I got stuck on these two steps, can someone help me ?

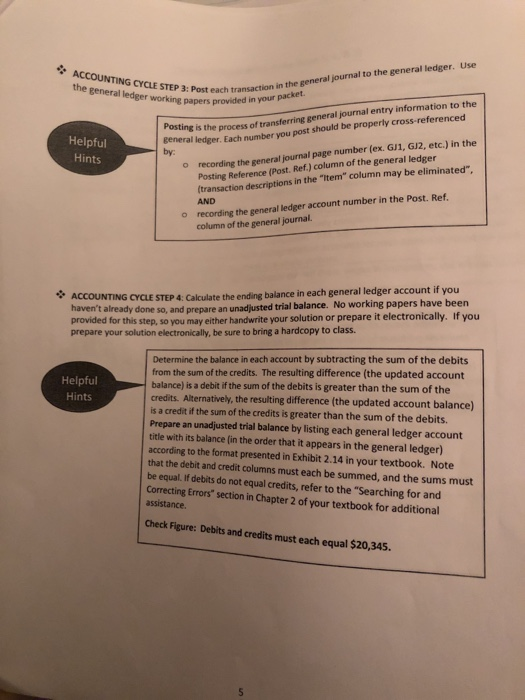

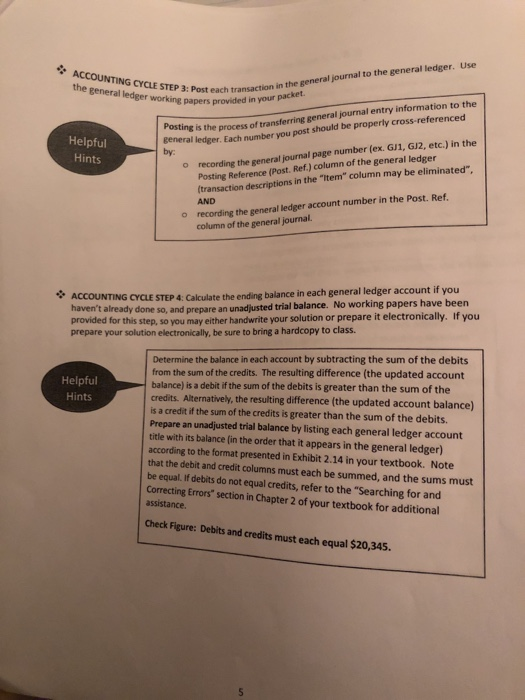

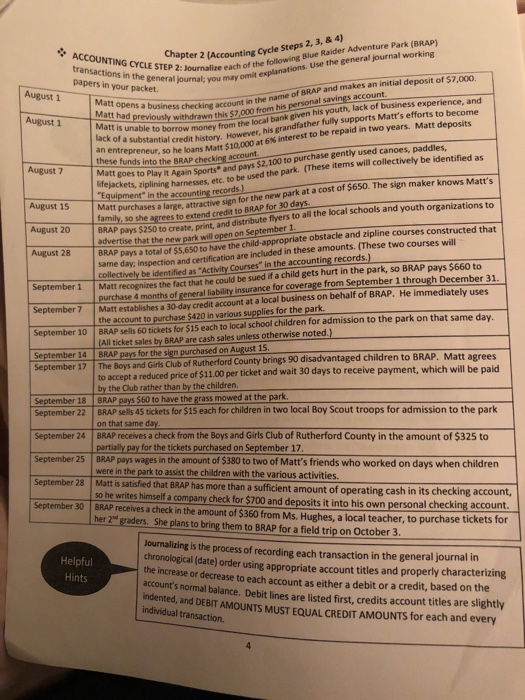

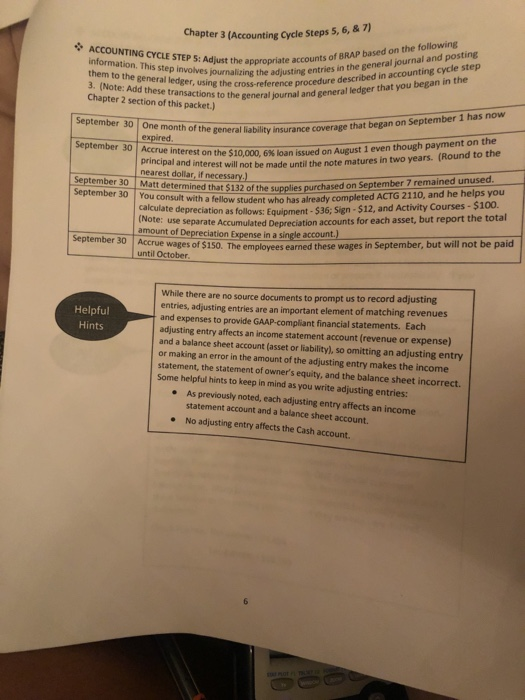

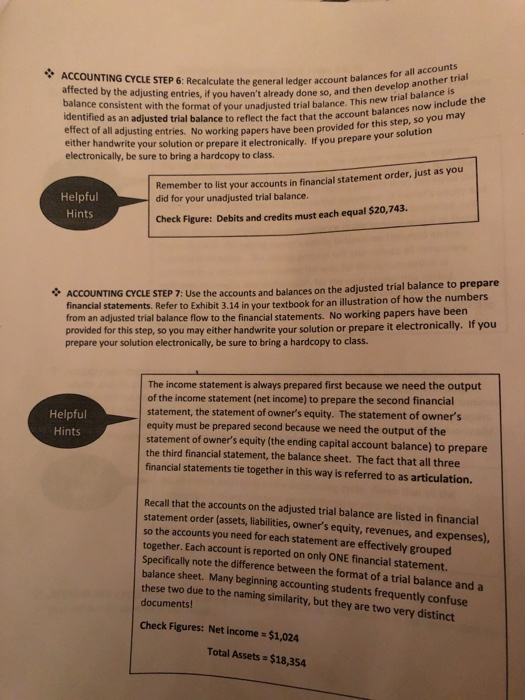

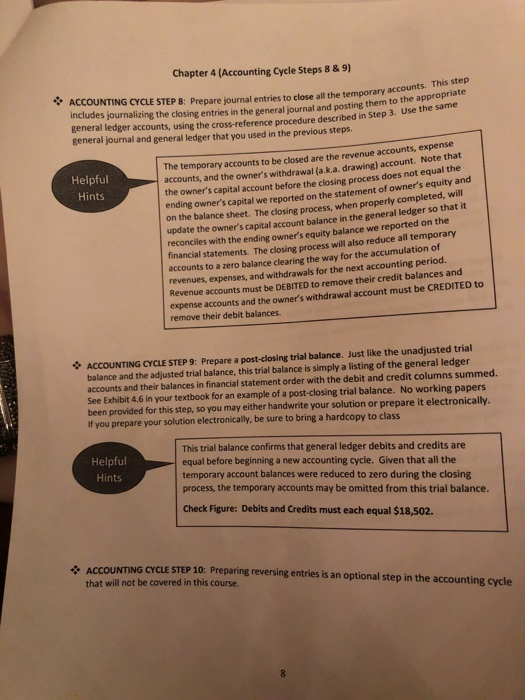

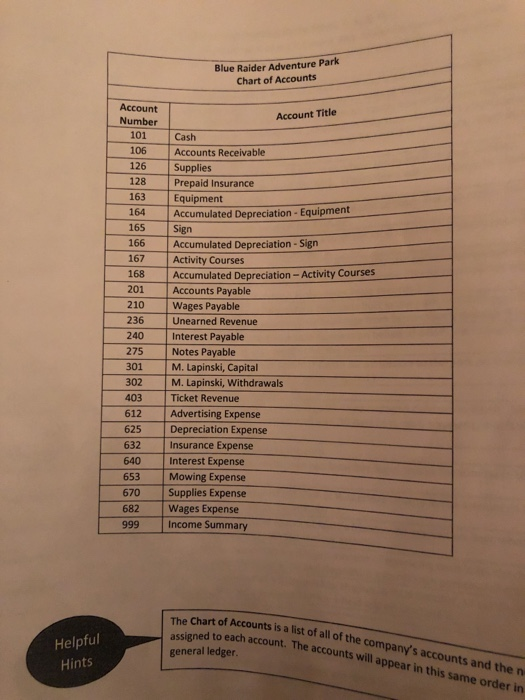

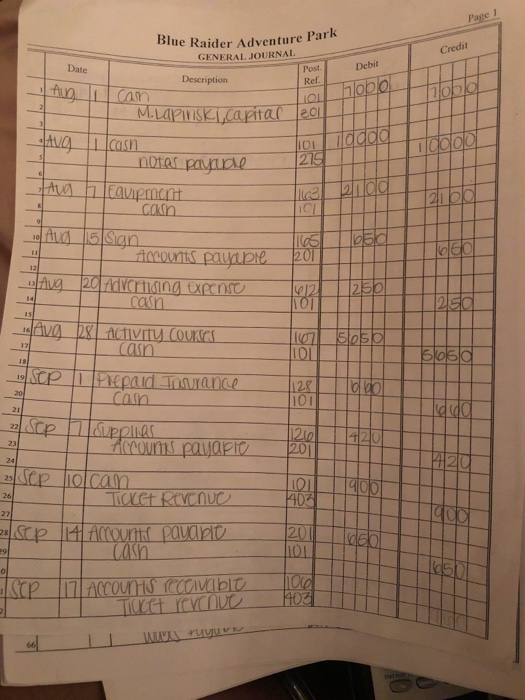

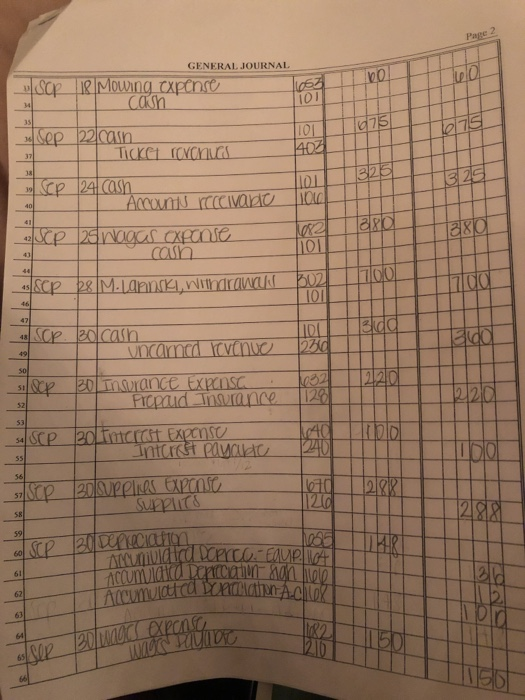

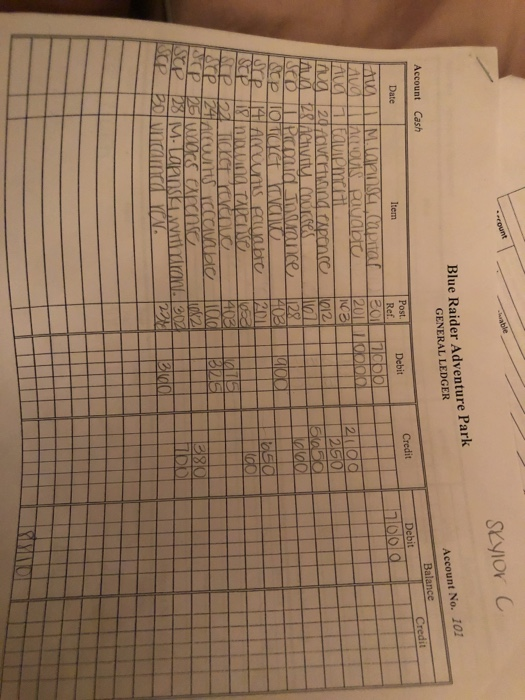

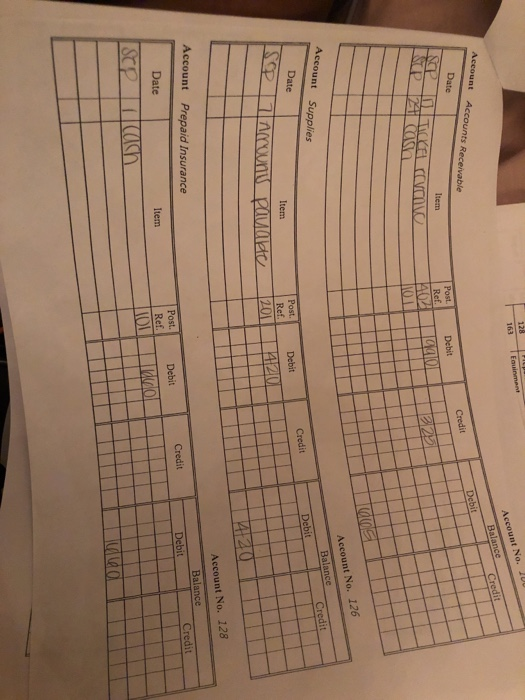

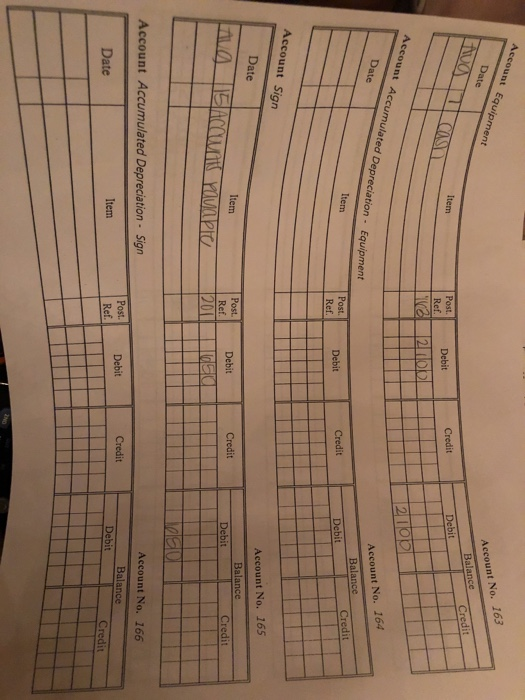

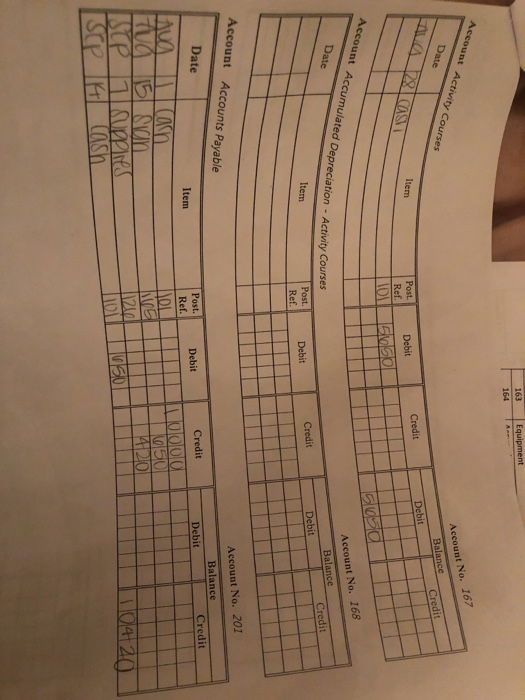

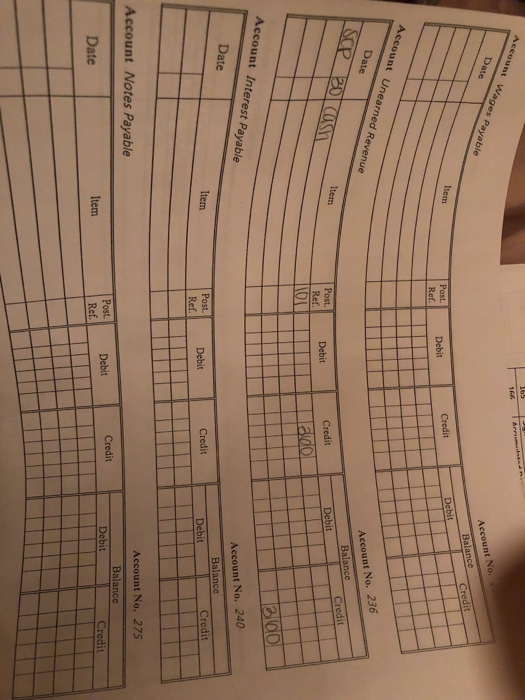

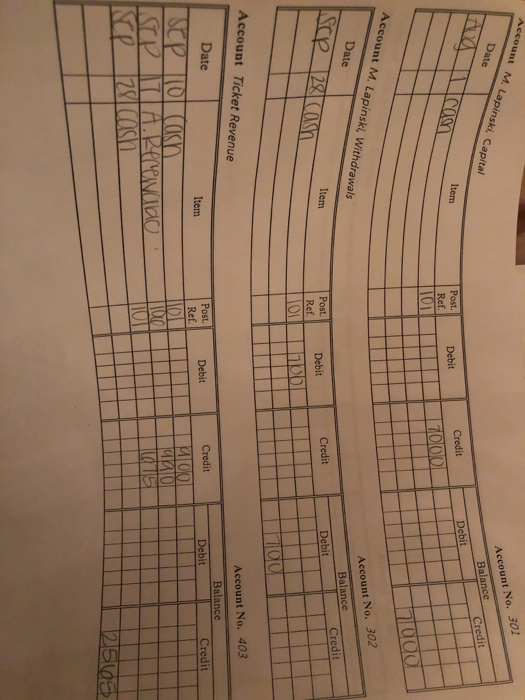

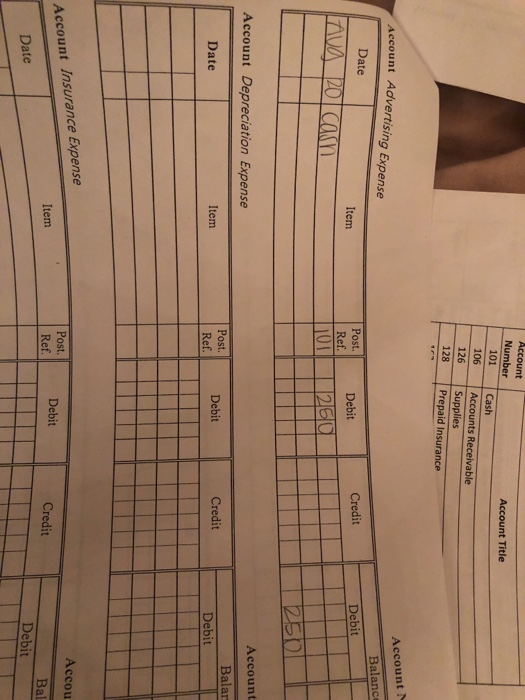

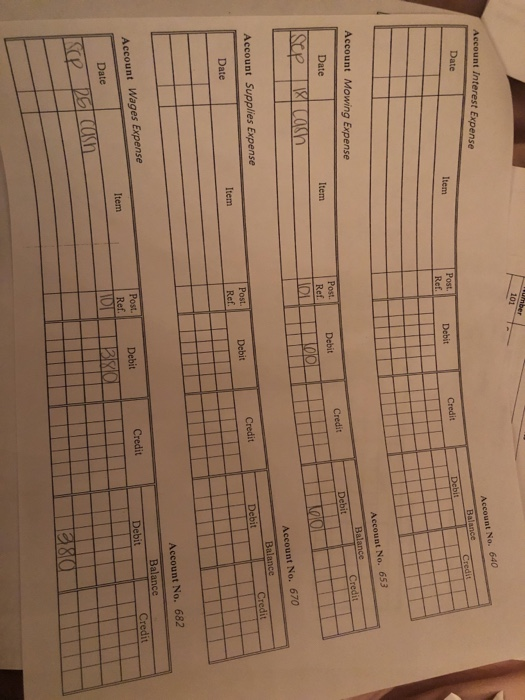

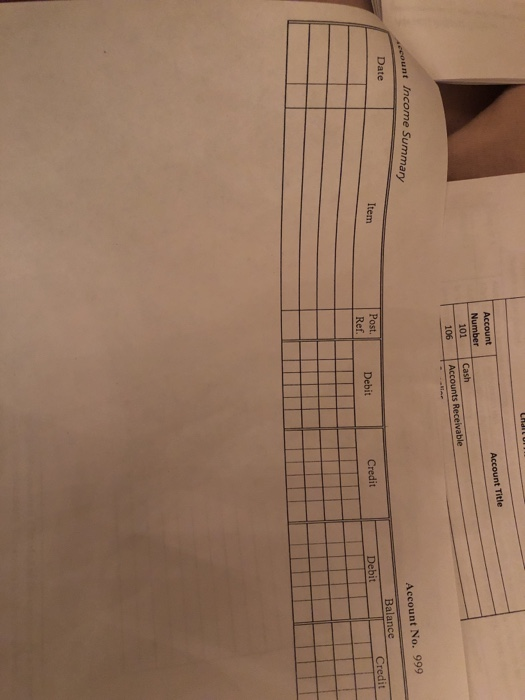

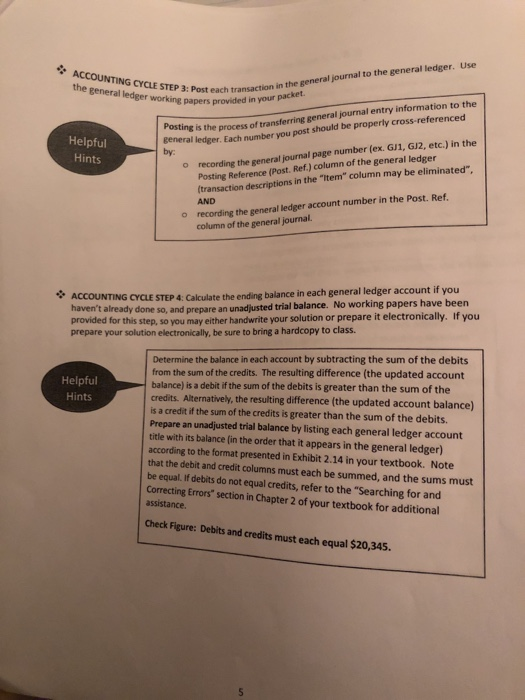

ACCOUNTING CYCLE STEP 3: Post each trans me general ledger working papers provideo teach transaction in the general journal to the general ledger. Use s provided in your packet. Posting is the process of transferring general journal entry information to the seneral ledger. Fach number you post should be properly Cross-referenced Helpful Hints by: recording the general journal page number (ex. G1, G2, etc.) in the Posting Reference (Post. Ref.) column of the general ledger (transaction descriptions in the "item column may be eliminated". AND recording the general ledger account number in the Post. Ref. column of the general journal * ACCOUNTING CYCLE STEP 4: Calculate the ending balance in each general ledger account if you haven't already done so, and prepare an unadjusted trial balance. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints Determine the balance in each account by subtracting the sum of the debits from the sum of the credits. The resulting difference (the updated account balance) is a debit if the sum of the debits is greater than the sum of the credits. Alternatively, the resulting difference (the updated account balance) is a credit if the sum of the credits is greater than the sum of the debits. Prepare an unadjusted trial balance by listing each general ledger account title