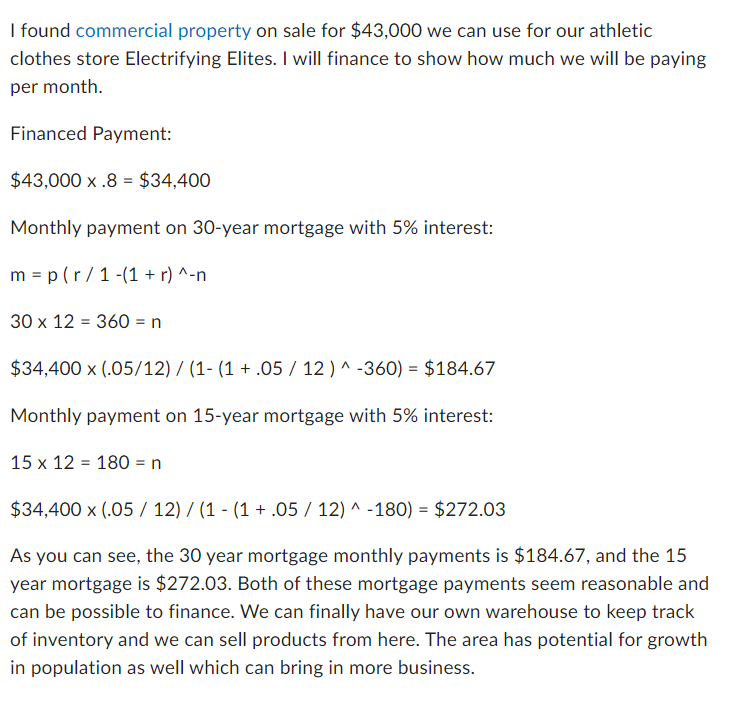

I found commercial property on sale for $43,000 we can use for our athletic clothes store Electrifying Elites. I will finance to show how

I found commercial property on sale for $43,000 we can use for our athletic clothes store Electrifying Elites. I will finance to show how much we will be paying per month. Financed Payment: $43,000 x .8 = $34,400 Monthly payment on 30-year mortgage with 5% interest: m p(r/1-(1+r)^-n 30 x 12 360 = n $34,400 x (.05/12)/(1- (1 + .05/12) ^ -360) = $184.67 Monthly payment on 15-year mortgage with 5% interest: 15 x 12 = 180 = n $34,400 x (.05/12)/ (1 - (1 + .05/12)^-180) = $272.03 As you can see, the 30 year mortgage monthly payments is $184.67, and the 15 year mortgage is $272.03. Both of these mortgage payments seem reasonable and can be possible to finance. We can finally have our own warehouse to keep track of inventory and we can sell products from here. The area has potential for growth in population as well which can bring in more business. Post 2: Reply to a Classmate You are helping make this important financial decision for the business. Find a classmate's post that has not been replied to. Calculate the total amount of interest paid over the life of the 30-year and 15-year mortgage. Show all steps in your calculations. In a summary paragraph, discuss the amount of money saved in the 15-year mortgage vs. the 30-year mortgage and which mortgage would make the most sense for the business at this time. Include these items in your post: Calculation of 30-year total interest Calculation of 15-year total interest Steps in calculations Summary Post 3: Reply to Another Classmate Find a classmate's thread in the Discussion Board that you find interesting and join the conversation by replying to a post. Post several sentences on this topic that are thoughtful and advance the discussion mathematically. Responses within your own initial thread will not count as a Post 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started