Question

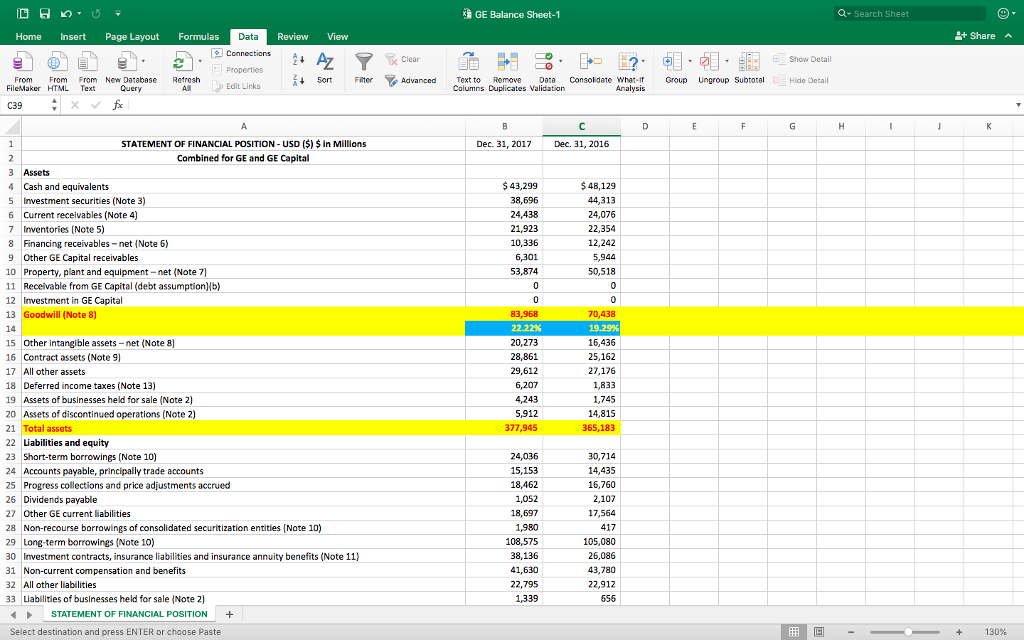

I have attached an Excel file that contains GE's consolidated balance sheets for fiscal years ending Dec 2017 and 2016. I highlighted a row that

I have attached an Excel file that contains GE's consolidated balance sheets for fiscal years ending Dec 2017 and 2016. I highlighted a row that says "Goodwill". You will note that this long-term asset is about 20% of total assets. If you go to the latest 10-K of GE from SEC.GOV, and read Note 8 under "Notes to Financial Statements" you can read the details. As a general rule always look at the notes to financial statements, there are many interesting details that are hidden in those notes.

Your question to discuss is "what is goodwill? How is it booked? Should we have an item like that in the balance sheet? If you do not think goodwill belongs in the financial statements, how do you think we should proceed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started