I got everything completed but there are a few areas where I am having trouble with this assignment. The boxes highlighted in red are where I got the answer wrong. Could you help me figure out what I am doing wrong? Everything in green is correct so it is only a couple I need help with.

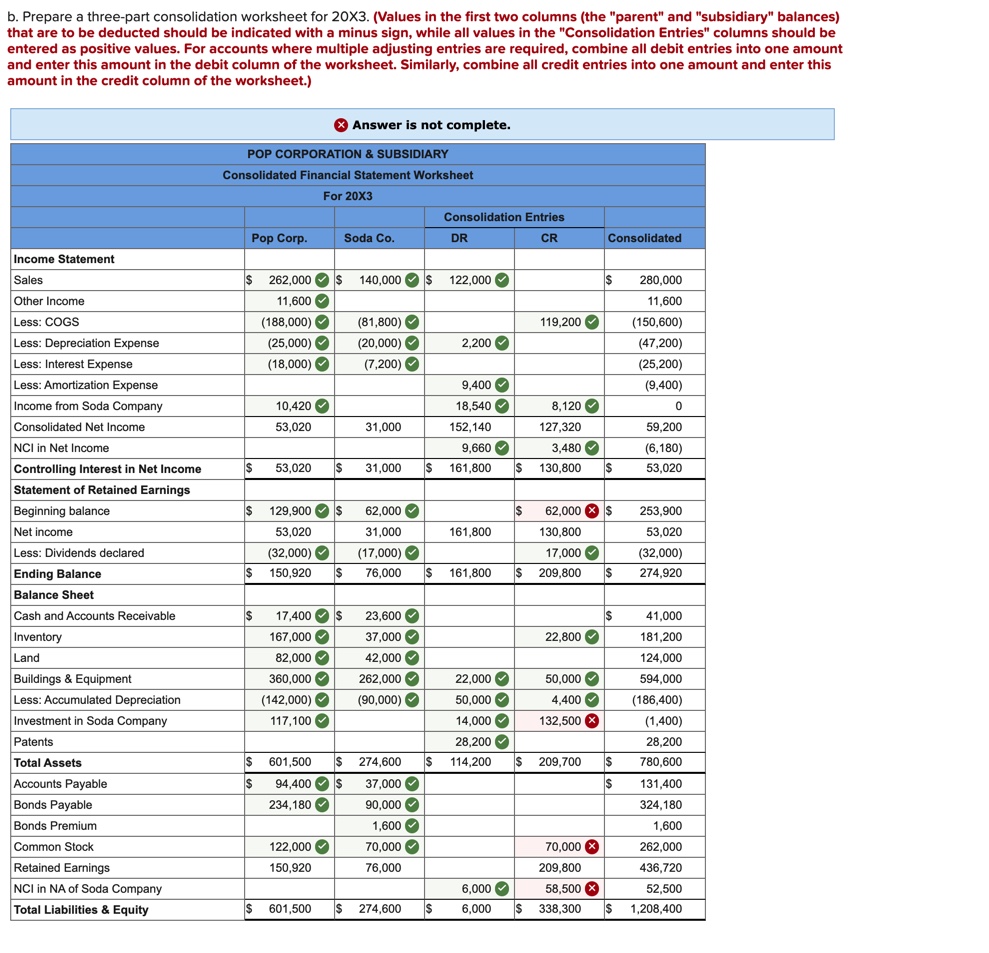

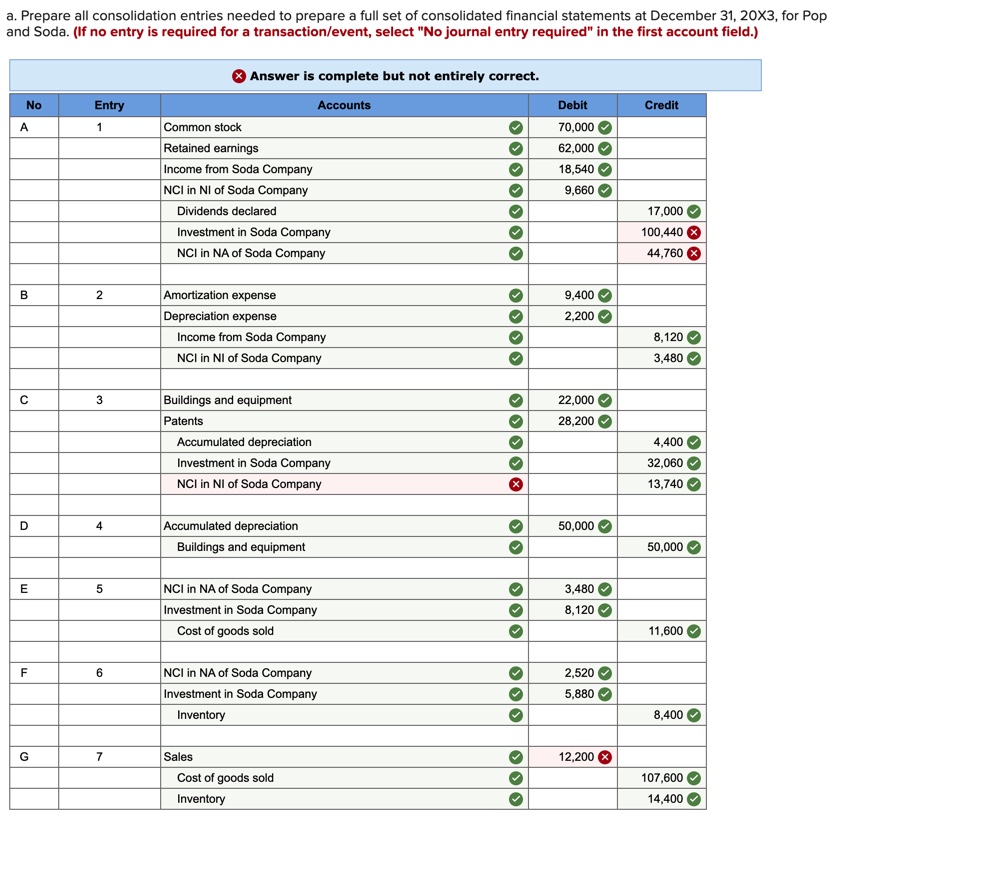

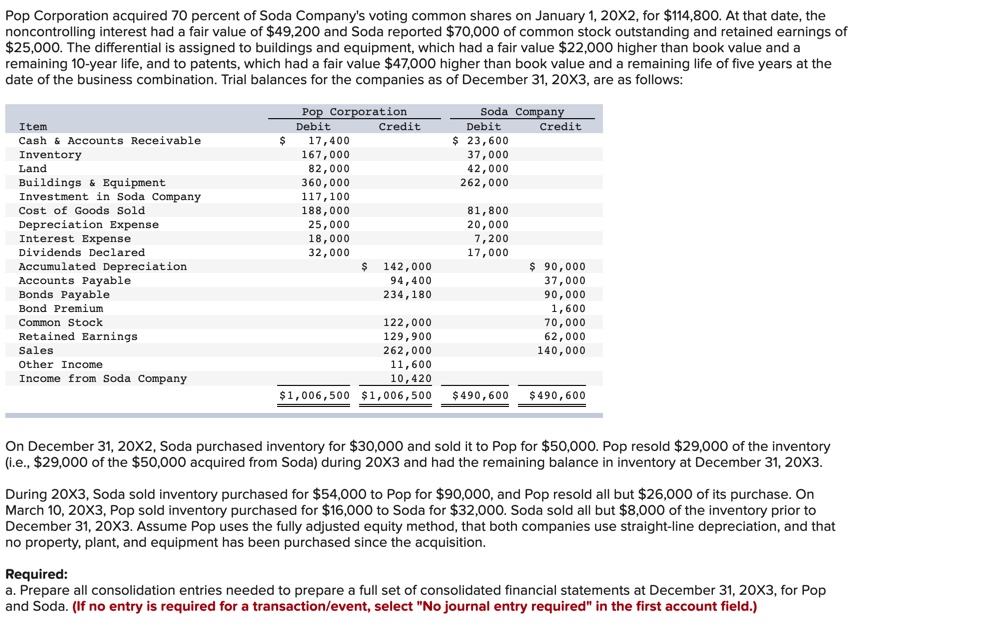

b. Prepare a three-part consolidation worksheet for 20X3. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) x Answer is not complete. POP CORPORATION & SUBSIDIARY Consolidated Financial Statement Worksheet For 20X3 Consolidation Entries Pop Corp. Soda Co. DR CR Consolidated Income Statement Sales $ 262,000 $ 140,000 $ 122,000 $ 280,000 Other Income 11,600 11,600 Less: COGS (188,000) (81,800) 119,200 (150,600) Less: Depreciation Expense 25,000) (20,000) 2,200 47,200 Less: Interest Expense (18,000) (7,200) (25,200) Less: Amortization Expense 9,400 9,400) Income from Soda Company 10,420 18,540 8,120 Consolidated Net Income 53,020 31,000 152,140 127,320 59,200 NCI in Net Income .660 3,480 (6, 180) Controlling Interest in Net Income 53,020 S 31,000 $ 161,800 $ 130,800 