Answered step by step

Verified Expert Solution

Question

1 Approved Answer

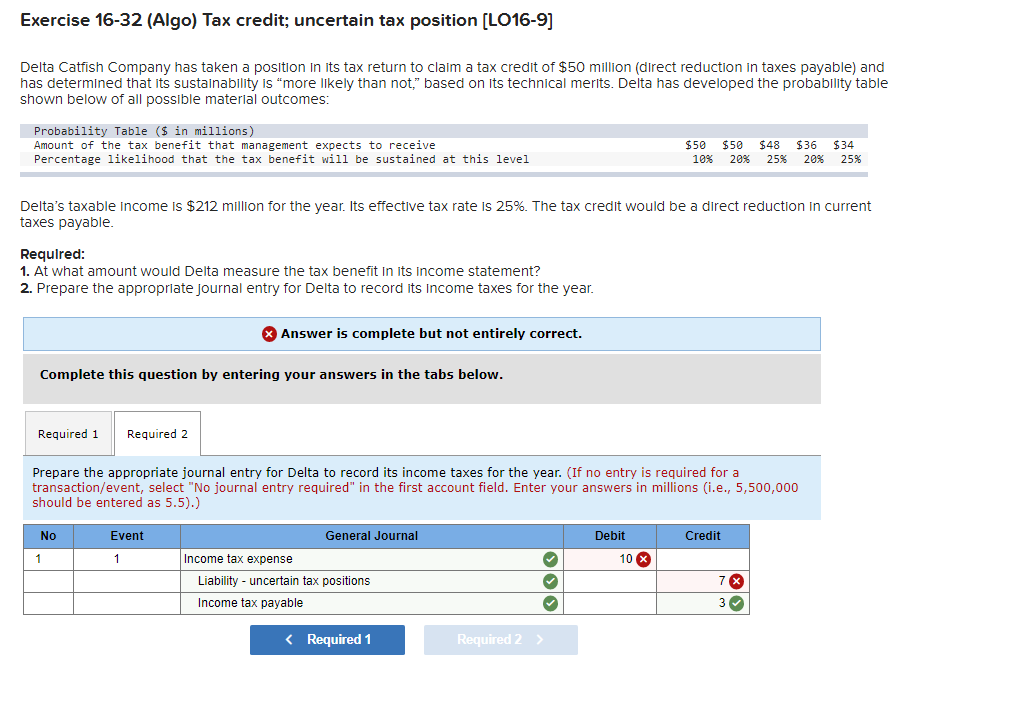

I have it down as 10.3 and 7.3 but it stil says it is wrong. I changed it to 10 and 7 but still wrong.

I have it down as 10.3 and 7.3 but it stil says it is wrong. I changed it to 10 and 7 but still wrong.

Exercise 16-32 (Algo) Tax credit; uncertain tax position (LO16-9) Delta Catfish Company has taken a position in its tax return to claim a tax credit of $50 million (direct reduction in taxes payable) and has determined that its sustainability is "more likely than not," based on its technical merits. Delta has developed the probability table shown below of all possible material outcomes: Probability Table ($ in millions) Amount of the tax benefit that management expects to receive Percentage likelihood that the tax benefit will be sustained at this level $50 109 $50 $48 $36 $34 20% 25% 20% 25% Delta's taxable income is $212 million for the year. Its effective tax rate is 25%. The tax credit would be a direct reduction in current taxes payable. Required: 1. At what amount would Delta measure the tax benefit in its income statement? 2. Prepare the appropriate journal entry for Delta to record its Income taxes for the year. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry for Delta to record its income taxes for the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 5,500,000 should be entered as 5.5).) No Event Debit Credit 1 1 10 X General Journal Income tax expense Liability - uncertain tax positions Income tax payable 7 X 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started