i have already done requirment 1. please help with 2-5 thank you!

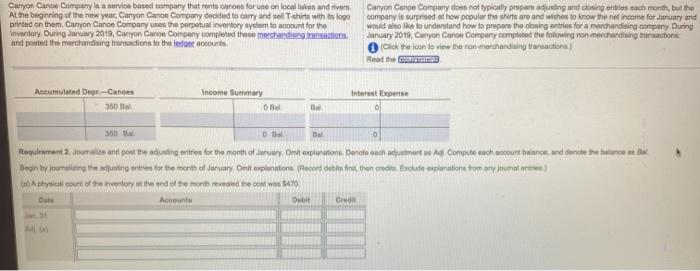

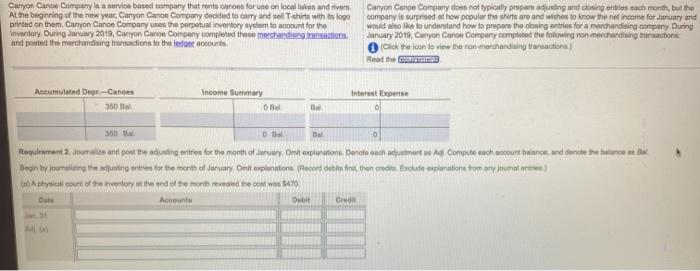

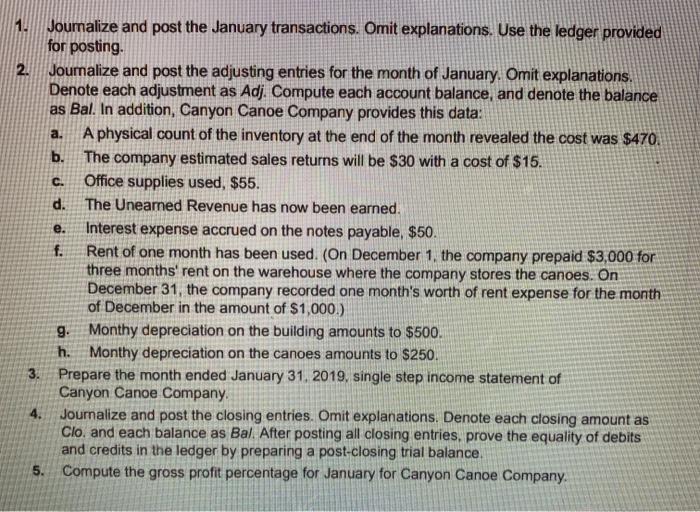

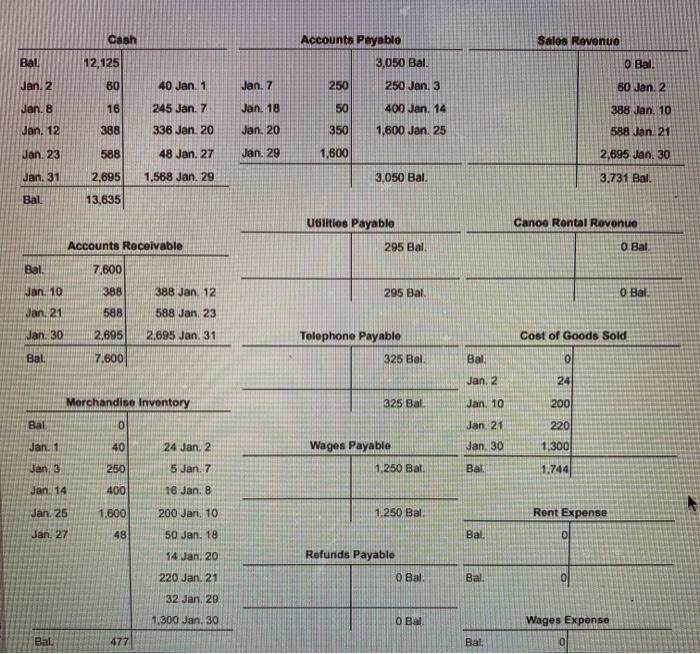

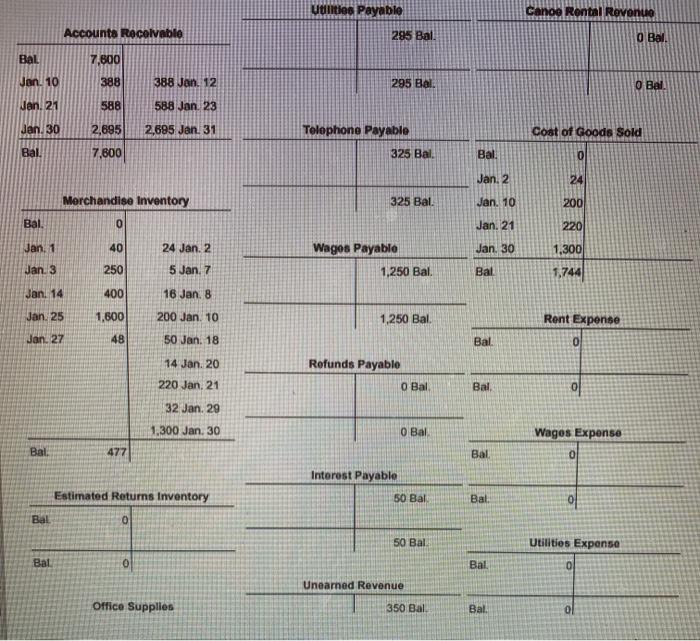

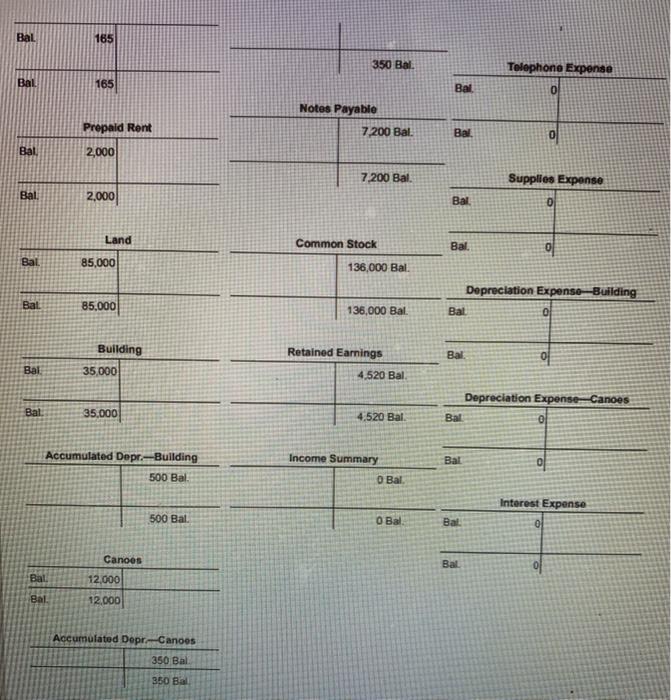

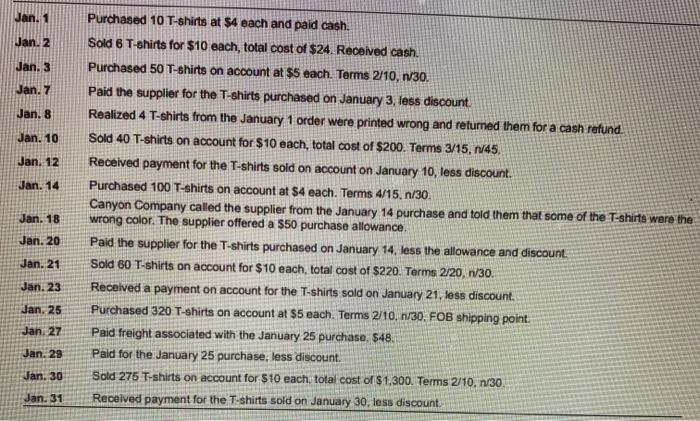

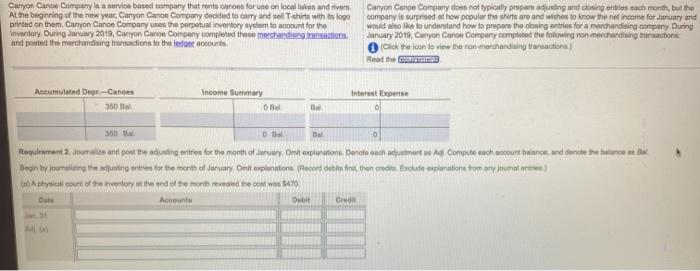

Canyon Cance Company is a service based company that rents canons for use on locales and rivers At the beginning of the new year, Canyon Cance Company decided to carty and to shirts with ts logo printed on them. Canyon Cance Company uses the perpetual inventory system to count for the Inventory During January 2019, Canyon Cance Company completed these merchandising ansactions and posted the merchandising transactions to the ledo court Canyon Cance Company does not typically prepare adjusting and closing entios cach month, but the company is surprised at how popular the shirts are and wishes to know the net income for January and would also like to understand how to prepare the closing entries for a marchandising company. During January 2018, Canyon Cance Company completed the following non merchandising mansactions Click then to view the non handling transactions) Read the Accumulated Dupe-Choes 350 Income Summary OB Interest Expense Dal OS Requirement 2. Joe and post the dusting entries for the month of January, OneplutonDenotath metal As Compute each count balance, and donde haare ne Begin by luming the integries for the month of daar Onit explanation (acord abitatir then credte felude explanation from any oumatore) Athical cours of endors