i have no idea where to start

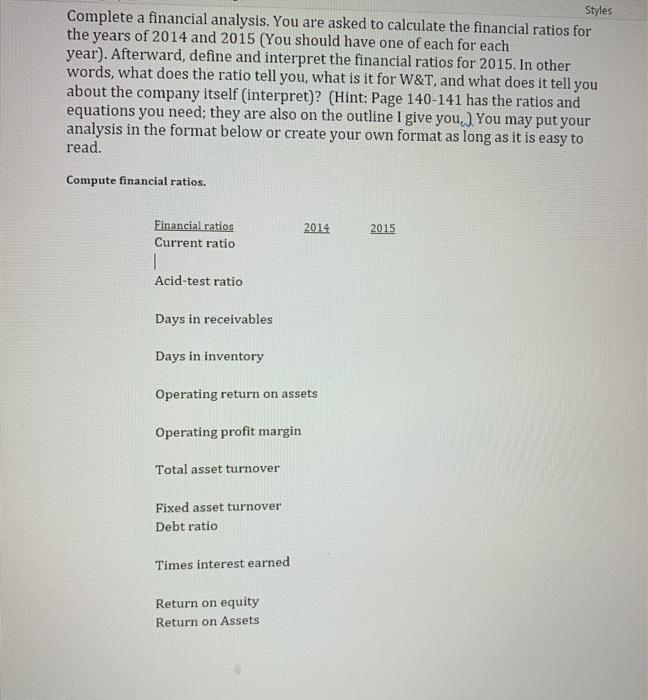

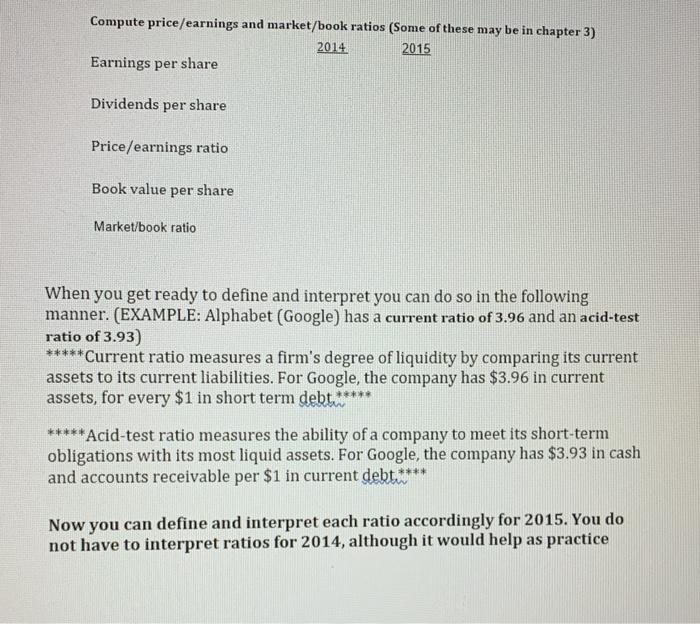

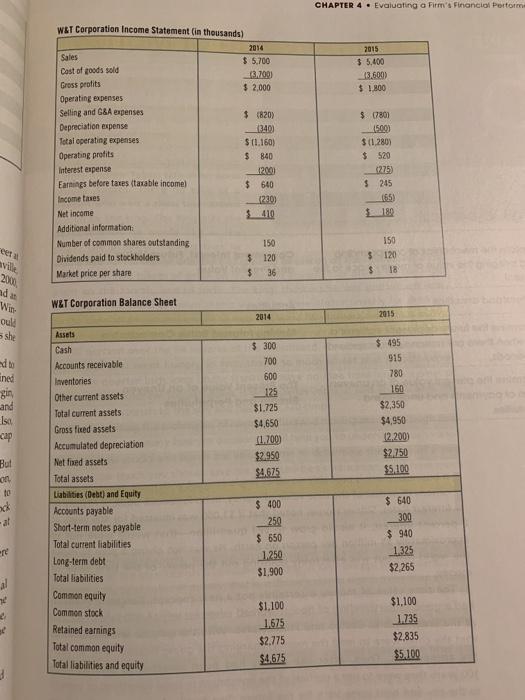

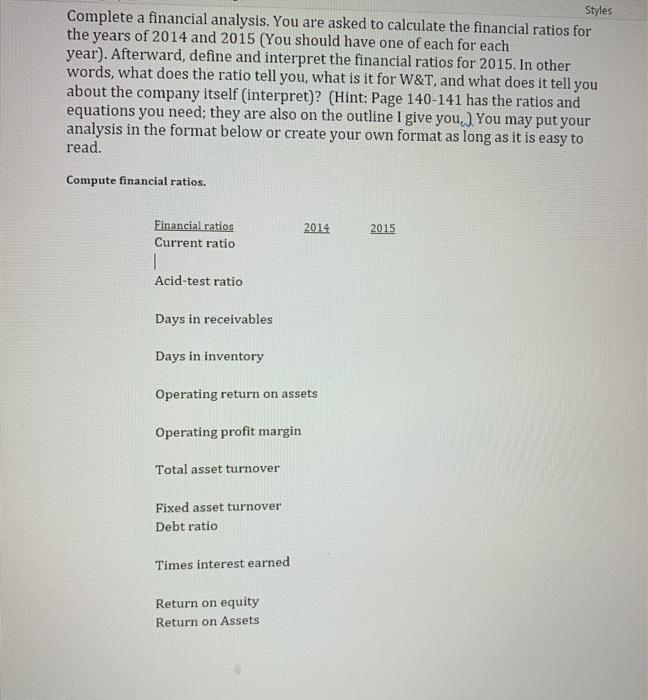

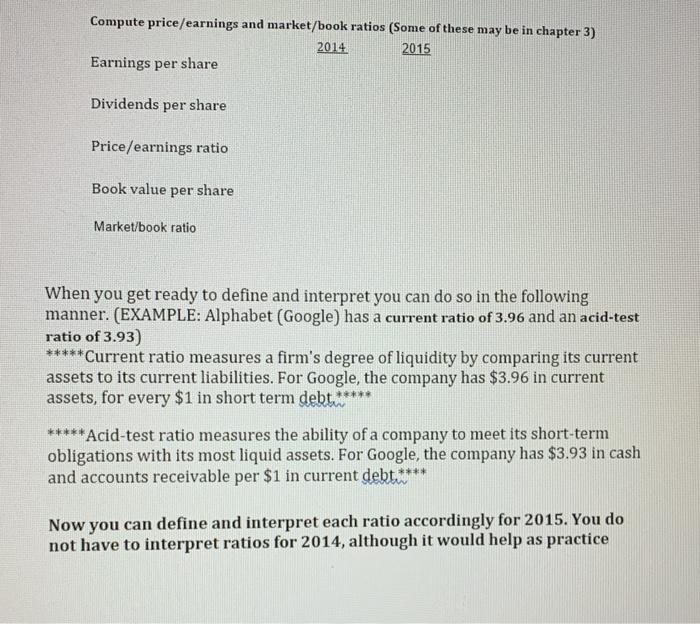

Styles Complete a financial analysis. You are asked to calculate the financial ratios for the years of 2014 and 2015 (You should have one of each for each year). Afterward, define and interpret the financial ratios for 2015. In other words, what does the ratio tell you, what is it for W&T, and what does it tell you about the company itself (interpret)? (Hint: Page 140-141 has the ratios and equations you need; they are also on the outline I give you, ) You may put your analysis in the format below or create your own format as long as it is easy to read. Compute financial ratios. 2014 2015 Financial ratios Current ratio 1 Acid-test ratio Days in receivables Days in inventory Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Debt ratio Times interest earned Return on equity Return on Assets Compute price/earnings and market/book ratios (Some of these may be in chapter 3) 2014 2015 Earnings per share Dividends per share Price/earnings ratio Book value per share Market/book ratio ***** When you get ready to define and interpret you can do so in the following manner. (EXAMPLE: Alphabet (Google) has a current ratio of 3.96 and an acid-test ratio of 3.93) ** Current ratio measures a firm's degree of liquidity by comparing its current assets to its current liabilities. For Google, the company has $3.96 in current assets, for every $1 in short term debt.