Answered step by step

Verified Expert Solution

Question

1 Approved Answer

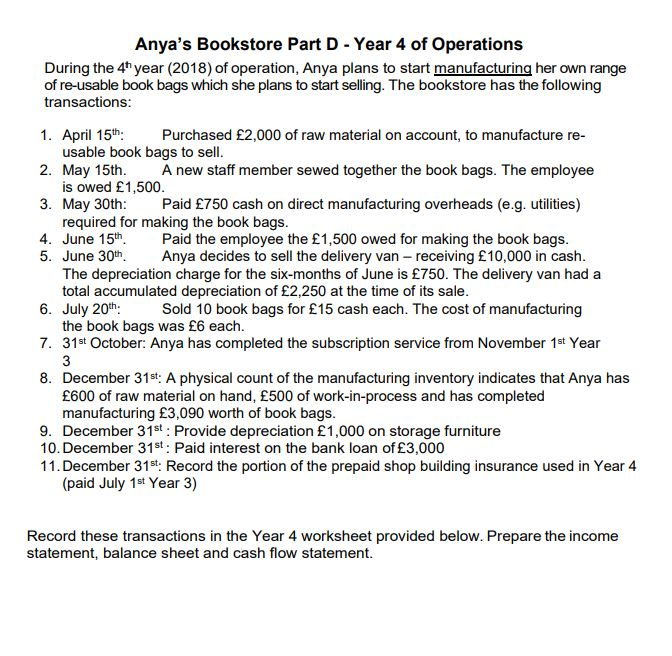

Anya's Bookstore Part D - Year 4 of Operations During the 4h year (2018) of operation, Anya plans to start manufacturing her own range

