I have no idea how do I need to write down for Statement of Comprehensive Income.

Please help! Thank you:)

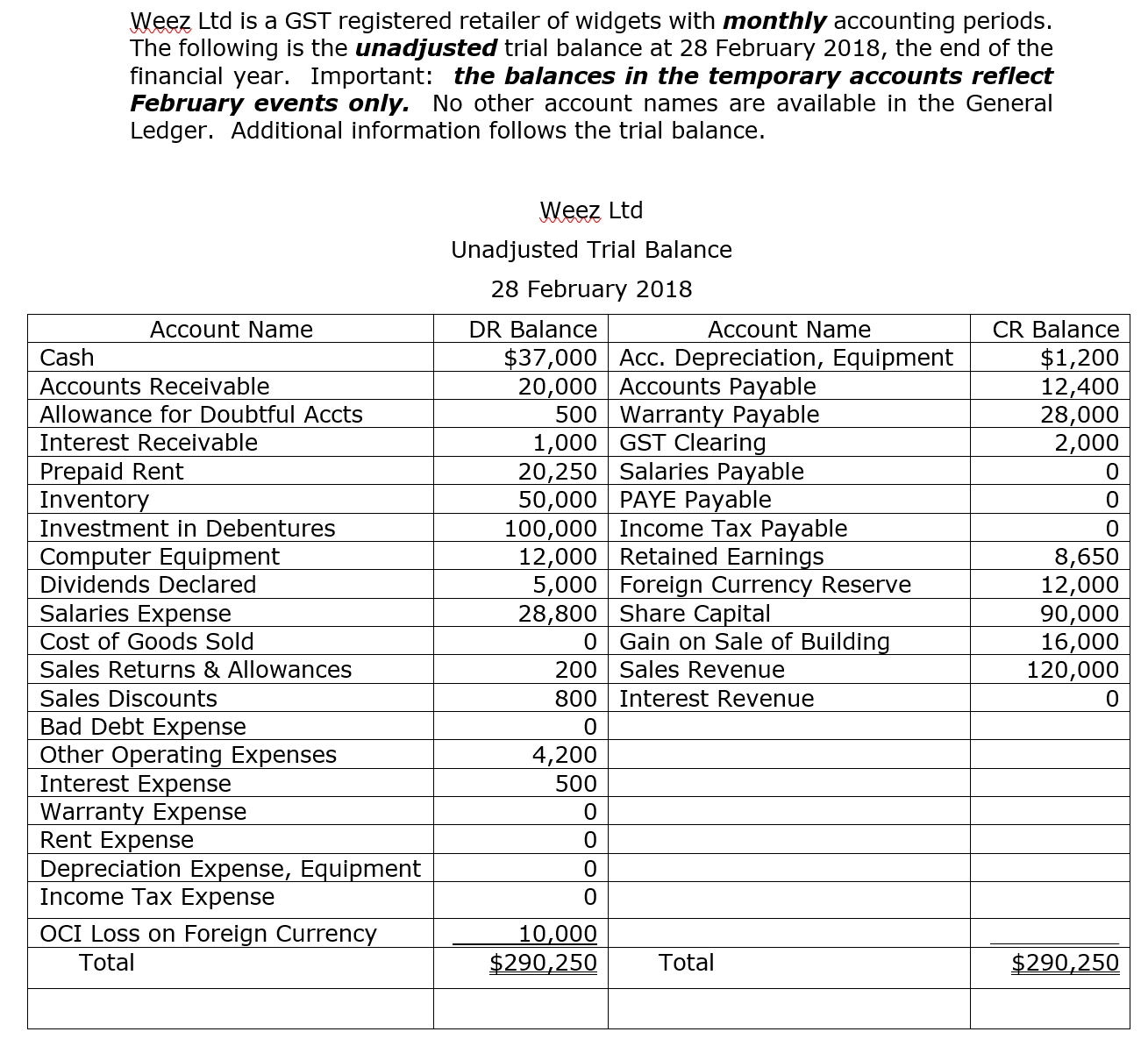

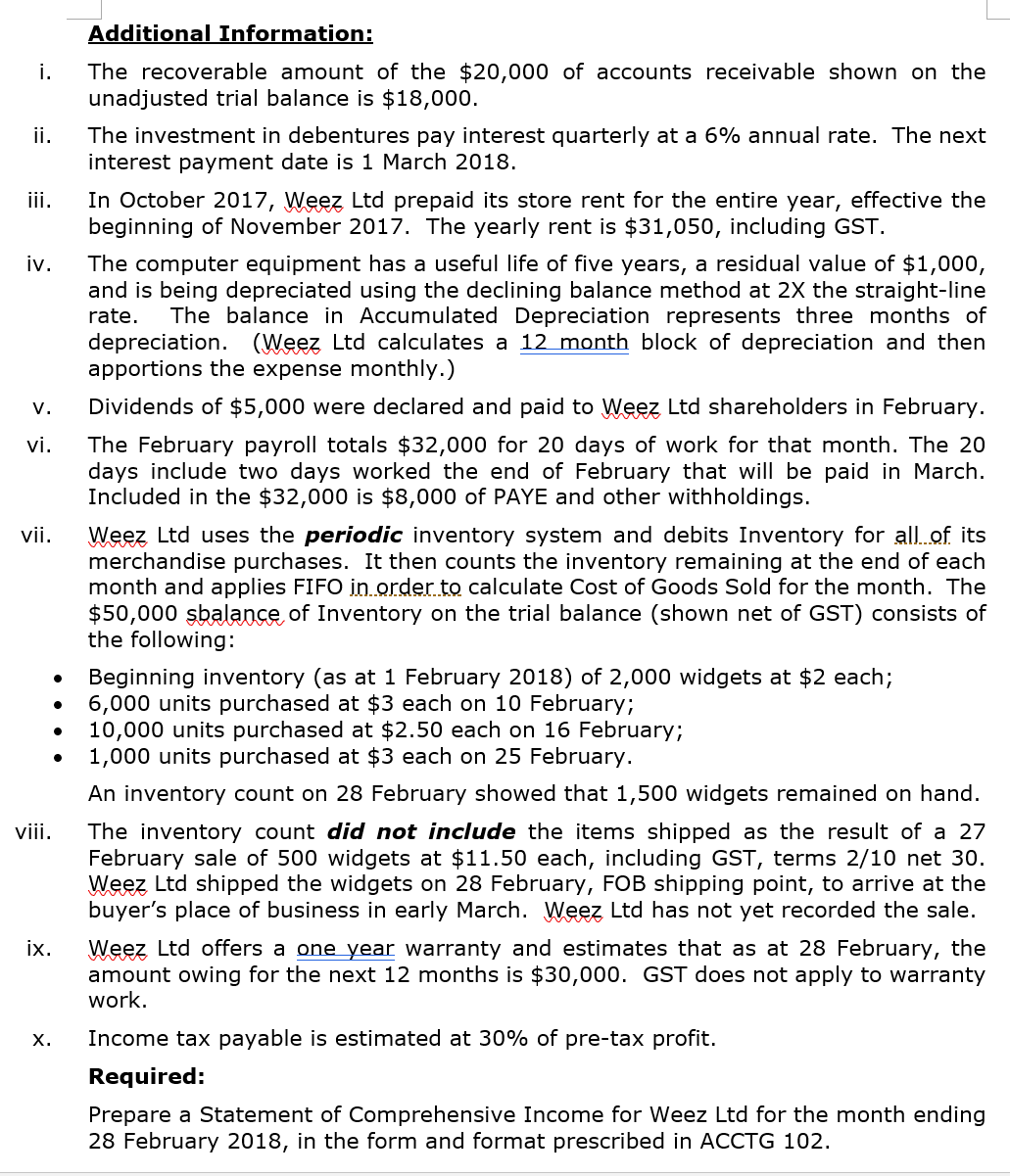

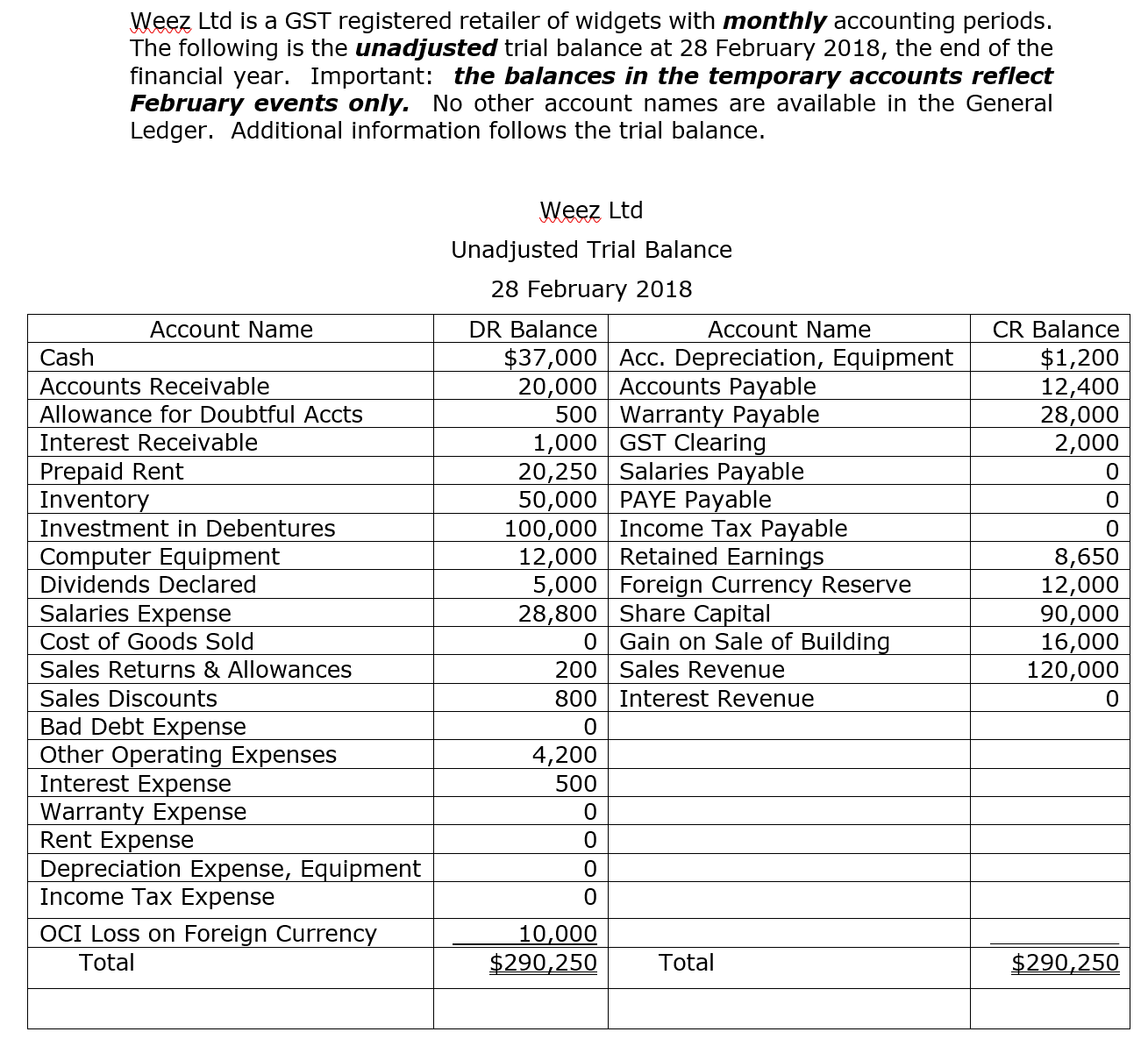

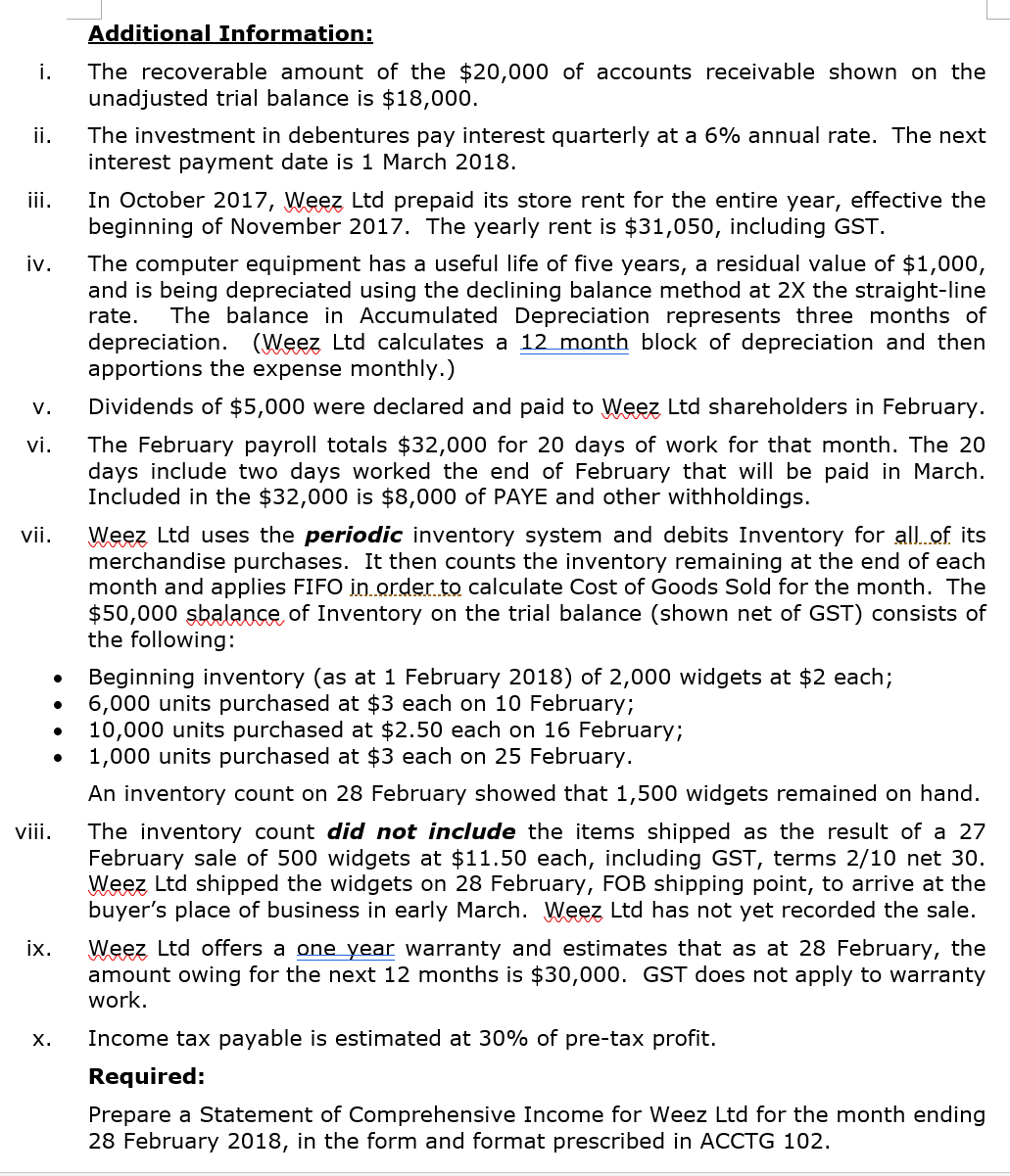

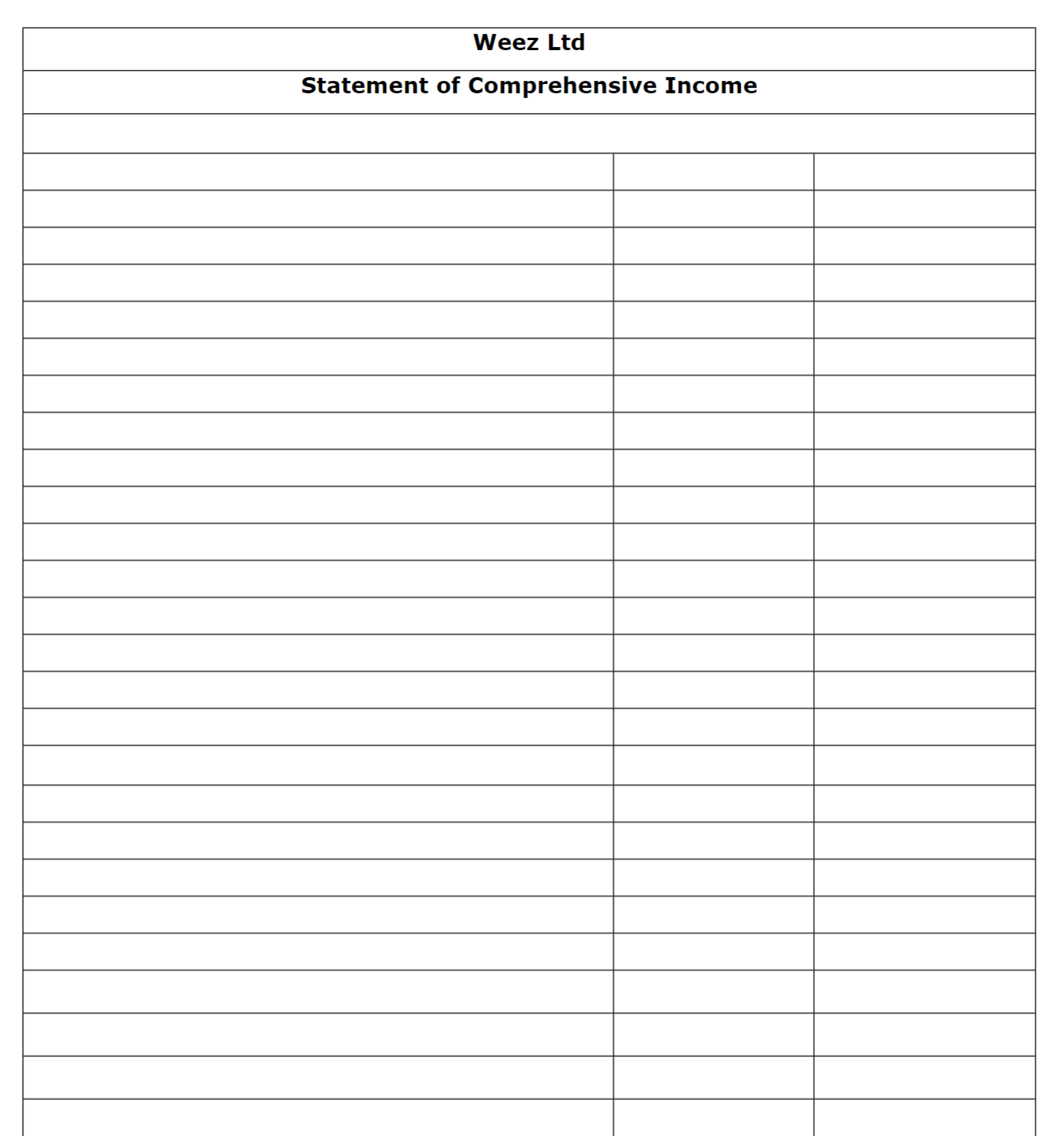

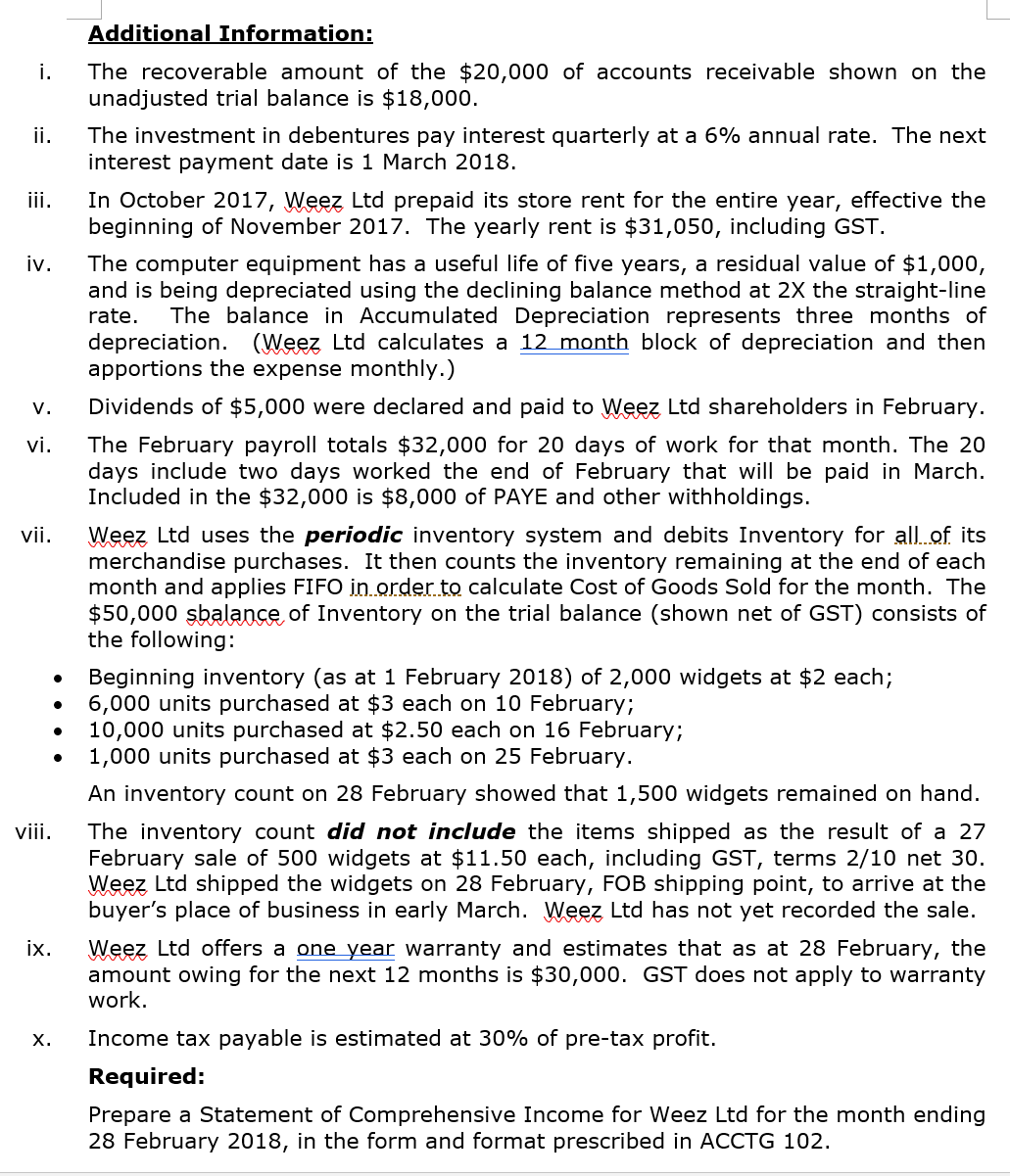

Wee; Ltd is a GST registered retailer of widgets with monthly accounting periods. The following is the unadjusted trial balance at 28 February 2018, the end of the the balances in the temporary accounts reflect February events