Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have 3 separate questions that need answering. please only answer if you are going to answer the whole problems. stop wasting my questions. to

I have 3 separate questions that need answering. please only answer if you are going to answer the whole problems. stop wasting my questions.

to clarify the last 2 photos

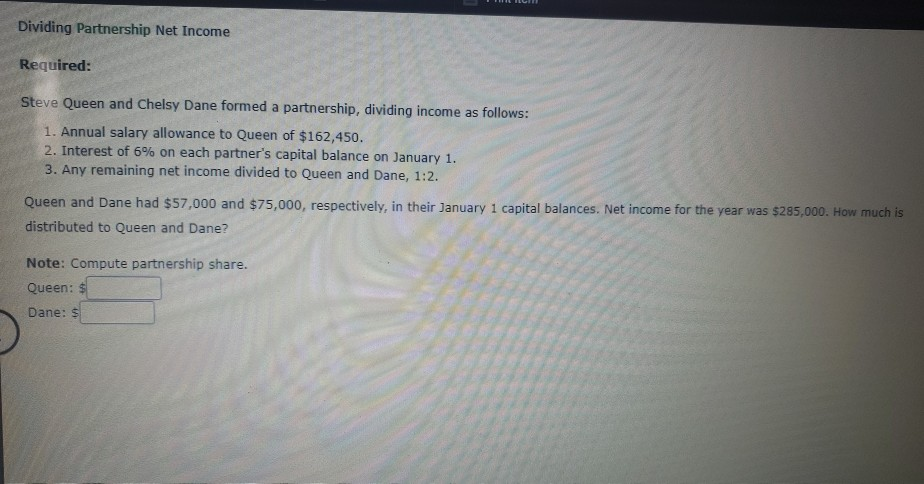

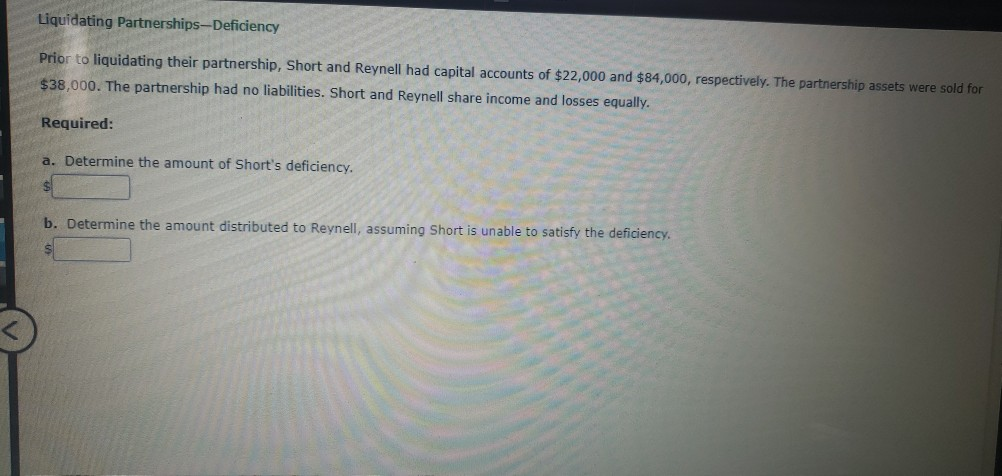

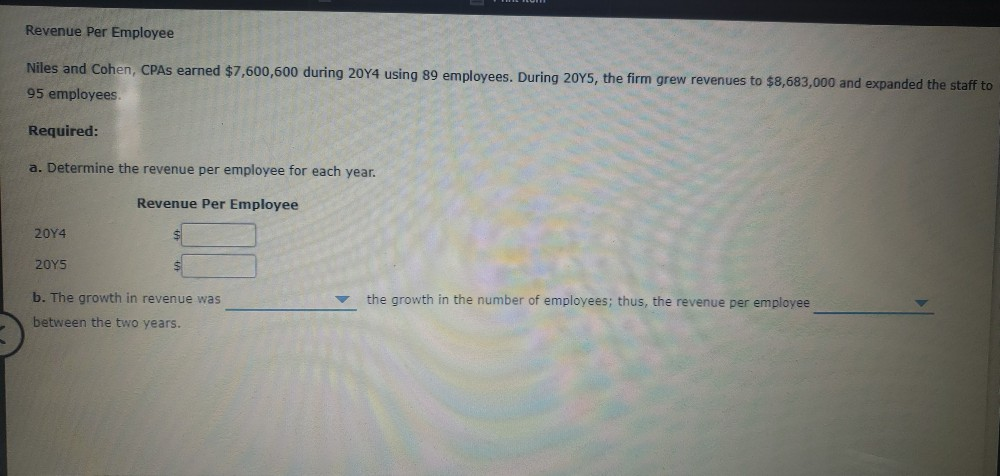

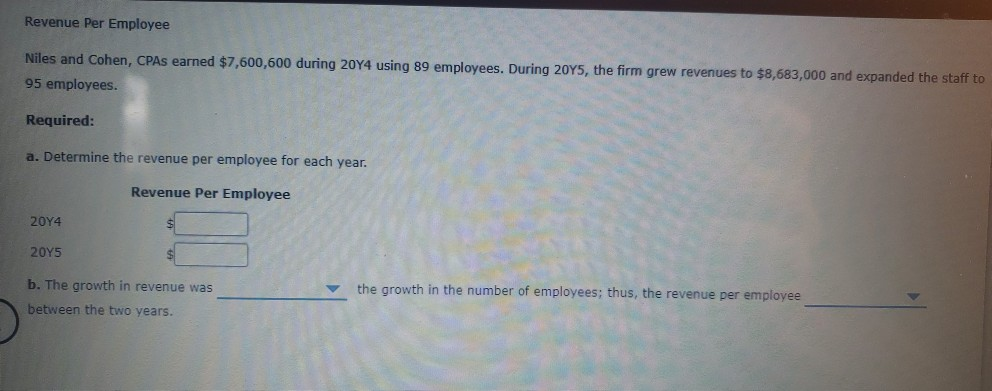

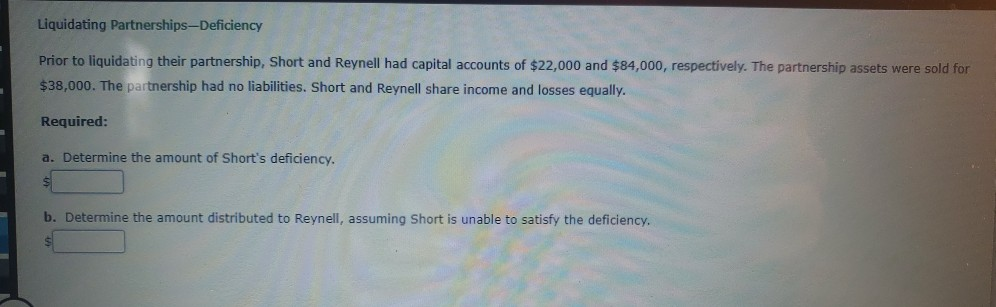

Dividing Partnership Net Income Required: Steve Queen and Chelsy Dane formed a partnership, dividing income as follows: 1. Annual salary allowance to Queen of $162,450. 2. Interest of 6% on each partner's capital balance on January 1. 3. Any remaining net income divided to Queen and Dane, 1:2. Queen and Dane had $57,000 and $75,000, respectively, in their January 1 capital balances. Net income for the year was $285,000. How much is distributed to Queen and Dane? Note: Compute partnership share. Queen: $ Dane: $ Liquidating Partnerships-Deficiency Prior to liquidating their partnership, Short and Reynell had capital accounts of $22,000 and $84,000, respectively. The partnership assets were sold for $38,000. The partnership had no liabilities. Short and Reynell share income and losses equally. Required: a. Determine the amount of Short's deficiency. b. Determine the amount distributed to Reynell, assuming Short is unable to satisfy the deficiency. Revenue Per Employee Niles and Cohen, CPAs earned $7,600,600 during 2044 using 89 employees. During 2045, the firm grew revenues to $8,683,000 and expanded the staff to 95 employees Required: a. Determine the revenue per employee for each year. Revenue Per Employee 2014 2015 b. The growth in revenue was the growth in the number of employees; thus, the revenue per employee between the two years. Revenue Per Employee Niles and Cohen, CPAs earned $7,600,600 during 2074 using 89 employees. During 2045, the firm grew revenues to $8,683,000 and expanded the staff to 95 employees. Required: a. Determine the revenue per employee for each year. Revenue Per Employee 2014 2015 b. The growth in revenue was between the two years. the growth in the number of employees; thus, the revenue per employee Liquidating Partnerships-Deficiency Prior to liquidating their partnership, Short and Reynell had capital accounts of $22,000 and $84,000, respectively. The partnership assets were sold for $38,000. The partnership had no liabilities. Short and Reynell share income and losses equally. Required: a. Determine the amount of Short's deficiency. $ b. Determine the amount distributed to Reynell, assuming Short is unable to satisfy the deficiency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started