i have 30 min left

i have 30 min left

please solve in page

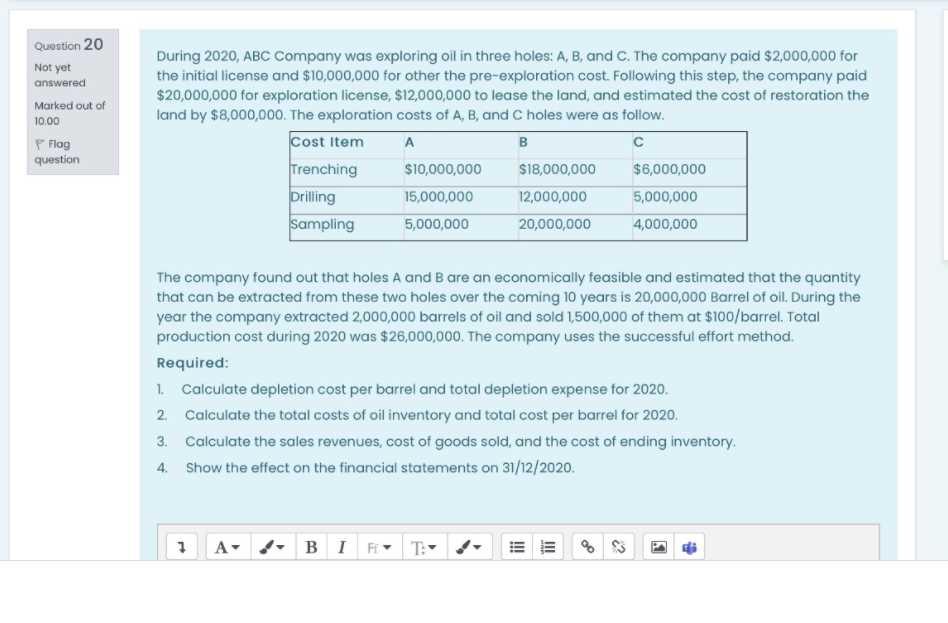

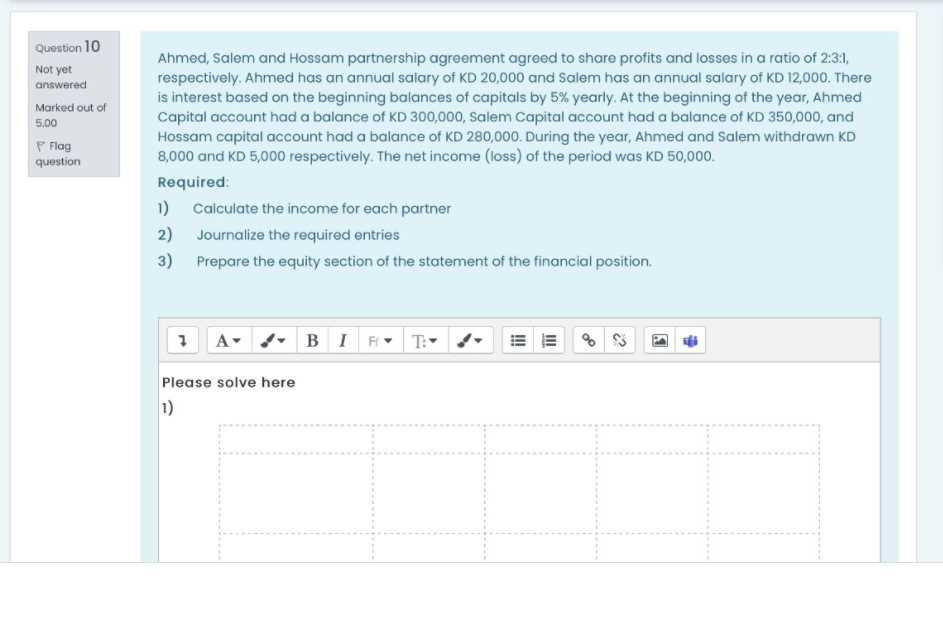

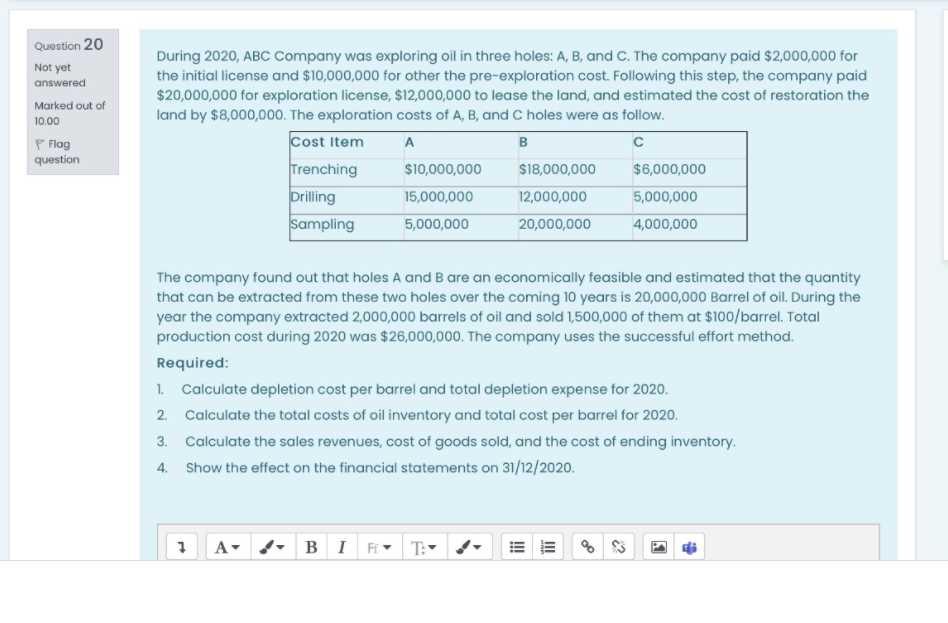

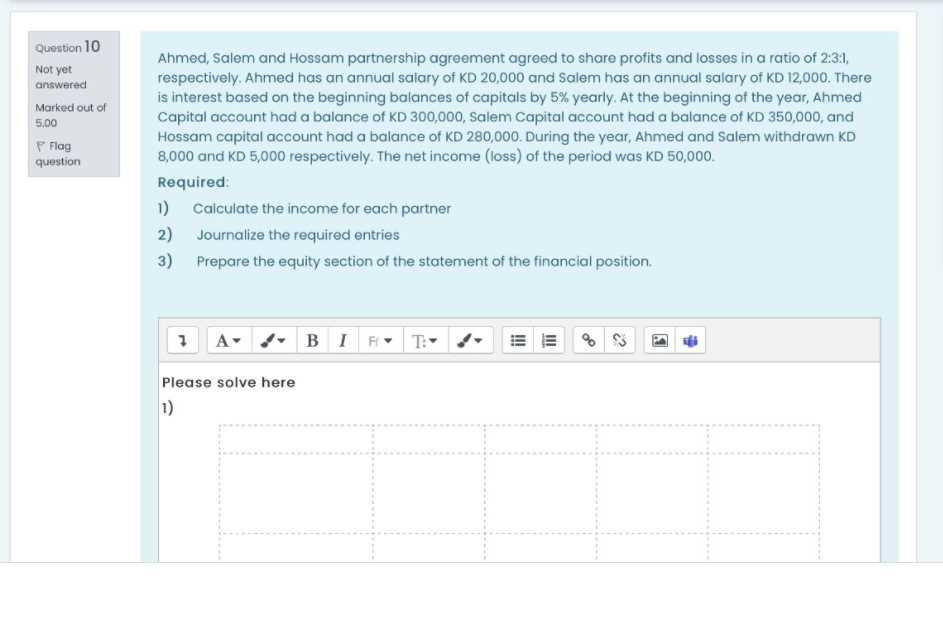

Question 10 Not yet answered Marked out of 5.00 P Flag question Ahmed, Salem and Hossam partnership agreement agreed to share profits and losses in a ratio of 2:3:1, respectively. Ahmed has an annual salary of KD 20,000 and Salem has an annual salary of KD 12,000. There is interest based on the beginning balances of capitals by 5% yearly. At the beginning of the year, Ahmed Capital account had a balance of KD 300,000, Salem Capital account had a balance of KD 350,000, and Hossam capital account had a balance of KD 280,000. During the year, Ahmed and Salem withdrawn KD 8,000 and KD 5,000 respectively. The net income (loss) of the period was KD 50,000 Required: 1) Calculate the income for each partner 2) Journalize the required entries 3) Prepare the equity section of the statement of the financial position 7 A BIRE EE Please solve here 1) Question 20 Not yet answered Marked out of 10.00 Flog question During 2020, ABC Company was exploring oil in three holes: A, B, and C. The company paid $2,000,000 for the initial license and $10,000,000 for other the pre-exploration cost. Following this step, the company paid $20,000,000 for exploration license, $12,000,000 to lease the land, and estimated the cost of restoration the land by $8,000,000. The exploration costs of A, B, and C holes were as follow. Cost Item A B Trenching $10,000,000 $18,000,000 $6,000,000 Drilling 15,000,000 12,000,000 5,000,000 Sampling 5,000,000 20,000,000 4,000,000 The company found out that holes A and B are an economically feasible and estimated that the quantity that can be extracted from these two holes over the coming 10 years is 20,000,000 Barrel of oil. During the year the company extracted 2,000,000 barrels of oil and sold 1,500,000 of them at $100/barrel. Total production cost during 2020 was $26,000,000. The company uses the successful effort method. Required: 1. Calculate depletion cost per barrel and total depletion expense for 2020. 2. Calculate the total costs of oil inventory and total cost per barrel for 2020. 3. Calculate the sales revenues, cost of goods sold, and the cost of ending inventory 4. Show the effect on the financial statements on 31/12/2020 1A BIFE T

i have 30 min left

i have 30 min left