** *****Acid-test ratio measures the ability of a company to meet its short-term obligations with its most liquid assets. For Google, the company has $3.93 in cash and accounts receivable per $1 in current debt.*** **** Now you can define and interpret each ratio accordingly for 2015. You do not have to interpret ratios for 2014, although it would help as practice CHAPTER 4 Evaluating a Firm's Financial Porto 2015 $ 5.400 43.6008 $ 1.800 $07801 _1500) W&T Corporation Income Statement in thousands) 2014 Sales $ 5.700 Cast of goods sold 13.2001 Gross profits $ 2.000 Operating expenses Selling and G&A expenses $ 820) Depreciation expense 2340) Total operating expenses $ 1.160) Operating profits $ 840 Interest expense 2001 Earnings before taxes (taxable income $ 640 Income taxes (220) Net income Additional information Number of common shares outstanding 150 Dividends paid to stockholders $ 120 Market price per share $36 $(1.280) $ 520 (275) $ 245 eet 150 $ 120 $ 18 vi 20 ad W W&T Corporation Balance Sheet 2014 2015 ould ssh ned and Isa cap $ 300 700 600 125 $1.725 $4,650 11.700 $2.950 $4.675 $ 495 915 780 160 $2,350 $4,950 12.200 $2750 $5.100 Bot 10 Assets Cash Accounts receivable Inventories Other current assets Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities (Debt and Equity Accounts payable Short-term notes payable Total current liabilities Long-term debt Total liabilities Common equity Common stock Retained earnings Total common equity Total liabilities and equity od $ 400 250 $ 650 1.250 $1,900 $ 640 300 $ 940 1325 $2,265 re $1,100 1675 $2.775 $4.675 $1,100 1735 $2,835 $5.100