I have answered the first half of the problem. all the numbers you see on the problem are already correct. Please provide answers to the salvage value portion, as well as the questions in yellow! thank you for you help, I will upvote your response so thank you in advance

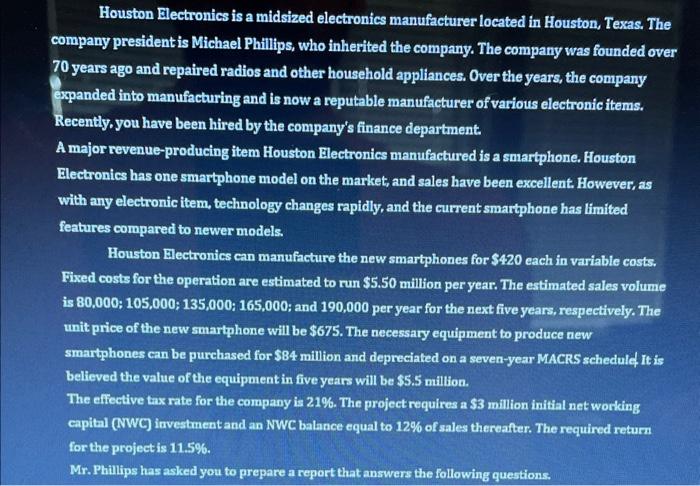

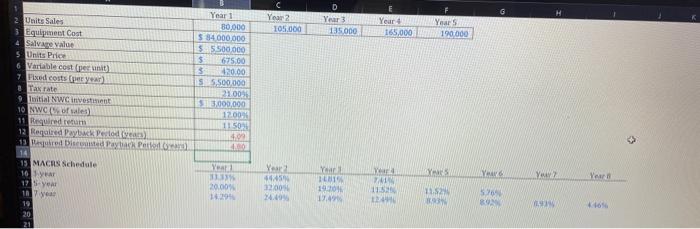

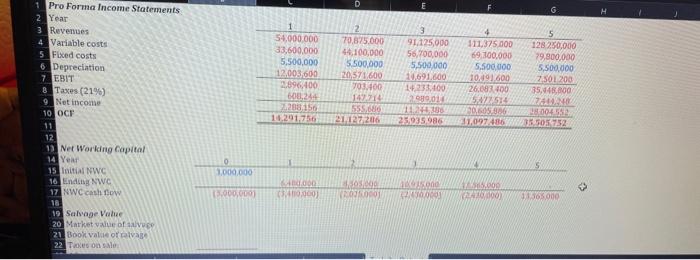

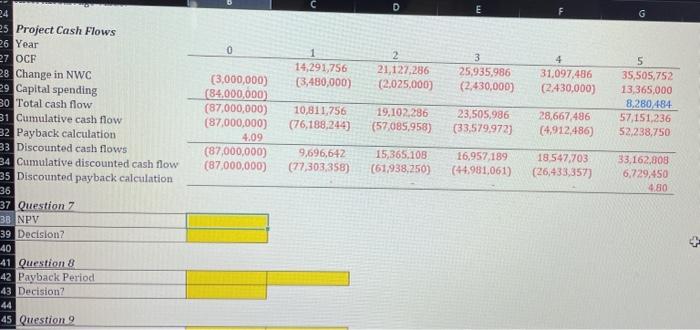

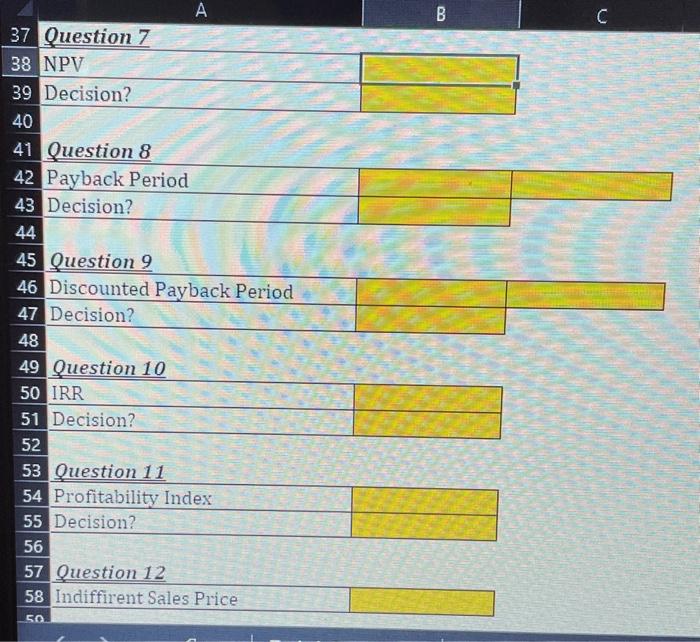

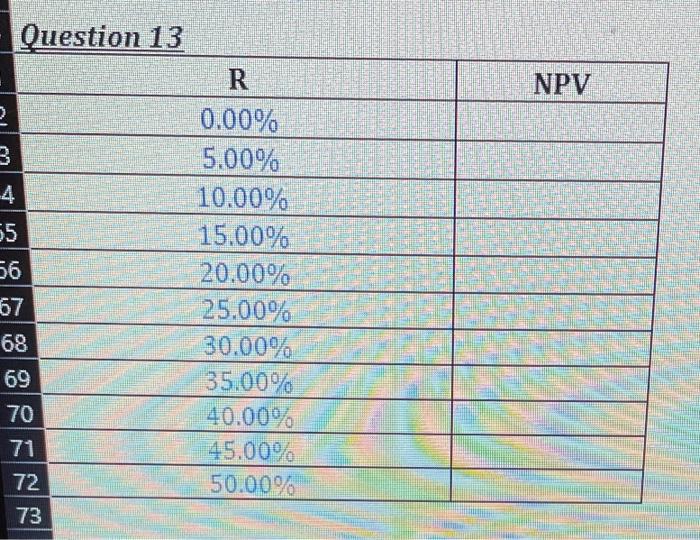

Houston Electronics is a midsized electronics manufacturer located in Houston, Texas. The company president is Michael Phillips, who inherited the company. The company was founded over 70 years ago and repaired radios and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacturer of various electronic items. Recently, you have been hired by the company's finance department. A major revenue-producing item Houston Electronics manufactured is a smartphone. Houston Electronics has one smartphone model on the market, and sales have been excellent. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features compared to newer models. Houston Electronics can manufacture the new smartphones for $420 each in variable costs. Fixed costs for the operation are estimated to run $5.50 million per year. The estimated sales volume is 80,000;105,000;135,000;165,000; and 190,000 per year for the next five years, respectively. The unit price of the new smartphone will be $675. The necessary equipment to produce new smartphones can be purchased for $84 million and depreciated on a seven-year MACRS scheduld It is believed the value of the equipment in five years will be $5.5 million. The effective tax rate for the company is 21%. The project requires a $3 million initial net working capital (NWC) investment and an NWC balance equal to 12% of sales thereater. The required return for the project is 11.5%. Mr. Phillips has asked you to prepare a report that answers the following questions. 