I have a case study that I am struggling to understand, can you please provide any tips or information that could help me.

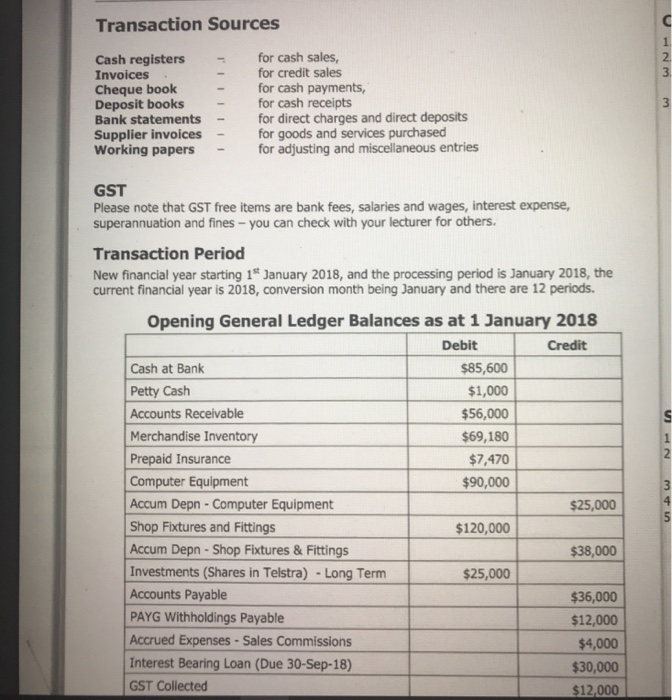

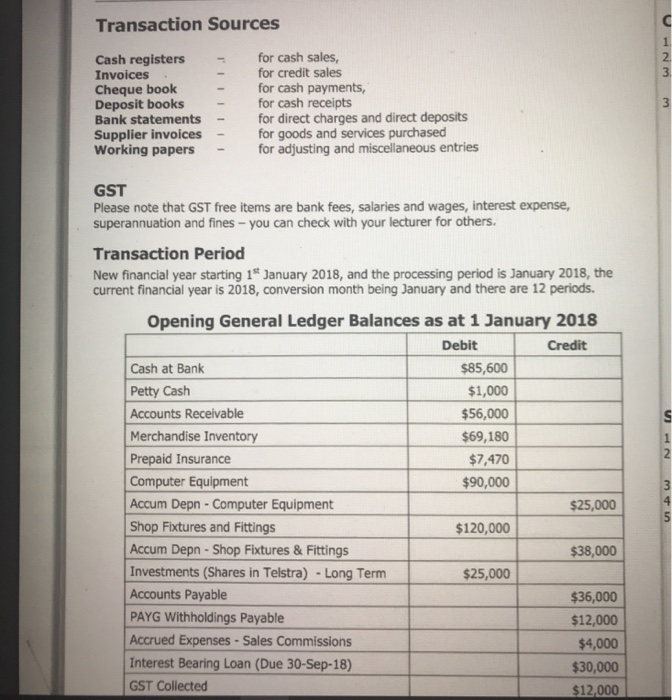

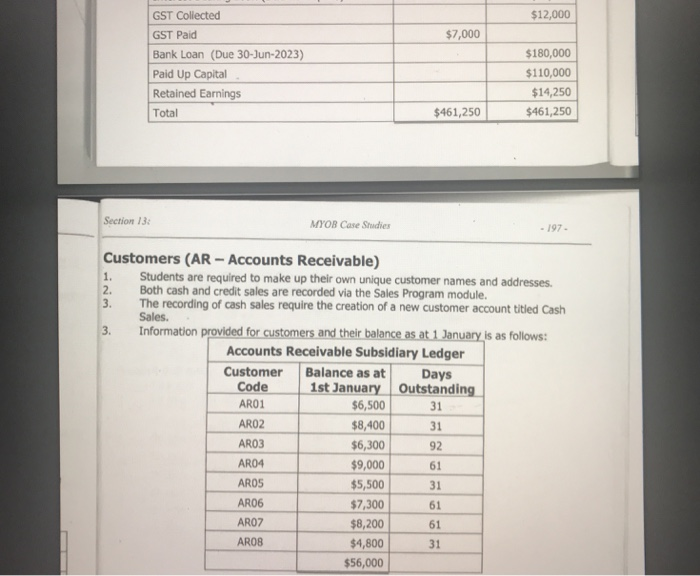

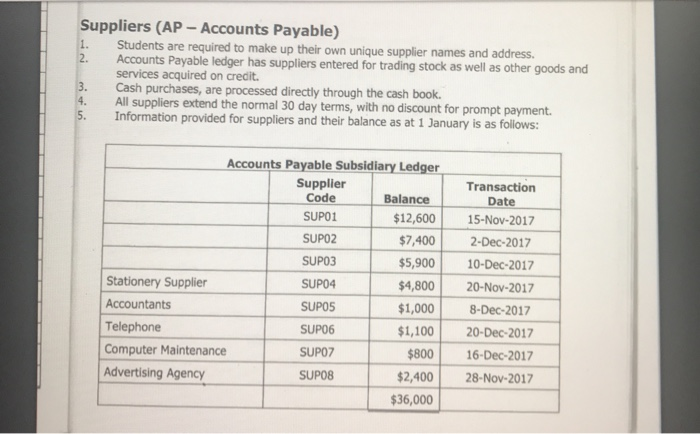

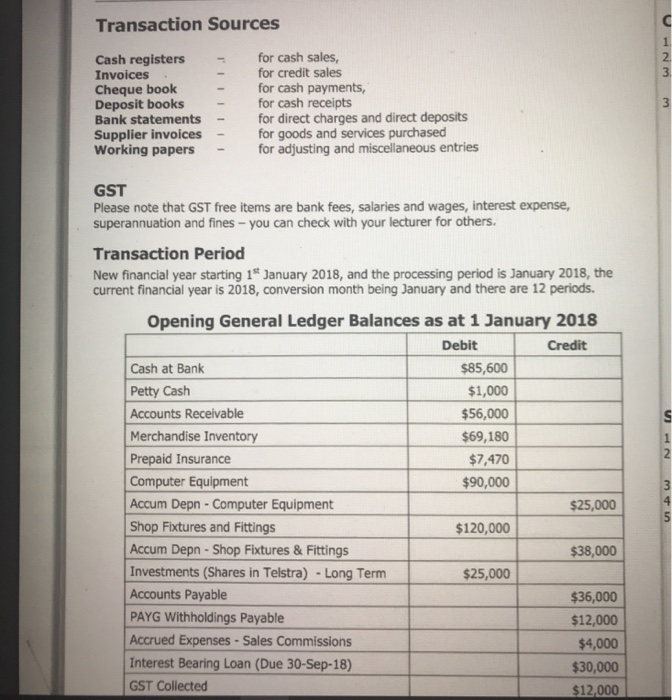

Transaction Sources Cash registersfor cash sales, Invoices Cheque book Deposit books Bank statements Supplier invoices Working papers - 2. 3. for credit sales - for cash payments for cash receipts for direct charges and direct deposits for goods and services purchased for adjusting and miscellaneous entries GST Please note that GST free items are bank fees, salaries and wages, interest expense superannuation and fines -you can check with your lecturer for others. Transaction Period New financial year starting 1st January 2018, and the processing period is January 2018, the current financial year is 2018, conversion month being January and there are 12 periods. Opening General Ledger Balances as at 1 January 2018 Debit Credit Cash at Bank Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Computer Equipment Accum Depn- Computer Equipment Shop Fixtures and Fittings Accum Depn-Shop Fixtures&Fittings Investments (Shares in Telstra) Long Term Accounts Payable PAYG Withholdings Payable Accrued Expenses-Sales Commissions Interest Bearing Loan (Due 30-Sep-18) GST Collected $85,600 $1,000 $56,000 $69,180 $7,470 $90,000 $25,000 $120,000 $38,000 $25,000 $36,000 $12,000 $4,000 $30,000 $12,000 GST Collected GST Paid Bank Loan (Due 30-Jun-2023) Paid Up Capital Retained Earnings Total $12,000 $7,000 $180,000 $110,000 $14,250 $461,250 $461,250 Section 13 MYOB Case Studie 197 Customers (AR- Accounts Receivable) 1. Students are required to make up their own unique customer names and addresses 2. Both cash and credit sales are recorded via the Sales Program module. 3. The recording of cash sales require the creation of a new customer account titled Cash Sales. 3. Information provided for customers and their balance as at 1 January is as follows: Accounts Receivable Subsidiary Ledger Customer Balance as atDays Code 1st January Outstanding ARO1 AR02 AR03 AR04 ARO5 AR06 AR07 AR08 31 31 92 61 31 $7,30061 61 31 $6,500 8,400 $6,300 $9,000 $5,500 $8,200 $4,800 $56,000 Suppliers (AP - Accounts Payable) 1. Students are required to make up their own unique supplier names and address. 2. Accounts Payable ledger has suppliers entered for trading stock as well as other goods and services acquired on credit. Cash purchases, are processed directly through the cash book. 3. All suppliers extend the normal 30 day terms, with no discount for prompt payment Information provided for suppliers and their balance as at 1 January is as follows Accounts Payable Subsidiary Ledger Transaction Date Supplier Code SUPO1 SUPO2 SUP03 SUP04 SUPO5 SUPO6 SUP07 SUP08 Balance 12,600 15-Nov-2017 $7,400 2-Dec-2017 5,90010-Dec-2017 $4,800 20-Nov-2017 1,000 8-Dec-2017 1,10020-Dec-2017 Stationery Supplier Accountants Telephone Computer Maintenance Advertising Agency $800 16-Dec-2017 2,400 28-Nov-2017 $36,000 Inventory (PR) 1. Students are required to make up their own unique product names. 