Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have no idea what to do. Need help with Part 4 and creating the Statement of Cashflow For the Years Ended July 31, 2019

I have no idea what to do. Need help with Part 4 and creating the Statement of Cashflow

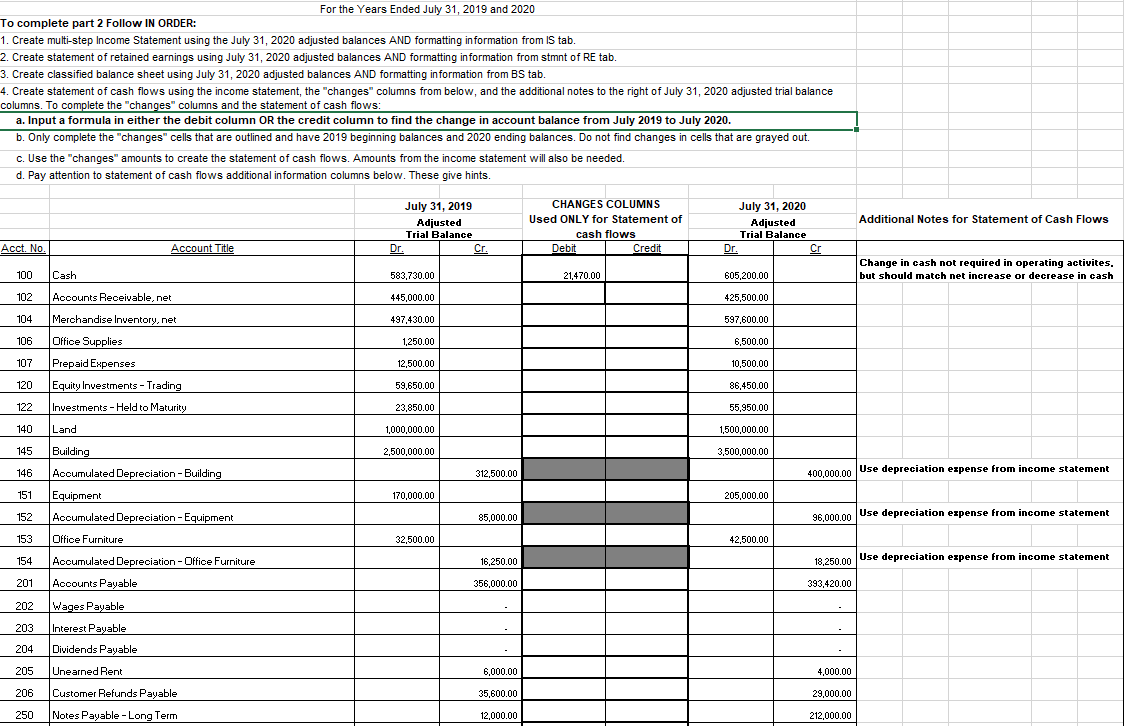

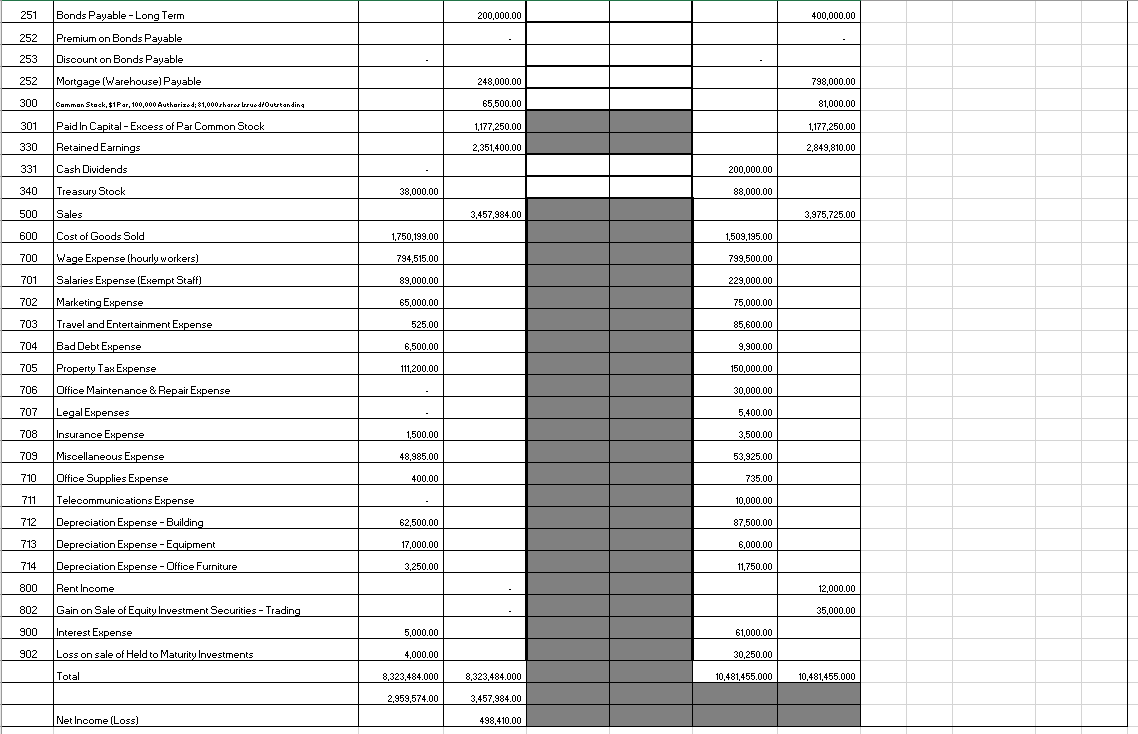

For the Years Ended July 31, 2019 and 2020 To complete part 2 Follow IN ORDER: 1. Create multi-step Income Statement using the July 31, 2020 adjusted balances AND formatting information from IS tab. 2. Create statement of retained earnings using July 31,2020 adjusted balances AND formatting information from stmnt of RE tab. 3. Create classified balance sheet using July 31,2020 adjusted balances AND formatting information from BS tab. 4. Create statement of cash flows using the income statement, the "changes" columns from below, and the additional notes to the right of July 31,2020 adjusted trial balance columns. To complete the "changes" columns and the statement of cash flows: a. Input a formula in either the debit column OR the credit column to find the change in account balance from July 2019 to July 2020. b. Only complete the "changes" cells that are outlined and have 2019 beginning balances and 2020 ending balances. Do not find changes in cells that are grayed out. c. Use the "changes" amounts to create the statement of cash flows. Amounts from the income statement will also be needed. d. Pay attention to statement of cash flows additional information columns below. These give hints. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & & & & & & & \\ \hline & & July 31 & & CHANGES & LUMNS & July 31 & \\ \hline & & AdjusTrialB & & UsedONLYfocash & atementofws & AdjuTrialB & \\ \hline Acct. No. & Account Title & \begin{tabular}{l|l} Dr. & \\ \end{tabular} & Cr. & Debit & Credit & Dr. & Cr \\ \hline 100 & Cash & 583,730.00 & & 21,470.00 & & 605,200.00 & \\ \hline 102 & Accounts Receivable, net & 445,000.00 & & & & 425,500.00 & \\ \hline 104 & Merchandise Inventory, net & 497,430.00 & & & & 597,600.00 & \\ \hline 106 & Dffice Supplies & 1,250.00 & & & & 6,500.00 & \\ \hline 107 & Prepaid Expenses & 12,500.00 & & & & 10,500.00 & \\ \hline 120 & Equity Investments - Trading & 59,650.00 & & & & 86,450.00 & \\ \hline 122 & Investments - Held to Maturity & 23,850.00 & & & & 55,950.00 & \\ \hline 140 & Land & 1,000,000.00 & & & & 1,500,000.00 & \\ \hline 145 & Building & 2,500,000,00 & & & & 3,500,000.00 & \\ \hline 151 & Equipment & 170,000.00 & & & & 205,000.00 & \\ \hline 152 & Accumulated Depreciation - Equipment & & 85,000.00 & & & & 96,000.00 \\ \hline 153 & Glfice Furniture & 32,500.00 & & & & 42,500.00 & \\ \hline 154 & Acoumulated Depreciation - Dffice Furniture & & 16,250.00 & & & & 18,250.00 \\ \hline 201 & Accounts Payable & & 356,000.00 & & & & 393,420.00 \\ \hline 202 & Wages Payable & & & & & & \\ \hline 203 & Interest Payable & & . & & & & - \\ \hline 204 & Dividends Payable & & . & & & & \\ \hline 205 & Unearned Rent & & 6,000.00 & & & & 4,000.00 \\ \hline 206 & Customer Refunds Payable & & 35,600.00 & & & & 29,000.00 \\ \hline 250 & Notes Payable - Long Term & & 12,000.00 & & & & 212,000.00 \\ \hline \end{tabular} For the Years Ended July 31, 2019 and 2020 To complete part 2 Follow IN ORDER: 1. Create multi-step Income Statement using the July 31, 2020 adjusted balances AND formatting information from IS tab. 2. Create statement of retained earnings using July 31,2020 adjusted balances AND formatting information from stmnt of RE tab. 3. Create classified balance sheet using July 31,2020 adjusted balances AND formatting information from BS tab. 4. Create statement of cash flows using the income statement, the "changes" columns from below, and the additional notes to the right of July 31,2020 adjusted trial balance columns. To complete the "changes" columns and the statement of cash flows: a. Input a formula in either the debit column OR the credit column to find the change in account balance from July 2019 to July 2020. b. Only complete the "changes" cells that are