with its balance in the order that it appears in the general ledger) according to the format presented in Exhibit 2.14 in your textbook. Note that the debit and credit columns must each be summed, and the sums must be equal. If debits do not equal credits, refer to the "Searching for and Correcting Errors' section in Chapter 2 of your textbook for additional assistance. Check Figure: Debits and credits must each equal $20,345. ACCOUNTING CYCLE STEP 2: Jou transactions in the general journals you may papers in your packet. apter 2 (Accountine Cycle Steps 2, 3,8 Journalire each of the following Blue Raider Adventure Park (BRAP urnal you may omit explanations. Use the general journal working August 1 August 1 Matt is unable to borrow mon an entrepreneur, so he loans Matt Aurust 7 Matt goes to August 15 August 20 Matt opens a business checking account in the name of BRAP and makes an initial deposit of $7.000 matt had previously withdrawn this $7.000 from thdrawn this $7.000 from his personal savings account able to borrow money from the local bank given his youth, lack of business experience, and dfather fully supports Matt's efforts to become Ck of a substantial credit history. However, his repreneur, so he loans Matt 510.000 at 6% interest to be repaid in two years. Matt deposits these funds into the BRAP checking account. goes to Play It Again Sports and pays $2,100 to purchase gently used canoes, paddles fejackets, ziplining harnesses, etc. to be used the park. (These items will collectively be identified as Equipment in the accounting records Matt purchases a large attractive sign for the new park at a cost of $650. The sign maker knows Matt's Family. So she agrees to extend credit to BRAP for BRAP pays $250 to create, print and distribute flyers to all the local schools and youth organizations to advertise that the new park will open on September BRAP pays a total of 55.650 to have the child-appropriate obstacle and zipline courses constructed that Same day, inspection and certification are included in these amounts. These two courses will collectively be identified as "Activity Courses in the accounting records.) Matt recognizes