2. Inventory unit measure is per item 3. Selling prices are listed in the table below. 4. The firm uses the perpetual inventory method of accounting for inventory, (that is when inventory is purchased it is added to Inventory 'account and when goods are sold, the inventory account is reduced with the debited being to 'Cost of Sales). information provided for inventory and their balances as at 1st January is as follows: 5. Inventory QuantityUnit Cost Balance Unit Sell Price PRO1 PRO2 420 380 535 280 450 320 550 $26.00 $18.00 $12.00 $20.00 $24.00 $16.00 14.00 $22.00 15,860$45.50 31.50 $21.00 $10,700 $35.00 $7,560 $4,560 PRO4 PRO5 PRO6 PRO7 6,720 $42.00 $7,200$28.00 $4,480 12,100 $38. $24.50 $69,180 Transactions for January 2018 Data source: Suppliers' Invoices. Dates shown are invoice dates, amounts include GST where applicable. Date Transaction Details Received invoice from SUPO3 for 100 units PRO4 for $2,200, and 120 units PRO8 5 Jan 6 Jan 7 Jan 9 Jan 12 Jan 28 Received invoice from SUPO6 for telephone and communications systems Installation $1,870. Installation costs are expensed when incurred Purchased stationery on account from SUP04 amounting to $528. Stationery is expensed when purchased. Received invoice from SUPO2 for 160 units of PR07 $2,464 and 120 units of PR02 $2,376. Received invoice from SUPO1 for 190 units of PRO1 $5,434. 31 an Received invoice from SUPO5 for January accounting fees amounting to $1,540. 15 Jan Purchased 200 units PRO3 for $2,640, 250 units PROS for $6,600, and 200 units of PR06 for $4,400 from SUPO3. Invoice was included with goods supplied. 27 Jan Of the sales to ARO7 on the 25 January, the customer returned 12 units of PR07 and 8 units PRO8. 28 Jan Sold 110 units PR02 and 80 units of PRO5 to AR06 30 Jan Sales invoice to AR04 for 100 units PROS and 120 units PR07 31 Jan Cash sales 105 units PRO1, 110 units PR04 and 130 units PRO8. Data source- deposit book (cash receipts) 02 ll receipts for cash sales and monies received are banked on the same day Date 2 Jan Customer ARO3 paid his account as at 1* January amounting to $6,300. 5 Jan Cheque received from ARO6 for balance owing as at 1* January. 10 Jan Cheque received from AR07 for balance owing as at 1* January. 15 Jan Customer ARO1 paid his account as at 1t January amounting to $6,500 20 Jan Received Dividend form Telstra amounting to $1,200. 23 Jan Cheque received from AR02 for $8,400 25 Jan Cheque received from ARO8 for total amount owing as at today's date leaving a nill Transaction Details balance on this account. Cheque received from AROS for total amount owing as at today's date leaving a nil balance on this account. 30 Jan 03 200 MYOB v19.12-AccountRight Plus- A Practical Guide to Computer Accounting Section Data source-cheque book (cash payments) Mont Date Chq # 2 Jan 4150 Paid for rent of business premises for the month amounting to $2,420. 