Question

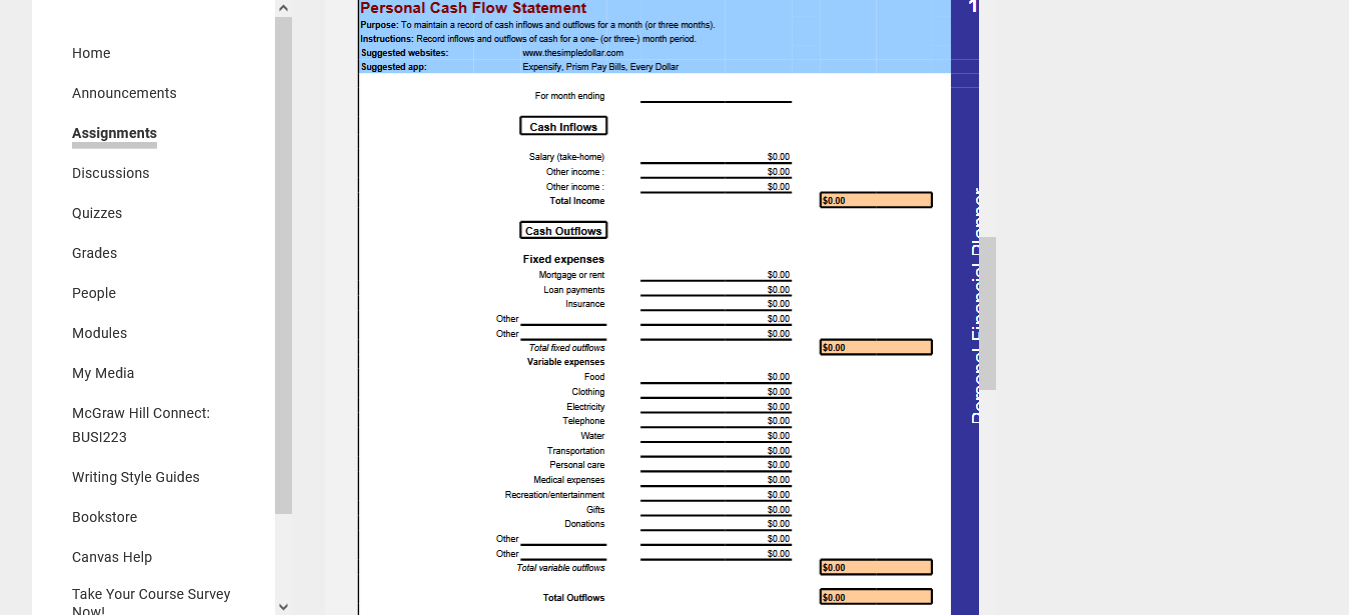

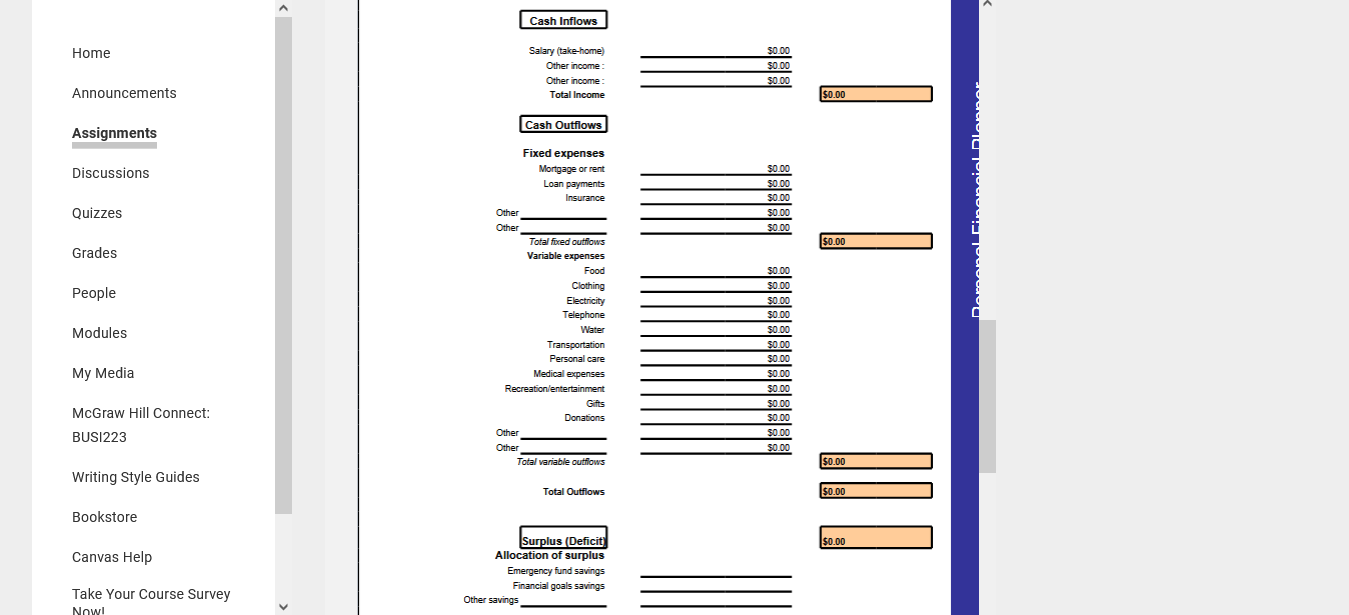

I graduated from college 3 years ago and just bought my first house. I make $42,000 a year for a salary. I get paid $1436.25

I graduated from college 3 years ago and just bought my first house. I make $42,000 a year for a salary. I get paid $1436.25 (which taxes and my 401K are taken out) on the 1st and 15th. My company also pays my health insurance premium. My company does a 100% match on my 401K up to 6% of my salary, so I have been doing that for the last 3 years and have that money and what they matched in my retirement account. I also have been saving $200 a month for the last 3 years that is in my savings account. If I have a surplus when I budget or do my cash flow, I save $200 and put the rest in mutual funds. I have invested $10,500 in mutual funds.

I bought my house for $175,000, but it is already appraising for $180,000. My mortgage is for $150,000. I got a 3% interest rate over 30 years, so my monthly payment including taxes is $800 a month. Insurance is $900 a year, but I pay it monthly. Electric is about $75 a month and water is $25. Food generally is around $400 a month. My car payment is $250/month and car insurance of $50/month and gas of $200/month. My cell phone is $50/month, clothes average $50/month and fun money is about $100/month. I tithe 10% of my gross income every month.

As far as what I own, my checking account is currently at $1,600. I have a life insurance plan that will pay out $100,000 if I die, but it has a cash value of $6,250. According to KBB, my car is worth $12,000. However, I still owe $4,000 on it. I have a credit card that I pay off every month, but the current balance is $545. I do not put the credit card payment in my cash flow or budget, as I use it to pay the items that are already in my budget and cash flow like gas and food. I also own a laptop that I paid $2000 for, but it is probably worth $600 currently. I just paid $6,000 for furniture for my house.

As far as what I own, my checking account is currently at $1,600. I have a life insurance plan that will pay out $100,000 if I die, but it has a cash value of $6,250. According to KBB, my car is worth $12,000. However, I still owe $4,000 on it. I have a credit card that I pay off every month, but the current balance is $545. I do not put the credit card payment in my cash flow or budget, as I use it to pay the items that are already in my budget and cash flow like gas and food. I also own a laptop that I paid $2000 for, but it is probably worth $600 currently. I just paid $6,000 for furniture for my house.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started