Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have already answered them but I just need to see if the journal entries are correct. The yellow lines are the ones I need

i have already answered them but I just need to see if the journal entries are correct. The yellow lines are the ones I need help on.

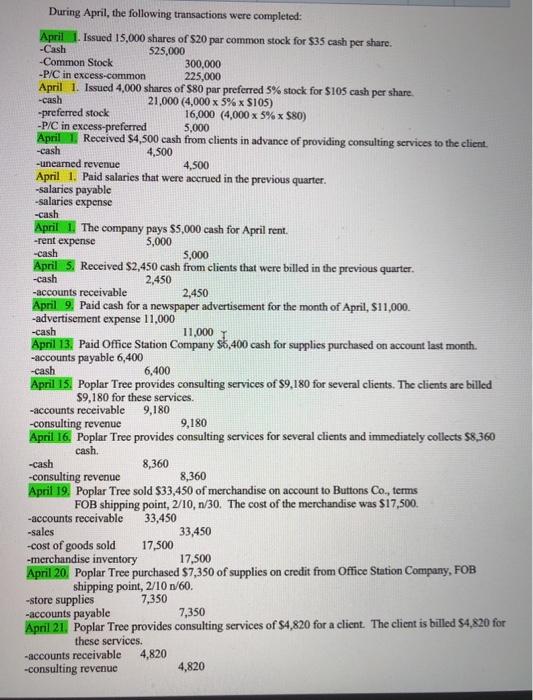

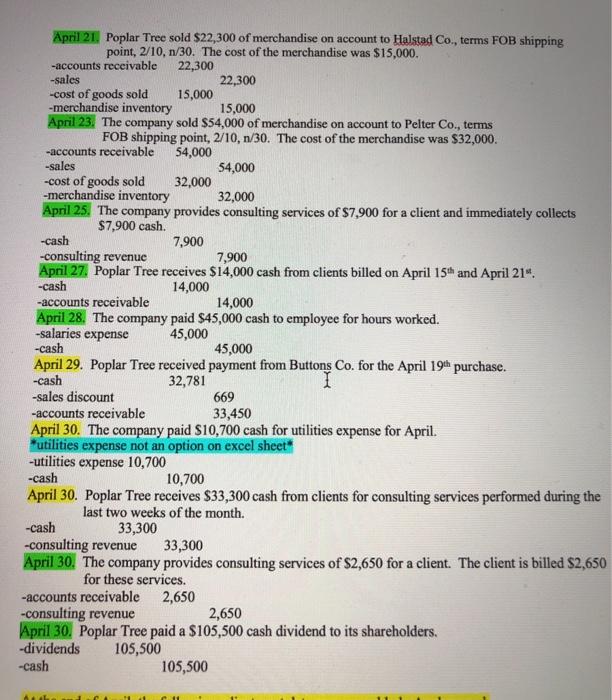

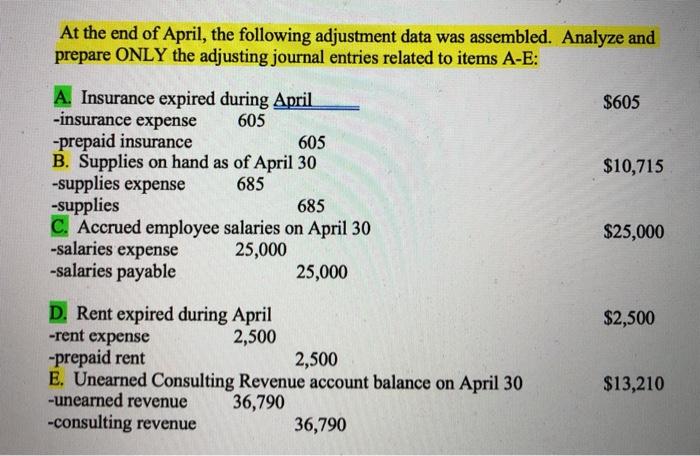

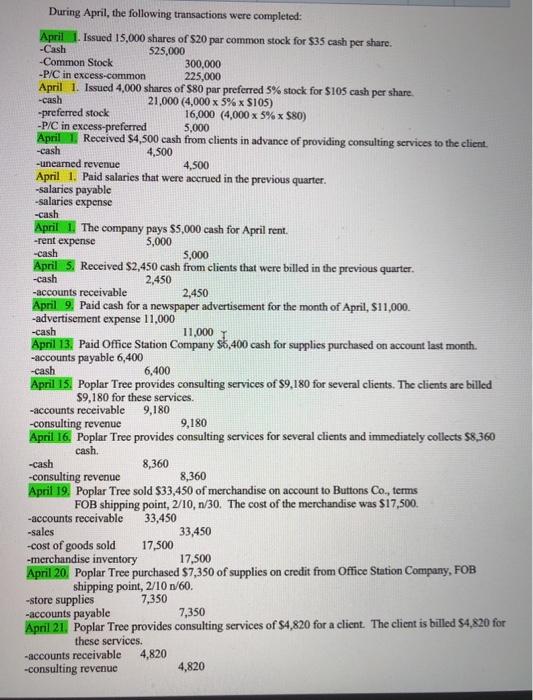

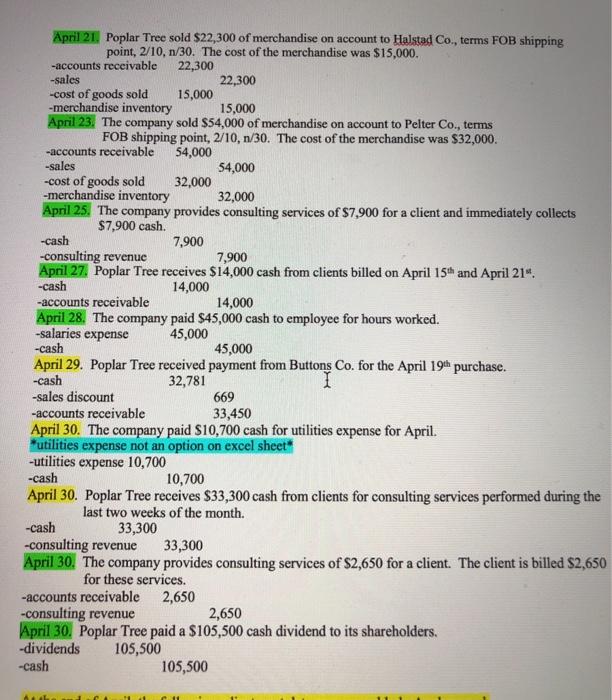

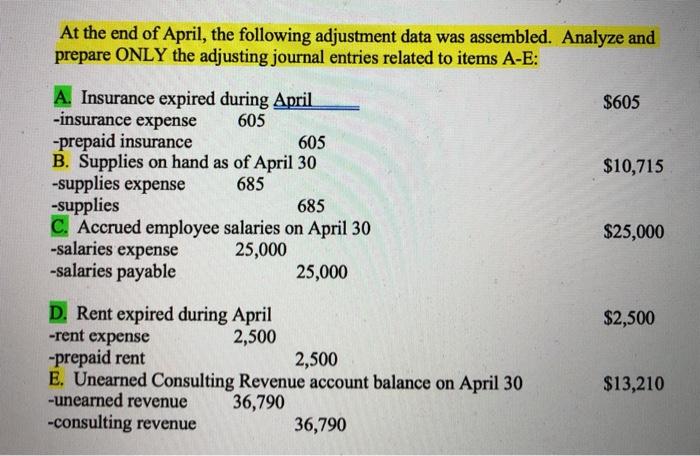

-Cash During April, the following transactions were completed: April 1. Issued 15,000 shares of $20 par common stock for $35 cash per share. 525.000 -Common Stock 300,000 -P/C in excess-common 225,000 April 1. Issued 4,000 shares of S80 par preferred 5% stock for $105 cash per share. -cash 21.000 (4,000 x 5% x S105) -preferred stock 16,000 (4,000 x 5% x $80) -P/C in excess-preferred 5,000 April Received 4,500 cash from clients in advance of providing consulting services to the client. -cash 4,500 -unearned revenue 4,500 April 1. Paid salaries that were accrued in the previous quarter. -salaries payable -salaries expense -cash April 1. The company pays $5,000 cash for April rent. -rent expense 5,000 -cash 5,000 April Received $2,450 cash from clients that were billed in the previous quarter. -cash 2,450 -accounts receivable 2,450 April 9. Paid cash for a newspaper advertisement for the month of April, $11,000 -advertisement expense 11,000 -cash 11,000 April 13. Paid Office Station Company s6,400 cash for supplies purchased on account last month. -accounts