4 Jan 4151 Paid December Sales Commission owing as at 1* January $4,000 6 Jan 4152 Paid SUPO1 $12,600 being the balance owing as at 1* Jan. 8 Jan 4153 Paid for repairs and maintenance to office $605 9 Jan 4154 Pald SUPO4 balance owing as at 1* January, Transaction Details 9 Jan154 Paid SUP04 balance owing as at January. 12 Jan 4155 Paid SUPO8 balance owing as at 1t January. 14 Jan 4156 Paid NET wages for the fortnight amounting to $8,400 and recorded PAYG withholding tax of $3,600 to be paid in February 2018. 16 Jan 4157 Paid SUP02 $7,400 being balance owing as at 1st January. 17 Jan 4158 Paid PAYG withholding payable as at 1t January (see trial balance). 18 Jan 4159 Paid GST obligation as at 1st January. 20 Jan 4160 Paid SUPO3 balance owing as at 1 January. 21 Jan 4161 Paid SUPO5 balance owing as at 1 January. 23 Jan 4162 Reimbursed petty cash for the following cash expenses incurred: Local Travel -taxi fares General Office Expenses Postage $275 $176 $308 25 Jan 4163 Paid SUPO7 balance owing as at 1 January. 28 Jan 4164 Paid NET wages for the fortnight amounting to $9,300 and recorded PAYG withholding tax of $3,700 to be paid in February 2018 30 Jan 4165 Prepaid rent for February 2018 amounting to $2,420. 31 Jan 4166 Paid SUPO6 balance owing as at 1* January as well as all purchases for the month leaving a nil balance owing on this supplier's account. The ba Data source-bank statements Date 15 Jan 20 Jan Transaction Details Periodic payment for lease on motor vehicles $1,650. Customer AR04 deposited $9,000 in the company's bank account being the balance owing as at 1t January. 31 Jan Bank Charges charged $120 31 Jan Bank credited our account for interest earned on funds in bank account $250 Month End (31st January) Adjusting Entries Data source-notes and working papers Transaction Details Sales commission earned by retail assistants during January but not paid amounted to $2,600. Salaries & Wages accrued at the end of the month amount to $3,800. 1 3 Computer Equipment is depreciated at 35% p.a. reducing balance method. (Written Down Value * 35% * 31+365) 4 Prepaid Insurance as at 1 January, $7,470 as per the trial balance represents the unexpired portion on the annual insurance policy which commenced on 1* November 2017. Shop Fixtures & Fittings are depreciated at 20% per annum straight line (prime cost) method 5 (Original Cost * 2096 * 31+365) 6 The company's short and long term loans are charged interest at the rate of 10.00% p.a. paid quarterly, but accrued daily. Interest is to be accrued on both short and iong term loans using the following formula: Interest Accrual-Loan Balance interest rate days in month + days in year) 7 Other expenses accrued at the end of the month include: $440 Annual Leave Provision $890 Create a Provision for Doubtful Debts equal to 5% of Accounts Receivable as at 31 January 9 On 31* January, after the depreciation charge was made, the company sold some surplus to requirement