I have already got all of the results for subquestions 1-3 I just would like 4,5 and 6 answered. Thank you :)

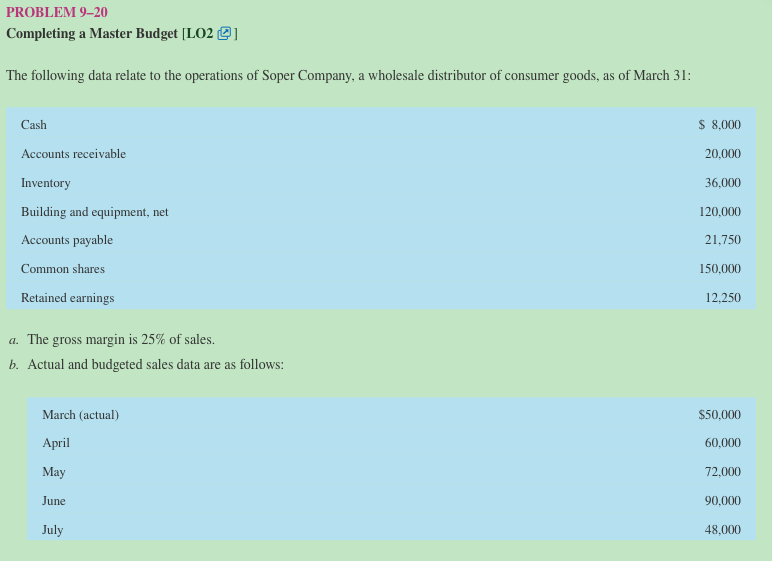

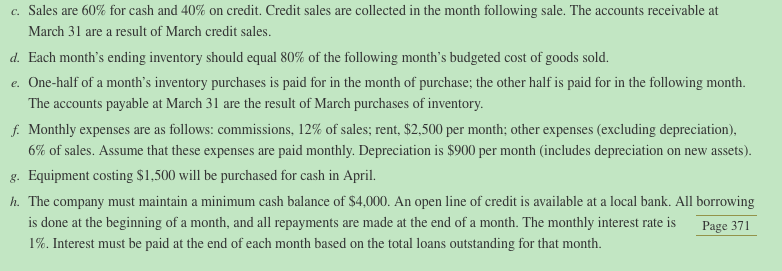

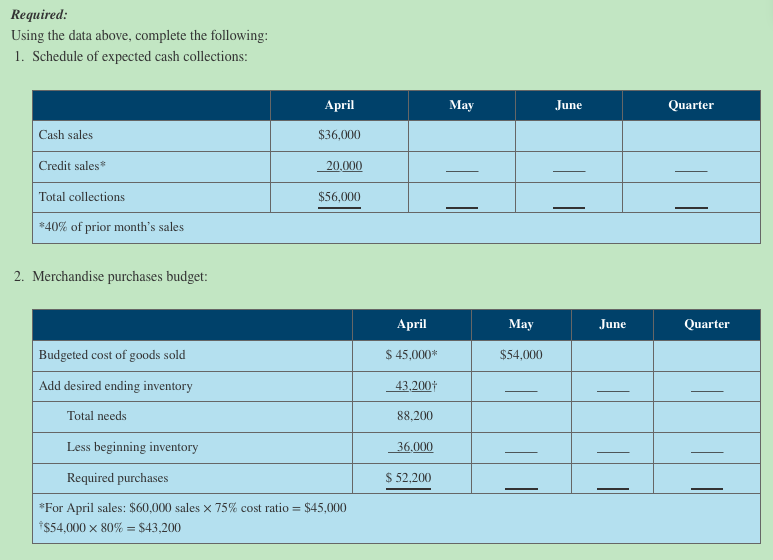

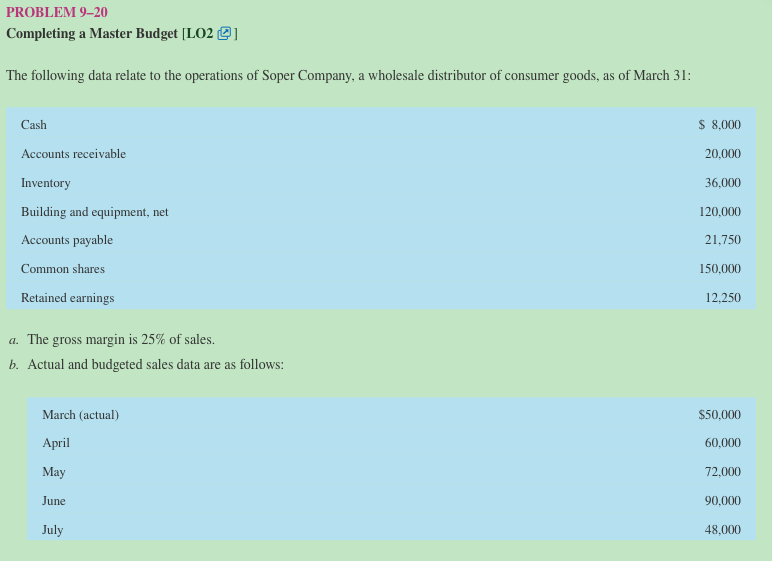

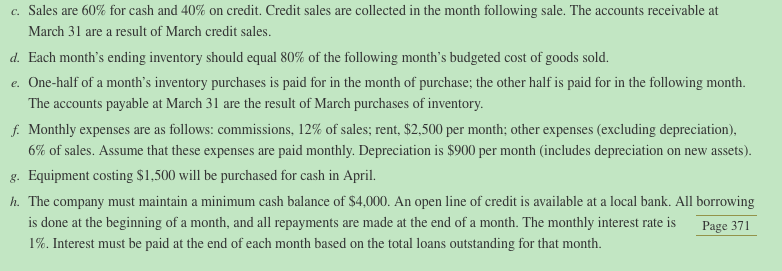

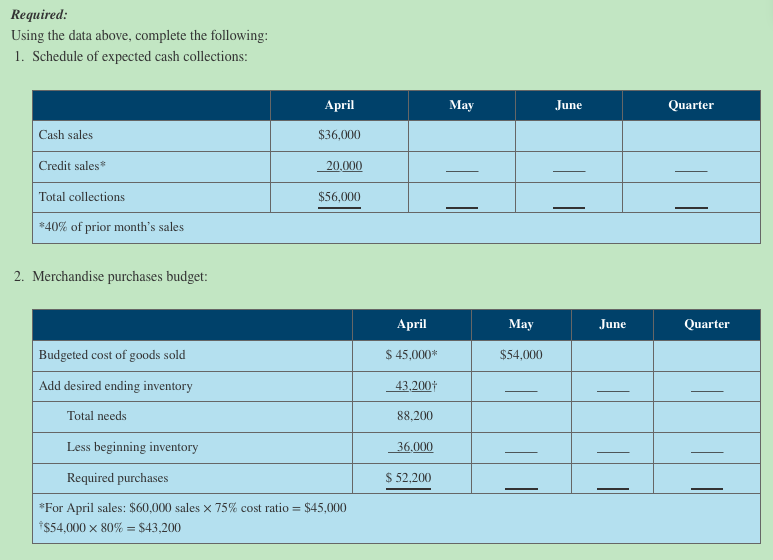

PROBLEM 9-20 Completing a Master Budget [LO2 Q1 The following data relate to the operations of Soper Company, a wholesale distributor of consumer goods, as of March 31: Cash $ 8,000 Accounts receivable 20,000 36,000 Inventory Building and equipment, net 120,000 Accounts payable 21.750 Common shares 150,000 Retained earnings 12.250 a. The gross margin is 25% of sales. b. Actual and budgeted sales data are as follows: March (actual) $50,000 April 60,000 May 72,000 June 90,000 July 48.000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. f. Monthly expenses are as follows: commissions, 12% of sales; rent, $2,500 per month; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $900 per month (includes depreciation on new assets). g. Equipment costing $1,500 will be purchased for cash in April. h. The company must maintain a minimum cash balance of $4,000. An open line of credit is available at a local bank. All borrowing is done at the beginning of a month, and all repayments are made at the end of a month. The monthly interest rate is Page 371 1%. Interest must be paid at the