Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have a question about bond valuation. How can I solve this: Consider a bond that promises to pay coupons annually for 10 years. The

I have a question about bond valuation. How can I solve this:

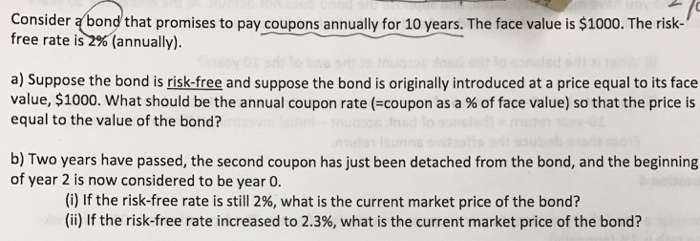

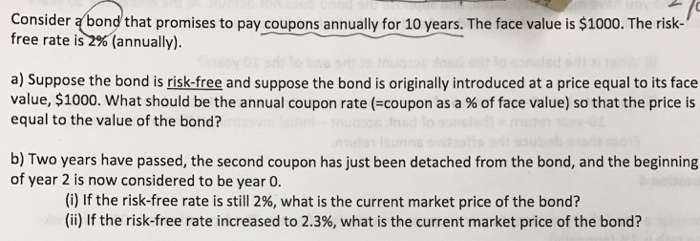

Consider promises to pay coupons annually for 10 years. The face value is $1000. The risk free rate is 2% (annually). a) Suppose the bond is risk-free and suppose the bond is originally introduced at a price equal to its face value, $1000. What should be the annual coupon rate coupon as a of face value) so that the price is equal to the value of the bond? b) Two years have passed, the second coupon has just been detached from the bond, and the beginning of year 2 is now considered to be year 0. (i) If the risk-free rate is still 2%, what is the current market price of the bond? (ii) If the risk-free rate increased to 2.3%, what is the current market price of the bond Consider a bond that promises to pay coupons annually for 10 years. The face value is $1000. The riskfree rate is 2% (annually).

a) Suppose the bond is risk-free and suppose the bond is originally introduced at a price equal to its face value, $1000. What should be the annual coupon rate (=coupon as a % of face value) so that the price is equal to the value of the bond?

b) Two years have passed, the second coupon has just been detached from the bond, and the beginning of year 2 is now considered to be year 0.

(i) If the risk-free rate is still 2%, what is the current market price of the bond?

(ii) If the risk-free rate increased to 2.3%, what is the current market price of the bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started