Computer Equipment that had a written down value of $8,600 at the time of sale, for $8,800 (GST inclusive) cash. The computer equipment had originally cost the company $17,000 The bank statement received from the bank at the end of January is as follows: Bastrac Bank Branch: Haymarket, Sydney Account No. 1234 59876 Account Name: Case Study 3 ACN: 00 000 000 000 The Manager, Your Names Clothes Pty Ltd From: -January-2018 Sydney NSW 2000 0: 31-January-2018 Date Particulars Debit Credit Balance 1-JanOpening Balance 3-Jan Deposit- Cash& Cheques 4-Jan Deposit- Cash& Cheques 5-Jan Chq 4150 6-Jan $85,600.00 8,239.00$93,839.00 $6,300.00 $100,139.00 $2,420.00 97,719.00 Deposit-Cash & Cheques $7,300.00 $105,019.00 $4,000.00 $101,019.00 6,500.00$94,919.00 $88,419.00 SIOI,117.50 $100,512.50 $8,200.00 $108,712.50 $106,312.50 $101,512.50 $99,862.50 7-Jan 8-Jan Deposit -Cash &Cheques | Chq # 4152 $12,600.00 9-Jan Deposit- Cash & Cheques 10-Jan IChq # 4153 $6,19850| $605.00 1-Jan Depaiti- Cast&Chegues 12-Jan hq # 4155 14-Jan hq # 4154 15-JanPeriodic Payment-Lease MV 16-Jan ICbq # 4157 $2,400.00 $4,800.00 $1,650.00 $7,400.00 $8,400.00 - $92,462.50 584,062 50 9,000.00$93,062.50 1,200.00 $94,262.50 50 6.314.00 $94,676.50 $89,676.50 5,813.50 595,490.00 583.490.00 490.00 19-Jan 20-Jan 21-Jan 22-Jan IChq # 4156 Direct deposit- AR04 Deposit- Cash & Cheques Chq #4160 Deposit-Cash &Cheques Ichq # 4159 Deposit- Cash & Cheques $5,900.00 22-Jan 24Jan 23-Jan 24-Jan $5,000.00 Chq # 4158 $12,000.00 24-Jan 24-Jan 25-Jan |Chq #4161 Deposit- Cash & Cheques IChq # 4163 51,000.00 582. 58,400.00 890.00 090.00 5800.00 27-Jan 28-Jan 29-Jan Deposit-Cash & Cheques Deposit-Cash & Cheques IChq # 4162 7.507 50$97,597.50 $10,690.50 $108,288.00 5759 107,529.00 31-Jan Deposit- Cash & Cheque 14,547.50 $1 31-Jan Deposit Cash& Cheques 31-Jan IChq #4164 31-Jan Bank Chares 31-Jan Interest on Deposits 14,547.50 $122,076.50 $112,776.50 $112,656.50 $250.00 $112,906.50 $9,300.00 120.00 Transaction not shown on the Bank Statement are either UNPRESENTED CHEQUES or OUTSTANDING DEPOSITS Section 13 MYOB Case Srudies -203 Required: 1. Set up the business in MYOB-Remember to incorporate YOUR NAME as part of the 2. Modify the chart of accounts as required to ensure that the transactions affecting the 3. Enter the Opening Balances to the General Ledger and set up the subsidlary ledger for 4. Process transactions for January, Including the completion of the Bank Reconciliation. 5. Print reports for the month of January, to be submitted, are as follows company name company are recorded and classified correctly. Customers, Suppliers and Inventory Accounts (General Ledger) Accounts List-Summary Trial Balance Transaction Journals General Journal Profit& Loss Accrual Standard Balance Sheet Sales (Accounts Recelvable) Recelvables-Reconciliation Summary Item -Sales Summary Purchases (Accounts Payable) Payables- Reconciliation Summary Item -Purchase Summary . Banking Transaction Journals Cash Disbursements Journal Cash Receipts Journal Cheques and Deposits Reconciliation Report GST/ Sales Tax Reports GST Reports GST [Detail -Accrual] . Inventory Items Items List Summary Inventory Value Reconciliation Transaction Sources Cash registersfor cash sales, Invoices Cheque book Deposit books Bank statements Supplier invoices Working papers - 2. 