at the end of the month revealed to cont wan 54% Accounts Cell Obit a. C. 1. Joumalize and post the January transactions. Omit explanations. Use the ledger provided for posting 2. Journalize and post the adjusting entries for the month of January. Omit explanations. Denote each adjustment as Adj. Compute each account balance, and denote the balance as Bal. In addition, Canyon Canoe Company provides this data: A physical count of the inventory at the end of the month revealed the cost was $470. The company estimated sales returns will be $30 with a cost of $15. Office supplies used, $55. d. The Unearned Revenue has now been earned. e. Interest expense accrued on the notes payable, $50. f. Rent of one month has been used. (On December 1, the company prepaid $3,000 for three months' rent on the warehouse where the company stores the canoes. On December 31, the company recorded one month's worth of rent expense for the month of December in the amount of $1,000.) g. Monthy depreciation on the building amounts to $500. h. Monthy depreciation on the canoes amounts to $250. 3. Prepare the month ended January 31, 2019, single step income statement of Canyon Canoe Company, 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo, and each balance as Bal. After posting all closing entries, prove the equality of debits and credits in the ledger by preparing a post-closing trial balance. Compute the gross profit percentage for January for Canyon Canoe Company 5. Cash Sales Revenuo Accounts Payable 3,050 Bal. Bal 12,125 O Bal Jan. 2 60 40 Jan. 1 Jan 7 250 250 Jan. 3 60 Jan. 2 Jan 8 16 245 Jan. 7 Jan, 18 50 388 Jan. 10 400 Jan. 14 1,600 Jan 25 Jan. 12 388 