the fact that he could be sued if a child gets hurt in the park, SO BRAP pays $660 to purchase 4 months of general liability insurance for coverage from September 1 through December 31. Matt establishes a 30 day credit account at a local business on behalf of BRAP. He immediately uses the account to purchase $420 in various supplies for the park. BRAP sells tickets for $15 each to local school children for admission to the park on that same day (All ticket sales by BRAP are cash sales unless otherwise noted.) BRAP pays for the sign purchased on August 15. August 28 september 1 September 7 September 10 September 14 September 17 The Boys and Girls Club of Rutherford County brings 90 disadvantaged children to BRAP, Matt agrees to accept a reduced price of $11.00 per ticket and wait 30 days to receive payment, which will be paid by the Club rather than by the children. September 18 BRAP pays $60 to have the grass mowed at the park. September 22 BRAP sells 45 tickets for $15 each for children in two local Boy Scout troops for admission to the park on that same day. September 24 BRAP receives a check from the Boys and Girls Club of Rutherford County in the amount of $325 to partially pay for the tickets purchased on September 17. September 25 BRAP pays wages in the amount of $380 to two of Matt's friends who worked on days when children were in the park to assist the children with the various activities. September 28 Mattis satisfied that BRAP has more than a sufficient amount of operating cash in its checking account, so he writes himself a company check for $700 and deposits it into his own personal checking account. September 30 BP receives a check in the amount of $360 from Ms. Hughes, a local teacher, to purchase tickets for her 2 graders. She plans to bring them to BRAP for a field trip on October 3. Helpful Hints Journalizing is the process of recording each transaction in the general journal in chronological (date) order using appropriate account titles and properly characterizing the increase or decrease to each account as either a debit or a credit, based on the account s normal balance. Debit lines are listed first. credits