3. for credit sales - for cash payments for cash receipts for direct charges and direct deposits for goods and services purchased for adjusting and miscellaneous entries GST Please note that GST free items are bank fees, salaries and wages, interest expense superannuation and fines -you can check with your lecturer for others. Transaction Period New financial year starting 1st January 2018, and the processing period is January 2018, the current financial year is 2018, conversion month being January and there are 12 periods. Opening General Ledger Balances as at 1 January 2018 Debit Credit Cash at Bank Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Computer Equipment Accum Depn- Computer Equipment Shop Fixtures and Fittings Accum Depn-Shop Fixtures&Fittings Investments (Shares in Telstra) Long Term Accounts Payable PAYG Withholdings Payable Accrued Expenses-Sales Commissions Interest Bearing Loan (Due 30-Sep-18) GST Collected $85,600 $1,000 $56,000 $69,180 $7,470 $90,000 $25,000 $120,000 $38,000 $25,000 $36,000 $12,000 $4,000 $30,000 $12,000 GST Collected GST Paid Bank Loan (Due 30-Jun-2023) Paid Up Capital Retained Earnings Total $12,000 $7,000 $180,000 $110,000 $14,250 $461,250 $461,250 Section 13 MYOB Case Studie 197 Customers (AR- Accounts Receivable) 1. Students are required to make up their own unique customer names and addresses 2. Both cash and credit sales are recorded via the Sales Program module. 3. The recording of cash sales require the creation of a new customer account titled Cash Sales. 3. Information provided for customers and their balance as at 1 January is as follows: Accounts Receivable Subsidiary Ledger Customer Balance as atDays Code 1st January Outstanding ARO1 AR02 AR03 AR04 ARO5 AR06 AR07 AR08 31 31 92 61 31 $7,30061 61 31 $6,500 8,400 $6,300 $9,000 $5,500 $8,200 $4,800 $56,000 Suppliers (AP - Accounts Payable) 1. Students are required to make up their own unique supplier names and address. 2. Accounts Payable ledger has suppliers entered for trading stock as well as other goods and services acquired on credit. Cash purchases, are processed directly through the cash book. 3. All suppliers extend the normal 30 day terms, with no discount for prompt payment Information provided for suppliers and their balance as at 1 January is as follows Accounts Payable Subsidiary Ledger Transaction Date Supplier Code SUPO1 SUPO2 SUP03 SUP04 SUPO5 SUPO6 SUP07 SUP08 Balance 12,600 15-Nov-2017 $7,400 2-Dec-2017 5,90010-Dec-2017 $4,800 20-Nov-2017 1,000 8-Dec-2017 1,10020-Dec-2017 Stationery Supplier Accountants Telephone Computer Maintenance Advertising Agency $800 16-Dec-2017 2,400 28-Nov-2017 $36,000 Inventory (PR) 1. Students are required to make up their own unique product names. 