I have been having trouble with this practice problem and need help! Please do on excel

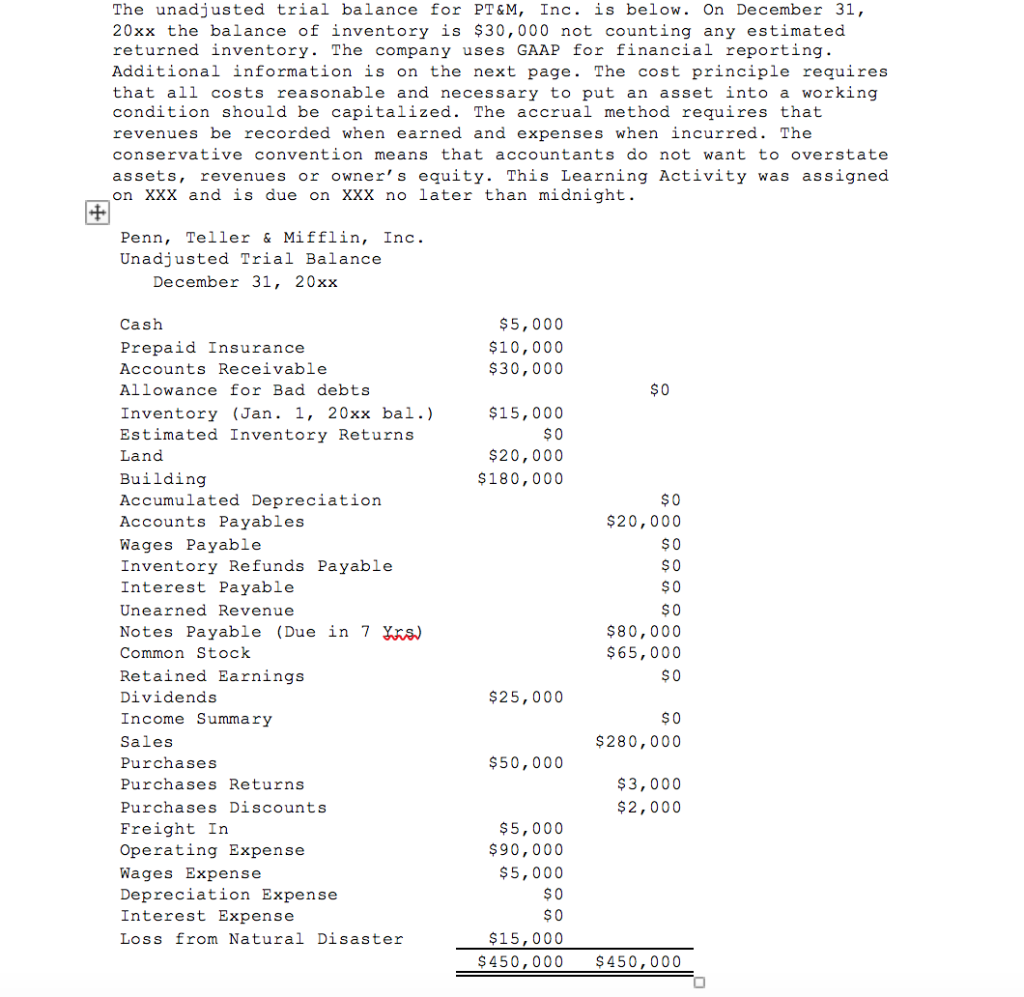

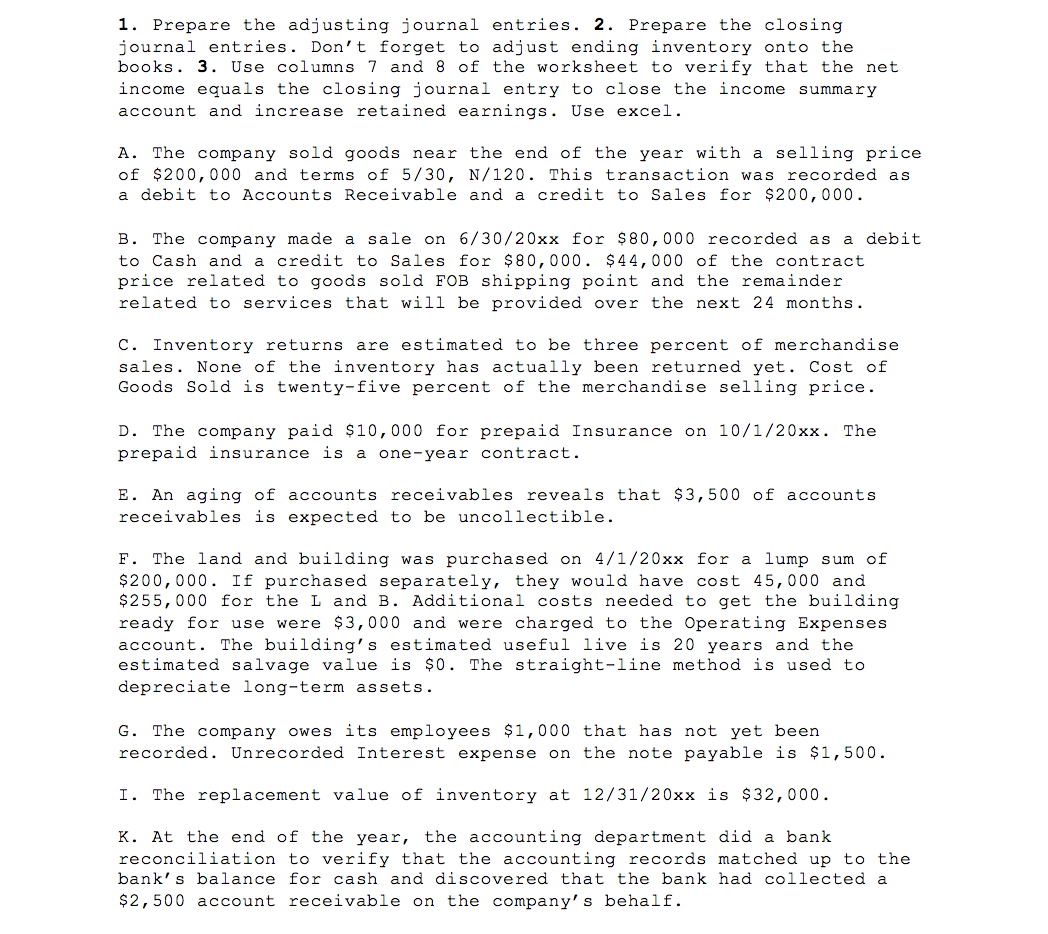

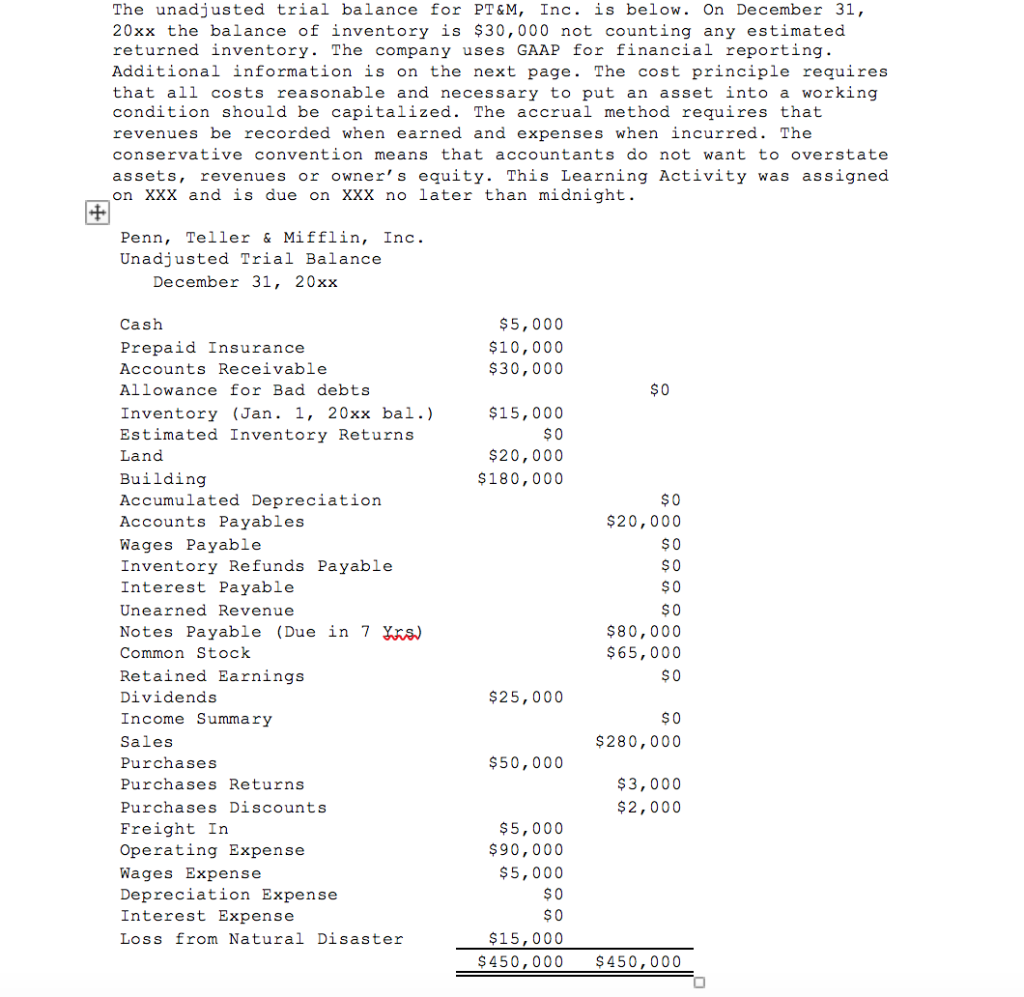

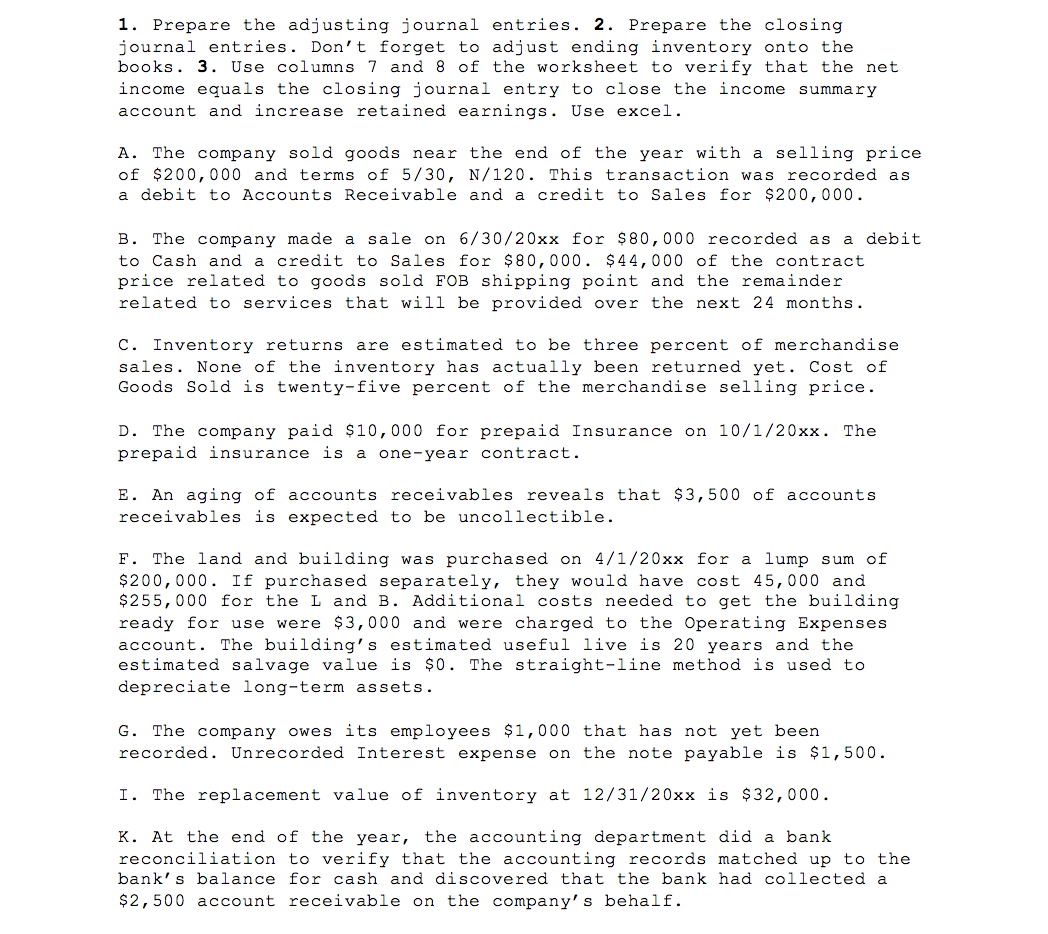

The unadjusted trial balance for PT&M, Inc. is below. On December 31, 20xx the balance of inventory is $30,000 not counting any estimated returned inventory. The company uses GAAP for financial reporting. Additional information is on the next page. The cost principle requires that all costs reasonable and necessary to put an asset into a working condition should be capitalized. The accrual method requires that revenues be recorded when earned and expenses when incurred. The conservative convention means that accountants do not want to overstate assets, revenues or owner's equity. This Learning Activity was assigned on XXX and is due on XXX no later than midnight Penn, Teller & Mifflin, Inc. Unadjusted Trial Balance December 31, 20xx Cash $5,000 Prepaid Insurance $10,000 $30,000 Accounts Receivable $0 Allowance for Bad debts $15,000 Inventory (Jan. 1, 20xx bal.) Estimated Inventory Returns $0 Land $20,000 Building $180,000 $0 Accumulated Depreciation Accounts Payables $20,000 Wages Payable $ 0 Inventory Refunds Payable Interest Payable $0 Unearned Revenue $0 $80,000 $65,000 Notes Payable (Due in 7 Xfs) Common Stock Retained Earnings $25,000 Dividends $0 Income Summary $280,000 Sales $50,000 Purchases Purchases Returns $3,000 Purchases Discounts $2,000 Freight In Operating Expense $5,000 $90,000 $5,000 Expense Depreciation Expense Interest Expense $0 Loss from Natural Disaster $15,000 $450,000 $450,000 1. Prepare the adjusting journal entries. 2. Prepare the closing journal entries. Don' t forget to adjust ending inventory onto the books. 3. Use columns 7 and 8 of the worksheet to verify that the net income equals the closing journal entry to close the income summary account and increase retained earnings. Use excel A. The company sold goods near the end of the year with a selling price of $200,000 and terms of 5/30, N/120. This transaction was recorded as a debit to Accounts Receivable and a credit to Sales for $200,000 a sale on 6/30/20xx for $80,000 recorded as a B. The company made to Cash and a credit to Sales for $80,000. $44,000 of the contract price related to goods sold FOB shipping point and the remainder related to services that will be provided over the next 24 months. debit C. Inventory returns are estimated to be three percent of merchandise sales. None of the inventory has actually been returned yet. Cost of Goods Sold is twenty-five percent of the merchandise selling price. D. The company paid $10,000 for prepaid Insurance on 10/1/20xx. The prepaid insurance is a one-year contract. E. An aging of accounts receivables reveals that $3,500 of accounts receivables is expected to be uncollectible. F. The land and building was purchased on 4/1/20xx for a lump sum of $200,000. If purchased separately, they would have cost 45,000 and $255,000 for the L and B. Additional costs neededd to get the building ready for use were $3,000 and were charged to the Operating Expenses account. The building's estimated useful live is 20 years and the estimated salvage value is $0. The straight-line method is used to depreciate long-term assets G. The company owes its employees $1,000 that has not yet been recorded. Unrecorded Interest expense on the note payable is $1,500 I. The replacement value of inventory at 12/31/20xx is $32,000 K. At the end of the year, the accounting department did a bank reconciliation to verify that the accounting records matched up to the bank's balance for cash and discovered that the bank had collected a $2,500 account receivable on the company's behalf