1 Pro Forma Income Statements 2 Year 3 Revenues 4 Variable costs 5 Fixed costs 6. Depreciation 7 EBIT B. Taxes (21%) 9 Net incoase 10oCr 11 12 13 Net Working Capital 14. Yeat 15 Initial NWy 16 Enaisg NWC 17 NWC cash fow 18 19 Salvage Vatice 20 Matket value of atvece 21 Book valie of petvage? 22 Troves on salie. Salvage Value Market value of salvage Book value of salvage Taxes on sale: Aftertax salvage value: Project Cash Flows Year OCF Change in NWC Capital spending Total cash flow Cumulative cash flow Payback calculation Discounted cash flows Cumulative discounted cash flow Discounted payback calculation Question 7 NPV Decision? Question 8 Payback Period Decision? Question? \begin{tabular}{l|l|l|} \hline \multicolumn{2}{|c|}{ A } & \multicolumn{2}{|c|}{ Question 7 } \\ \hline 38 & NPV & \\ \hline 39 & Decision? \\ \hline 40 & & \\ \hline 41 & Question 8 \\ \hline 42 & Payback Period \\ \hline 43 & Decision? & \\ \hline 44 & & \\ \hline 45 & Question 9 \\ \hline 46 & Discounted Payback Period & \\ \hline 47 & Decision? & \\ \hline 48 & \\ \hline 49 & Question 10 \\ \hline 50 & IRR & \\ \hline 51 & Decision? \\ \hline 52 & \\ \hline 53 & Question 11 \\ \hline 54 & Profitability Index \\ \hline 55 & Decision? & \\ \hline 56 & \\ \hline 57 & Question 12 \\ \hline 58 & Indiffirent Sales Price \\ \hline 50 & \\ \hline \end{tabular} Orpetion 1? Houston Electronics is a midsized electronics manufacturer located in Houston, Texas. The company president is Michael Phillips, who inherited the company. The company was founded over 70 years ago and repaired radios and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacturer of various electronic items. Recently, you have been hired by the company's finance department. A major revenue-producing item Houston Electronics manufactured is a smartphone. Houston Electronics has one smartphone model on the market, and sales have been excellent. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features compared to newer models. Houston Electronics can manufacture the new smartphones for $420 each in variable costs. Fixed costs for the operation are estimated to run $5.50 million per year. The estimated sales volume is 80,000;105,000;135,000;165,000; and 190,000 per year for the next five years, respectively. The unit price of the new smartphone will be $675. The necessary equipment to produce new smartphones can be purchased for $84 million and depreciated on a seven-year MACRS scheduld It is believed the value of the equipment in five years will be $5.5 million. The effective tax rate for the company is 21%. The project requires a $3 million initial net working capital (NWC) investment and an NWC balance equal to 12% of sales thereater. The required return for the project is 11.5%. Mr. Phillips has asked you to prepare a report that answers the following questions. 1 Pro Forma Income Statements 2 Year 3 Revenues 4 Variable costs 5 Fixed costs 6. Depreciation 7 EBIT B. Taxes (21%) 9 Net incoase 10oCr 11 12 13 Net Working Capital 14. Yeat 15 Initial NWy 16 Enaisg NWC 17 NWC cash fow 18 19 Salvage Vatice 20 Matket value of atvece 21 Book valie of petvage? 22 Troves on salie. Salvage Value Market value of salvage Book value of salvage Taxes on sale: Aftertax salvage value: Project Cash Flows Year OCF Change in NWC Capital spending Total cash flow Cumulative cash flow Payback calculation Discounted cash flows Cumulative discounted cash flow Discounted payback calculation Question 7 NPV Decision? Question 8 Payback Period Decision? Question? \begin{tabular}{l|l|l|} \hline \multicolumn{2}{|c|}{ A } & \multicolumn{2}{|c|}{ Question 7 } \\ \hline 38 & NPV & \\ \hline 39 & Decision? \\ \hline 40 & & \\ \hline 41 & Question 8 \\ \hline 42 & Payback Period \\ \hline 43 & Decision? & \\ \hline 44 & & \\ \hline 45 & Question 9 \\ \hline 46 & Discounted Payback Period & \\ \hline 47 & Decision? & \\ \hline 48 & \\ \hline 49 & Question 10 \\ \hline 50 & IRR & \\ \hline 51 & Decision? \\ \hline 52 & \\ \hline 53 & Question 11 \\ \hline 54 & Profitability Index \\ \hline 55 & Decision? & \\ \hline 56 & \\ \hline 57 & Question 12 \\ \hline 58 & Indiffirent Sales Price \\ \hline 50 & \\ \hline \end{tabular} Orpetion 1