Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have added the original work book question and the excel modified numbers in the templet, in excel can you show me how each answer

i have added the original work book question and the excel modified numbers in the templet, in excel can you show me how each answer was done in each cell by referencing, very much appreciated.

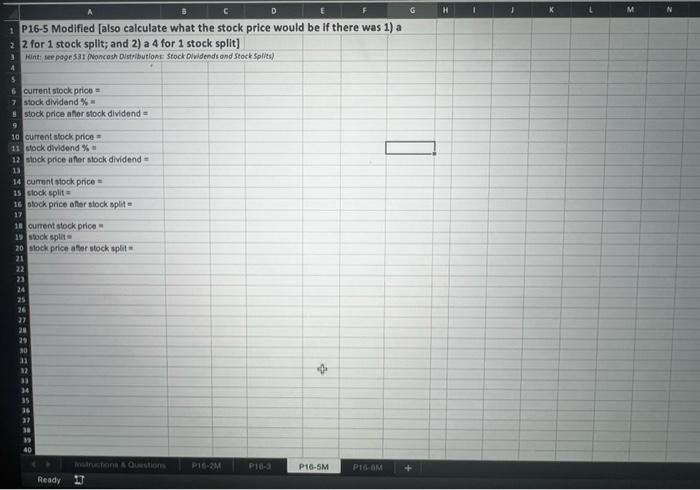

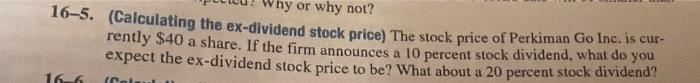

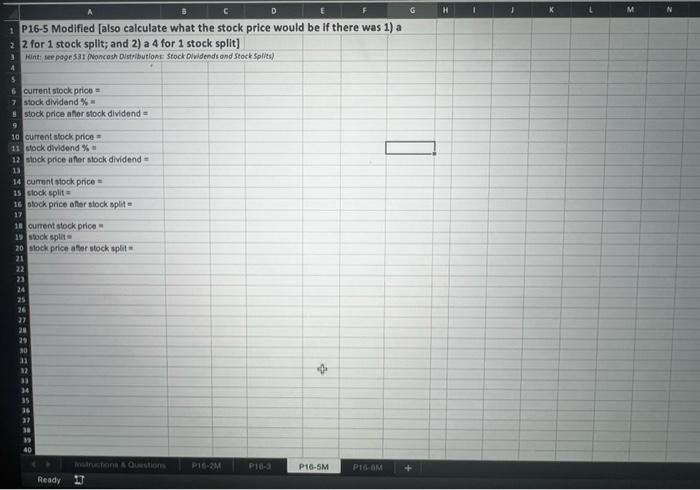

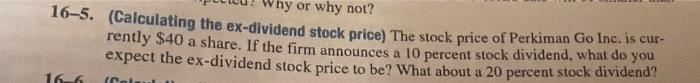

G H M N 1 D P16-5 Modified (also calculate what the stock price would be if there was 1) a 2 2 for 1 stock split; and 2) a 4 for 1 stock split) Hints see page 531 (Noncos Distribution Stock Dividends and Stock Spides) $ current stock price stock dividend % stock price for stock dividend 9 10 current stock price 11 stock dividend % 12 stock price for stock dividend 13 14 current stock price 15 stock split 16 stock price for stock split 17 11 current stock price 19 stock split 20 stock price after stock split 21 22 23 24 25 26 27 21 29 30 31 12 11 34 35 16 27 18 40 PIE. PIB-3 hatrustana A Questions P16-5M PIS-OM Ready or why not? 16-5. (Calculating the ex-dividend stock price) The stock price of Perkiman Go Inc. is cur rently $40 a share. If the firm announces a 10 percent stock dividend, what do you expect the ex-dividend stock price to be? What about a 20 percent stock dividend? 16, (Callu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started