payable 6,400 -cash 6,400 April 15. Poplar Tree provides consulting services of S9,180 for several clients. The clients are billed $9,180 for these services. -accounts receivable 9,180 -consulting revenue 9,180 April 16. Poplar Tree provides consulting services for several clients and immediately collects $8,360 cash, -cash 8,360 -consulting revenue 8,360 April 19. Poplar Tree sold $33,450 of merchandise on account to Buttons Co., terms FOB shipping point, 2/10, n/30. The cost of the merchandise was $17.500 -accounts receivable 33,450 -sales 33,450 -cost of goods sold 17,500 -merchandise inventory 17,500 April 20. Poplar Tree purchased $7,350 of supplies on credit from Office Station Company, FOB shipping point, 2/10 /60. -store supplies 7,350 -accounts payable 7,350 April 21. Poplar Tree provides consulting services of $4,820 for a client. The client is billed 54,820 for these services -accounts receivable 4,820 -consulting revenue 4,820 April 21, Poplar Tree sold $22,300 of merchandise on account to Halstad Co., terms FOB shipping point, 2/10, 1/30. The cost of the merchandise was $15,000. -accounts receivable 22,300 -sales 22,300 -cost of goods sold 15,000 -merchandise inventory 15,000 April 23. The company sold $54,000 of merchandise on account to Pelter Co., terms FOB shipping point, 2/10, 1/30. The cost of the merchandise was $32,000. -accounts receivable 54,000 -sales 54,000 -cost of goods sold 32,000 -merchandise inventory 32,000 April 25. The company provides consulting services of $7,900 for a client and immediately collects $7,900 cash. -cash 7,900 -consulting revenue 7,900 April 27. Poplar Tree