336 Jan 20 Jan 20 350 588 Jan. 21 Jan. 23 588 48 Jan 27 Jan. 29 1,600 2,695 Jan. 30 Jan. 31 2,695 1,568 Jan. 29 3,050 Bal 3,731 Bal. Bal 13,635 Utiltios Payablo Canoo Rental Revenue Accounts Receivable 295 Bal O Bal Bal. 7,600 Jan. 10 388 388 Jan. 12 295 Bal O Bal Jan, 21 588 588 Jan, 23 Jan. 30 2,695 2.695 Jan, 31 Telephone Payable Cost of Goods Sold Bal. 7.600 325 Bal Bal Jan. 2 24 Merchandise Inventory 325 Bal Jan. 10 200 Bal 0 Jan 21 220 Jan. 1 40 24 Jan. 2 Jan. 30 1.300 Wages Payable 1.250 Bal Jan 3 250 5 Jan. 7 Bal 1.744 Jan. 14 400 16 Jan. 8 Jan 25 1.600 200 Jan 10 1.250 Bal. Rent Expense Jan 27 48 50 Jan. 18 Bal 0 14 Jan, 20 Refunds Payablo 220 Jan. 21 O Bal Bal oll 32 Jan. 29 1.300 Jan. 30 O Bal . Wages Expense Bal 477 Bal, 0 Utilities Payable Canoe Rontal Revenue Account Recolvable 295 Bal O Bal BAL 7,800 Jan. 10 388 388 Jan. 12 295 Bal O Bal Jan, 21 588 588 Jan. 23 Jan. 30 2,695 2,695 Jan. 31 Telephone Payable Cont of Goods Sold Bal 7,600 325 Bal Bal 0 Jan. 2 24 Merchandise Inventory 325 Bal. Jan. 10 200 Bal 0 Jan. 21 220 Jan, 1 40 24 Jan. 2 Wagos Payable Jan. 30 1,300 Jan 3 250 5 Jan, 7 1,250 Bal. Bal 1.744 Jan. 14 400 16 Jan 8 Jan. 25 1,600 200 Jan. 10 1,250 Bal Rent Expense Jan. 27 48 50 Jan 18 Bal o 14 Jan. 20 Refunds Payablo O Bal 220 Jan, 21 Bal 32 Jan. 29 1.300 Jan. 30 O Bal Wagos Expenso 0 Bal 477 Bar Interest Payable Estimated Returns Inventory 50 Bal Bal Bal 0 50 Bal Utilities Expanse Bal 0 Bal 01 Unearned Revenue Office Supplies 350 Bal Bal. Bal 185 350 Bal Telephone Expense Bal 165 Bal 0 Notes Payablo 7.200 Bal. Prepaid Rent Bal. 0 Bal 2,000 7200 Bal. Supplies Expense Bal 2,000 Bal 0 Land Common Stock Bal. op Bal 85.000 136,000 Bal. Depreciation Expense Building Bal 85.000 136,000 Bal Bal 0 Bal Building 35 000 Retained Earnings 4.520 Bal of Bal Bal Depreciation Expense-Canoes Bal 0 35,000 4.520 Bal Accumulated Depr.