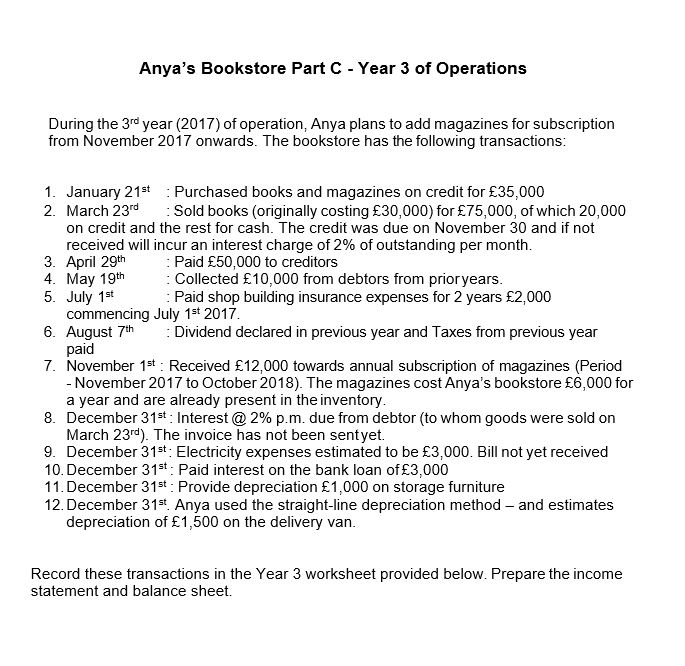

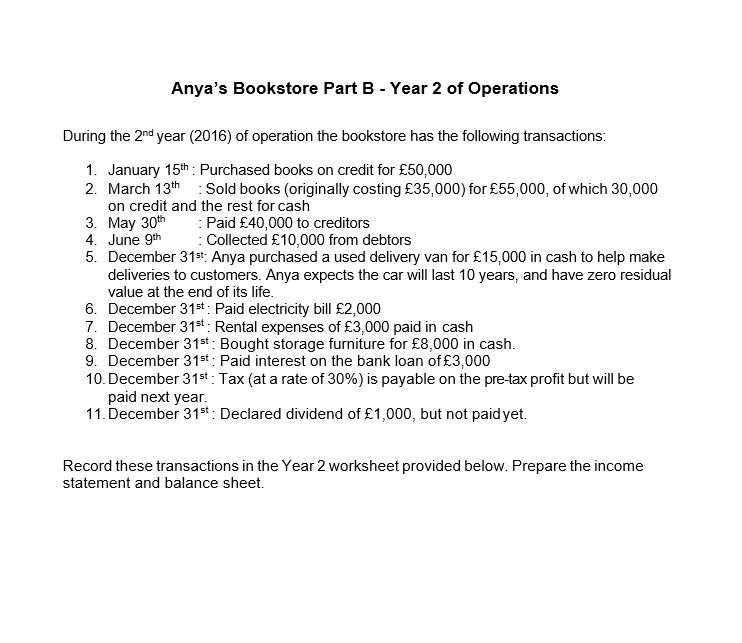

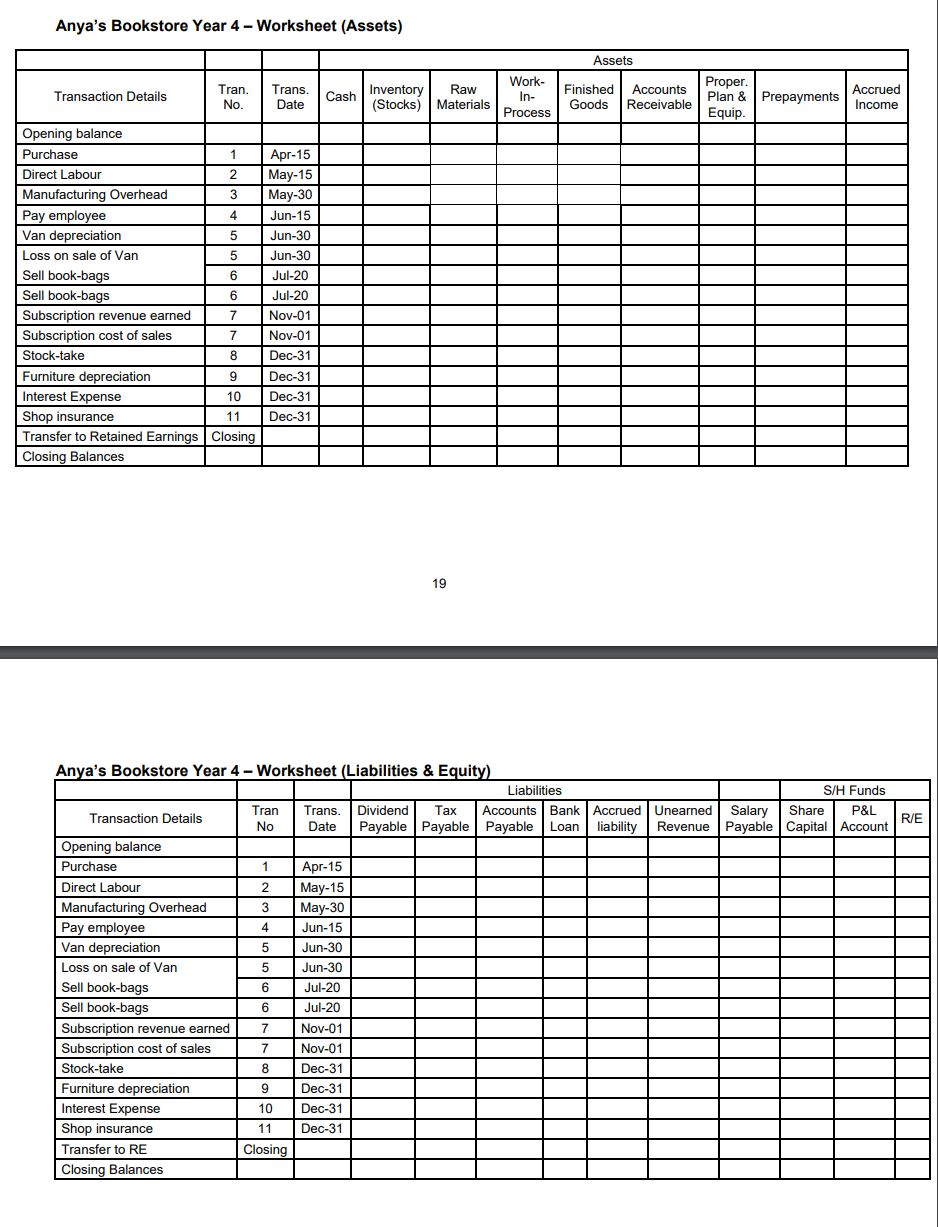

Anya's Bookstore Part D - Year 4 of Operations During the 4h year (2018) of operation, Anya plans to start manufacturing her own range of re-usable book bags which she plans to start selling. The bookstore has the following transactions: 1. April 15th: usable book bags to sell. 2. May 15th. is owed 1,500. 3. May 30th: required for making the book bags. 4. June 15th. Purchased 2,000 of raw material on account, to manufacture re- A new staff member sewed together the book bags. The employee Paid 750 cash on direct manufacturing overheads (e.g. utilities) Paid the employee the 1,500 owed for making the book bags. Anya decides to sell the delivery van receiving 10,000 in cash. 5. June 30th. The depreciation charge for the six-months of June is 750. The delivery van had a total accumulated depreciation of 2,250 at the time of its sale. 6. July 20th: the book bags was 6 each. 7. 31st October: Anya has completed the subscription service from November 1st Year Sold 10 book bags for 15 cash each. The cost of manufacturing 8. December 31st: A physical count of the manufacturing inventory indicates that Anya has 600 of raw material on hand, 500 of work-in-process and has completed manufacturing 3,090 worth of book bags. 9. December 31st : Provide depreciation 1,000 on storage furniture 10. December 31st: Paid interest on the bank loan of 3,000 11. December 31st: Record the portion of the prepaid shop building insurance used in Year 4 (paid July 1st Year 3) Record these transactions in the Year 4 worksheet provided below. Prepare the income statement, balance sheet and cash flow statement. Anya's Bookstore Part C - Year 3 of Operations During the 3rd year (2017) of operation, Anya plans to add magazines for subscription from November 2017 onwards. The bookstore has the following transactions: 1. January 21st : Purchased books and magazines on credit for 35,000 2. March 23rd on credit and the rest for cash. The credit was due on November 30 and if not received will incur an interest charge of 2% of outstanding per month. 3. April 29th 4. May 19th 5. July 1st commencing July 1st 2017. 6. August 7th paid 7. November 1st : Received 12,000 towards annual subscription of magazines (Period - November 2017 to October 2018). The magazines cost Anya's bookstore 6,000 for a year and are already present in the inventory. 8. December 31st : Interest @ 2% p.m. due from debtor (to whom goods were sold on March 23rd). The invoice has not been sentyet. 