Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got these wrong please answer both Assume that the price of a bushel of corn is EUR 3.50 in the Euro Zone and USD

I got these wrong please answer both

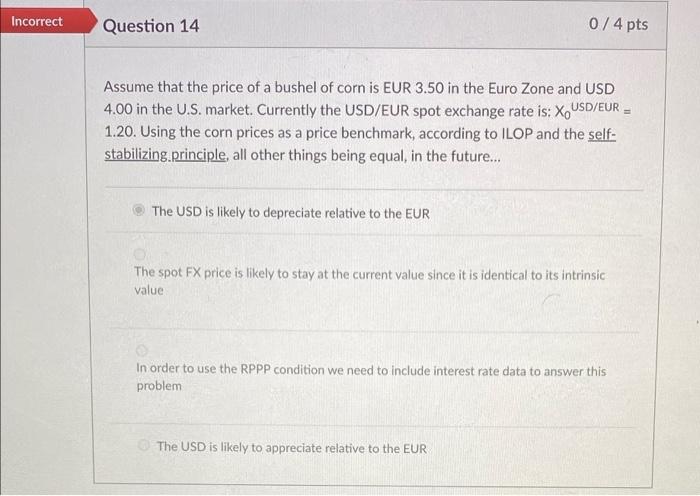

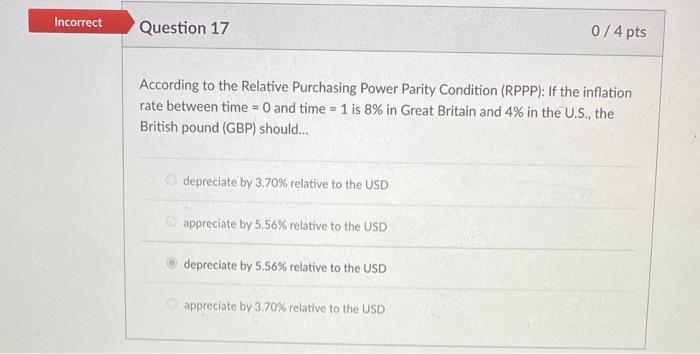

Assume that the price of a bushel of corn is EUR 3.50 in the Euro Zone and USD 4.00 in the U.S. market. Currently the USD/EUR spot exchange rate is: X0 USD/EUR = 1.20. Using the corn prices as a price benchmark, according to ILOP and the selfstabilizing.principle, all other things being equal, in the future... The USD is likely to depreciate relative to the EUR The spot FX price is likely to stay at the current value since it is identical to its intrinsic value In order to use the RPPP condition we need to include interest rate data to answer this problem The USD is likely to appreciate relative to the EUR According to the Relative Purchasing Power Parity Condition (RPPP): If the inflation rate between time =0 and time =1 is 8% in Great Britain and 4% in the U.S., the British pound (GBP) should... depreciate by 3.70% relative to the USD appreciate by 5.56% relative to the USD depreciate by 5.56% relative to the USD appreciate by 3.70% relative to the USD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started