2. Inventory unit measure is per item 3. Selling prices are listed in the table below. 4. The firm uses the perpetual inventory method of accounting for inventory, (that is when inventory is purchased it is added to Inventory 'account and when goods are sold, the inventory account is reduced with the debited being to 'Cost of Sales). information provided for inventory and their balances as at 1st January is as follows: 5. Inventory QuantityUnit Cost Balance Unit Sell Price PRO1 PRO2 420 380 535 280 450 320 550 $26.00 $18.00 $12.00 $20.00 $24.00 $16.00 14.00 $22.00 15,860$45.50 31.50 $21.00 $10,700 $35.00 $7,560 $4,560 PRO4 PRO5 PRO6 PRO7 6,720 $42.00 $7,200$28.00 $4,480 12,100 $38. $24.50 $69,180 Transactions for January 2018 Data source: Suppliers' Invoices. Dates shown are invoice dates, amounts include GST where applicable. Date Transaction Details Received invoice from SUPO3 for 100 units PRO4 for $2,200, and 120 units PRO8 5 Jan 6 Jan 7 Jan 9 Jan 12 Jan 28 Received invoice from SUPO6 for telephone and communications systems Installation $1,870. Installation costs are expensed when incurred Purchased stationery on account from SUP04 amounting to $528. Stationery is expensed when purchased. Received invoice from SUPO2 for 160 units of PR07 $2,464 and 120 units of PR02 $2,376. Received invoice from SUPO1 for 190 units of PRO1 $5,434. 31 an Received invoice from SUPO5 for January accounting fees amounting to $1,540. 15 Jan Purchased 200 units PRO3 for $2,640, 250 units PROS for $6,600, and 200 units of PR06 for $4,400 from SUPO3. Invoice was included with goods supplied. 27 Jan Of the sales to ARO7 on the 25 January, the customer returned 12 units of PR07 and 8 units PRO8. 28 Jan Sold 110 units PR02 and 80 units of PRO5 to AR06 30 Jan Sales invoice to AR04 for 100 units PROS and 120 units PR07 31 Jan Cash sales 105 units PRO1, 110 units PR04 and 130 units PRO8. Data source- deposit book (cash receipts) 02 ll receipts for cash sales and monies received are banked on the same day Date 2 Jan Customer ARO3 paid his account as at 1* January amounting to $6,300. 5 Jan Cheque received from ARO6 for balance owing as at 1* January. 10 Jan Cheque received from AR07 for balance owing as at 1* January. 15 Jan Customer ARO1 paid his account as at 1t January amounting to $6,500 20 Jan Received Dividend form Telstra amounting to $1,200. 23 Jan Cheque received from AR02 for $8,400 25 Jan Cheque received from ARO8 for total amount owing as at today's date leaving a nill Transaction Details balance on this account. Cheque received from AROS for total amount owing as at today's date leaving a nil balance on this account. 30 Jan 03 200 MYOB v19.12-AccountRight Plus- A Practical Guide to Computer Accounting Section Data source-cheque book (cash payments) Mont Date Chq # 2 Jan 4150 Paid for rent of business premises for the month amounting to $2,420. 