receives $14,000 cash from clients billed on April 15th and April 21". -cash 14,000 -accounts receivable 14,000 April 28. The company paid $45,000 cash to employee for hours worked. -salaries expense 45,000 -cash 45,000 April 29. Poplar Tree received payment from Buttons Co. for the April 19h purchase. -cash 32,781 I -sales discount 669 -accounts receivable 33,450 April 30. The company paid $10,700 cash for utilities expense for April. *utilities expense not an option on excel sheet" -utilities expense 10,700 -cash 10,700 April 30. Poplar Tree receives $33,300 cash from clients for consulting services performed during the last two weeks of the month. -cash 33,300 -consulting revenue 33,300 April 30. The company provides consulting services of $2,650 for a client. The client is billed $2,650 for these services. -accounts receivable 2,650 -consulting revenue 2,650 April 30. Poplar Tree paid a $105,500 cash dividend to its shareholders. -dividends 105,500 -cash 105,500 At the end of April, the following adjustment data was assembled. Analyze and prepare ONLY the adjusting journal entries related to items A-E: $605 $10,715 Insurance expired during April -insurance expense 605 -prepaid insurance 605 B. Supplies on hand as of April 30 -supplies expense 685 -supplies 685 C. Accrued employee salaries on April 30 -salaries expense 25,000 -salaries payable 25,000 $25,000 $2,500 D. Rent expired during April -rent expense 2,500 -prepaid rent 2,500 E. Unearned Consulting Revenue account balance on April 30 -unearned revenue 36,790 -consulting revenue 36,790 $13,210

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started