- Building 500 Bal. Bal Income Summary O Bal. Interest Expense 500 Bal O Bal Bal 0 Bal Bal Canoes 12,000 12.000 Bal Accumulated Depr - Canoos 350 Bal 350 Bal Jan. 1 Jan. 2 Jan. 3 Jan. 7 Jan. 8 Jan. 10 Jan. 12 Jan. 14 Purchased 10 T-shirts at $4 each and paid cash. Sold 6 T-shirts for $10 each, total cost of $24. Received cash. Purchased 50 T-shirts on account at $5 each. Terms 2/10, 1/30. Paid the supplier for the T-shirts purchased on January 3, less discount. Realized 4 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. Sold 40 T-shirts on account for $10 each, total cost of $200. Terms 3/15, 1/45 Received payment for the T-shirts sold on account on January 10, less discount. Purchased 100 T-shirts on account at $4 each. Terms 4/15. n/30. Canyon Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $50 purchase allowance Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. Sold 60 T-shirts on account for $10 each, total cost of $220. Terms 2/20, 1/30. Received a payment on account for the T-shirts sold on January 21, less discount Purchased 320 T-shirts on account at $5 each Terms 2/10, 1/30. FOB shipping point. Paid freight associated with the January 25 purchase. $48. Paid for the January 25 purchase, less discount. Sold 275 T-shirts on account for 510 each total cost of $1,300. Terms 2/10, 1/30 Received payment for the T-shirts sold on January 30. less discount Jan. 18 Jan. 20 Jan. 21 Jan. 23 Jan. 25 Jan. 27 Jan. 29 Jan. 30 Jan. 31