end of each month based on the total loans outstanding for that month. Required: Using the data above, complete the following: 1. Schedule of expected cash collections: April May June Quarter Cash sales $36,000 Credit sales 20,000 Total collections $56,000 *40% of prior month's sales 2. Merchandise purchases budget: April May June Quarter $ 45,000* $54,000 Budgeted cost of goods sold Add desired ending inventory Total needs 43.2007 88,200 Less beginning inventory 36.000 Required purchases $ 52,200 *For April sales: $60,000 sales x 75% cost ratio = $45,000 *$54,000 x 80% = $43,200 Schedule of expected cash disbursementsMerchandise purchases: April May June Quarter $21,750 $ 21,750 March purchases April purchases May purchases 26,100 $26,100 52,200 June purchases Total disbursements $47,850 3. Schedule of expected cash disbursementsSelling and administrative expenses: April May June Quarter Commissions $ 7.200 Rent 2,500 Other expenses 3.600 Total disbursements $ 13,300 4. Cash budget: April May June Quarter Cash balance, beginning $ 8,000 Add cash collections 56,000 Total cash available $ 64,000 Less cash disbursements For inventory For expenses $ 47,850 13,300 For equipment 1,500 Total cash disbursements 62.650 Excess (deficiency) of cash $ 1,350 Financing: Etc. 5. Prepare an absorption costing income statement, similar to the one shown in Schedule 9 Q. for the quarter ended June Page 372 30. 6. Prepare a balance sheet as of June 30