account titles are signty Indented, and DEBIT AMOUNTS MUST EQUAL CREDIT AMOUNTS for each and every individual transaction Chapter 3 (Accounting Cycle Steps 5, 6, & 7) ACCOUNTING CYCLE STEP 5: Adjust the app information. This step involves journalizing them to the general ledger, using the cros 3. (Note: Add these transactions to the generale Chapter 2 section of this packet.) djust the appropriate accounts of BRAP based on the following warnalizing the adjusting entries in the general journal and posting the cross-reference procedure described in accounting cycle step ctions to the general journal and general ledger that you began in the e general liability insurance coverage that began on September 1 has now September 30 One month of the general liability expired September 30 Accrue interest on the $10,000, 6% lo erest on the $10,000, 6% loan issued on August 1 even though payment on the principal and interest will the Pal and interest will not be made until the note matures in two years. (Round to the nearest dollar, if necessary.) September 30 Matt determined that $132 of the supplies determined that $132 of the supplies nurchased on September 7 remained unused. sunt with a fellow student who has already completed ACTG 2110, and he helps you calculate der ulate depreciation as follows: Fouinment - $36: Sien - $12, and Activity Courses - $100. (Note: use separate Accumulated Derreciation accounts for each asset, but report the total amount of Depreciation Expense in a single account.) September 30 Accrue wages of $150 ccrue wages of $150. The employees earned these wages in September, but will not be paid until October Helpful Hints While there are no source documents to prompt us to record adjusting entries, adjusting entries are an important element of matching revenues and expenses to provide GAAP-compliant financial statements. Each adjusting entry affects an income statement account (revenue or expense) and a balance sheet account asset or liability). so omitting an adjusting entry or making an error in the amount of the adjusting entry makes the income statement, the statement of owner's equity, and the balance sheet incorrect. Some