Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have an in class assignment due tommorrow for Real Estate Finance and I need to know what formulas are needed in order to solve

I have an in class assignment due tommorrow for Real Estate Finance and I need to know what formulas are needed in order to solve this and what should be already given. Help will be greatly appreciated.

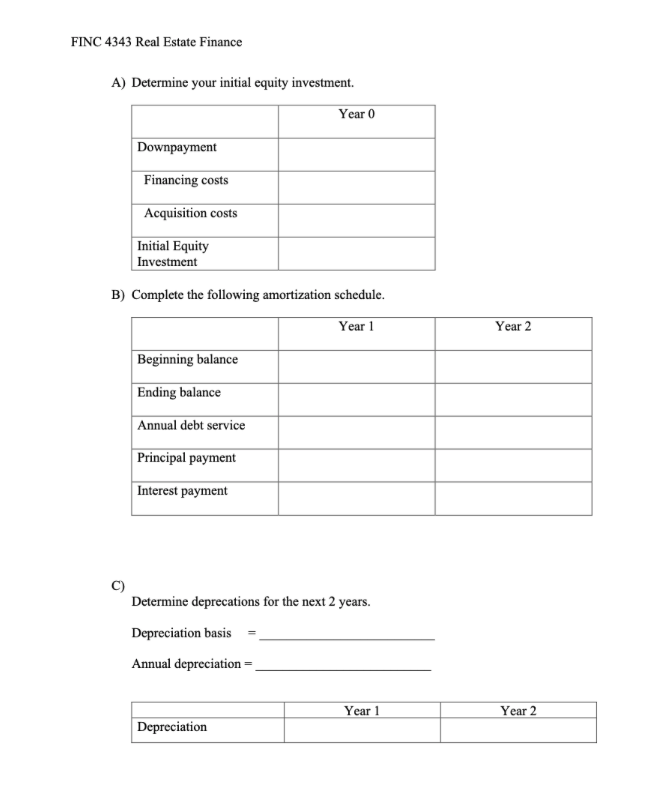

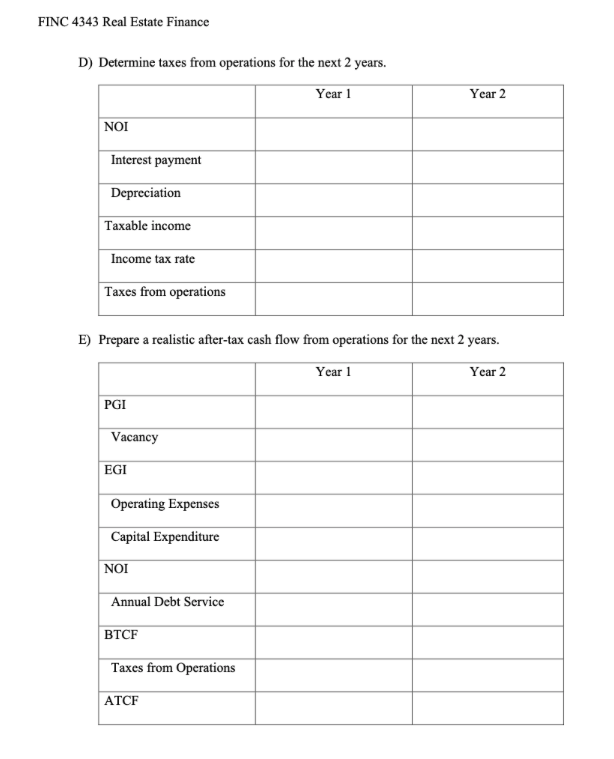

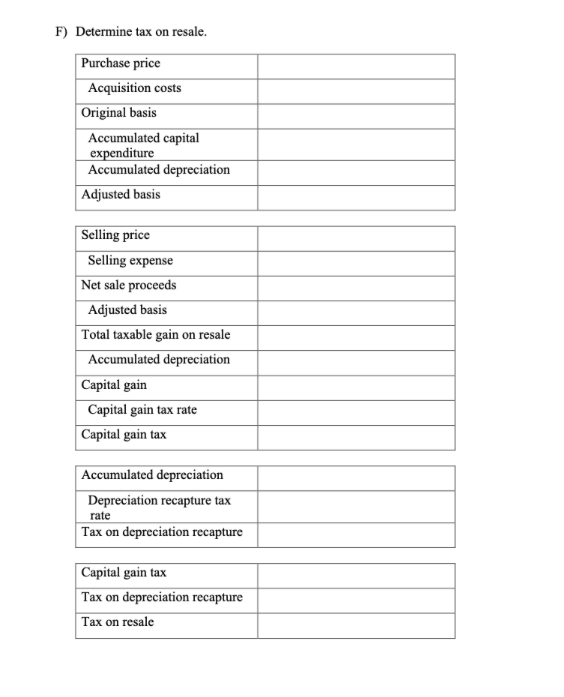

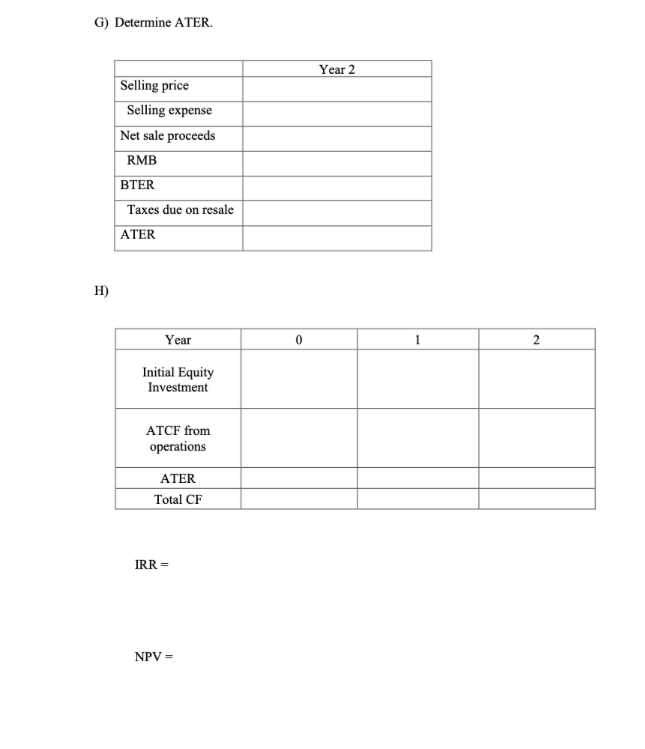

FINC 4343 Real Estate Finance A) Determine your initial equity investment. Year 0 Downpayment Financing costs Acquisition costs Initial Equity Investment B) Complete the following amortization schedule. Year 1 Beginning balance Year 2 Ending balance Annual debt service Principal payment Interest payment C) ) Determine deprecations for the next 2 years. Depreciation basis Annual depreciation Year 1 Year 2 Depreciation FINC 4343 Real Estate Finance D) Determine taxes from operations for the next 2 years. Year 1 Year 2 NOI Interest payment Depreciation Taxable income Income tax rate Taxes from operations E) Prepare a realistic after-tax cash flow from operations for the next 2 years. Year 1 Year 2 PGI Vacancy EGI Operating Expenses Capital Expenditure NOI Annual Debt Service BTCF Taxes from Operations ATCF F) Determine tax on resale. Purchase price Acquisition costs Original basis Accumulated capital expenditure Accumulated depreciation Adjusted basis Selling price Selling expense Net sale proceeds Adjusted basis Total taxable gain on resale Accumulated depreciation Capital gain Capital gain tax rate Capital gain tax Accumulated depreciation Depreciation recapture tax rate Tax on depreciation recapture Capital