Question

a. How could you interpret these securities? (Are they bonds, swaps, shorted stocks, call options, put options, straddles, etc.) b. Are the market prices compatible

a. How could you interpret these securities? (Are they bonds, swaps, shorted stocks, call options, put options, straddles, etc.)

b. Are the market prices compatible with some sort of market equilibrium? Please, be precise and explain what you mean with the concept of a market equilibrium. How can you figure out if the market is in equilibrium, or not?

c. Can you work out the risk neutral probabilities when the Arrow-certificates 4, 5 and 6 trade at p4 = 0.1, p5 = 0.1 and p6 = 0.1 respectively?

d. Now suppose that a new security A5 = (1, 1, 0, 0, 0,0)' is successfully launched in the market and trades at p5 =0.4. What does this innovation imply for market equilibrium? Does this innovation increase welfare? Explain carefully!

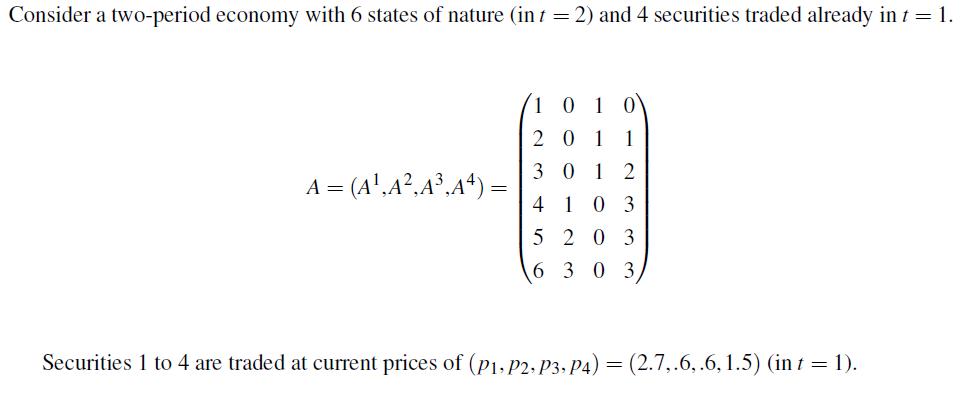

Consider a two-period economy with 6 states of nature (in t = 2) and 4 securities traded already in t = 1. 1 01 0 201 1 301 2 A = (A',A,A.A*) - 4 1 0 3 5 203 6 30 3 Securities 1 to 4 are traded at current prices of (p1, P2- P3, P4) = (2.7,.6, .6, 1.5) (in i = 1).

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started