helpful hints to keep in mind as you write adjusting entries: As previously noted, each adjusting entry affects an income statement account and a balance sheet account. No adjusting entry affects the Cash account. ACCOUNTING CYCLE STEP 6: Recalculate the general ledger account affected by the adjusting entries, if you haven't already done so, and then balance consistent with the format of your undiusted trial balance. This new identified as an adjusted trial balance to reflect the fact tep, so you may effect of all adjusting entries. No working papers have adjusting entries. No working papers have been provided for this step, so her handwrite your solution or prepare it electronically. If you prepare your sou electronically, be sure to bring a hardcopy to class. ledger account balances for all accounts one so, and then develop another trial balance. This new trial balance is act that the account balances now include the Helpful Hints Remember to list your accounts in financial statement order, just as you did for your unadjusted trial balance. Check Figure: Debits and credits must each equal $20,743. ACCOUNTING CYCLE STEP 7: Use the accounts and balances on the adiusted trial balance to prepare financial statements. Refer to Exhibit 3.14 in our textbook for an illustration of how the numbers from an adjusted trial balance flow to the financial statements. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints The income statement is always prepared first because we need the output of the income statement (net income) to prepare the second financial statement, the statement of owner's equity. The statement of owner's equity must be prepared second because we need the output of the statement of owner's equity (the ending capital account balance) to prepare the third financial statement, the balance sheet. The fact that all three financial statements tie together in this way is referred to as articulation Recall that the accounts on the adjusted trial balance are listed in financial statement order (assets, liabilities, owner's equity, revenues, and expenses), so the accounts you need for each statement are effectively grouped