gain tax Tax on depreciation recapture Tax on resale G) Determine ATER. Year 2 Selling price Selling expense Net sale proceeds RMB BTER Taxes due on resale ATER H) Year 0 1 2 Initial Equity Investment ATCF from operations ATER Total CF IRR NPV = FINC 4343 Real Estate Finance A) Determine your initial equity investment. Year 0 Downpayment Financing costs Acquisition costs Initial Equity Investment B) Complete the following amortization schedule. Year 1 Beginning balance Year 2 Ending balance Annual debt service Principal payment Interest payment C) ) Determine deprecations for the next 2 years. Depreciation basis Annual depreciation Year 1 Year 2 Depreciation FINC 4343 Real Estate Finance D) Determine taxes from operations for the next 2 years. Year 1 Year 2 NOI Interest payment Depreciation Taxable income Income tax rate Taxes from operations E) Prepare a realistic after-tax cash flow from operations for the next 2 years. Year 1 Year 2 PGI Vacancy EGI Operating Expenses Capital Expenditure NOI Annual Debt Service BTCF Taxes from Operations ATCF F) Determine tax on resale. Purchase price Acquisition costs Original basis Accumulated capital expenditure Accumulated depreciation Adjusted basis Selling price Selling expense Net sale proceeds Adjusted basis Total taxable gain on resale Accumulated depreciation Capital gain Capital gain tax rate Capital gain tax Accumulated depreciation Depreciation recapture tax rate Tax on depreciation recapture Capital gain tax Tax on depreciation recapture Tax on resale G) Determine ATER. Year 2 Selling price Selling expense Net sale proceeds RMB BTER Taxes due on resale ATER H) Year 0 1 2 Initial Equity Investment ATCF from operations ATER Total CF IRR NPV =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started