only. No other account names are available in the General Ledger. Additional information follows the trial balance. financial year. Important: Wes; Ltd Unadjusted Trial Balance 28 February 2018 Account Name DR Balance Account Name CR Balance Cash $37,000 Acc. Depreciation, Equipment $1,200 Accounts Receivable 20,000 Accounts Payable 12,400 Allowance for Doubtful Accts 500 Warranty Payable 28,000 Interest Receivable 1,000 GST Clearing 2,000 Prepaid Rent 20,250 Salaries Payable 0 Inventory 50,000 PAYE Payable 0 Investment in Debentures 100,000 Income Tax Payable 0 Computer Equipment 12,000 Retained Earnings 8,650 Dividends Declared 5,000 Foreign Currency Reserve 12,000 Salaries Expense 28,800 Share Capital 90,000 Cost of Goods Sold 0 Gain on Sale of Building 16,000 Sales Returns & Allowances 200 Sales Revenue 120,000 Sales Discounts 800 Interest Revenue 0 Bad Debt Expense 0 Other Operating Expenses 4,200 Interest Expense 500 Warranty Expense 0 Rent Expense 0 Depreciation Expense, Equipment 0 Income Tax Expense 0 DC] Loss on Foreign Currency 10,000 Total $290,250 Total $290,250 4 l_ Additional Information: i. The recoverable amount of the $20,000 of accounts