53,020 Statement of Retained Earnings Beginning balance $ 129,900 s 62,000 $ 62,000 x $ 253,900 Net income 53,020 31,000 161,800 130,800 ;3,020 Less: Dividends declared 32,000) (17,000) 17,000 (32,000) Ending Balance 150,920 S 76,000 $ 161,800 s 209,800 $ 274,920 Balance Sheet Cash and Accounts Receivable S 17,400 $ 23,600 41,000 Inventory 167,000 37,000 22,800 181,200 Land 82,000 42,000 124,000 Buildings & Equipment 360,000 262,000 22,000 50,000 594,000 Less: Accumulated Depreciation (142,000) (90,000) 60,000 4,400 (186,400) Investment in Soda Company 117,100 4,000 132,500 x (1,400) Patents 28,200 28,200 Total Assets 601,500 $ 274,600 S 114,200 S 209,700 780,600 Accounts Payable 94,400 s 37,000 131,400 Bonds Payable 234,180 90,000 324,180 Bonds Premium 1,600 1,600 Common Stock 122,000 70,000 70,000 x 262,000 Retained Earnings 150,920 76,000 209,800 436,720 NCI in NA of Soda Company 6,000 58,500 x 52,500 Total Liabilities & Equity $ 601,500 $ 274,600 s 6,000 $ 338,300 1,208,400a. Prepare all consolidation entries needed to prepare a full set of consolidated financial statements at December 31, 20X3, for Pop and Soda. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)