outlined and have 2019 beginning balances and 2020 ending balances. Do not find changes in cells that are grayed out. c. Use the "changes" amounts to create the statement of cash flows. Amounts from the income statement will also be needed. d. Pay attention to statement of cash flows additional information columns below. These give hints. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & & & & & & & \\ \hline & & July 31 & & CHANGES & LUMNS & July 31 & \\ \hline & & AdjusTrialB & & UsedONLYfocash & atementofws & AdjuTrialB & \\ \hline Acct. No. & Account Title & \begin{tabular}{l|l} Dr. & \\ \end{tabular} & Cr. & Debit & Credit & Dr. & Cr \\ \hline 100 & Cash & 583,730.00 & & 21,470.00 & & 605,200.00 & \\ \hline 102 & Accounts Receivable, net & 445,000.00 & & & & 425,500.00 & \\ \hline 104 & Merchandise Inventory, net & 497,430.00 & & & & 597,600.00 & \\ \hline 106 & Dffice Supplies & 1,250.00 & & & & 6,500.00 & \\ \hline 107 & Prepaid Expenses & 12,500.00 & & & & 10,500.00 & \\ \hline 120 & Equity Investments - Trading & 59,650.00 & & & & 86,450.00 & \\ \hline 122 & Investments - Held to Maturity & 23,850.00 & & & & 55,950.00 & \\ \hline 140 & Land & 1,000,000.00 & & & & 1,500,000.00 & \\ \hline 145 & Building & 2,500,000,00 & & & & 3,500,000.00 & \\ \hline 151 & Equipment & 170,000.00 & & & & 205,000.00 & \\ \hline 152 & Accumulated Depreciation - Equipment & & 85,000.00 & & & & 96,000.00 \\ \hline 153 & Glfice Furniture & 32,500.00 & & & & 42,500.00 & \\ \hline 154 & Acoumulated Depreciation - Dffice Furniture & & 16,250.00 & & & & 18,250.00 \\ \hline 201 & Accounts Payable & & 356,000.00 & & & & 393,420.00 \\ \hline 202 & Wages Payable & & & & & & \\ \hline 203 & Interest Payable & & . & & & & - \\ \hline 204 & Dividends Payable & & . & & & & \\ \hline 205 & Unearned Rent & & 6,000.00 & & & & 4,000.00 \\ \hline 206 & Customer Refunds Payable & & 35,600.00 & & & & 29,000.00 \\ \hline 250 & Notes Payable - Long Term & & 12,000.00 & & & & 212,000.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started