receivable shown on the unadjusted trial balance is $18,000. ii. The investment in debentures pay interest quarterly at a 6% annual rate. The next interest payment date is 1 March 2018. iii. In October 2017, Wee; Ltd prepaid its store rent for the entire year, effective the beginning of November 2017. The yearly rent is $31,050, including GST. iv. The computer equipment has a useful life of five years, a residual value of $1,000, and is being depreciated using the declining balance method at 2X the straightline rate. The balance in Accumulated Depreciation represents three months of depreciation. (Wee; Ltd calculates a 12_m11nj:l;1 block of depreciation and then apportions the expense monthly.) v. Dividends of $5,000 were declared and paid to Wee; Ltd shareholders in February. vi. The February payroll totals $32,000 for 20 days of work for that month. The 20 days include two days worked the end of February that will be paid in March. Included in the $32,000 is $8,000 of PAYE and other withholdings. vii. Wee; Ltd uses the periodic inventory system and debits Inventory for allugf, its merchandise purchases. It then counts the inventory remaining at the end of each month and applies FIFO momenta calculate Cost ofGoods Sold for the month. The $50,000 WM Inventory on the trial balance (shown net of GST) consists of the following: . Beginning inventory (as at 1 February 2018) of 2,000 widgets at $2 each; . 6,000 units purchased at $3 each on 10 February; . 10,000 units purchased at $2.50 each on 16 February; . 1,000 units purchased at $3 each on 25 February. An inventory count on 28 February showed that 1,500 widgets remained on hand. viii. The inventory count did not include the items shipped as the result of a 27 February sale of 500 widgets at $11.50 each, including GST, terms 2/10 net 30. Wee; Ltd shipped the widgets on 28 February, FOB shipping point, to arrive at the buyer's place of business in early March. Wee; Ltd has not yet recorded the sale. ix. Wag; Ltd offers a w warranty and estimates that as at 28 February, the amount owing for the next 12 months is $30,000. GST does not apply to warranty work. x. Income tax payable is estimated at 30% of pretax profit. Required: Prepare a Statement of Comprehensive Income for Weez Ltd for the month ending 28 February 2018, in the form and format prescribed in ACCTG 102.