9. December 31st : Electricity expenses estimated to be 3,000. Bill not yet received 10. December 31st : Paid interest on the bank loan of 3,000 11. December 31st : Provide depreciation 1,000 on storage furniture 12. December 31st Anya used the straight-line depreciation method and estimates depreciation of 1,500 on the delivery van. :Sold books (originally costing 30,000) for 75,000, of which 20,000 : Paid 50,000 to creditors : Collected 10,000 from debtors from prioryears. : Paid shop building insurance expenses for 2 years 2,000 : Dividend declared in previous year and Taxes from previous year Record these transactions in the Year 3 worksheet provided below. Prepare the income statement and balance sheet. Anya's Bookstore Part B - Year 2 of Operations During the 2nd year (2016) of operation the bookstore has the following transactions: 1. January 15th: Purchased books on credit for 50,000 2. March 13th : Sold books (originally costing 35,000) for 55,000, of which 30,000 on credit and the rest for cash 3. May 30th 4. June 9th 5. December 31st: Anya purchased a used delivery van for 15,000 in cash to help make deliveries to customers. Anya expects the car will last 10 years, and have zero residual value at the end of its life. : Paid 40,000 to creditors : Collected 10,000 from debtors 6. December 31st : Paid electricity bill 2,000 7. December 31st : Rental expenses of 3,000 paid in cash 8. December 31st : Bought storage furniture for 8,000 in cash. 9. December 31st : Paid interest on the bank loan of 3,000 10. December 31st : Tax (at a rate of 30%) is payable on the pre-tax profit but will be paid next year. 11. December 31st: Declared dividend of 1,000, but not paid yet. Record these transactions in the Year 2 worksheet provided below. Prepare the income statement and balance sheet. Anya's Bookstore Year 4 - Worksheet (Assets) Assets Work- Tran. No. Trans. Date Proper. Plan & Prepayments Equip. Accrued Income Raw Finished Cash | Inventory Accounts Receivable Transaction Details In- (Stocks) Materials Goods Process Opening balance Purchase 1 Ap-15 Direct Labour May-15 May-30 Manufacturing Overhead 3 Pay employee Van depreciation 4 Jun-15 Jun-30 Loss on sale of Van 5 Jun-30 Sell book-bags Sell book-bags 6 Jul-20 6. Jul-20 Subscription revenue earned 7 Nov-01 Subscription cost of sales Stock-take 7 Nov-01 8 Dec-31 Furniture depreciation 9 Dec-31 Interest Expense 10 Dec-31 Shop insurance Transfer to Retained Earnings | Closing 11 Dec-31 Closing Balances 19 Anya's Bookstore Year 4 - Worksheet (Liabilities & Equity) Liabilities S/H Funds Tran Trans. Dividend x Accounts Bank | Accrued Unearned Salary Share P&L R/E Revenue Payable Capital Account Transaction Details No Date Payable Payable Payable Loan liability Opening balance Purchase 1 Apr-15 May-15 May-30 Direct Labour Manufacturing Overhead 3 Pay employee Van depreciation 4 Jun-15 Jun-30 Loss on sale of Van 5 Jun-30 Sell book-bags 6 Jul-20 Sell book-bags Jul-20 Subscription revenue earned Nov-01 Subscription cost of sales 7 Nov-01 Stock-take 8 Dec-31 Furniture depreciation Dec-31 Interest Expense 10 Dec-31 Shop insurance 11 Dec-31 Transfer to RE Closing Closing Balances

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Van Cost 15000 Accumulated D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started