together. Each account is reported on only ONE financial statement. Specifically note the difference between the format of a trial balance and a balance sheet. Many beginning accounting students frequently confuse these two due to the naming similarity, but they are two very distinct documents! Check Figures: Net income = $1,024 Total Assets = $18,354 Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare journal entries to close all the temporary includes journalizing the closing entries in the general lournal and posting them to the app general ledger accounts, using the cross-reference procedure described in Step 3. general journal and general ledger that you used in the previous steps. lose all the temporary accounts. This step al journal and posting them to the appropriate ce procedure described in Step 3. Use the same Helpful Hints The temporary accounts to be closed are the revenue accounts, expense accounts, and the owner's withdrawal la ka, drawing) account. Note that the owner's capital account before the closing process does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period. Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class Helpful Hints This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Check Figure: Debits and Credits must each equal $18,502. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. Blue Raider Adventure Park Chart of Accounts Account Title Account Number 101 106 126 128 163 164 165 166 167 168 201 210 236 240 275 301 302 403 612 625 632 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation - Equipment Sign Accumulated Depreciation - Sign Activity Courses Accumulated Depreciation - Activity Courses Accounts Payable Wages Payable Unearned Revenue Interest Payable Notes Payable M. Lapinski, Capital M. Lapinski, Withdrawals Ticket Revenue Advertising Expense Depreciation Expense Insurance Expense Interest Expense Mowing Expense Supplies Expense Wages Expense Income Summary 640 653 670 682 999 The Chart of Accounts is a li assigned to each accou general ledger. of Accounts is a list of all of the company's accounts and then to each account. The accounts will appear in this same order