4 Jan 4151 Paid December Sales Commission owing as at 1* January $4,000 6 Jan 4152 Paid SUPO1 $12,600 being the balance owing as at 1* Jan. 8 Jan 4153 Paid for repairs and maintenance to office $605 9 Jan 4154 Pald SUPO4 balance owing as at 1* January, Transaction Details 9 Jan154 Paid SUP04 balance owing as at January. 12 Jan 4155 Paid SUPO8 balance owing as at 1t January. 14 Jan 4156 Paid NET wages for the fortnight amounting to $8,400 and recorded PAYG withholding tax of $3,600 to be paid in February 2018. 16 Jan 4157 Paid SUP02 $7,400 being balance owing as at 1st January. 17 Jan 4158 Paid PAYG withholding payable as at 1t January (see trial balance). 18 Jan 4159 Paid GST obligation as at 1st January. 20 Jan 4160 Paid SUPO3 balance owing as at 1 January. 21 Jan 4161 Paid SUPO5 balance owing as at 1 January. 23 Jan 4162 Reimbursed petty cash for the following cash expenses incurred: Local Travel -taxi fares General Office Expenses Postage $275 $176 $308 25 Jan 4163 Paid SUPO7 balance owing as at 1 January. 28 Jan 4164 Paid NET wages for the fortnight amounting to $9,300 and recorded PAYG withholding tax of $3,700 to be paid in February 2018 30 Jan 4165 Prepaid rent for February 2018 amounting to $2,420. 31 Jan 4166 Paid SUPO6 balance owing as at 1* January as well as all purchases for the month leaving a nil balance owing on this supplier's account. The ba Data source-bank statements Date 15 Jan 20 Jan Transaction Details Periodic payment for lease on motor vehicles $1,650. Customer AR04 deposited $9,000 in the company's bank account being the balance owing as at 1t January. 31 Jan Bank Charges charged $120 31 Jan Bank credited our account for interest earned on funds in bank account $250 Month End (31st January) Adjusting Entries Data source-notes and working papers Transaction Details Sales commission earned by retail assistants during January but not paid amounted to $2,600. Salaries & Wages accrued at the end of the month amount to $3,800. 1 3 Computer Equipment is depreciated at 35% p.a. reducing balance method. (Written Down Value * 35% * 31+365) 4 Prepaid Insurance as at 1 January, $7,470 as per the trial balance represents the unexpired portion on the annual insurance policy which commenced on 1* November 2017. Shop Fixtures & Fittings are depreciated at 20% per annum straight line (prime cost) method 5 (Original Cost * 2096 * 31+365) 6 The company's short and long term loans are charged interest at the rate of 10.00% p.a. paid quarterly, but accrued daily. Interest is to be accrued on both short and iong term loans using the following formula: Interest Accrual-Loan Balance interest rate days in month + days in year) 7 Other expenses accrued at the end of the month include: $440 Annual Leave Provision $890 Create a Provision for Doubtful Debts equal to 5% of Accounts Receivable as at 31 January 9 On 31* January, after the depreciation charge was made, the company sold some surplus to requirement Computer Equipment that had a written down value of $8,600 at the time of sale, for $8,800 (GST inclusive) cash. The computer equipment had originally cost the company $17,000 The bank statement received from the bank at the end of January is as follows: Bastrac Bank Branch: Haymarket, Sydney Account No. 1234 59876 Account Name: Case Study 3 ACN: 00 000 000 000 The Manager, Your Names Clothes Pty Ltd From: -January-2018 Sydney NSW 2000 0: 31-January-2018 Date Particulars Debit Credit Balance 1-JanOpening Balance 3-Jan Deposit- Cash& Cheques 4-Jan Deposit- Cash& Cheques 5-Jan Chq 4150 6-Jan $85,600.00 8,239.00$93,839.00 $6,300.00 $100,139.00 $2,420.00 97,719.00 Deposit-Cash & Cheques $7,300.00 $105,019.00 $4,000.00 $101,019.00 6,500.00$94,919.00 $88,419.00 SIOI,117.50 $100,512.50 $8,200.00 $108,712.50 $106,312.50 $101,512.50 $99,862.50 7-Jan 8-Jan Deposit -Cash &Cheques | Chq # 4152 $12,600.00 9-Jan Deposit- Cash & Cheques 10-Jan IChq # 4153 $6,19850| $605.00 1-Jan Depaiti- Cast&Chegues 12-Jan hq # 4155 14-Jan hq # 4154 15-JanPeriodic Payment-Lease MV 16-Jan ICbq # 4157 $2,400.00 $4,800.00 $1,650.00 $7,400.00 $8,400.00 - $92,462.50 584,062 50 9,000.00$93,062.50 1,200.00 $94,262.50 50 6.314.00 $94,676.50 $89,676.50 5,813.50 595,490.00 583.490.00 490.00 19-Jan 20-Jan 21-Jan 22-Jan IChq # 4156 Direct deposit- AR04 Deposit- Cash & Cheques Chq #4160 Deposit-Cash &Cheques Ichq # 4159 Deposit- Cash & Cheques $5,900.00 22-Jan 24Jan 23-Jan 24-Jan $5,000.00 Chq # 4158 $12,000.00 24-Jan 24-Jan 25-Jan |Chq #4161 Deposit- Cash & Cheques IChq # 4163 51,000.00 582. 58,400.00 890.00 090.00 5800.00 27-Jan 28-Jan 29-Jan Deposit-Cash & Cheques Deposit-Cash & Cheques IChq # 4162 7.507 50$97,597.50 $10,690.50 $108,288.00 5759 107,529.00 31-Jan Deposit- Cash & Cheque 14,547.50 $1 31-Jan Deposit Cash& Cheques 31-Jan IChq #4164 31-Jan Bank Chares 31-Jan Interest on Deposits 14,547.50 $122,076.50 $112,776.50 $112,656.50 $250.00 $112,906.50 $9,300.00 120.00 Transaction not shown on the Bank Statement are either UNPRESENTED CHEQUES or OUTSTANDING DEPOSITS Section 13 MYOB Case Srudies -203 Required: 1. Set up the business in MYOB-Remember to incorporate YOUR NAME as part of the 2. Modify the chart of accounts as required to ensure that the transactions affecting the 3. Enter the Opening Balances to the General Ledger and set up the subsidlary ledger for 4. Process transactions for January, Including the completion of the Bank Reconciliation. 5. Print reports for the month of January, to be submitted, are as follows company name company are recorded and classified correctly. Customers, Suppliers and Inventory Accounts (General Ledger) Accounts List-Summary Trial Balance Transaction Journals General Journal Profit& Loss Accrual Standard Balance Sheet Sales (Accounts Recelvable) Recelvables-Reconciliation Summary Item -Sales Summary Purchases (Accounts Payable) Payables- Reconciliation Summary Item -Purchase Summary . Banking Transaction Journals Cash Disbursements Journal Cash Receipts Journal Cheques and Deposits Reconciliation Report GST/ Sales Tax Reports GST Reports GST [Detail -Accrual] . Inventory Items Items List Summary Inventory Value Reconciliation