in Helpful Hints Page 1 Credit Date Debit lobo 1 Aug Tobla Blue Raider Adventure Park GENERAL JOURNAL Post Description Ref. I can LOL! M.Lapinski, capital 201 cash noooo notas payaude Equipment enda H con Avg hondddd 2191 Aug AUD 5 Sign 1050 ooo - ACCOUNTS payapie Aug 20 Adverhang acceso carn 12 1250 101 g 28 ActiVITY COURS cain 15.05 IOLI 5050 CP Idol 28 101 Isda 200 201 scp n supplies riccounis pavapio 23 Sep locain TICKET Revenue 129 26 14/01 Scp 14 Amounts payablo sep 11 Accounts receivable TIGE revenue |L WAUAS ruyun oo Sap GENERAL JOURNAL 18 Mowing expense cash 101 TOI 1675 0.75 1403 12112 . Sep 22 cain Ticket PCMCIAUGS Scp 24 can Accounts receivado Te21 100 also UCP 29 Wagas expense 1082 1980 no scp 8 M. danski, Windrance BO2 100 + + an SCP. 20 cash incarnea cvento 2310 1002 op 20 Insurance Expansa Freud numance suscp 20 Cast Expense net pamaldo 120-UP PIRAS Expand Supra 1120 ILL 20 Depreciate Monibidica UPCO, EURIA nccum laico. Dopaminan Hot Accumulata Petrichen 201110c expand TAMOS PUNTOS Skylor C Blue Raider Adventure Park GENERAL LEDGER Account No. 101 Balance Credit Credit Debit Inlood 2010 250 Account Cash Post. Date Item Debit Ref. M. desempia 2017 cbbl AVG AVS Padbo 1201 LCOOL LA 1 Equipment ng 20 Advertiand ripeno Aug 28 Activity courses SC Romidance | Stp IOCt TVTV Top Arcos punto 2014 SEP 18 DING CARCINO P TICKCE ONCOLO op 24 A S YcCabo_ SP 25 Moscanana Sep 28 M. LAPSL 204 tosa Kdo 220 Fouin Account No. 100 Balance Credit Account Accounts Receivable Debit Credit Date Post Ref. Debit C Item CCVCOVO 1402 10010 a INOL Account No. 126 Balance Account Supplies Credit Credit Debit Date Debit Item SPANUNU Puma Post. Ref. 201 1420 420 Account No. 128 Balance Account Prepaid Insurance Credit Credit Debit Debit Date Item Post. Rel. JOU Tavol SOP I can Account Equipment Date a Account No. 163 Balance Credit Item CASA Credit Debit Post. Debit Na 2 Tob Ref Account Accumulated Depreciation - Equip 2100 Date Account No. 164 Balance Item Post Ref Credit Credit Debit Debit Account Sign Account No. 165 Date Aug 15 Accents payable Item Post Balance Debit Credit Debit Credit 201 Account Accumulated Depreciation - Sign Account No. 166 Debit Credit Balance Post. Ref. Date Item Debit Credit 163 164 Equipment TA Account Activity Courses Account No. 167 Date Balance Credit ALAPOST Credit Debit Item Post Debit Ref. KONGR50 Account Accumulated Depreciation - ACE Account No. 168 Date Balance Credit eciation - Activity Courses Item Post. Ret. Debit Credit Debit Account Accounts Payable Account No. 201 Balance Debit Credit Debit Credit Post. Ref. Item Lololo Date An I can TU 15 Siin ISIP Supplies SCPK Cash NDI INC 050 4201 12 11014420 Account Wages Payable Date Account No. Balance Credit tem Post Debit Credit TIL Account Unearned Revenue Date SCP 30 cm Account No. 236 Balance Item Credit Post. Credit Debit Debit laido 200 Account Interest Payable Account No. 240 Date Balance Item Post Ref Debit Credit Credit Account No. 275 Account Notes Payable Balance Debit Credit Post Ref. Debit Date Item Credit Account M. Lapinski, Capital Date Account No. 301 Balance Credit Debit con Credit Debit fiem 7000 7000 Account M. Lapinski, Withdrawals Date SCP 28 cash Account No. 302 Balance Credit Item Post. Credit Debit Ref. Ref Debit 1 1 101 100 Account Ticket Revenue Account No. 403 Balance Post Credit Debit Debit Item Credit Date SCP 10 caso GIO COM CP TIA. Rerewold CP 281 cash 1 2565 Account Title Account Number 101 106 126 Cash Accounts Receivable Supplies Prepaid Insurance 128 Account Advertising Expense Account Balance Credit Debit Date Aug 20 cash Item R Debit 250 250 Account Depreciation Expense Account Post Balar Date Item Debit Credit Debit Accou Account Insurance Expense Item ' Post. Ref. Debit Credit Bal Date Debit Account No. 640 Account Interest Expense Balance Credit Date Credit Item Post. Ref. Debit Account No. 653 Balance Account Mowing Expense Credit Credit Debit Debit T Item Date SCP Post Ref. OL Debit 100 18 cash Account No. 670 Balance Credit Account Supplies Expense Credit Debit Post. Rel. Debit Item Date Account No. 682 Balance Debit Credit Credit Debit Account Wages Expense Item Post Ref. 101 Date KCP 25 Cush 1980 Account Title Account Number 101 106 Cash Accounts Receivable count Income Summary Account No. 999 Balance Date Credit Item Credit Debit Post Refl Debit